Alliance Bank Malaysia and Zurich Malaysia has jointly introduced Z-Alliance Cyber Protect, a first of its kind cyber insurance that protects Malaysians from cybercrime.

Cyberthreats are on the rise especially during the COVID-19 pandemic, as more Malaysians go online to shop for goods and daily necessities. According to the press announcement, there are close to 8,400 cybercrimes reported in Malaysia between January to September 2020.

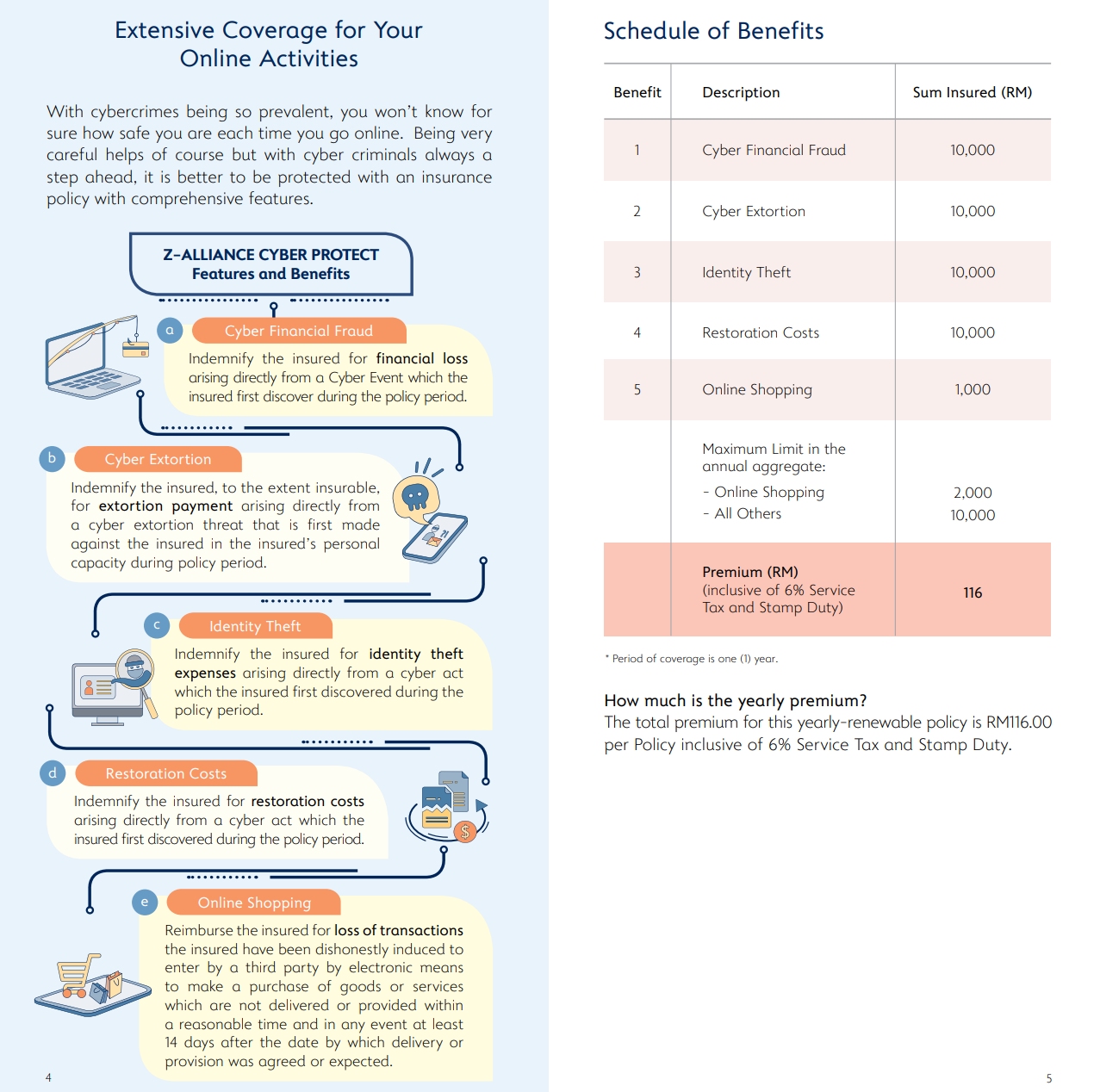

The personal cyber insurance plan is offered for RM116 per year (about RM0.31/day) inclusive of Sales & Service Tax. The plan aims to safeguard consumers from financial losses arising from online identity theft, extortion and fraud. This also includes restoration costs including laptop repairs affected by malware attacks and reimbursement for loss of transactions arising from undelivered goods or services.

According to the brochure, the plan is listed with sum insured of RM10,000 for Cyber Financial Fraud, Cyber Extortion, Identity Theft and Restoration Costs. For online shopping, there’s a sum insured of RM1,000, which a maximum annual aggregate of RM2,000. The plan is offered for individuals aged 18 years old and above.

As an introductory offer, Alliance Bank and Zurich are offering subscribers that sign up online from 1st November 2020 until 31st March 2021 an additional month of complimentary coverage. This means you’ll get 13 months of protection for the price of 12 months.

In addition, the first 100 customers that sign up for the plan with an Alliance Bank Visa Infinite or Platinum credit card can get a RM10 shopping voucher plus one-year subscription of CTOS SecureID alerts worth RM86.90. CTOS SecureID is a fraud protection and credit monitoring service which provides quarterly updates of MyCTOS score credit report and you’ll be alerted of any changes in your credit profile including leaks in the dark web.

For more info, visit the Z-Alliance Cyber Protect page on Alliance Bank’s website.