Facebook is looking to provide financial services to over 1.7 billion people who currently do not have access to banks as well as many more who do. To make this happen, it has joined an association — known as the Libra Association — comprising of tech companies like PayPal, Uber, Spotify, Visa and Mastercard to create a form of cryptocurrency that is accessible at a global scale.

The currency is called Libra and Facebook is taking the lead on building it as well as the technology required to support the ecosystem.

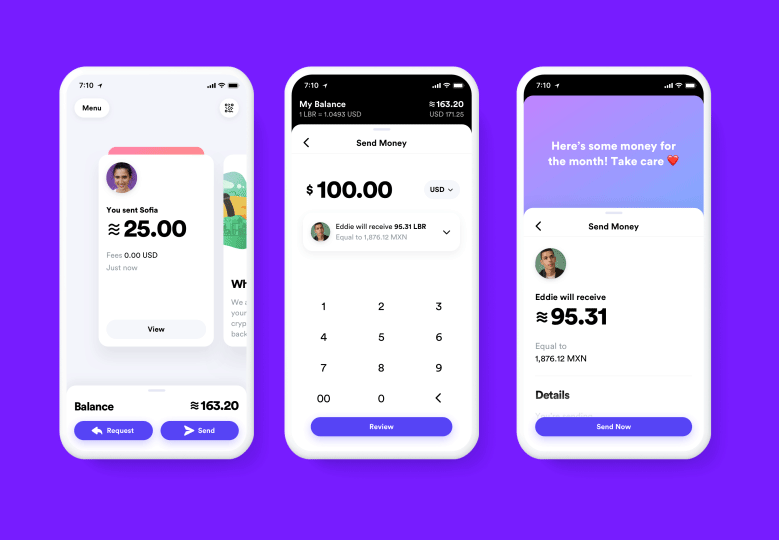

The biggest appeal of the currency will be its friction-less nature. With Libra, sending money will be as easy as sending a WhatsApp message and just as cheap.

You can convert local currency to Libra and with Libra you can pay for services, buy things, send money to family overseas without big transaction fees or your identity being tied to the transaction. And best of all, unlike many current eWallets, you can cash out your Libra anytime you want.

The vision is, sending money to anyone, anywhere, even internationally, will cost next to nothing with Libra. And because many of the 2 billion Facebook users globally very likely don’t have access to banks, Libra could potentially provide access financial services and commerce to people who currently don’t have bank accounts or credit cards.

The easiest place to start would be via Facebook-owned apps that these people are using right now.

To tap into this, Facebook has formed a subsidiary, Calibra, which will develop an eWallet app (also called Calibra) that will work with Libra. Calibra won’t be the only eWallet that can use Libra. Through the association, other companies will be able built eWallet apps that work with Libra but Facebook’s Calibra will the first to launch alongside the Libra currency. It will be available as a feature within Facebook Messenger and WhatsApp, and because Calibra doesn’t require users to have a Facebook account, the eWallet will also be available as a standalone app For iOS and Android.

But would you trust Facebook with your money?

Calibra (the subsidiary) promises that it will protect users’ privacy by keeping your Facebook data and your transaction data separate. But while the transaction fees using Libra will be almost next to nothing, the Libra Association will earn interest on the money you store in Calibra or any other Libra wallet.

Aside from low transaction fees and a ‘cash out at any time’ option, how would Calibra compete is the very crowded and competitive eWallet space?

Well, it will be like other eWallets right now, through incentives like rewards and discounts. On top of the friction-less experience and the convenience of being able to pay for services right from WhatsApp, for example.

What Facebook is peddling is not a new thing. Chinese developers have perfected the concept of the super-app for a few years already. WeChat in China allows you to do almost everything, social media, content, service, payment and more, in one app. Over here in Malaysia, you can consider Grab as a super app too.

In fact, you can argue that Grab and WeChat are more advanced than Facebook’s Libra as they have closed the online to offline gap allowing you to make a purchase online and collecting the services or good from a brick and mortar store.

In any case, it will be interesting to see how Facebook coming into the space will affect the market and how its competitors will react. For now, Facebook said Libra and Calibra will be released sometime in the 6 to 12 months timeline. That’s a lot of time for competitors to respond.

We’ll see.