If you maintain a GrabPay account, topping up via credit or debit card is pretty seamless and you can even enable auto top-up. For those that still use online banking, it can be very troublesome as you would need to login to your bank account and then wait for the SMS verification code. If you’re in a hurry to get a ride home, this can be very frustrating. Now there’s an easier way to reload if you have a Maybank online banking account.

GrabPay is now allowing Maybank2U users to link their bank account to GrabPay for a seamless reload experience. This means you can reload your eWallet by just entering your desired amount and then hit “Top Up”.

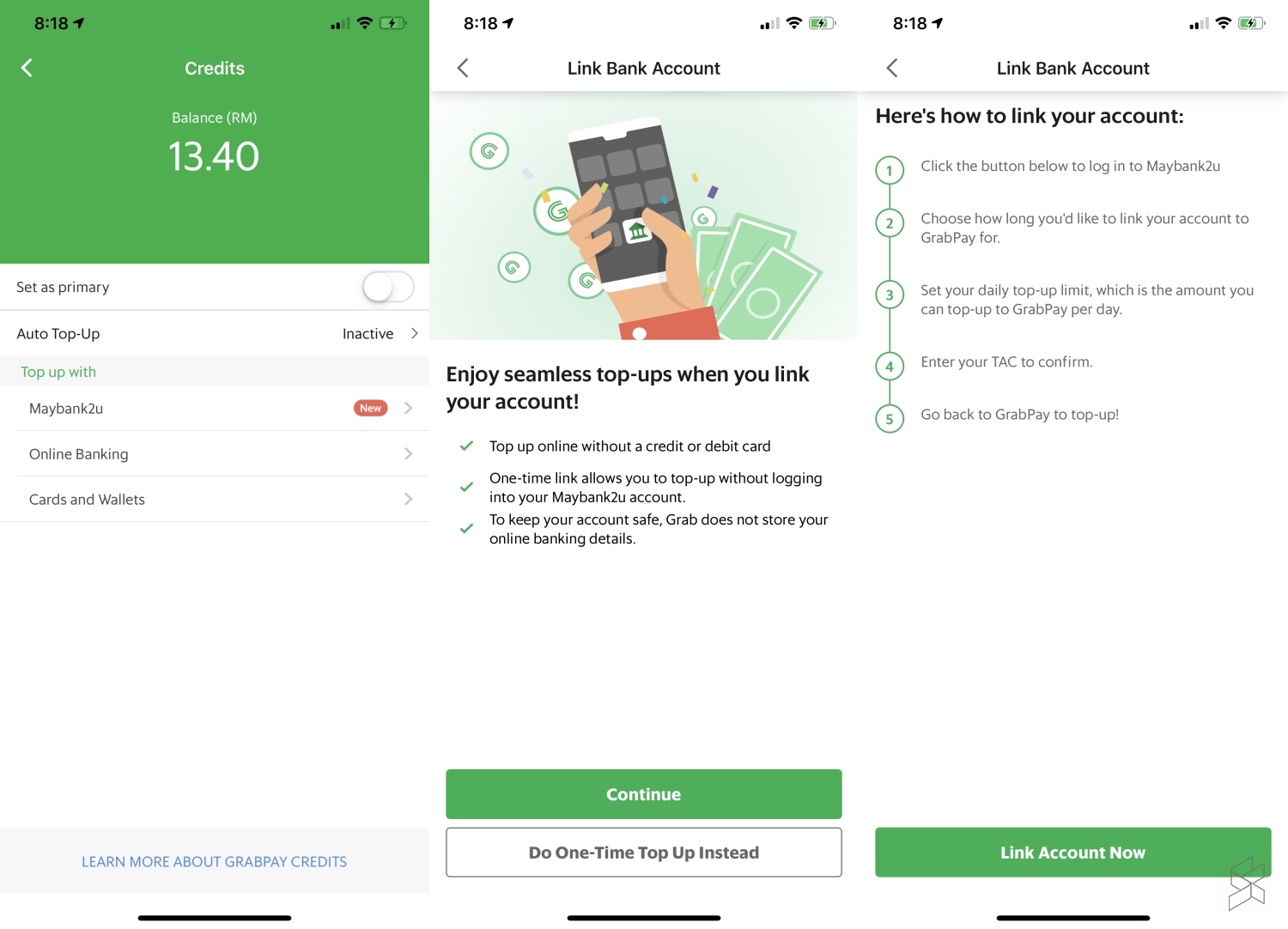

To get started, just launch the Grab app, select Payment and then tap on “Top Up”. Next, tap on the new “Maybank2u” option which appears above Online Banking and follow the next steps on the screen.

