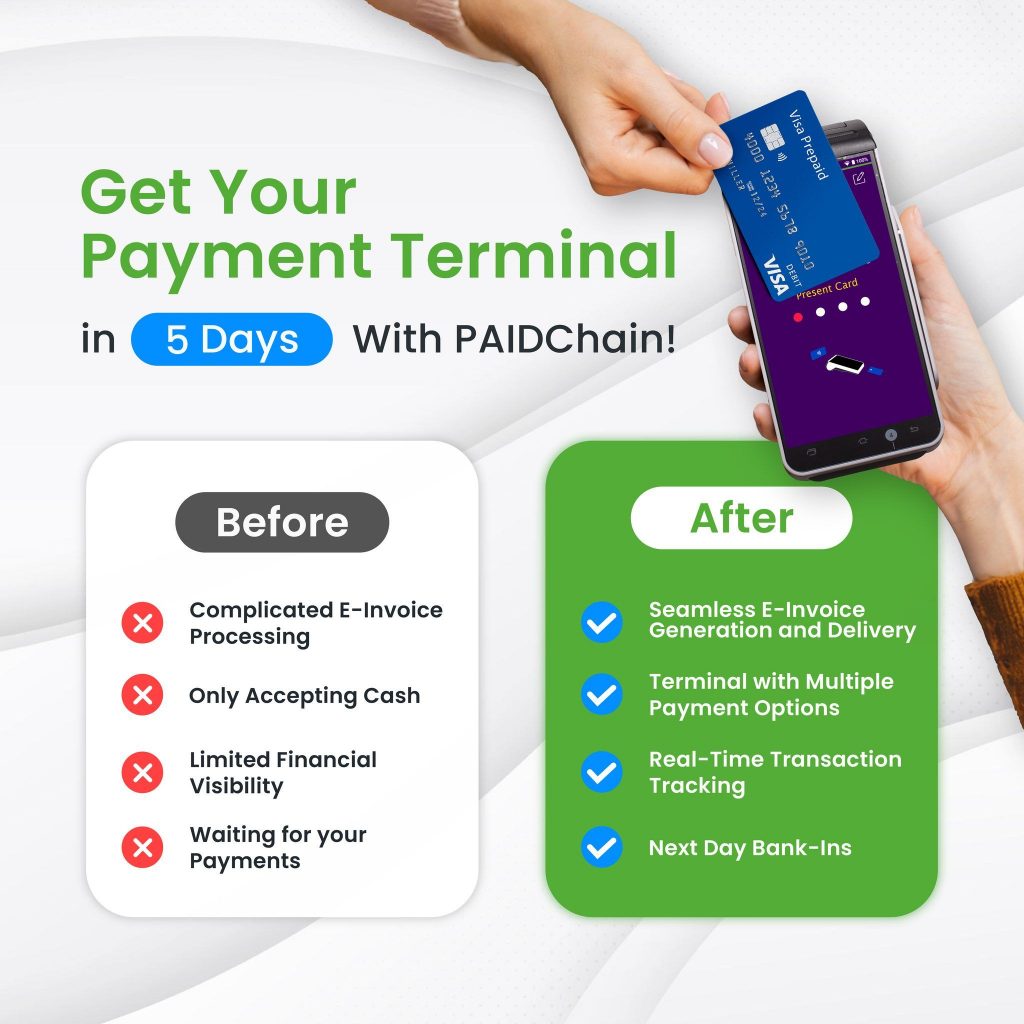

Managing multiple payment methods, issuing receipts, and keeping up with LHDN’s e-invoicing mandate can be overwhelming especially if you’re juggling with disconnected systems and manual paperwork.

That’s why SoyaCincau.com, in collaboration with PAIDChain, wants to help Malaysian MSMEs transition smoothly into the e-Invoicing era — with one of the most complete POS (Point of Sale) systems available today. It ticks all the right boxes, so we signed up for one ourselves.

And starting from 20th July 2025, the government is offering RM5,000 in support through the MSME Digital Grant MADANI to help businesses like yours make the switch.

Top 5 Features That Solve Real Business Pain Points

1. Built-in E-Invoicing (LHDN-Compliant)

E-invoicing is now a requirement for many businesses, but many don’t know where to begin.

This POS system automatically generates and submits e-invoices that’s fully compliant with LHDN’s format. No separate software, no compliance headaches. E-invoicing made easy!

2. Accept All Major Payment Methods — Including Apple Pay, Google Pay & Samsung Pay

Most business often need multiple terminals just to accept cards and eWallets. But this single device accepts it all:

Credit and debit cards (including Visa, Mastercard), Apple Pay, Google Pay and Samsung Pay — all from one sleek Android powered terminal.

