With more cashless players appearing in Malaysia, Maybank has recently introduced its own mobile payment solution that’s called QRPay. Instead of having a separate e-Wallet, QRPay works with your existing Maybank savings and current account.

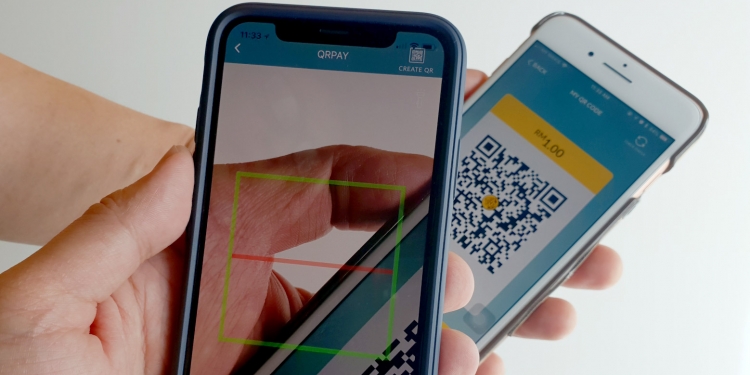

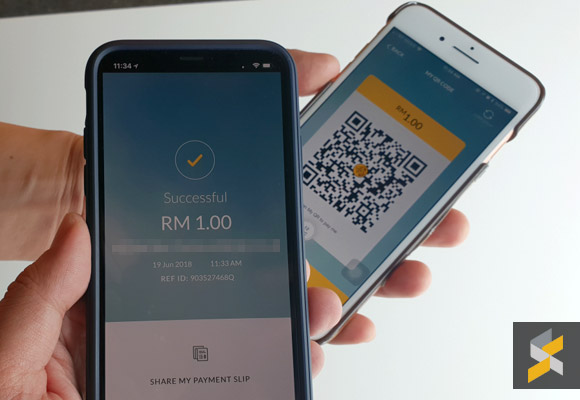

In the initial phase, QRPay was primarily used to pay merchants via QR Code. With the latest version, you can use it to make direct peer to peer transfers.

In the Maybank app, just tap on the QRPAY tab on the bottom of the screen. This will bring up the QR scanning mode and you’ll notice that there’s a new Create QR option on the top right. By default, it will show your personalised QR code which other Maybank users can scan to make the fund transfer. There’s also the option for you to specify the amount to receive so that the other party can pay with fewer steps.

From our experience, it’s quick and you can make fund transfers easier without the need for entering a mobile or account number. So if one of your friends owes you money, they can now pay you back in just a couple of steps. The only complaint is that the app isn’t fully optimised for the iPhone X as the “Create QR” icon is partially covered by the signal and battery indicator.

If you’re running a business, it is recommended that you use the Maybank QRPay app. This allows merchants to create separate access for cashiers and you have a separate interface for sales tracking.

In conjunction with the Raya, Maybank has also introduced a couple of ways for you to send e-Duit Raya. You can still send by mobile number or by scanning a QR code. The “My Raya QR” feature is basically a reskinned version of receiving payments via QRPay.

If you haven’t tried it yet, you can download the Maybank app on the AppStore and Google Play.