This year has undoubtedly been a challenging year for many around the world, with the COVID-19 pandemic affecting the global economy and livelihoods everywhere. To help combat the pandemic, social media platforms have played an important role in the dissemination of information, through means such as the Facebook‘s COVID-19 Information Centre.

To that end, Facebook has also changed the parameters of their research, via the Global State of Small Business Research report that surveys SMBs that have a Facebook page. This was a collaborative effort between Facebook, the Organisation for Economic Co-operation and Development (OECD), and the World Bank to survey SMBs around the world over a six-month period in the context of COVID-19

To provide insights into SMBs’ experience amid COVID-19, the report was done on a monthly basis (from a biannual report, previously). Facebook has now shared a couple of insights into the global SMB industry, which offers perspective on SMB’s challenges in the APAC region.

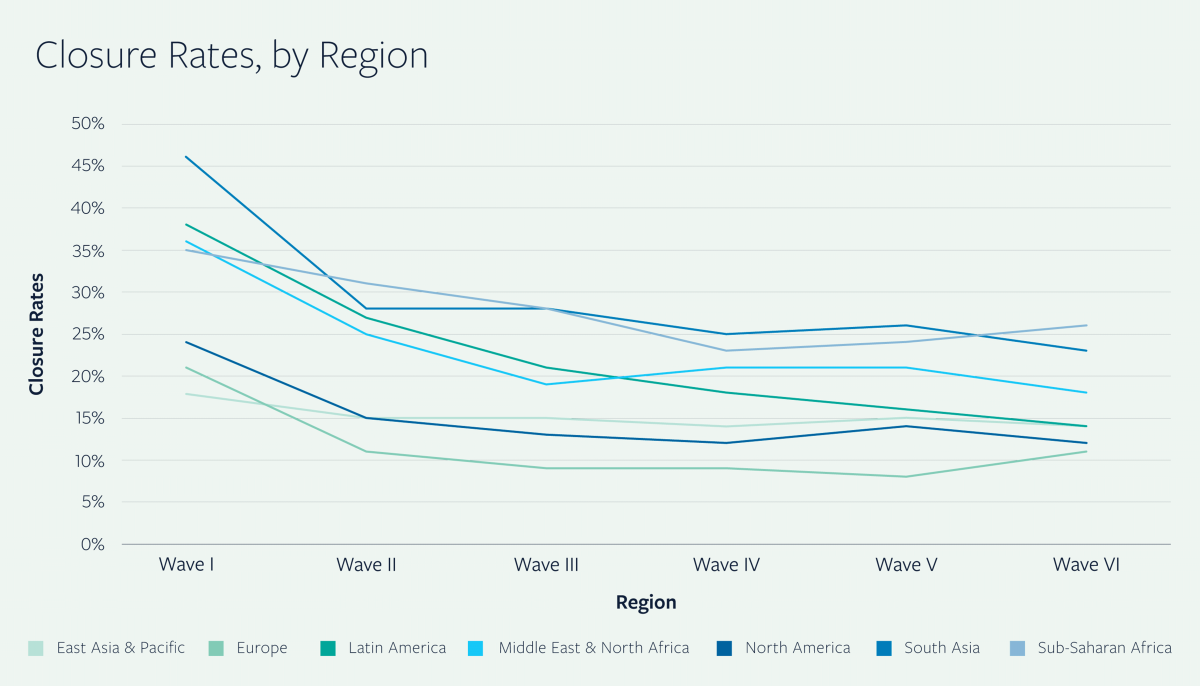

The report was conducted in multiple stages, from the 28th of May 2020 all the way till the 31st of October 2020. As you can see in the graph above, closure rates around the world were at their highest during the first wave of the pandemic, although there was a “partial return to business” as the global economy began to recover during Wave II. And as we entered the third wave, countries began to ease lockdown restrictions, a change that was reflected in the resumption of business operations in person.

Challenges faced by SMBs as the economy recovers

Despite the gradual recovery of the economy in many areas, SMBs in the APAC region still face a number of challenges, according to Facebook. This is evidenced by the fact that 15 percent of global SMBs in the report have closed operations during the course of the pandemic.

Even those who have reopened their doors since, or survived have faced severe financial pressure, with consumer-facing businesses such as retail being the most affected. Sales were lower for 55 percent of SMBs (compared to 2019), which forced one-third of SMBs to reduce workforces.

On a more personal note, the report also found that 53 percent of SMB leaders are “struggling” with basic necessities such as household expenses, with a lack of demand and cash flow issues named as the overriding problems faced. There also appears to be a gender divide based on the report, with women-owned small businesses closing at higher rates all through the world; women’s jobs are estimated to be 1.8 times more vulnerable to current economic issues than men’s jobs.

However, the data also shows that digitalisation has been an important cog in the wheel of the SMB machine, with 45 percent of SMBs in the APAC region making more than a quarter of their sales via digital channels. Despite a drop in sales throughout the region, more than half of APAC SMB owners said that they were “optimistic about the future”—perhaps pointing to the cloud slowly lifting after a tumultuous 2020.

To read the full report, click here.