Boost Bank has removed its complicated tiering system, allowing all users to enjoy better rates with a minimum deposit of as little as RM1. Previously, Boost Bank users were required to make a deposit and maintain a minimum balance of RM2,000 to unlock the Platinum President tier which offers up to 3.6% p.a. daily interest.

Boost Bank now lets you enjoy higher interest rates with just RM1 deposit

Effective today, Boost Bank users are only required to deposit at least RM1 to unlock the highest Platinum President Tier. Here’s the applicable interest rate:

- Savings Account: 2.5% p.a. daily interest

- Savings Jars: 3.6% p.a. daily interest

- Special Jars: 4% p.a. daily interest

To enjoy higher returns, you’ll have to save funds in the Savings Jar, which is like a sub-account designed to help you achieve your financial goal. The interest rate for Boost Bank is calculated daily but credited every week.

At 3.6% p.a., Boost Bank’s interest rate is higher than GXBank’s 3.00% p.a. rate but slightly lower than Aeon Bank’s 3.88% p.a. profit rate. However, it is worth pointing out that both GXBank and Aeon Bank provide the same returns for both Savings Account and Savings Pockets/Saving Pots.

Take note that Boost Bank’s Savings Jar rate of 3.6% p.a. is offered as a promo until 31st December 2024. The default rate for Savings Jar is 3.2% p.a.

As a comparison, Boost Bank previously offered 0.5% p.a. daily interest for Savings Accounts and 1.5% p.a. daily interest for Savings Jar for its base Boost Basic level. Once you’ve unlocked the Platinum President tier with a minimum deposit of RM2,000, the digital bank offered 2.5% p.a. daily interest for Savings Account and 3.2% p.a. (3.6% p.a. during promo) daily interest for Savings Jar.

Unlock 4% p.a. for Savings Jar when you use your Boost eWallet at Mydin and CelcomDigi

Boost Bank is offering a higher interest rate of 4% p.a. for Savings Jar if you spend at selected merchant partners using the Boost eWallet every month. As announced before, users can unlock a special Mydin Savings Jar by spending a minimum of RM50 in a single transaction at Mydin outlets.

Today, they announced CelcomDigi as their second partner and customers can unlock a special CelcomDigi Savings Jar by spending a minimum of RM20 in a single transaction for CelcomDigi Prepaid or Postpaid. In addition, CelcomDigi customers can enjoy a one-time 4% cashback (RM1.20 for Prepaid, RM2.40 for Postpaid) by redeeming the promo code CDPREPAID or CDPOSTPAID in Boost eWallet.

This 4% p.a. rate for Savings Jar is offered for a limited time. The Mydin Jar is offered until 30th September while the CelcomDigi Jar is offered until 7th November 2024. With the latest revision, users are no longer required to maintain a minimum balance of RM2,000 to enjoy the 4% p.a. rate for the Savings Jar.

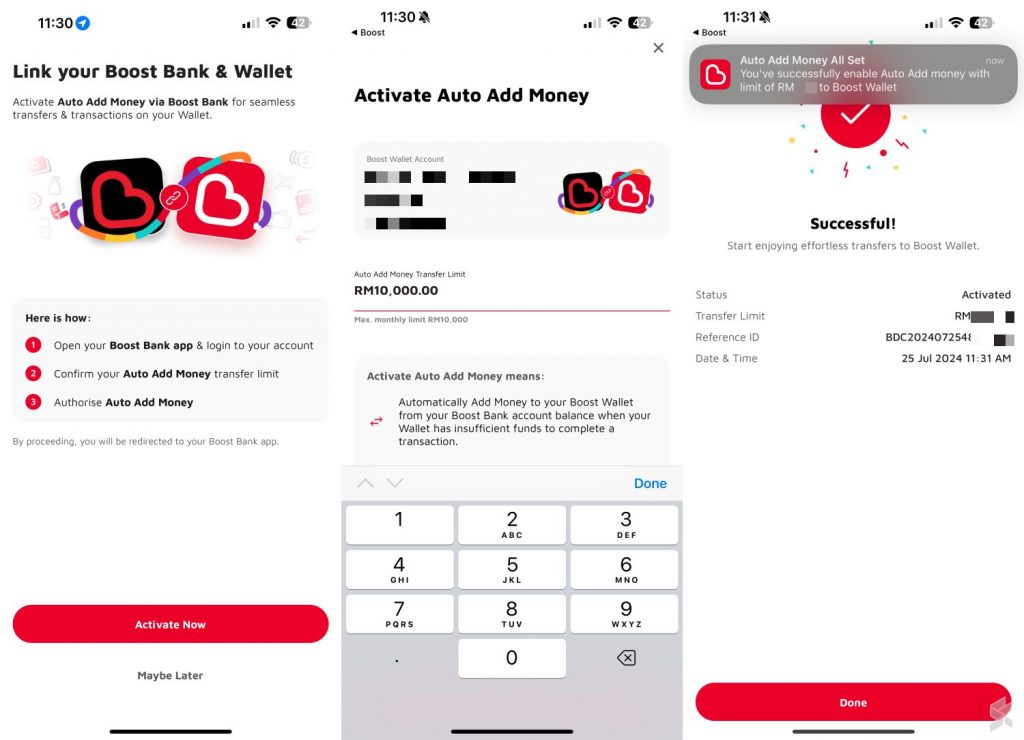

Boost Bank has enabled auto-add money for Boost eWallet

Boost Bank in its current state only offers a Savings Account product with no option for QR or card spending. If you wish to spend using your Boost Bank Savings Account, you can link it with your Boost eWallet and make payments via DuitNow QR.

To spend using funds from your Boost Bank account, they recently introduced the Auto Add Money feature which lets you auto-reload the required funds from your Bank when your eWallet balance is insufficient.

Boost Bank has also indicated that it will be releasing its Mastercard Debit Card soon.