Seeing the rising amount of daily COVID-19 cases in Malaysia, we’re definitely not going to be able to travel across states to visit our families for Raya. It’s been a bummer two years in a row, but you can still partake handing out Duit Raya with eWallet payments.

I mean, yeah, it’s not the same as handing out those neatly designed Raya-themed angpow packets—but it’s the thought that counts, right? Plus, who would say no to Duit Raya, even if it is in a different form?

But as there are so many different eWallets you can use in Malaysia, which one ranks supreme? I’ll look through four of the most popular eWallets in the country that we can use for sending Duit Raya and let you be the judge.

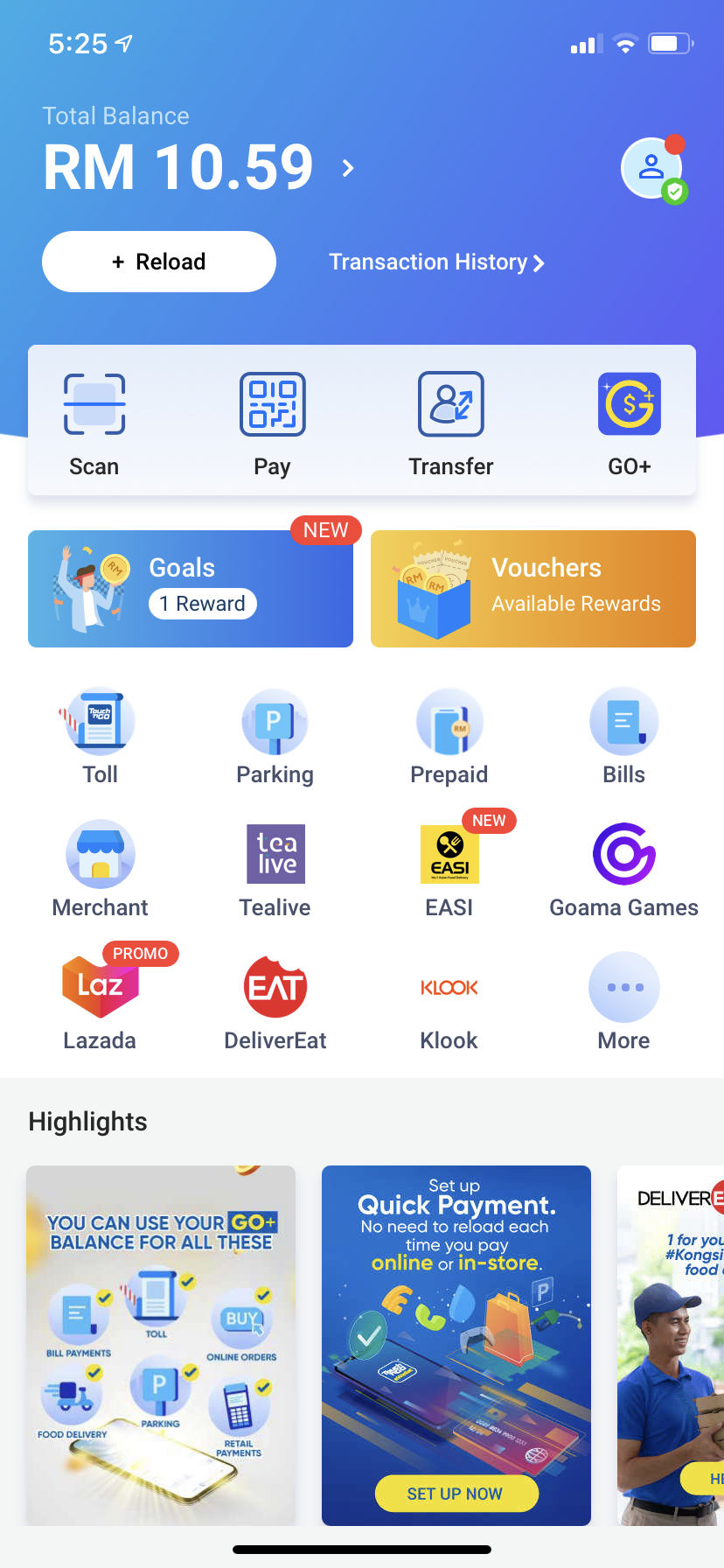

Touch ‘n Go eWallet

How do you send Duit Raya money?

- Make sure the recipient also has the Touch ‘n Go eWallet (iOS, Android)

- Make sure you have enough left in your eWallet. Tap “Reload” if you don’t have enough credit

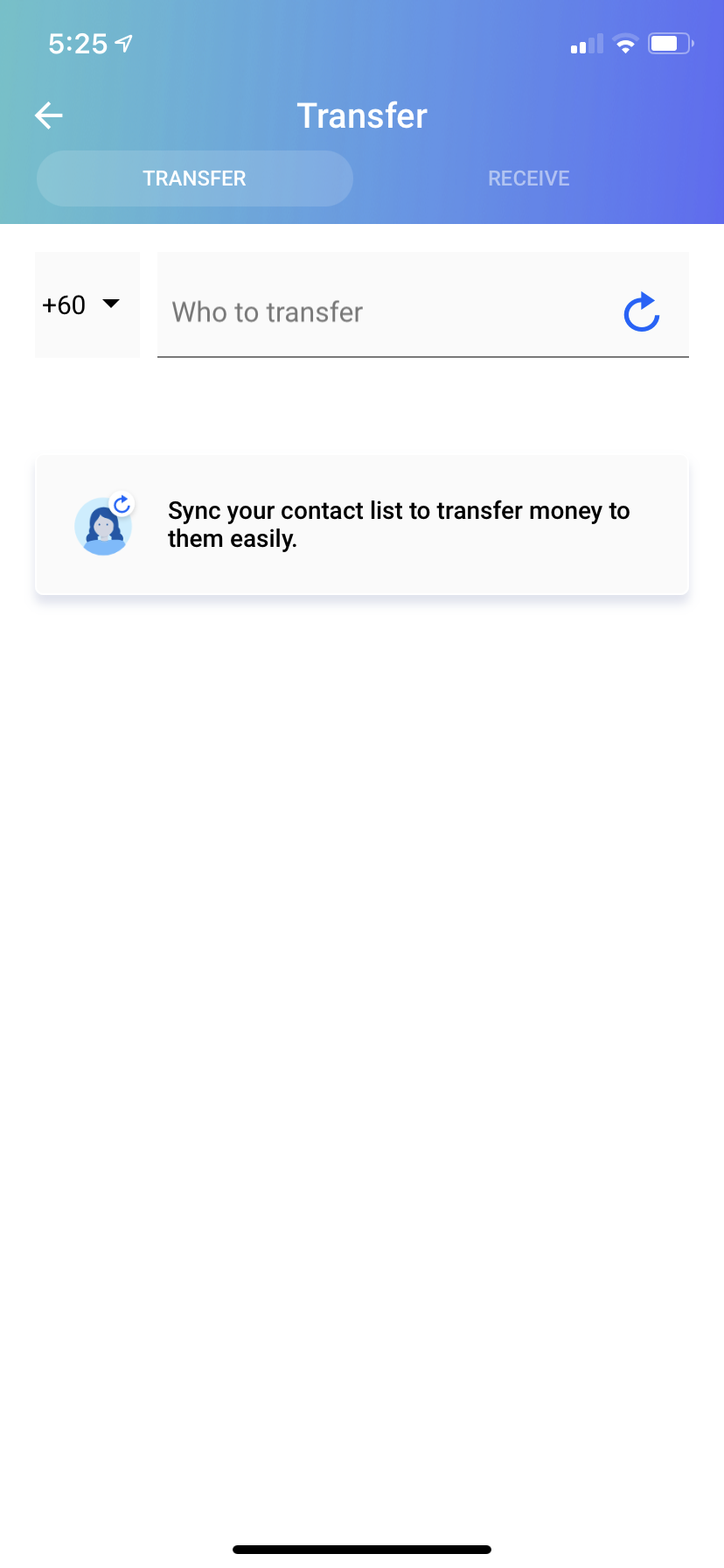

- Tap “Transfer” on the front page of the app

- Type in the telephone number of the recipient

- You can sync your contact list on the app so you don’t have to type in their mobile number manually