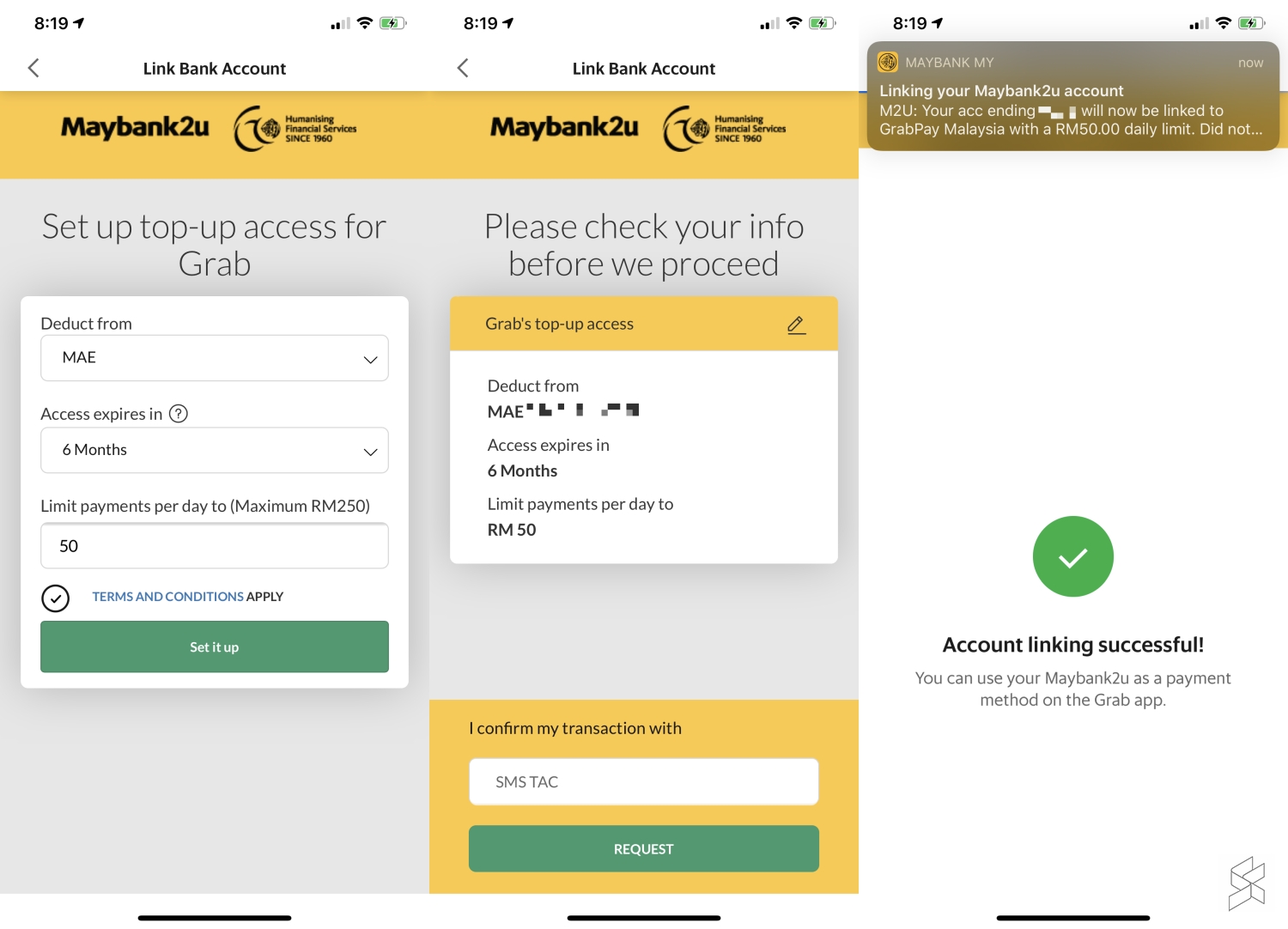

You’ll need to grant GrabPay permission by linking your desired Maybank account and this even works with Maybank’s MAE account which is a digital bank account that’s open to everyone.

For better control, you can set the duration of the access between 3 to 12 months as well as a daily transaction limit. To confirm the linkage, it will also