As one of the leading fintech players in Malaysia, TNG Digital, the operator of the Touch ‘n Go eWallet, went through peaks and valleys throughout last year. The company shared its 2023 performance and also outlined what users can expect from Touch ‘n Go eWallet in 2024 in a media briefing today.

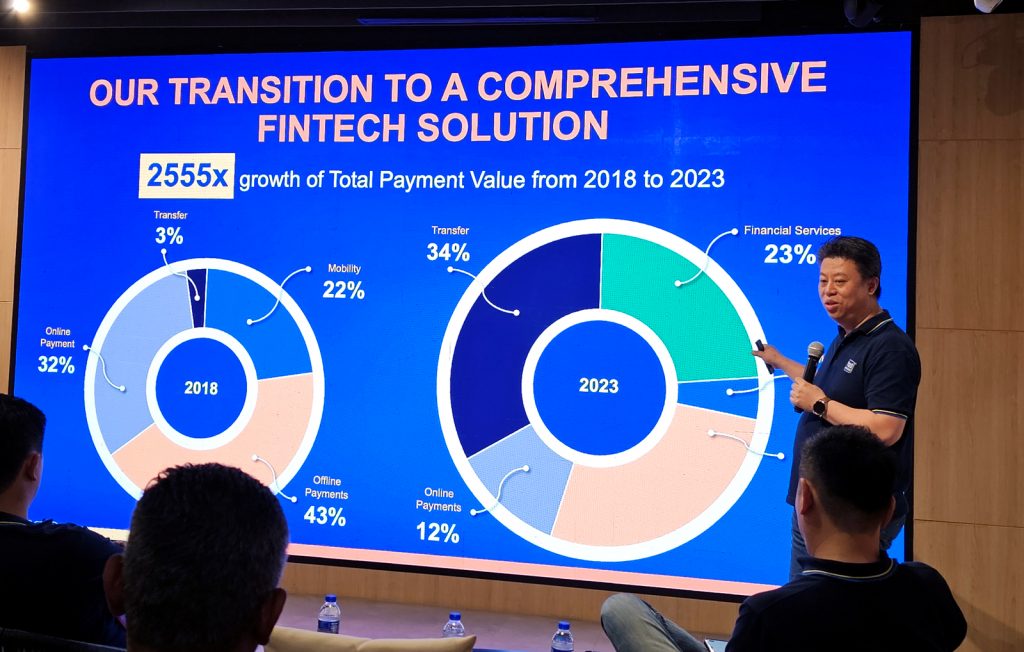

Alan Ni, CEO of TNG Digital, acknowledged the company’s significant growth and market leadership in Malaysia in his speech. He mentioned that Touch ‘n Go eWallet now holds a 50% market share in the country, and a Total Payment Value (TPV) worth over RM 7 billion a month was made last year, compared with a TPV of only RM 25 million for the whole of 2018.

The company still sees a large chunk of its transactions coming from offline transactions, which covers 27% of the total transactions recorded last year, but the biggest chunk was money transfers between accounts, standing at 34%. Mobility, which includes tolls and parking, is now only 4% of the total transactions, down from 22% in 2018.

With over 26 million registered users, or about two-thirds of the Malaysian population, it is no surprise that it is the top eWallet in market share. Out of the registered users, 20.9 million are verified users via electronic Know-Your-Customer (eKYC).

Speaking at the media briefing, Ni reflected on the remarkable performance of 2023, stating, “Our unwavering dedication to delivering convenience, confidence and a rewarding experience to our users has propelled Touch ‘n Go eWallet to the forefront of the industry. We are immensely proud of our achievements, including winning the prestigious Putra Brand of the Year 2023 and Fintech of the Year 2023 awards, which underscore our position as the preferred choice among Malaysians.”

TNG Digital plans to add more services for customers and merchants

For 2024, the company is committed to expanding the selection of services available to its customers. In the pipeline, the company is ready to roll out a new revolving credit facility eliminating the need for reloads, and a new lending product with lower interest rates and greater flexibility. With the new rolling credit, users can ‘buy now, pay later’ (BNPL) at every payment point, not just selected ones. Along with the revolving credit facility, TNG Digital will also introduce more products under GOInvest, including gold trading and share trading, to provide users with a range of diverse investment opportunities.

For the merchants, TNG Digital aims to enhance its value-added services for merchants by introducing a new merchant wallet and enhanced features to drive foot traffic for our merchants. Other new features include a merchant money packet, store finder and reviews and a suite of financial services products for merchants. These features, along with the Touch ‘n Go eWallet Soundbox, are how TNG Digital aims to position itself as a one-stop solution provider for businesses, particularly SMEs.

Lastly, the company is gearing up to increase the security factor of using the eWallet application. To strengthen security measures and enhance user verification, Touch ‘n Go eWallet will be embarking on a pioneering initiative to become the first eWallet in Malaysia to implement 100% eKYC or account verification.

The implementation is still underway, and more information will be shared as the full execution nears. They acknowledged that some roadblocks are still in place before the rollout can begin, but they are confident that they can find the right solutions for the problems.