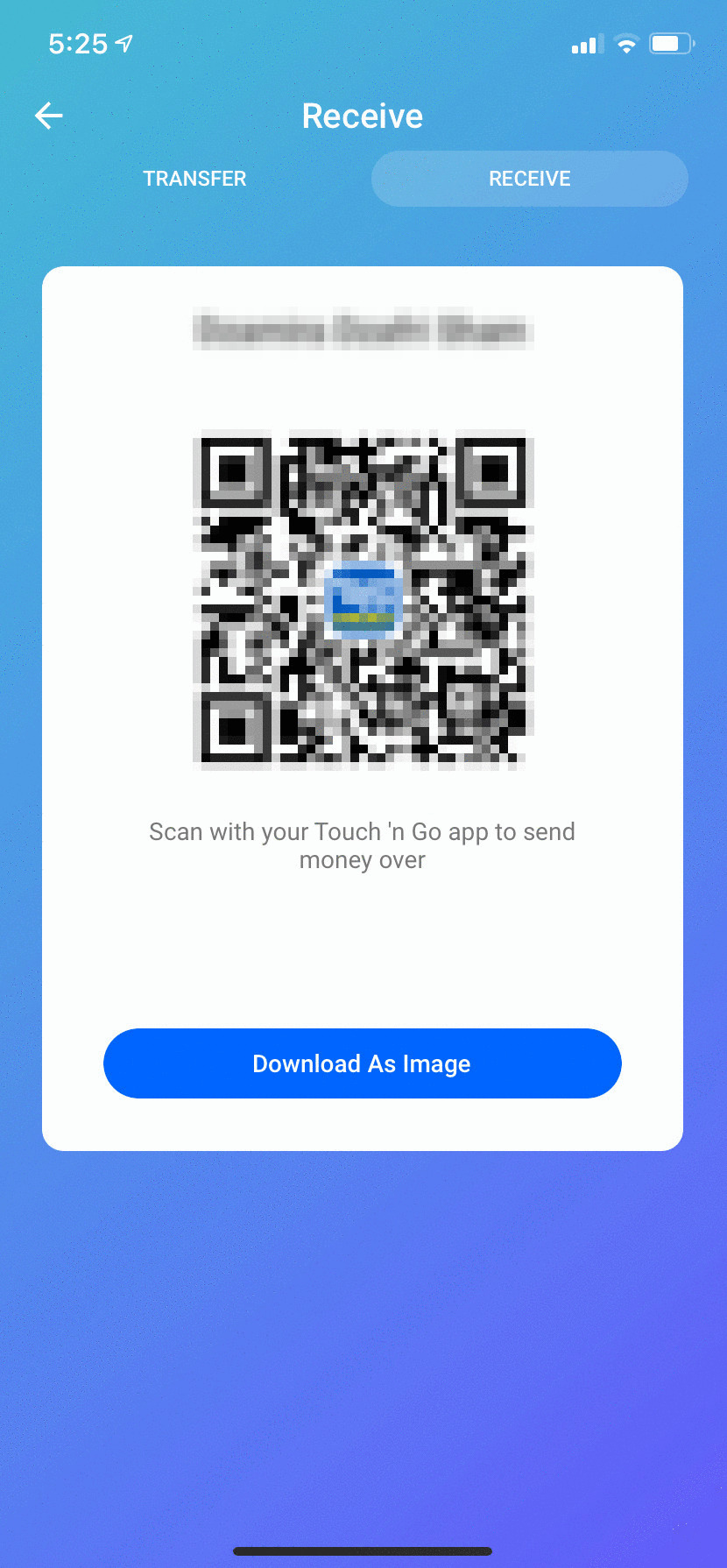

If you’re a recipient, you can also receive payments by letting people nearby scan your own QR code by pressing “receive” under “Transfer”. You can also download the QR code as an image and send it to a recipient if they’re further away.

Another perk to using the Touch ‘n Go app is that you can use a new investment feature called Go+—which allows you to earn daily returns with their balance. You will have the option to cash-out directly to eWallet or to their local bank account, and the app doesn’t impose any charges for making a cash-out request.

This way, you can also earn a little bit of money while using the eWallet. You’re able to transfer money to the Go+ feature from either online banking or eWallet balance—but the minimum top-up needs to be at least RM10.

If you want to cash out from Go+, you can do so by sending it to your bank account, or to your eWallet. You can learn more about the Go+ feature here.

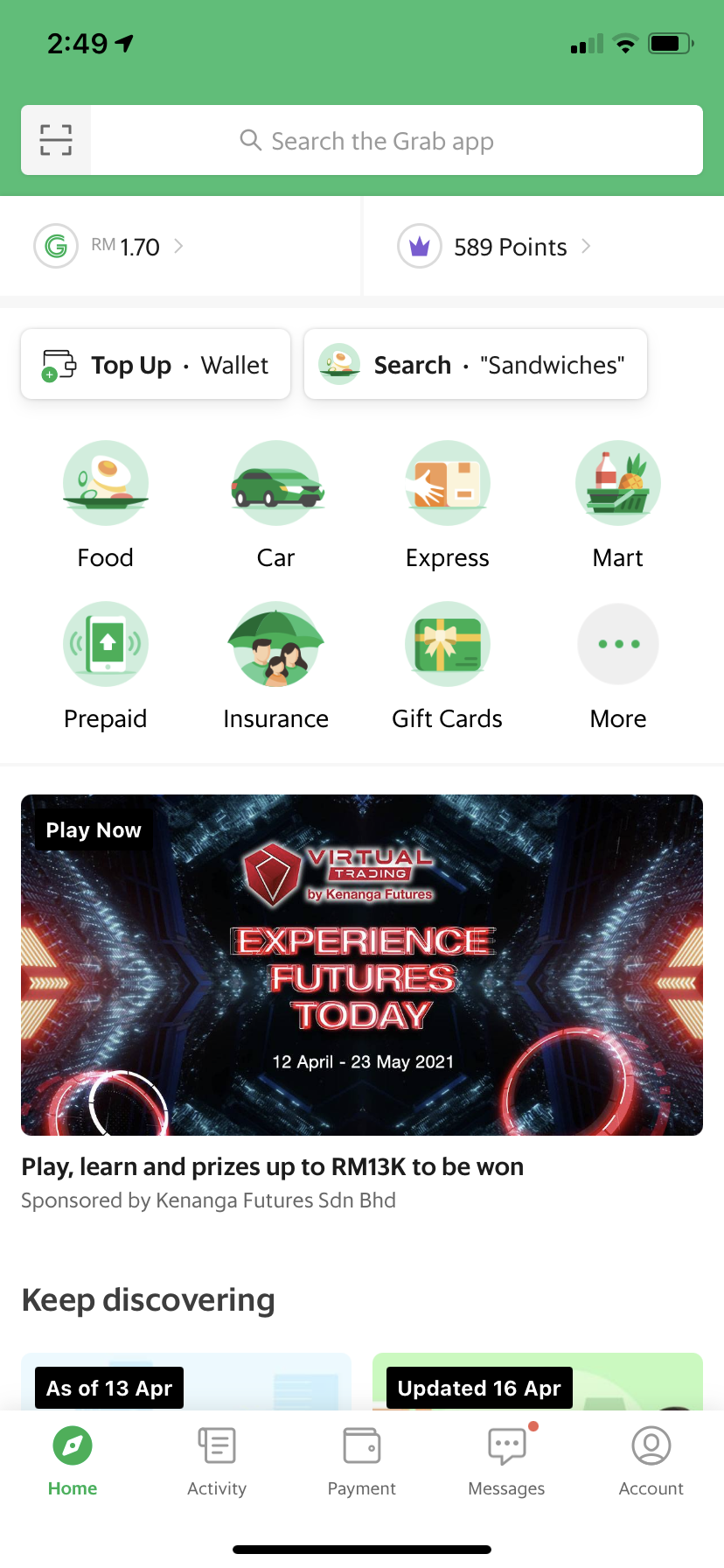

Grab

How do you send Duit Raya money?