require a TAC which is sent to your registered mobile number.

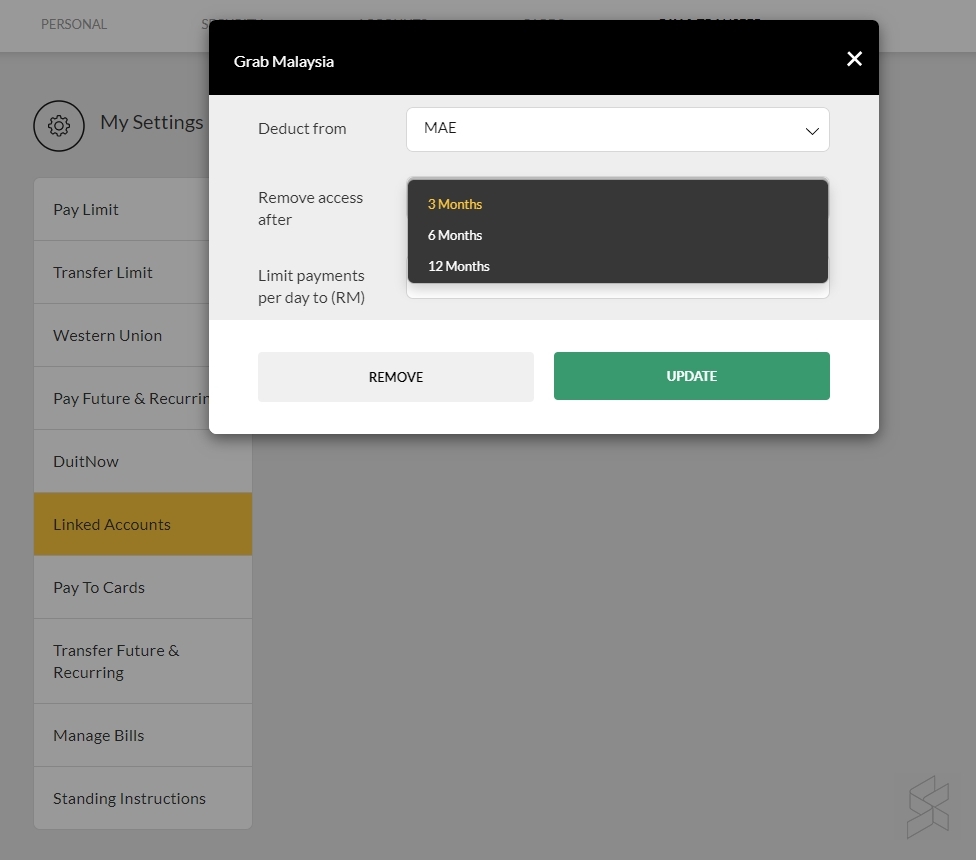

If you want to remove the link to GrabPay or wanted to change some settings, you can do so via Maybank2U on your desktop. Just go to My Settings > Pay & Transfer and look for “Linked Accounts”. From here you can change your access duration, daily limit or remove it altogether.

