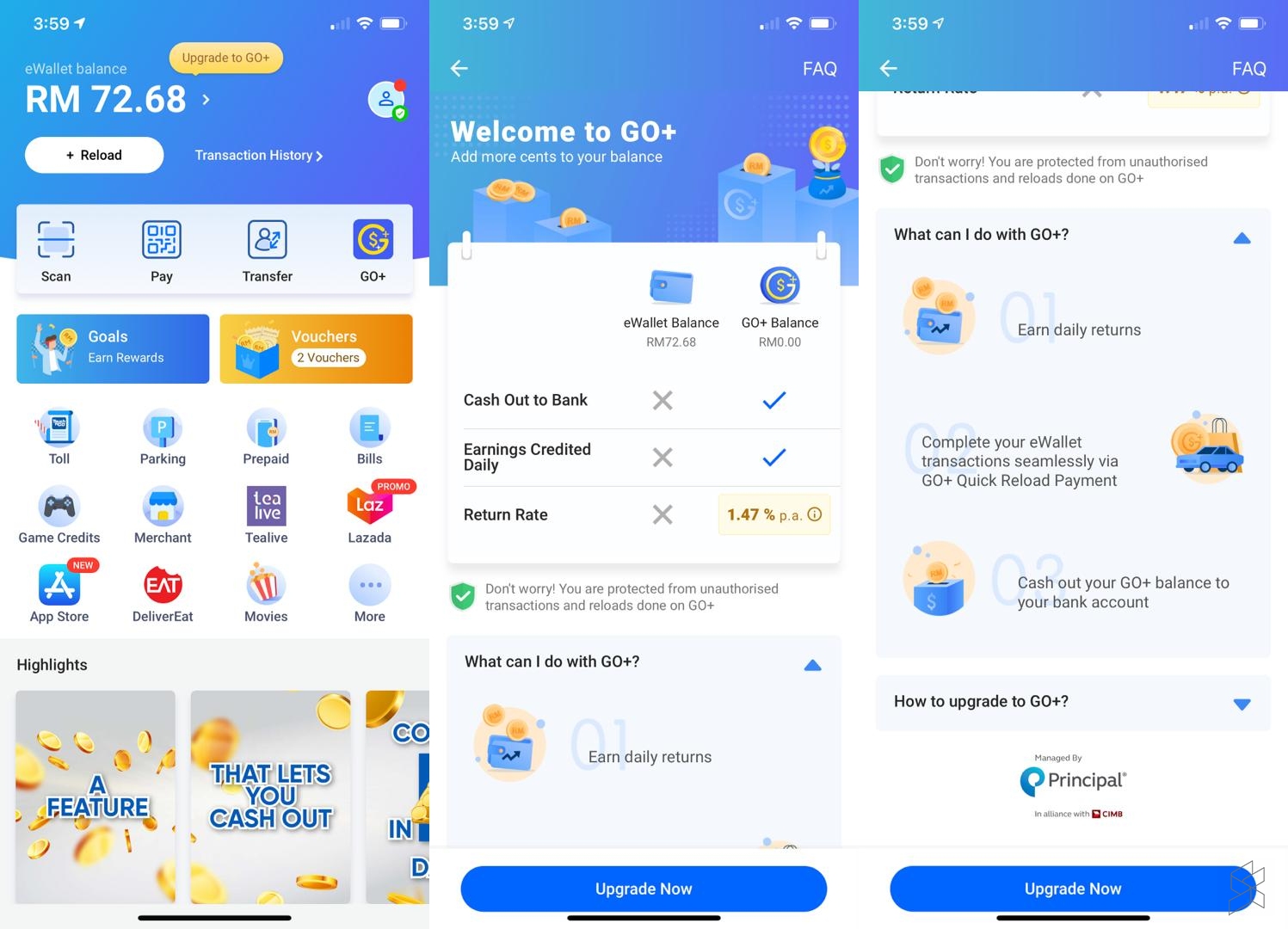

If you’re using Touch ‘n Go eWallet, you probably might have noticed a new Go+ feature on the home screen today. This is their new investment product which allows you to earn interest from your current eWallet balance.

As mentioned recently, the new investment product is made possible with Touch ‘n Go’s partnership with Principal Asset Management, a joint venture between Principal Financial Group and CIMB Group Holdings.