- Make sure the recipient also has the Grab app (iOS, Android)

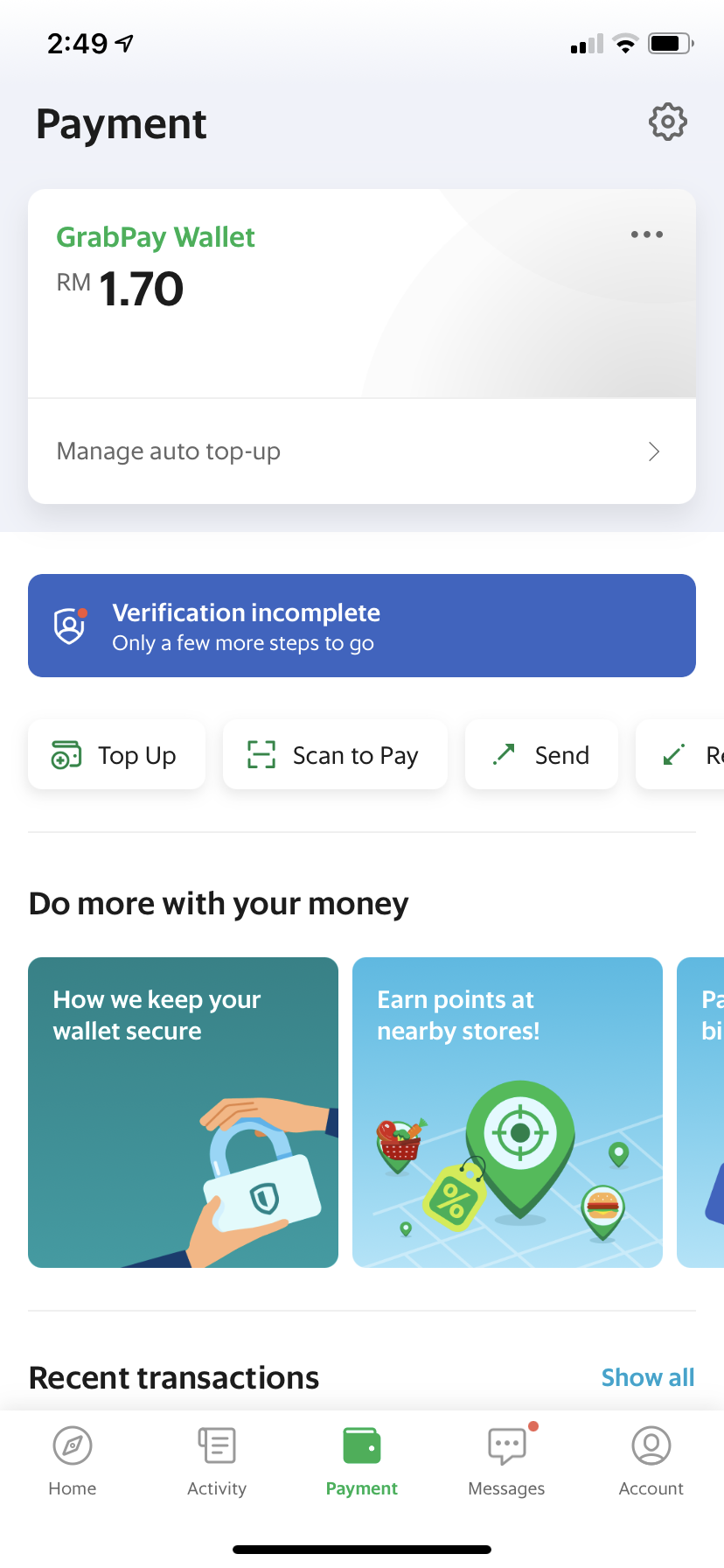

- Make sure you have enough credit in your GrabPay Wallet. Tap “Top Up” if it isn’t enough credit

- Tap on “Payment” at the bottom of the screen of the home page

- Tap “Send” to send money

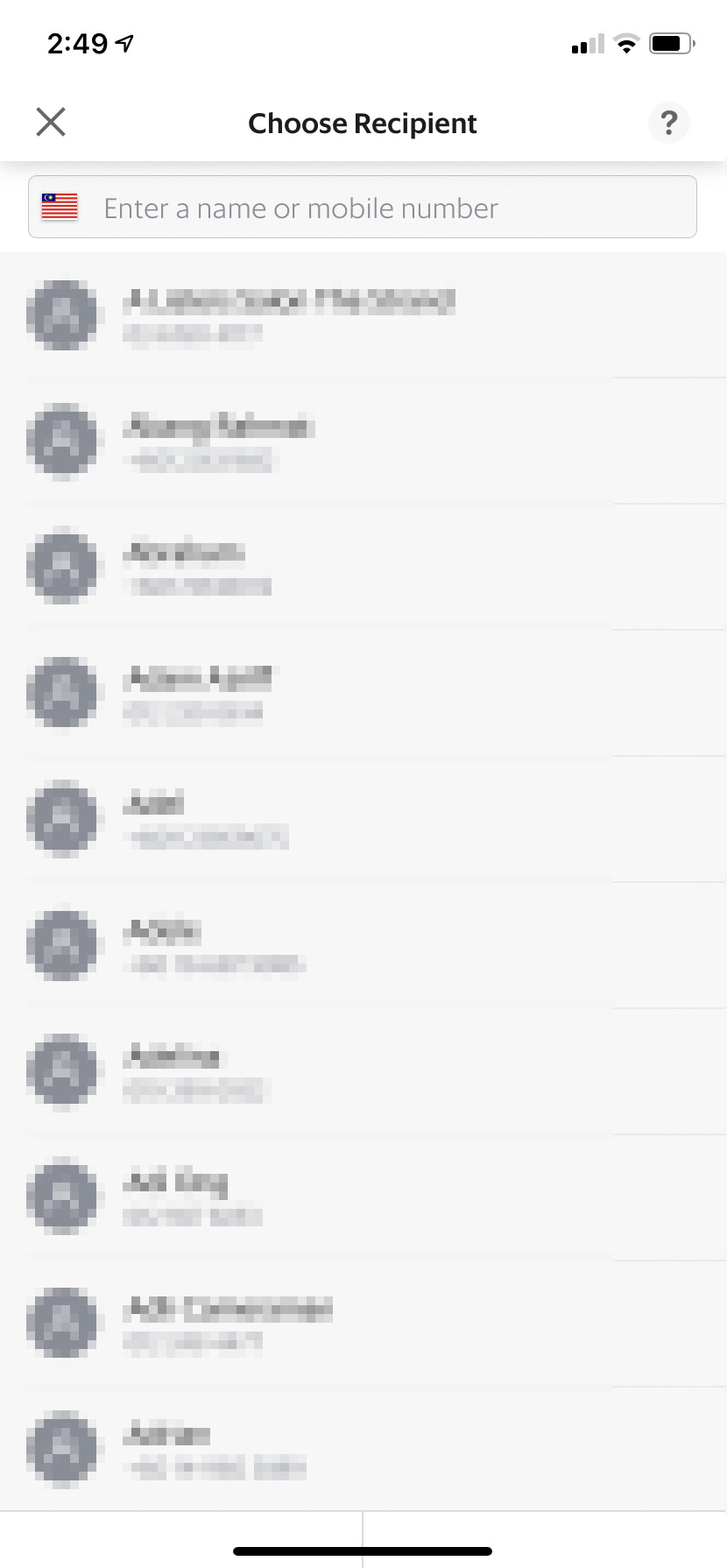

- Select the recipient for your Duit Raya. You can also manually enter a mobile number in

