If you’ve ever opened your eWallet only to find that you can’t make payments, transfer money, or access certain features, it can feel like your account has been frozen.

Recently, a single case shared on social media drew attention when a Touch ‘n Go (TNG) eWallet user found their account temporarily restricted. The incident caught the user off guard and raised questions about why such restrictions happen and what they mean for account holders.

While this is one public example, the process explained here reflects how licensed eWallets operate under Malaysian regulations.

Here’s how account restrictions work, why they happen, and what you can do if it happens to you.

How eWallets are regulated in Malaysia

In Malaysia, licensed eWallets operate under regulations set by Bank Negara Malaysia (BNM). These include requirements related to anti-money laundering (AML) and counter-terrorism financing (CFT), which apply to banks and financial institutions as well.

What this means in practice is that eWallet providers are required to monitor account activity and flag anything that appears unusual or potentially risky. This monitoring is largely automated and can be triggered by a range of factors, including transaction patterns or inconsistencies in account information.

When something is flagged, platforms are expected to step in and review the account. That’s where temporary restrictions come in.

Why an account may be temporarily restricted

When users describe their account as frozen, it usually means certain functions are temporarily restricted, not that the account has been shut down entirely.

During this review period:

- Your money is typically not moved, transferred, or lost

- You may be unable to make payments or transfers

- Some features may be limited until checks are completed

The restriction acts as a safety measure, giving the platform time to verify that your account hasn’t been compromised and that transactions are legitimate.

Using Touch ’n Go as an example

Most major eWallets follow similar processes because they operate under the same regulatory framework.

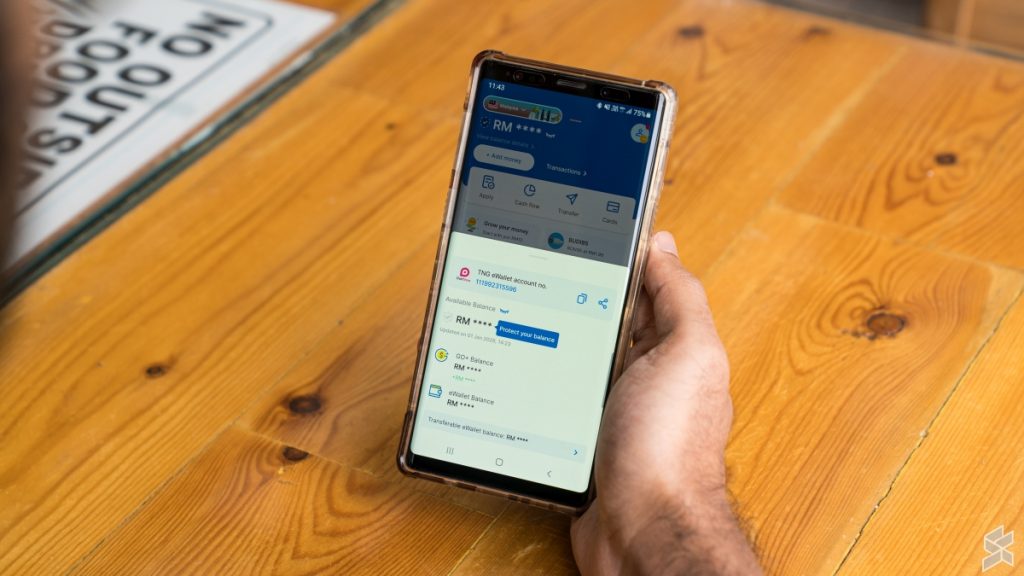

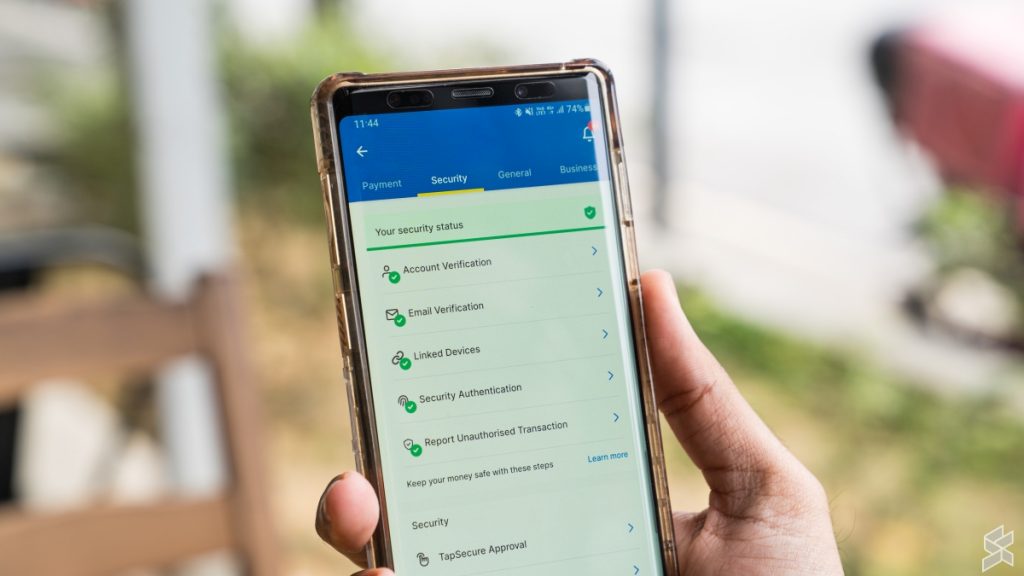

Touch ’n Go eWallet, for example, explains in its Security Centre and FAQs that it uses automated systems to detect unusual activity. If an account is flagged, users may be asked to provide additional information or documents to confirm their identity.

Once the review is completed and the information is verified, access is typically restored. The exact duration can vary depending on the case and how quickly the requested details are provided.

Clearing up some common misconceptions

There are a few persistent myths around account restrictions that are worth addressing.

One common belief is that creating a second account will automatically lead to suspension. According to TNG eWallet, reviews are generally risk-based and not triggered by a single action alone.

Another misconception is that restrictions are linked to how much money you have in your account, how often you use it, or how long you’ve been a customer. In most cases, TNG eWallet says restrictions are tied to specific activity patterns or verification issues, not account size or usage history.

Why identity verification matters

Account verification plays a key role in preventing fraud and protecting user identity. Licensed eWallets are required to verify accounts using official documents and identity checks, often as part of eKYC (electronic Know Your Customer) processes.

While this can feel inconvenient when additional checks are required, verification helps ensure that only you can access your account and that your funds can’t be misused by someone else.

What you should do if your eWallet account is restricted

If your account is temporarily restricted, there are a few practical steps you can take:

- Check official notifications or in-app messages for instructions

- Respond promptly if additional documents or information are requested

- Avoid creating duplicate accounts, which can complicate verification

- Refer to official help centres or FAQs for guidance

For TNG eWallet users, this information is available through its Security Centre. For a broader context, Bank Negara Malaysia also provides consumer education resources related to digital payments and financial services.

Why these systems exist

While having an account restricted can be frustrating, these checks exist to protect users. As digital payments become more common, so do fraud attempts and identity misuse. Temporary restrictions are one of the tools eWallet providers use to balance convenience with security, helping ensure that your money and personal information remain protected.

Understanding how the system works can make the experience less confusing and help you respond more effectively if it ever happens to you.