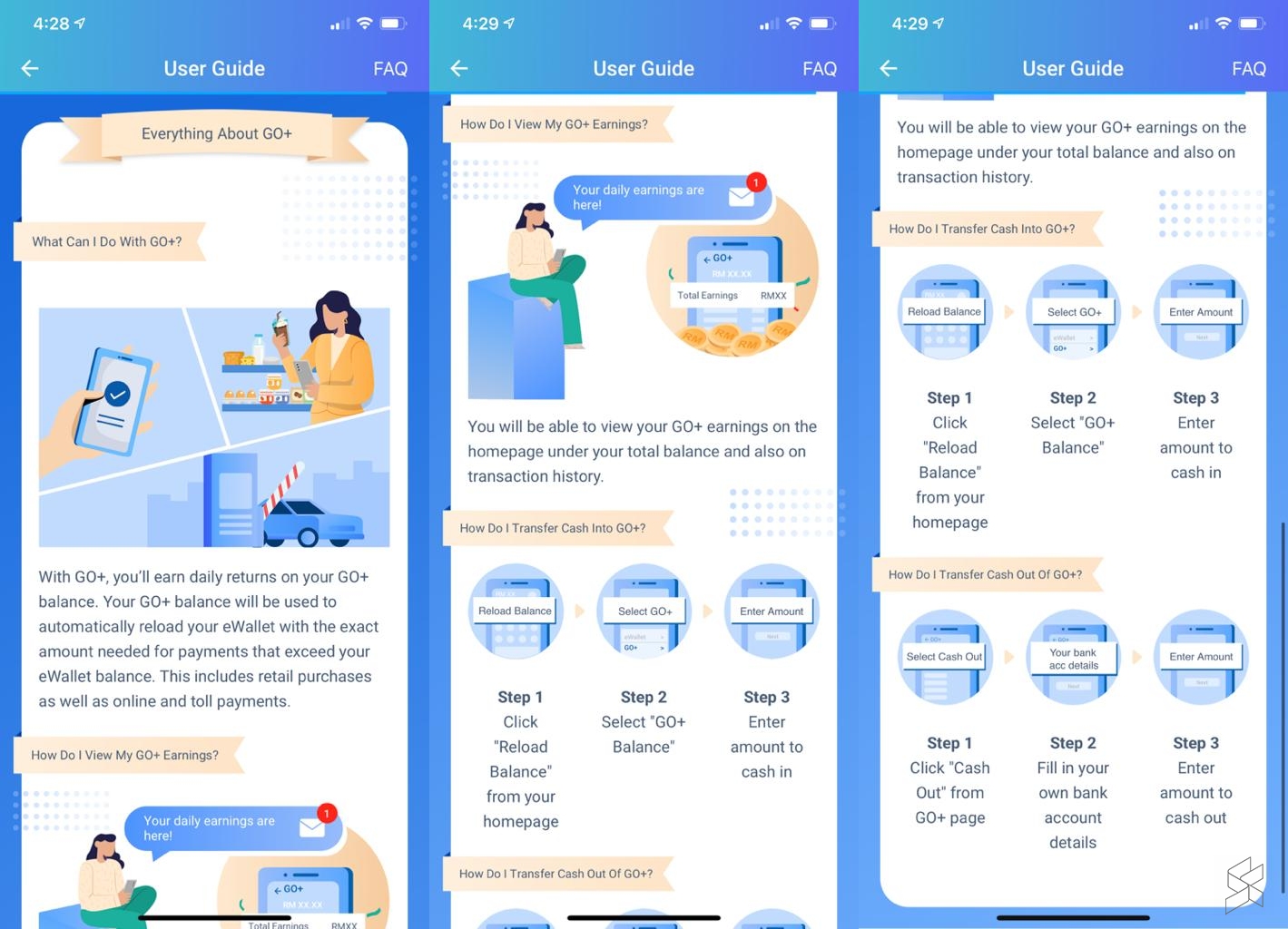

Go+ offers an easier way to gain access to Principal’s e-Cash money market fund. When activated, you can earn daily returns on your Go+ balance which you can top-up via your existing TNG eWallet balance or online banking through FPX.

If your main eWallet balance is insufficient, your Go+ balance can automatically reload your eWallet with the exact amount by enabling the Quick Reload Payment feature. This can be used for retail purchases or for paying tolls.