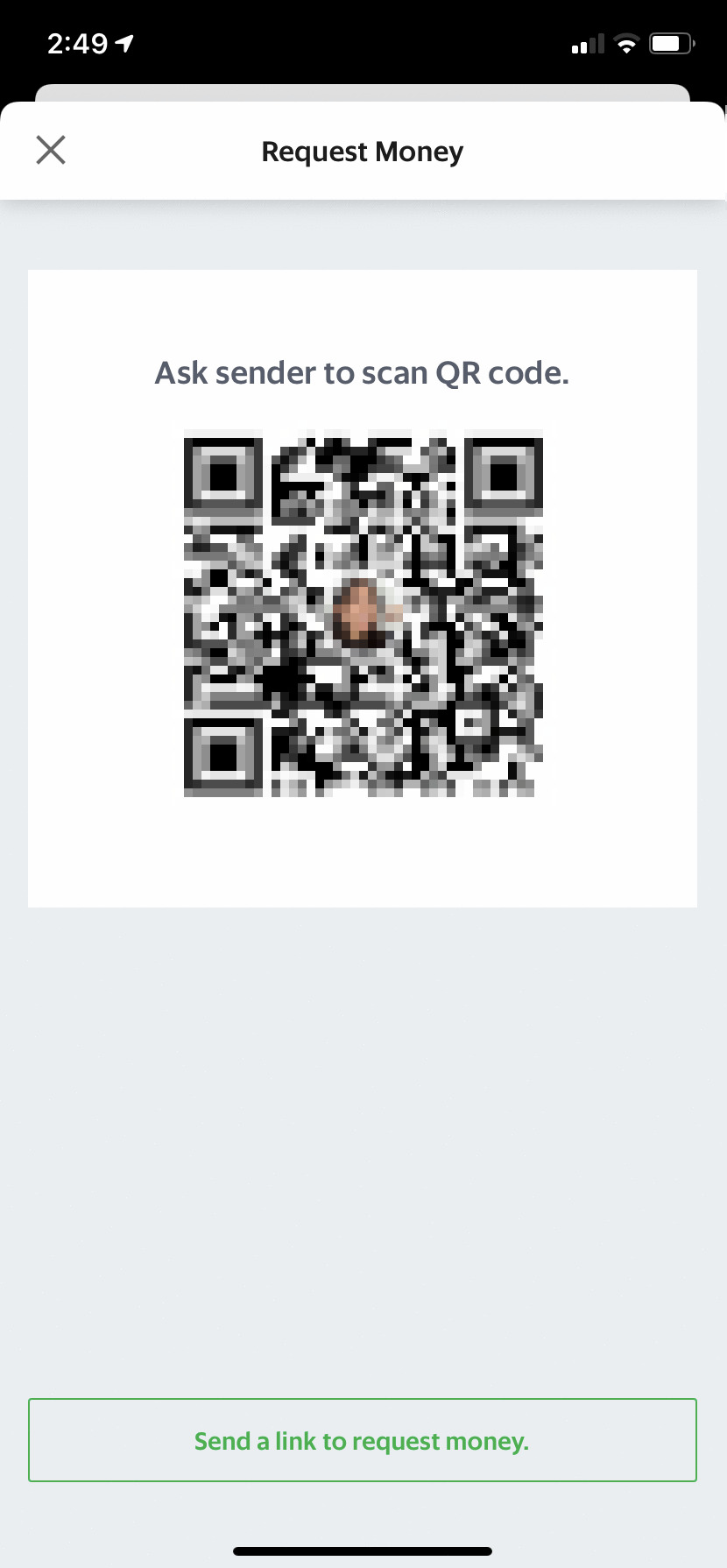

- If you’re a receiver, you can tap “Receive” to get your own QR code

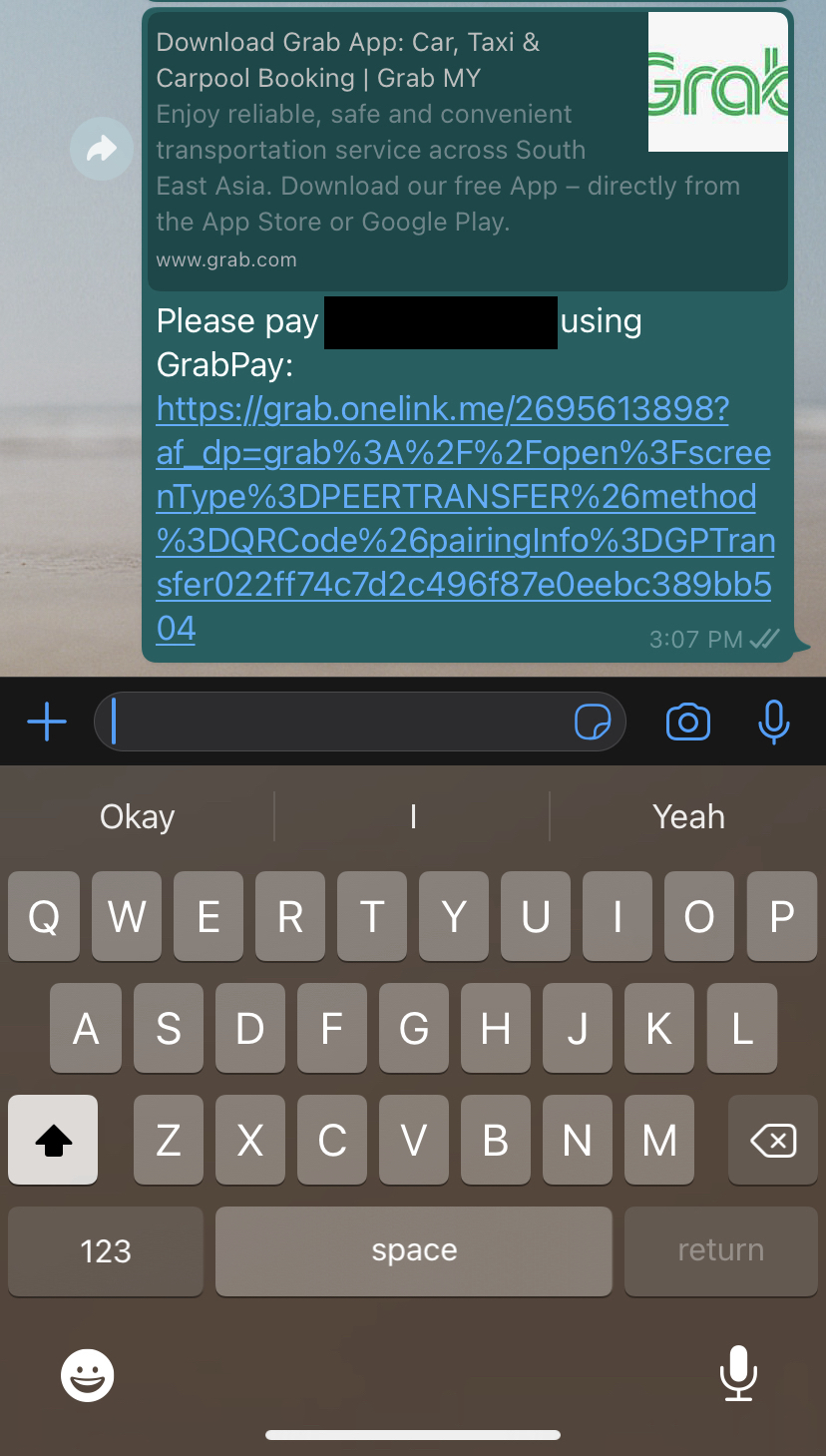

- Alternatively, you can also send a link to request money

Grab is one of the most versatile eWallets out there as it also offers ride-hailing, food and grocery delivery. The money in your Wallet can also be used for Grab services like rides and food delivery, and even things like bills and prepaid top-up.

A bummer, however, would be that once money is in the Grab app, you won’t be able to cash it back out. You can only spend the eWallet credit through the app itself, but at least you can use the credit to pay at shops.

Please note that the minimum top-up for the Grab eWallet is RM50 via online banking, except if you’re using a credit or debit card, or Maybank2U—to which the minimum top-up is RM20. Learn more about GrabPay here.

Maybank MAE

How do you send Duit Raya money?