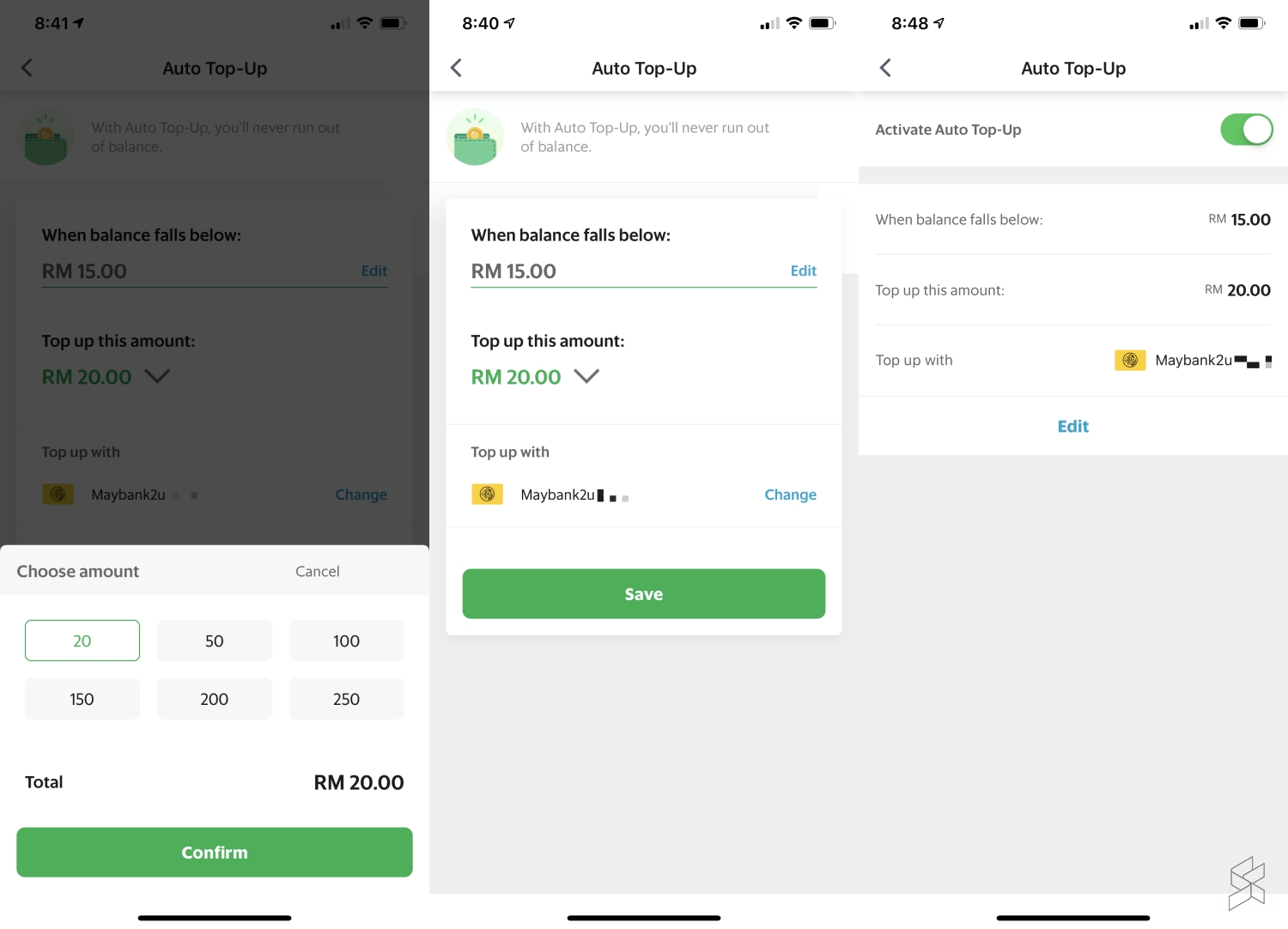

For greater convenience, you can also enable Auto Reload for GrabPay with your linked Maybank account. You can set when to trigger the auto-reload (when the balance falls below at least RM15) and choose between RM20 to RM250 to top up your GrabPay eWallet.