Maybank2u was first introduced in 2000 and it’s Malaysia’s number 1 online banking site. With more customers transacting online, Maybank has just revealed its all-new Maybank2u which offers a fresh new experience with greater personalisation.

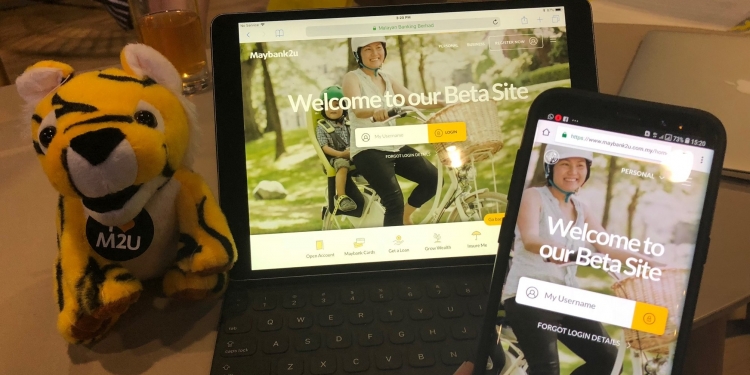

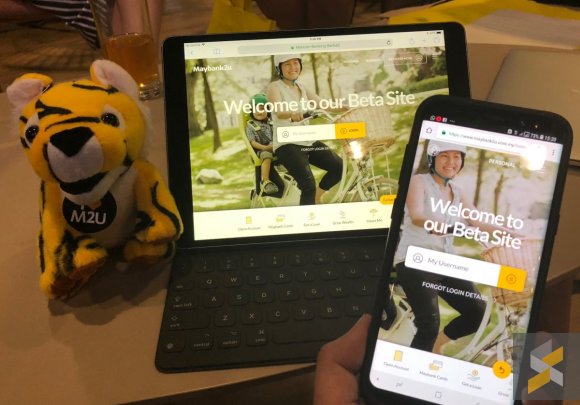

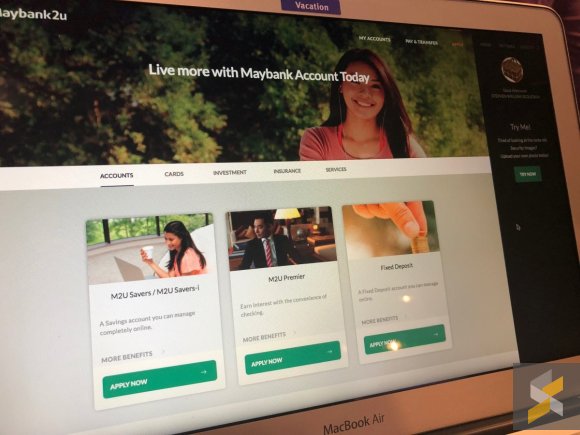

The new Maybank2u now comes with a cleaner design that’s now responsive and optimised for mobile, tablet and desktop users. The new site was developed mainly using in-house resources and they have also incorporated more security features to enhance customer confidence.

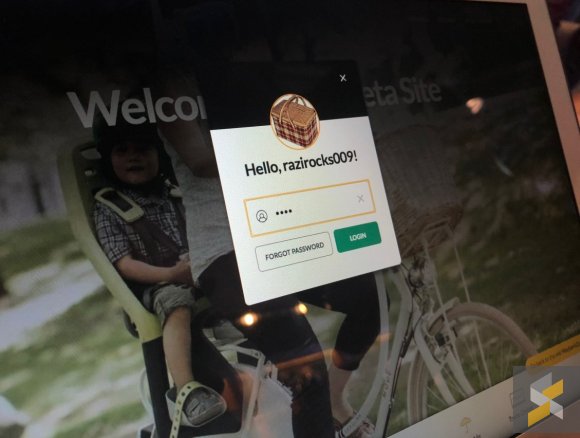

For those who often transfer funds overseas, the new Maybank2u site will display remittance options and it will provide greater transparency on the charges and foreign exchange rates as well as the time it takes to transfer. When it comes to security, users can now personalise their security image with their own photo. You can use a picture of yourself or of anything which can help you verify that you’re logging in to the right site. There are also customised themes for your online account.

The new site also offers a 360 Dashboard which gives you a holistic view of your accounts and investments. Also coming soon is a Debit and Credit Card Spending Pattern tracker which gives you a clearer understanding of your spending habits and it will help you to manage your spending according to your own needs. On top of that, there’s also a Goal Savings Plan which is a customised savings planner to help you plan and to achieve your goal by setting aside savings in different sub-accounts.

At the moment, Maybank2u has 10.69 million users and half of them are active users. In terms of total transactions, 99.6% are conducted digital either online or via the ATM. Only 0.4% of transactions are still done at physical branches.

The new Maybank2u site will be available starting from 19 April. If you want to give it a spin, you can visit the beta site at https://www.maybank2u.com.my/new. The current classic Maybank2u website will still be available for the next few months.

The new revamped site will be available for other key markets such as Singapore, Indonesia and the Philippines. A new Maybank App is also underway and it will be introduced at a later date.