- Make sure you have the Maybank MAE app (iOS, Android)

- Make sure you have enough in your MAE eWallet. Tap “Top Up Now” if it isn’t enough credit

- Press “eDuit Raya”, then “Send Greetings”

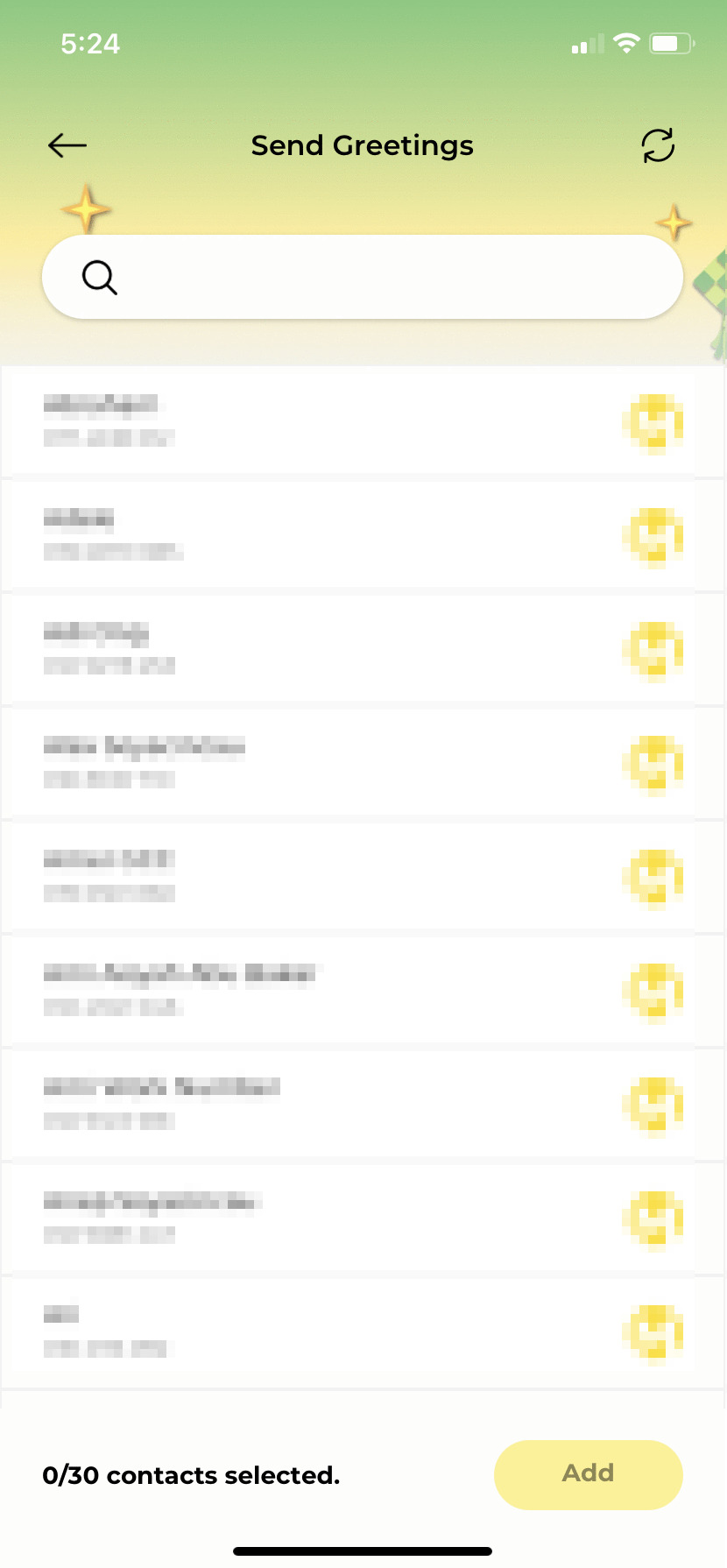

- Pick up to 30 recipients you want to send the Raya greeting to, but their names in your phone book will only appear on the app if they have MAE, too

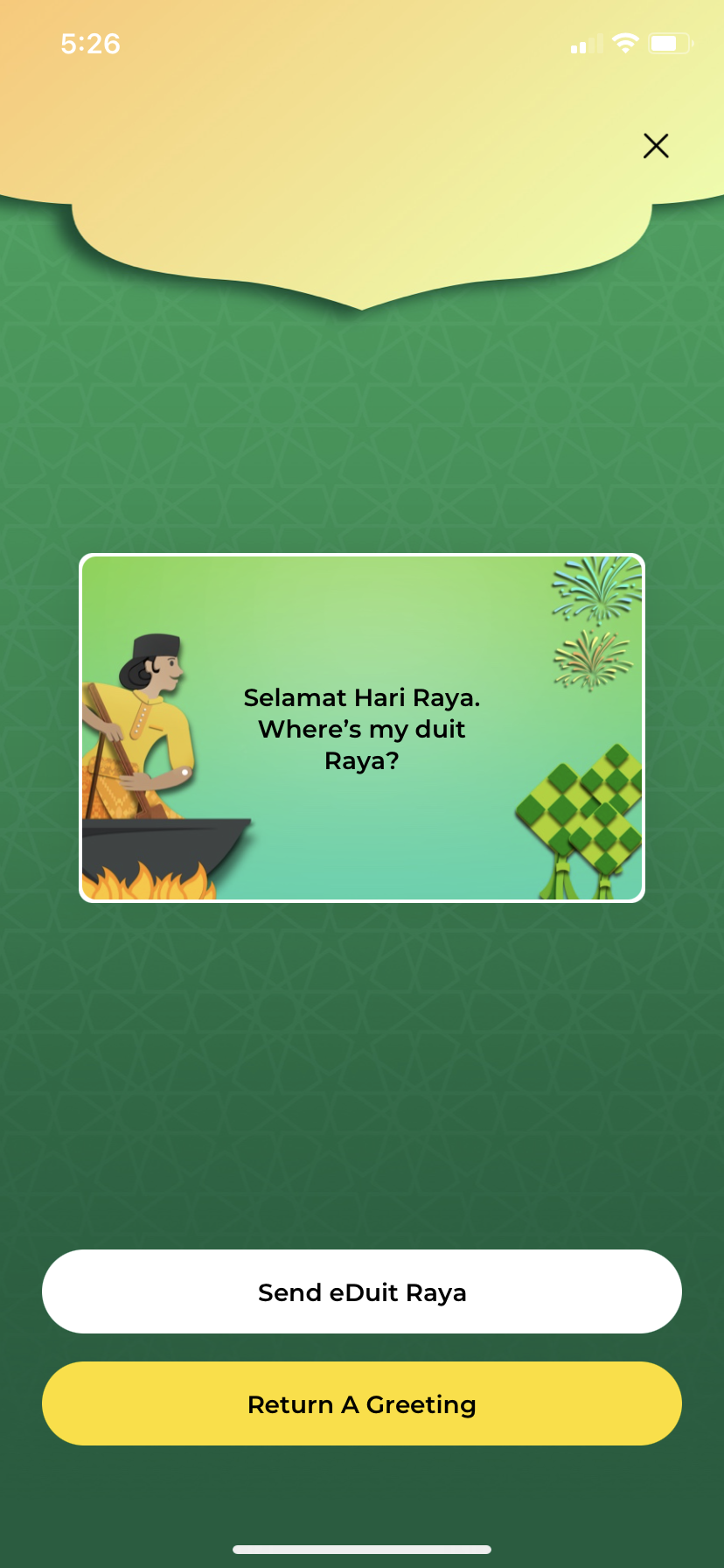

- Pick amongst 5 different Raya card designs. You can tap on the card to edit the message to make it more personalised