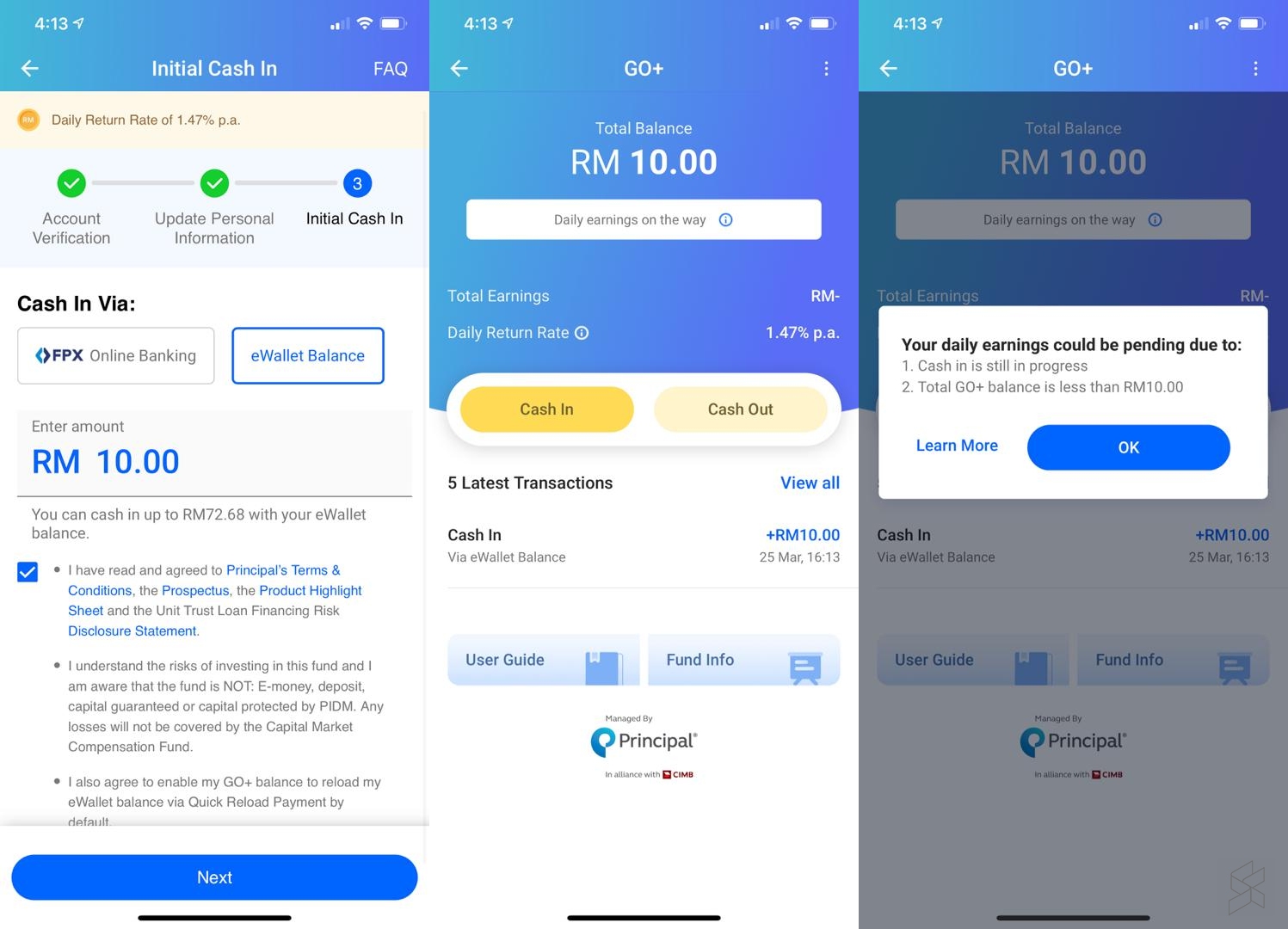

To get started, click on the “Go+” icon on the home screen to upgrade your account. You’ll need to fill up a form with your personal information and make a deposit. You’ll need to top up a minimum of RM10 and any subsequent top-up also requires a minimum of RM10.

Go+ is currently available to all Malaysians who is 18 years old and above with a verified eWallet account. Unfortunately, it isn’t offered to foreigners for now.

At the time of writing, the listed return rate is 1.47% per annum. The daily returns will be credited to your Go+ account starting the next day if the cash in is made before 4pm. The Go+ account has a maximum limit of RM9,500 and you can top up a maximum of RM5,000 per day from the eWallet or up to RM9,500 via FPX.

According to the FAQ, there’s zero sales charge but there’s a management fee up to 0.45% per annum and a trustee fee of up to 0.03% per annum. It also states that Principal e-Cash is not a Shariah-compliant fund and it isn’t treated as E-money or deposit and it is neither capital guaranteed nor capital protected by PIDM.

