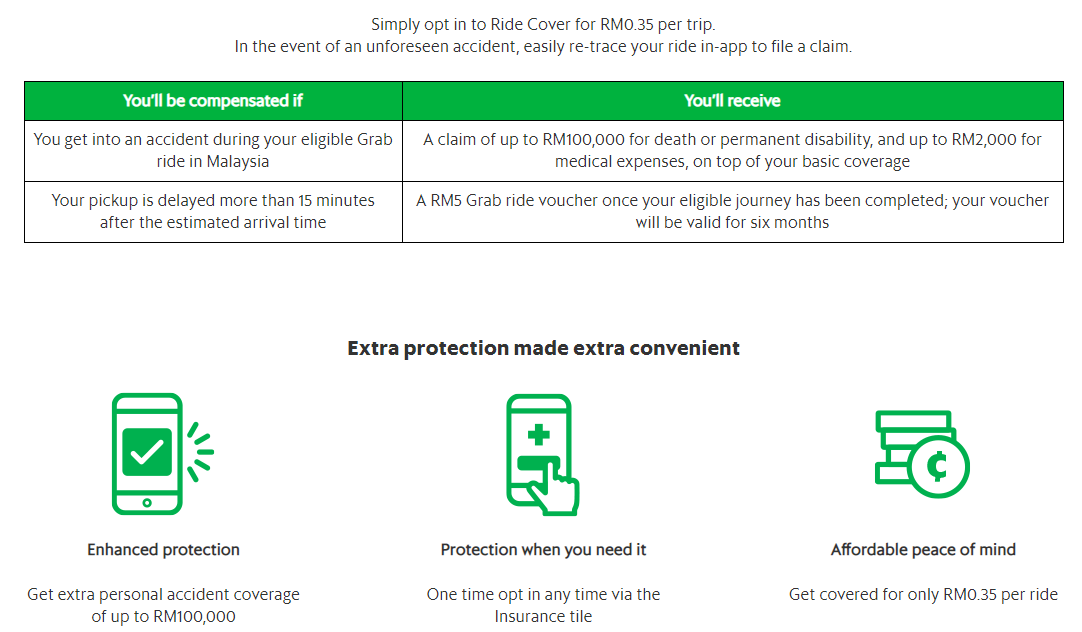

For greater peace of mind, Grab has introduced Ride Cover which is an optional insurance package that provides additional protection for GrabCar users in Malaysia at only RM0.35 per ride. Not only it covers you during accidents but it also offers a small compensation for late pickups.

The insurance aspect of Ride Cover is offered by CHUBB and you’ll get up to RM100,000 personal accident coverage (Death or permanent disability) which includes up to RM2,000 for medical costs on top of the basic insurance coverage of up to RM41,800 which is already offered to all GrabCar users.

In addition, Ride Cover also offers a 100% No Delay Guarantee. If your ride doesn’t arrive within 15 minutes of the estimated time of travel, you will be compensated with a RM5 Grab ride voucher. However, do note that this compensation is only valid if you continued with the ride and it isn’t applicable if the ride is cancelled.

At the moment, Ride Cover is only available to selected active GrabCar users from 25th February 2020 and it is based on the frequency of usage. If you’re eligible, you’ll see an “Insurance” option on the home screen.

According to the FAQ, the Ride Cover fee of RM0.35 is inclusive of RM0.05 for Personal Accident Insurance premium, of which RM0.005 is paid as a commission to GrabInsurace Agency (M) Sdn Bhd as an agent. Ride Cover does not cover rides on GrabShare, GrabRent and GrabBike.

To enable Ride Cover, just tap on “Insurance” and click on “View” under Ride Cover and select “Opt-in Now”. You will be charged RM0.35 for each ride until you decided to opt-out.

You can learn more on Grab’s Ride Cover page.