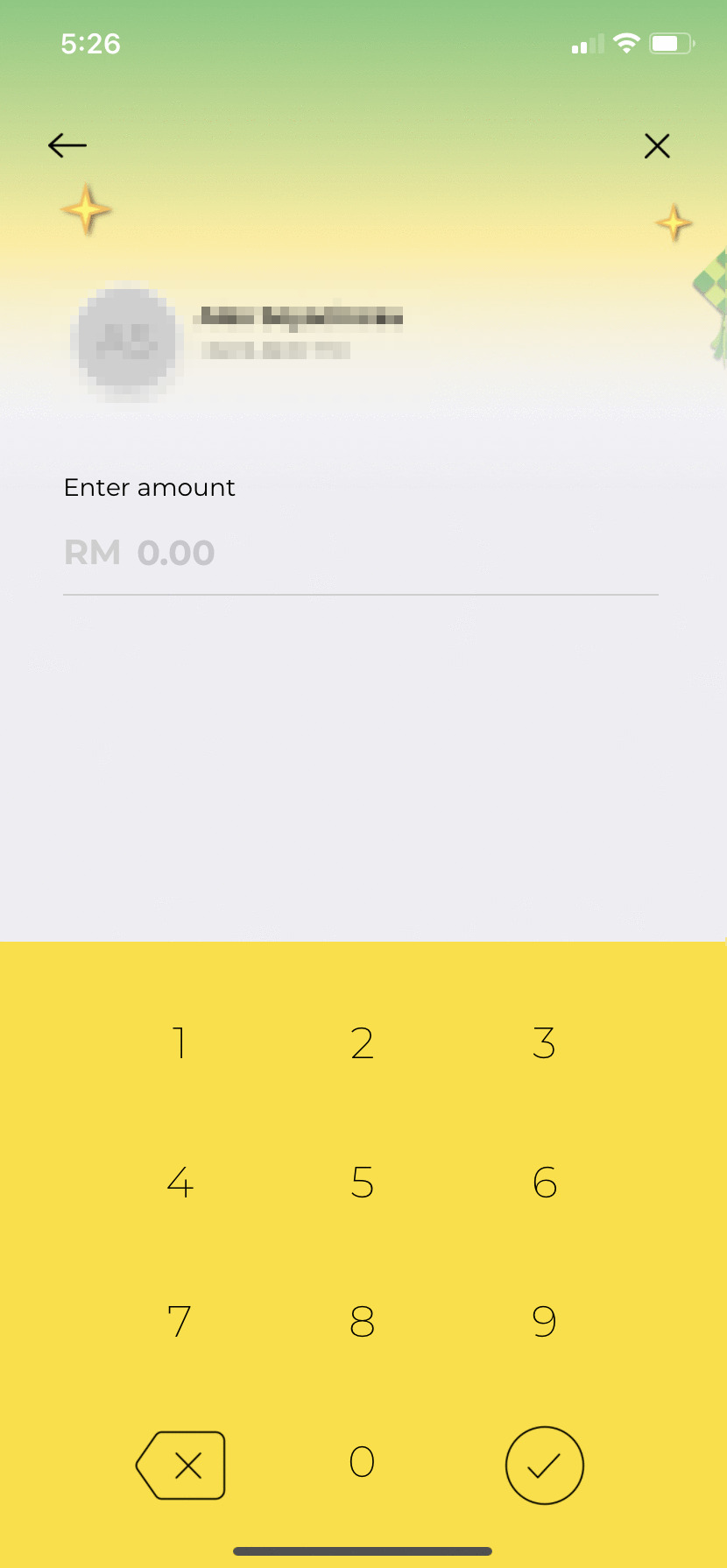

- After you press “Continue”, you will be able to send the greeting card with Duit Raya—but you can also send it without any money

Maybank MAE is not the regular Maybank2U app (iOS, Android)—it basically can serve as a place for you to handle your savings and budget expenses. Upon signing up, the app will make you a separate online-based MAE account.

With DuitNow, you can send money with just their IC number or phone number—no bank account numbers required. It also allows you to send money to people that uses different banks as long as they have DuitNow enabled.

MAE is also open to non-Maybank customers and you can open an account immediately with electronic Know Your Customer (eKYC). If you’re an existing Maybank customer, you can also create a separate MAE account just for your cashless transactions.

Among the eWallets listed here, MAE is the only platform that offers an optional Visa debit card and it supports Samsung Pay. This allows you to pay at more merchants worldwide where Visa is accepted.

Still, you can use it to straightaway send Duit Raya to a recipient’s bank account—without having to go through a separate eWallet. Also, please note that the minimum top-up for MAE is RM10. Learn more about Maybank MAE here.

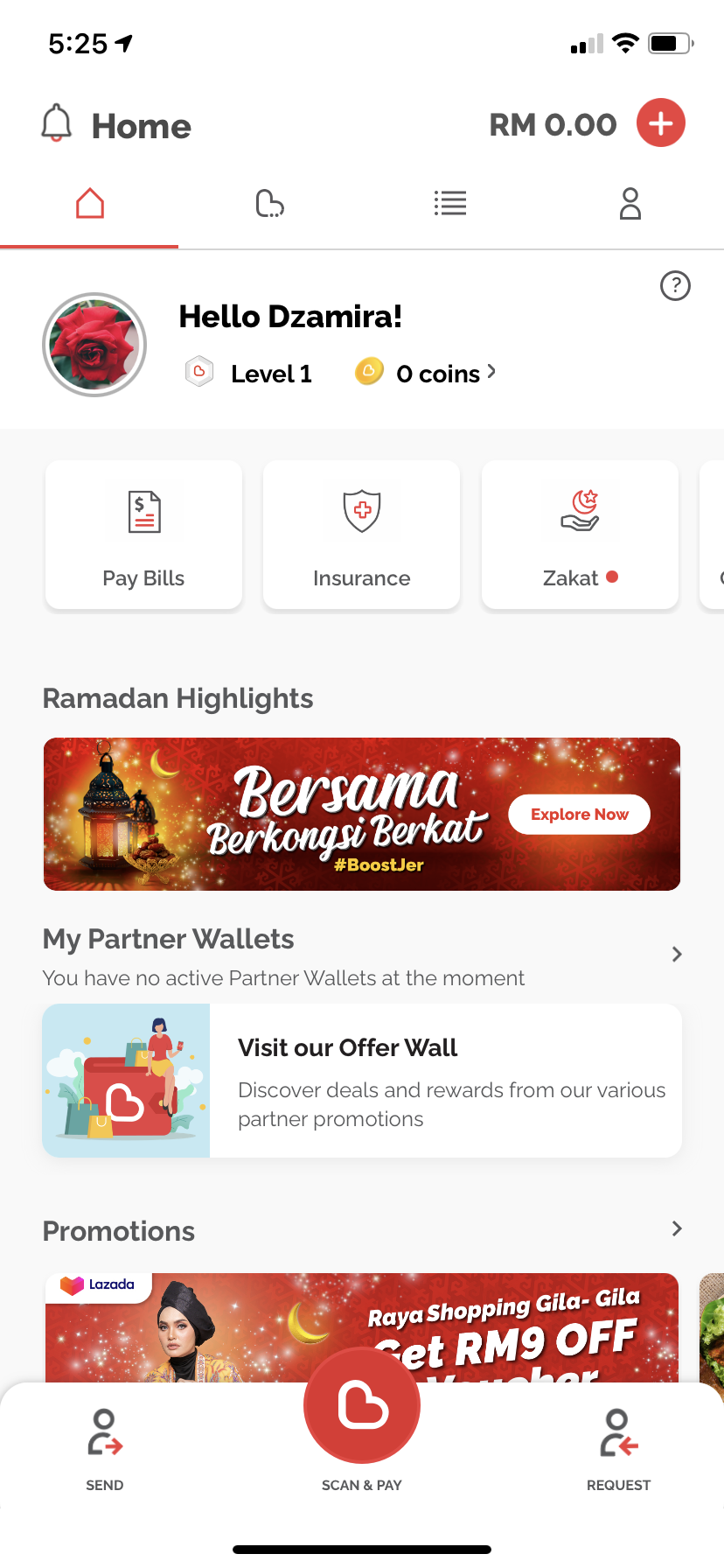

Boost

How do you send Duit Raya money?

