Boost Bank by Axiata and RHB has officially launched and they are now accepting public registrations for its savings account. If you want to make cashless payments worldwide, the Boost Bank Debit card is expected to be released sometime next month.

Boost Bank to launch retail debit card next month

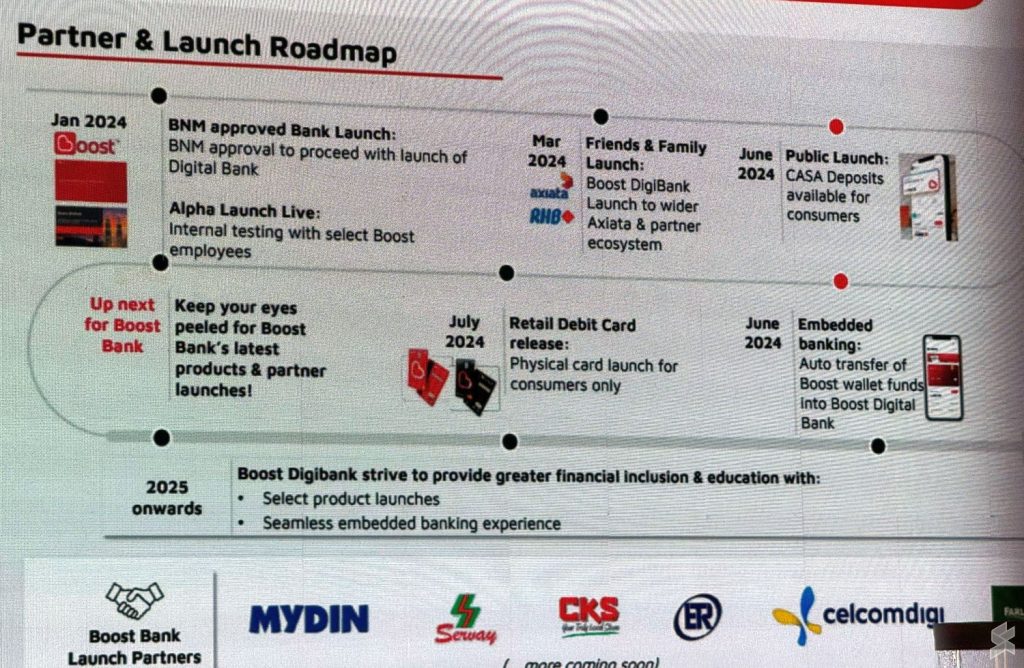

According to the digital bank’s launch roadmap, Boost Bank intends to launch its retail debit card in July 2024. As teased earlier, the Mastercard debit card will come in either Black or Red, and they are currently asking the public to vote for their preferred card design.

The front comes with an all-black or all-red design with the large Boost logo, while the card details such as the 16-digit number, expiry and CVV, are printed on the back. Another interesting detail is that the side edges of the red card are black, while the black card has red edges.

When we asked about Apple Pay and Google Pay support, they told us that it is something they are looking into but it isn’t a main focus right now. The new digital bank wants to prioritise serving micro-SME and SME segments and to drive education and digital literacy.

Boost Bank has plans to enable DuitNow QR support

In its current version, the Boost Bank app doesn’t support DuitNow QR but they are plans to enable the feature later. During the press conference, Boost Bank CEO Fozia Amanulla said the DuitNow QR feature on the Boost Bank app isn’t crucial at the moment as users can make QR payments via the Boost eWallet app.

She added that if a user has linked their Boost eWallet with their Boost Bank, the eWallet will be able to pull money from the Bank’s savings account when they use their eWallet to pay. So the idea is to have all your balances to sit with the bank while earning interest and then use QR to pay via the eWallet.

However, take note that the Boost Bank and Boost eWallet “link feature” is still a work in progress. When you launch your Boost eWallet app which is registered under the same mobile number, you will be asked to link your Boost Bank account to the eWallet app.

After linking the two apps, you will see a unified balance from both eWallet and Boost Bank Account. However, the unified balance is for viewing only as DuitNow QR transactions on the Boost eWallet app will still only utilise your remaining balance in your eWallet and there’s no option to choose your Bank Balance as the source of payment.

While users can currently top-up the Boost eWallet from other banks (e.g. Maybank, Ambank, Public Bank, RHB, OCBC, etc.), there’s no seamless option to reload your Boost eWallet from Boost Bank. We’ve been informed that a new “Transfer from Boost Bank to Boost eWallet” feature will be coming soon. Hopefully, it comes with an auto-reload or auto-cash-out function similar to TNG eWallet Go+.

To recap, Boost Bank is Malaysia’s third digital bank and they offer interest rates of up to 3.6% p.a. for their Savings Jar. To enjoy higher rates, you’ll need to unlock the Platinum President tier which requires you to deposit and maintain a balance of RM2,000.

You can learn more about Boost Bank’s Savings Account and interest rates here.