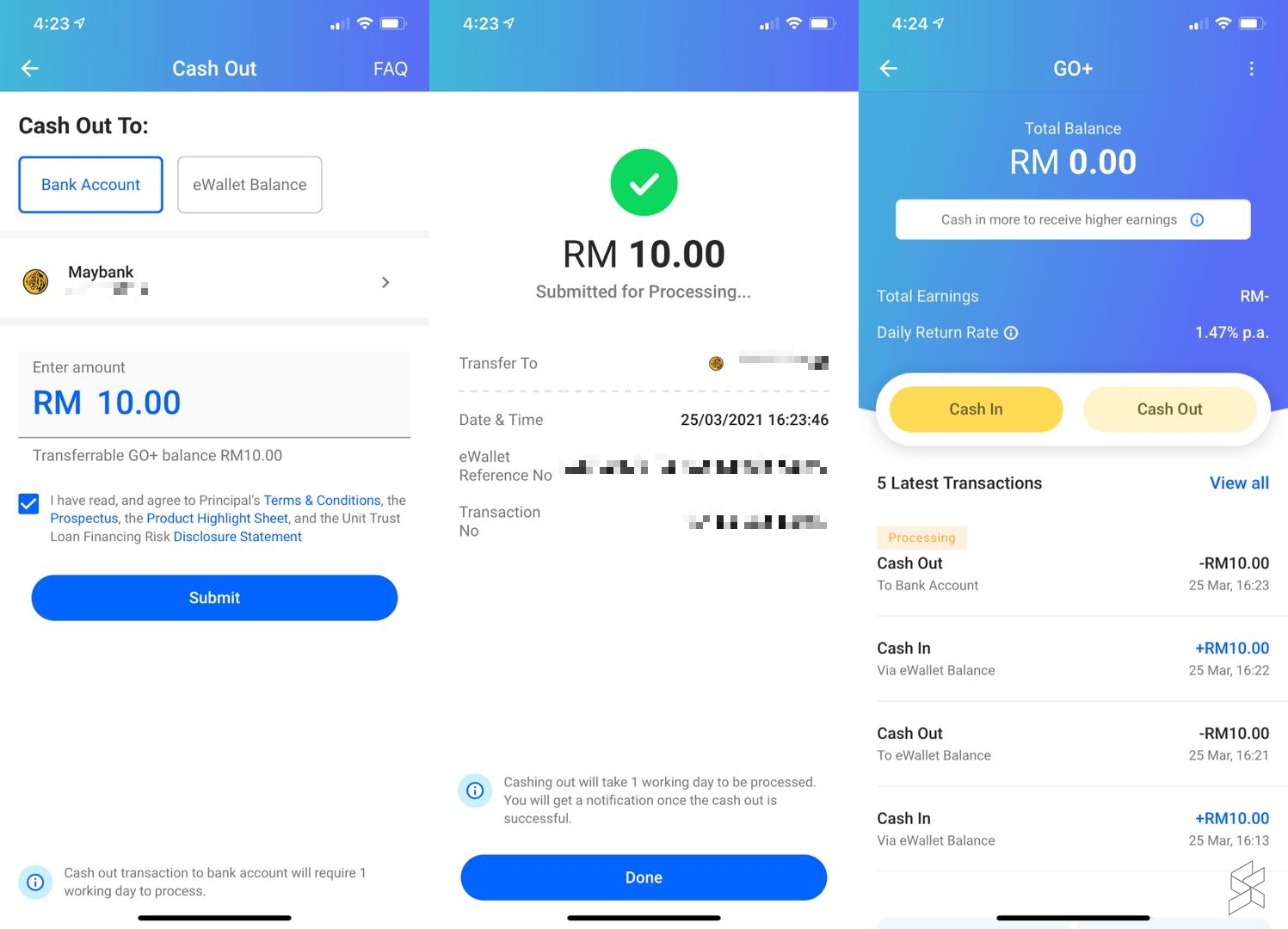

What’s interesting is that you can cash out your Go+ balance to either your eWallet or local bank account. Cash out to eWallet is done instantly while cash out to bank account will take 1 working day.

It’s also worth highlighting that Touch ‘n Go doesn’t impose any cash out fees. This also means that Go+ can be used as a way for you to withdraw funds from your eWallet balance to your own bank account. There’s no limit for withdrawal to bank account but there’s a maximum limit of RM5,000 for eWallet, as that’s the maximum wallet size.

Have you gotten Go+ in your Touch ‘n Go eWallet app? Let us know in the comments below.