- Make sure you have the Boost app (iOS, Android)

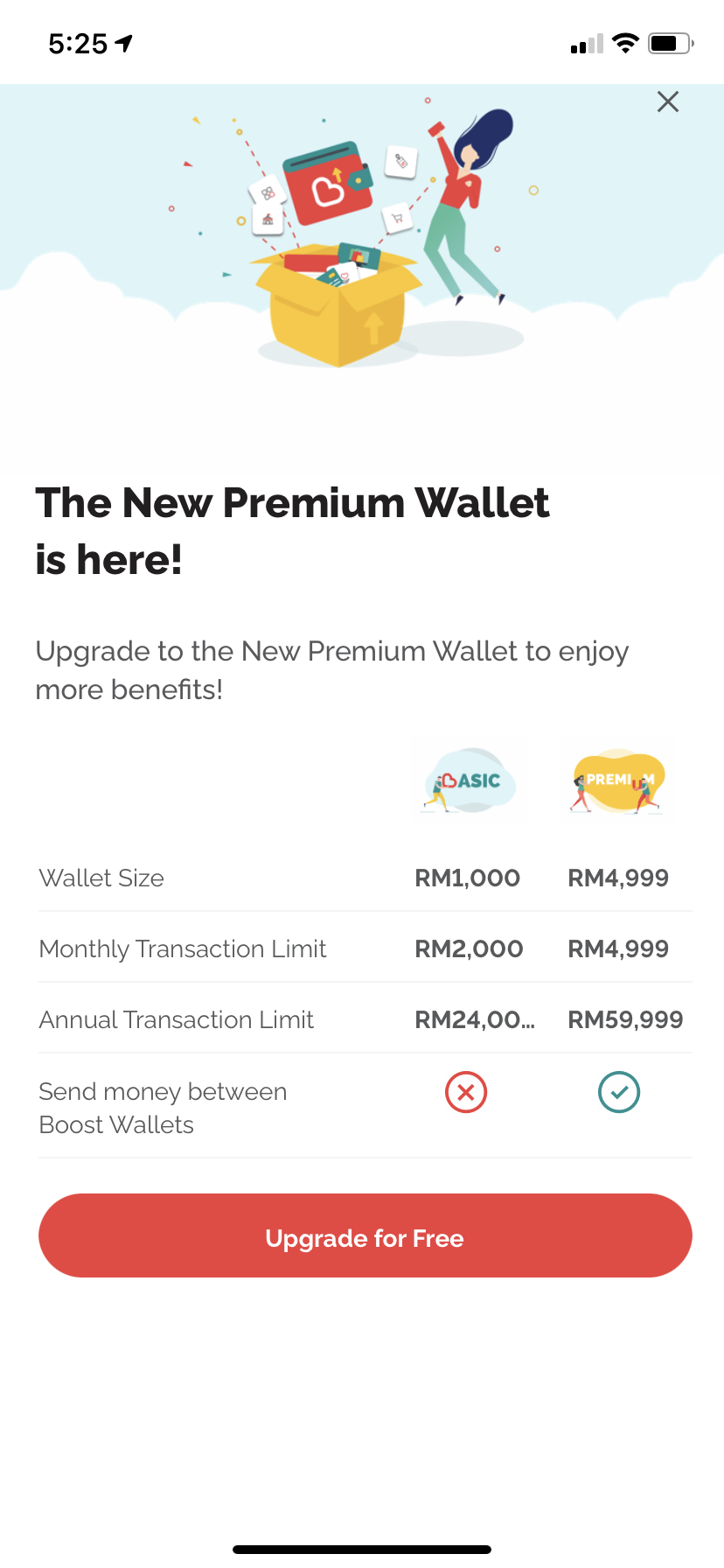

- Tap “Send” at the bottom left, and the app will ask you to upgrade to the premium wallet for free if you’re new. You won’t be able to send money without upgrading

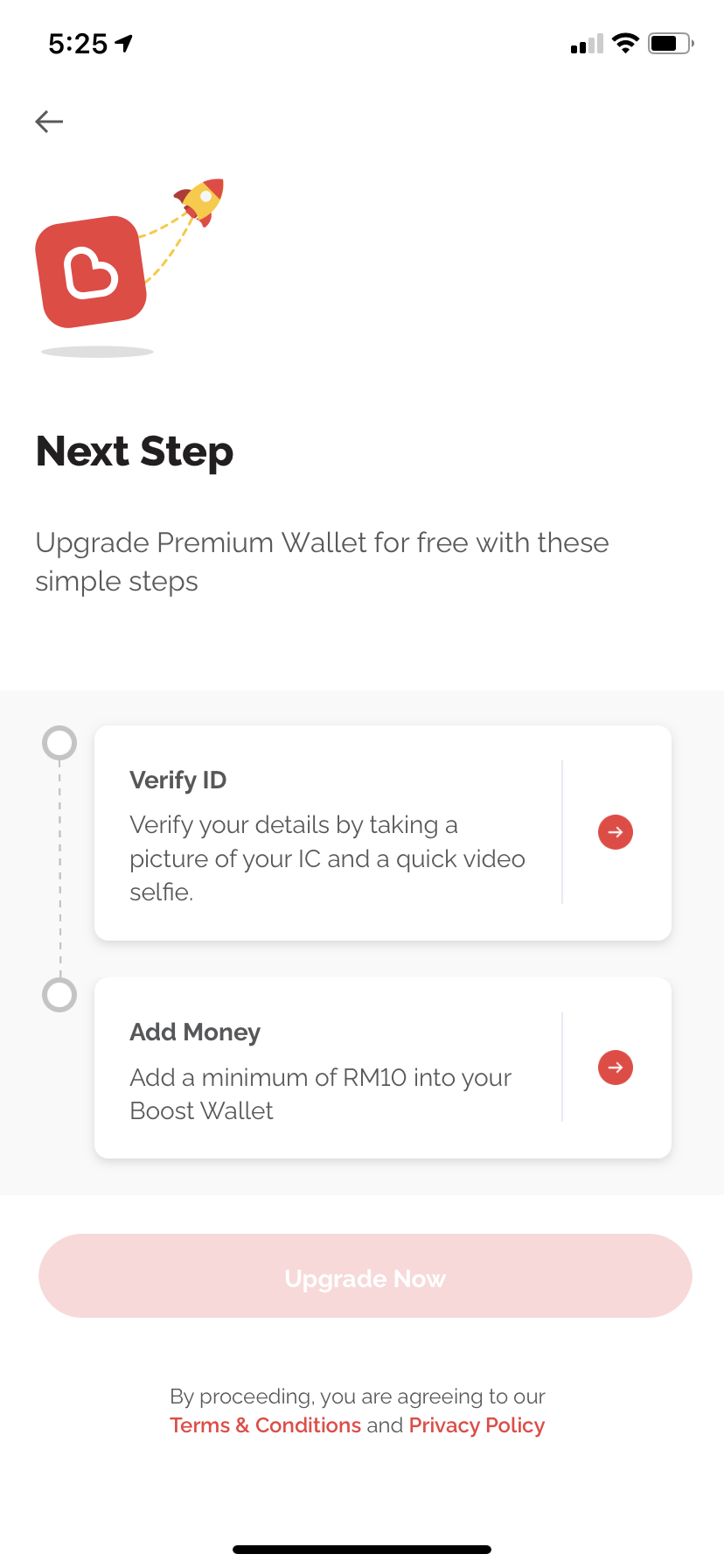

- Follow the steps like verifying your ID, and add a minimum of RM10 into your Boost Wallet

- Make sure you have enough in your Boost eWallet. Tap the top left + icon on the app’s front page if it isn’t enough credit

