Hong Leong Bank (HLB) is currently running a limited-time RM30 cashback promotion for customers who use Apple Pay with their HLB Visa credit or debit cards, giving Apple users an added incentive to start paying with their iPhone or Apple Watch.

How the RM30 Cashback Promotion Works

To qualify for the cashback, customers simply need to:

- Add any HLB Visa credit or debit card to Apple Pay

- Make three (3) Apple Pay transactions, with a minimum spend of RM50 per transaction

- Complete all three transactions within one week

Once the requirements are met, the RM30 cashback will be credited back to the same credit or debit card account. The cashback campaign will run from 15 January to 25 February.

What is Apple Pay?

Apple Pay allows users to make contactless payments in-store, online and within apps without needing to carry their physical card. Payments are authorised using Face ID, Touch ID or a device passcode, while card details are protected through tokenisation, ensuring the actual card number is never shared with merchants.

A Quick Recap

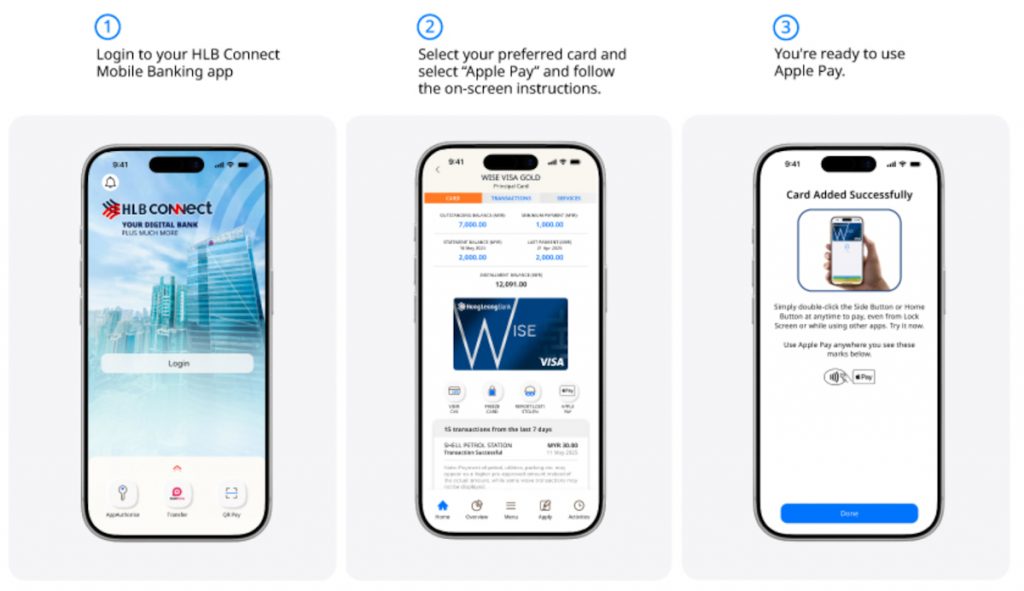

For those who may have missed it, Apple Pay is now supported for all HLB Visa credit and debit cards. Cards can be added via the Apple Wallet app or through the HLB Connect app, enabling customers to tap and pay at merchants that accept Apple Pay.

More information, including full terms and conditions for Apple Pay and the cashback promotion, is available on the Hong Leong Bank website.