Accept QR payments (DuitNow QR) with confidence as it supports Dynamic QR code with built-in SoundBox feature that audibly confirms successful payments.

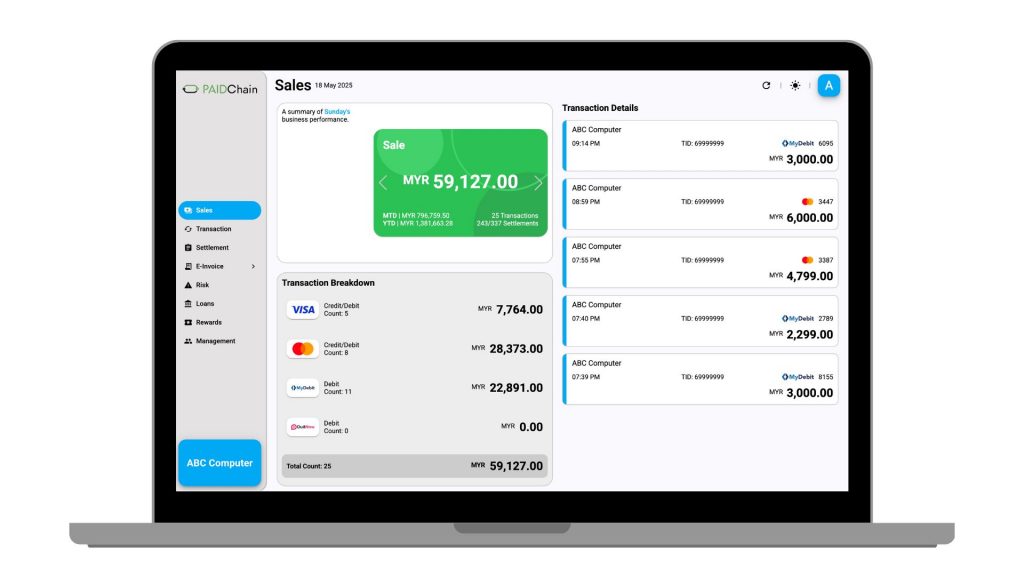

3. Real-Time Sales & Dispute Monitoring

Most small businesses can’t track their income until day-end and they miss out on chargeback alerts entirely.

With the Merchant Hub, you get live visibility of sales, settlements, and dispute notifications across all branches.

4. Seamless POS + Accounting Integration

Many businesses rely on separate systems for payments, receipts and accounting. And this fragmented approach is inherently more susceptible to human error and may cause admin overload.

This solution has built-in integration with SalesPlay POS and Xero, ensuring everything is connected from checkout to cash flow.

5. Instant Onboarding via WhatsApp

Traditional terminal onboarding can be a lengthy process and some could take over 30 days due to manual paperwork and extensive administrative requirements.

PAIDChain’s solution lets you onboard instantly via WhatsApp — no manual paper forms, no bank visits, #noqueue.

Get Paid — And Then Get Money Back

Here’s what makes this solution even more exciting:

With this POS system, you can earn cashback just by using it.

For every RM10,000 in transactions, you’ll get RM10 in cash rebates.

That means the more you use it, the more it pays for itself! You’re not just digitalising your business; you’re turning your everyday transactions into extra returns.

RM5,000 Grant Support Opens 1st August — But Don’t Wait

The MSME Digital Grant MADANI is offering RM5,000 in support to help eligible businesses get started.

Applications officially open on 1st August 2025, but grant slots are limited and demand is expected to be high.

Let us help you prepare your application in advance so you’re first in line.

Ready to Learn More or Get Started?

Let us walk you through it personally. We’ll explain how to apply, claim the grant, and get started with your new POS system. WhatsApp us at +60 10-202 7212. Alternatively, you can scan the QR code or click on the link below:

To apply for the POS system under the Digital Grant, please prepare the following:

- MyKad or Passport (Of the business owner, director, authorised representative)

- SSM Certificate (of business registration under PBT or SKM if applicable)

- Financial Proof (any ONE of the following):

- Latest 2 months’ business bank statements

- OR latest audited financial report

- OR latest management account statement

(Documents must be certified by issuer)

- Business Info:

- Business name

- Registration number

- Type (Sole Prop, Partnership, Sdn Bhd, Cooperative)

- Business address

- Years in operation (must be 6 months or more)

- Annual revenue (must be RM50,000 or more)

- % Malaysian ownership (must be at least 60%)

- Contact Info:

- Your name

- Phone number (WhatsApp)

- Email address