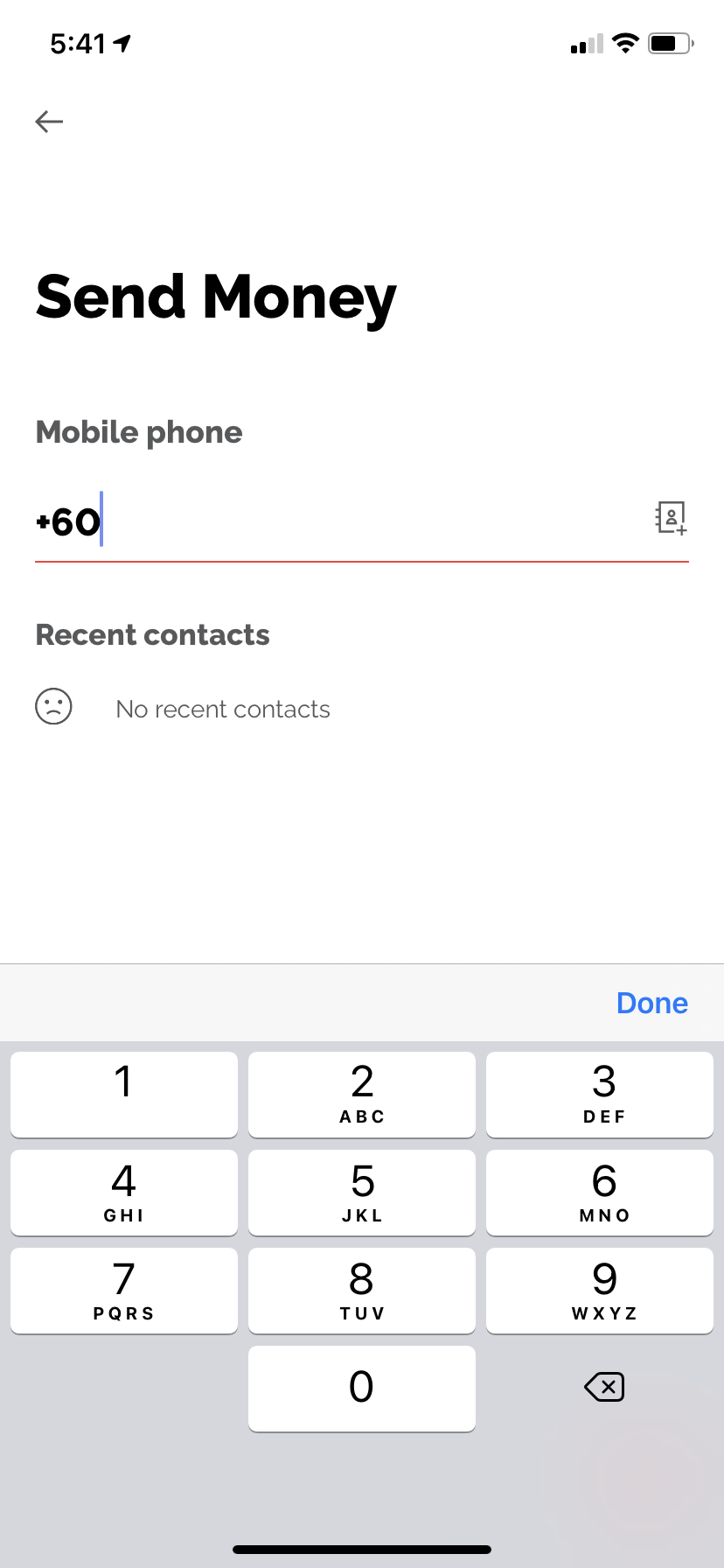

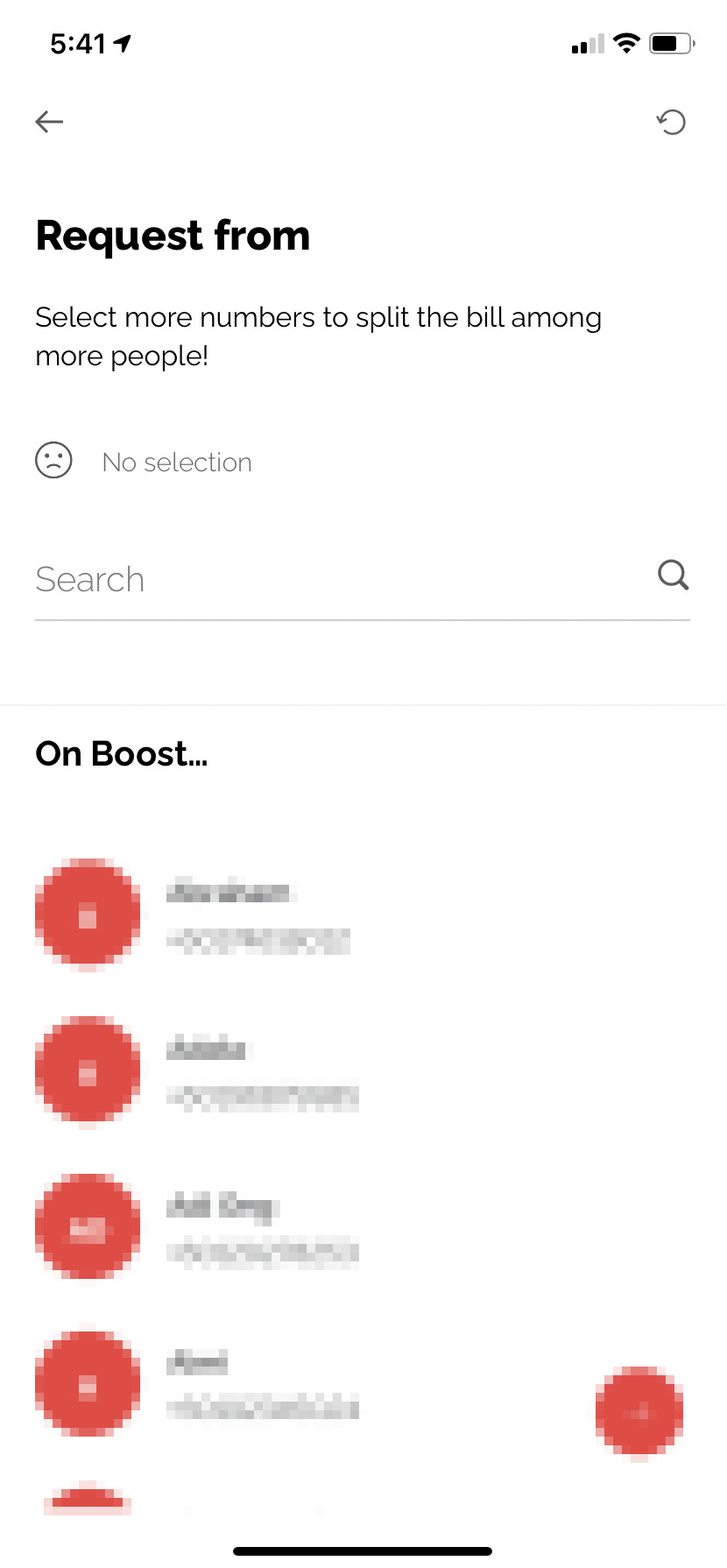

- Once you’re all set, you can start sending money to a recipient by typing in their mobile number or by looking for them in your address book

Please note that you would gave to wait until your ID is verified before you can proceed to send money. For me, it only took a few minutes. As for adding the RM10 into your Boost Wallet, I wasn’t able to add only RM10—as the app informed me that I had to add a minimum of RM20 through online banking.

As a recipient, you can request money from other Boost users. People who already have Boost downloaded will show up as a list if you choose the “Request Money” feature. Learn more about Boost here.

So, which eWallet is the best to send Duit Raya with?

All four eWallets have their pros and cons, so it really has everything to do with your preference. I’m completely new to Boost so I’m personally not that keen on it but Boost is currently one of the most popular eWallets out there as it’s used for smaller merchants.

However, when it comes to good-old Duit Raya, I’m going to fully utilise the Maybank MAE app. I was quite new to it when I started working on this article, but it’s new eDuit Raya feature is especially made for the task—you can even send personalised greetings!

I was also pretty impressed with it’s one-stop-shop tabung and split bill features which I can use even after Raya season. You can also sign up for the app even if you don’t have your own Maybank account as you can treat it as just another convenient eWallet.

Another great alternative if you don’t have a Maybank account is the Touch ‘n Go eWallet. You can use the Go+ feature to send the money back into your bank accounts, and it will also make you some money in the long run with its investment feature.

Grab might be kind of unforgiving seeing as it won’t let me transfer the money back into my own bank account, but if you’re an avid user of its eHailing and Food Delivery option you might not mind it at all.

Do you think that we will slowly be transitioning to eWallet Duit Raya throughout the coming years, or will we see Raya packets making a comeback next year? Whatever it is, I’m glad that we still have options to move forward with this tradition—even with the lack of face-to-face family reunions.

(6 May 2021, 5:40pm – We’ve updated the article to match a new update by the Maybank MAE app.)

[ IMAGE SOURCE ]