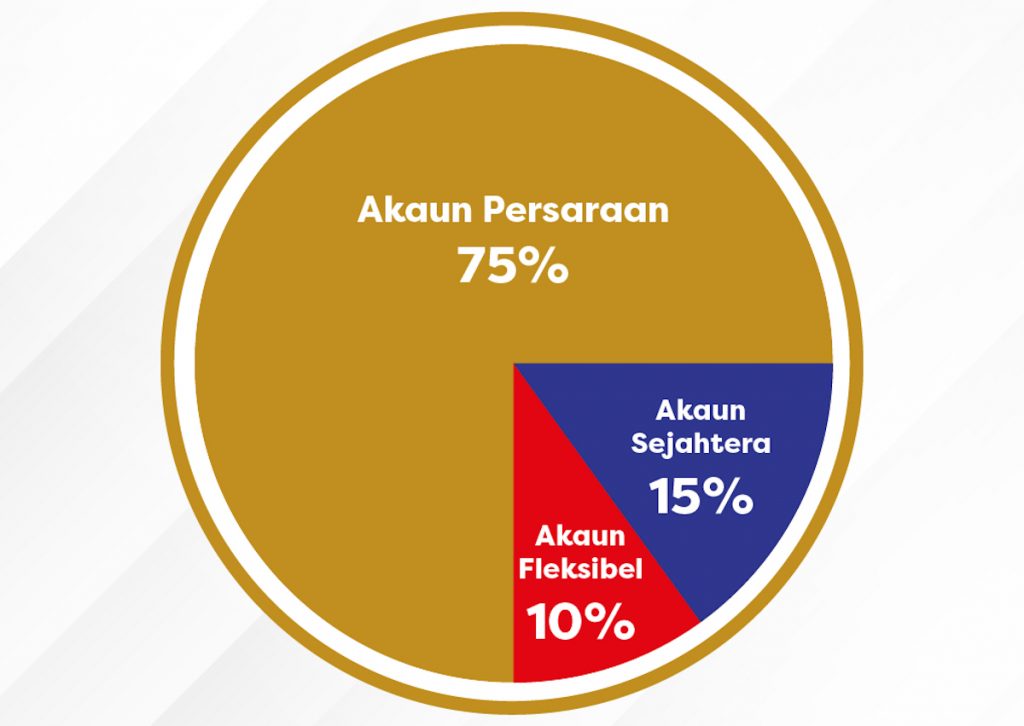

Employee’s Provident Fund (EPF) will be adopting the new 3-account structure starting from 11 May 2024. Immediately, many have asked whether the new account structure will affect the dividend policy for EPF members.

EPF Account 3 dividend rate is the same as Account 1 and 2

In its media statement, EPF did not cover this particular question. Similarly, it was not part of the FAQ section on EPF’s official website.

However, we got two confirmations that the Account 3 dividend is the same as per the existing policy. One is a response from EPF itself on its X account:

@ongmalimali.

— KWSPMalaysia (@KWSPMalaysia) April 25, 2024

Rest assured that the dividend for Account 3 (Flexible Account) will be the same as Account 1 (Retirement Account) and Account 2 (Wellbeing Account).

TQ.

-ZHS-

Meanwhile, a report by Bernama has also said that the Account 3 dividend will be the same as Account 1 and Account 2. Citing EPF’s CEO, Ahmad Zulqarnain Onn, the report also pointed out that things may change in the future given that liquid assets are not usually associated with high interest rates.

EPF Account 3’s massive potential as an emergency saving

The financial literacy advocator, The Futurizts has predicted that EPF Account 3 could be a popular choice for the public to store their savings.

This is because EPF has consistently provided a much higher dividend rate than Amanah Saham Bumiputera and Amanah Saham Malaysia. Both of them are two of the most popular and largest unit trust funds in Malaysia.

It's confirmed: EPF's Account 3 dividend will be the same as Acc 1 and 2.

— The Futurizts (@TheFuturizts) April 26, 2024

This is huge.

ASB & ASM averaged 4.93% pa and 4.79% pa for the past 6 years.

Meanwhile, EPF's conventional and Shariah savings averaged 5.63% pa and 5.27% pa.

We're not surprised if this would be the… https://t.co/CmyN6ZjfoY pic.twitter.com/3g51j0yByC

Of course, this is provided that EPF maintained the same dividend policy for Account 3. Given that the latest dividend announcement just occurred last month, EPF certainly has some time to amend it for 2025.