To assist SMEs during the COVID-19 pandemic, the Employees Provident Fund (EPF) has launched the Employer COVID-19 Assistance Programme (e-CAP). It allows employers to defer employer share contribution payment to help them manage their monthly cash flow and to retain their employees. EPF CEO Tunku Alizakri Raja Muhammad Alias said SMEs are the cornerstone of the Malaysian economy, contributing around RM522 billion to the gross domestic product and providing the largest amount of employment for the domestic labour market.

According to the EPF, employers can apply for deferment and restructuring of the Employer Share Contribution Payment for April, May and June 2020 contributions. These are for March, April and May 2020 salaries.

Eligibility

e-CAP is offered for small and medium-sized enterprises that are registered with the EPF. It’s applicable for companies with a workforce of 200 or less, and has made all monthly EPF contribution payments (for employee and employer portions) up to February 2020 (January 2020 salary).

During the deferment period, employers must ensure that the employee’s share of the monthly contribution are being paid up. To reiterate, employers can only defer the employer’s portion of the EPF contribution under the e-CAP.

How does the deferment work?

SMEs that apply for e-CAP can defer the contribution of the respective months (April, May and June) over a maximum period of 3 months. This means if an SME applies deferment for April contribution, they can start paying for the restructured payments in July and it must be settled by September 2020. For the month of June, the restructure payments will start in September and it will end in November 2020.

What you should know

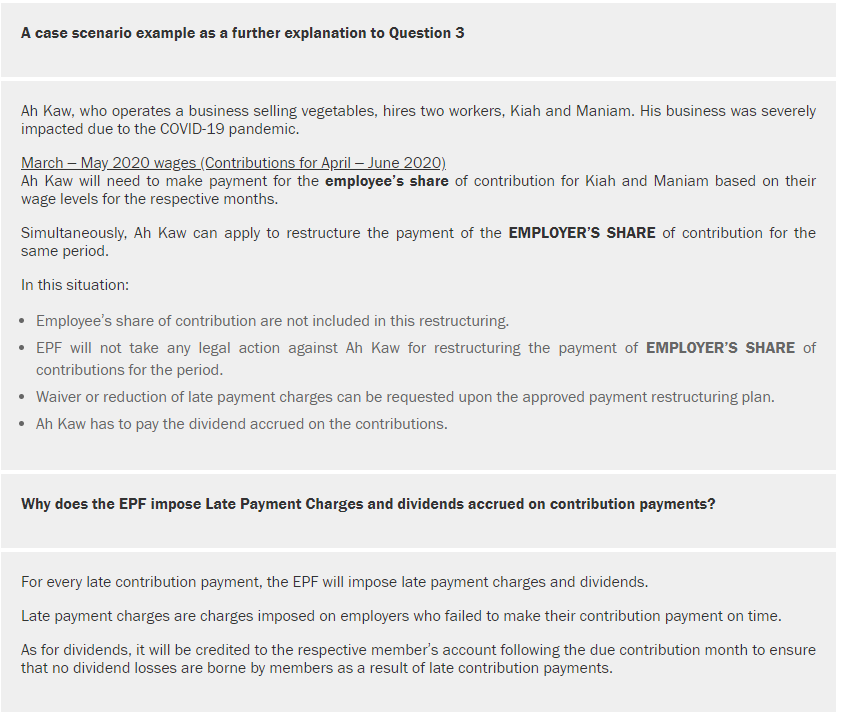

Before you apply for e-CAP, do note that EPF will still impose late payment charges and dividends on the contribution payments. According to the FAQ, late payment charges are imposed on employers who failed to make their contribution payment on time. However, it is mentioned that a waiver or reduction of late payment charges can be requested upon the approval payment restructuring plan as highlighted in the FAQ below.

It is mentioned that employers will have to pay for the dividend accrued on the contributions to ensure that EPF members will not lose out on the dividend losses as a result of the late contribution payments.

Settlement of all payments under the e-CAP program must be settled by 30th December 2020. For those that wish to exit the restructuring plan may do so by making a full settlement. If an employer fails to comply with the approved contributions restructuring plan, EPF reserves the right to pursue legal action.

For SMEs that are still able to pay for their EPF contribution, it would be better to continue making monthly payments as usual. Eligible companies can consider applying for e-CAP if they are struggling with their cash flow.

How to apply?

EPF will accept applications to restructure contribution payments beginning 23rd April 2020. This can be done via the EPF’s portal under the i-Akaun (Majikan) section. Employers will have to submit on a monthly basis and this is to ensure that the employee’s share for the previous month has been paid and the employer’s share has been restructured accordingly.

The instalment payments can be made via the i-Akaun (Majikan) portal, EPF counters or at EPF-appointed bank counters.

If more info, you can visit EPF’s FAQ on eCAP program here.

[ SOURCE, IMAGE SOURCE ]