This post is brought to you by Maybank.

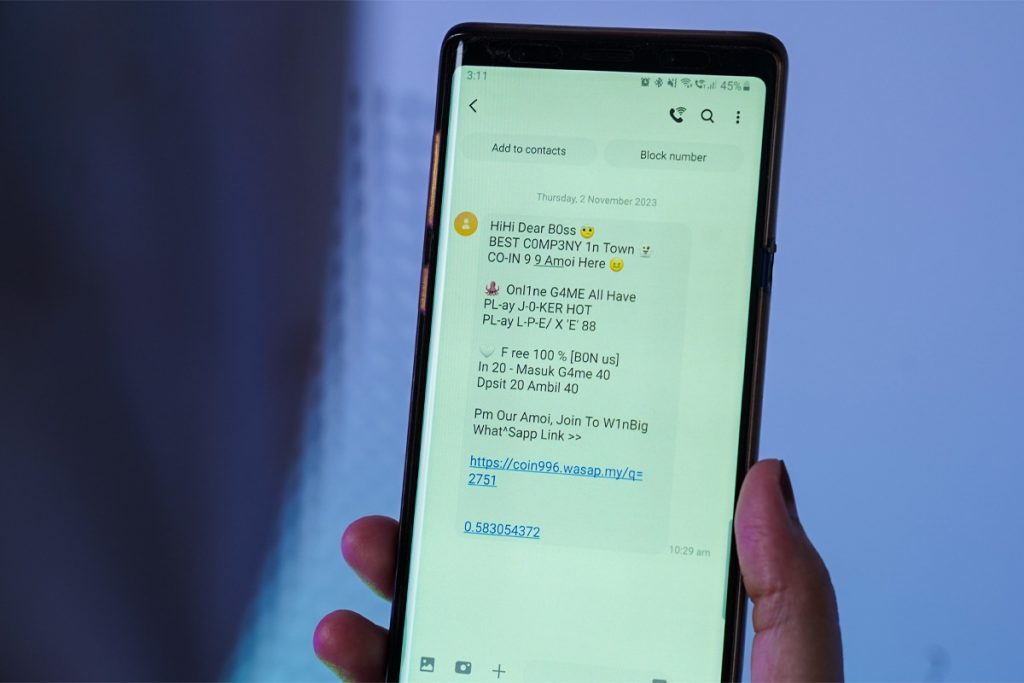

It’s now easier than ever to find the products and services you’re looking for on eCommerce platforms. As such, people with malevolent intentions have taken advantage of the situation to scam people out of their hard-earned money. One popular method is to obtain One-Time Passwords (OTP) sent through SMS for authenticating banking transactions.

Victims will be tricked into sharing the OTP or convinced to download malicious apps that will relay the OTP to the scammer. More advanced tactics include SIM jacking where the scammer will obtain the necessary information from the victim to request a replacement SIM from the telco.

To protect its customers from unauthorised transactions, Maybank introduced Secure2u on its mobile banking app as a secure replacement for SMS OTP.

Strengthened security with Secure2u

Maybank’s Secure2u strengthens security over SMS OTP by running within a secure environment in the MAE app. Thanks to the security measures baked into Maybank’s mobile banking app, it’s more difficult for malware to penetrate.

Unlike SMS OTP, Secure2u provides more details of the transaction, helping you verify the legitimacy of the party you’re in business with. Even after you confirm the transaction, you are required to enter your 6-digit PIN for authentication.

For tighter security, Maybank only allows Secure2u to be activated on one smartphone at a time. Moreover, there’s a minimum 12-hour cooling-off period after activation, during which Secure2u will be inactive and no transactions can be made. This provides customers with time to take countermeasures for unauthorised Secure2u activations.

With such a secure system in place, Maybank has discontinued SMS OTP for banking transactions effective 1st July 2023.

For tighter security, here’s the new process for activating Secure2u

Previously, Maybank relied on activating Secure2u solely through the app. However, Maybank is beefing up this part of the process with a more secure method. As of 31st October 2023, Secure2u activations for new customers and on new devices will need to be authenticated at a Maybank ATM.

Though this is an additional step, it’s worth noting that the security advantages of this new process will go a long way to protect your savings. Moreover, you only need to go through the Secure2u activation process once when you switch smartphones.

Here’s how to activate Secure2u at a Maybank ATM for ATM cardholders

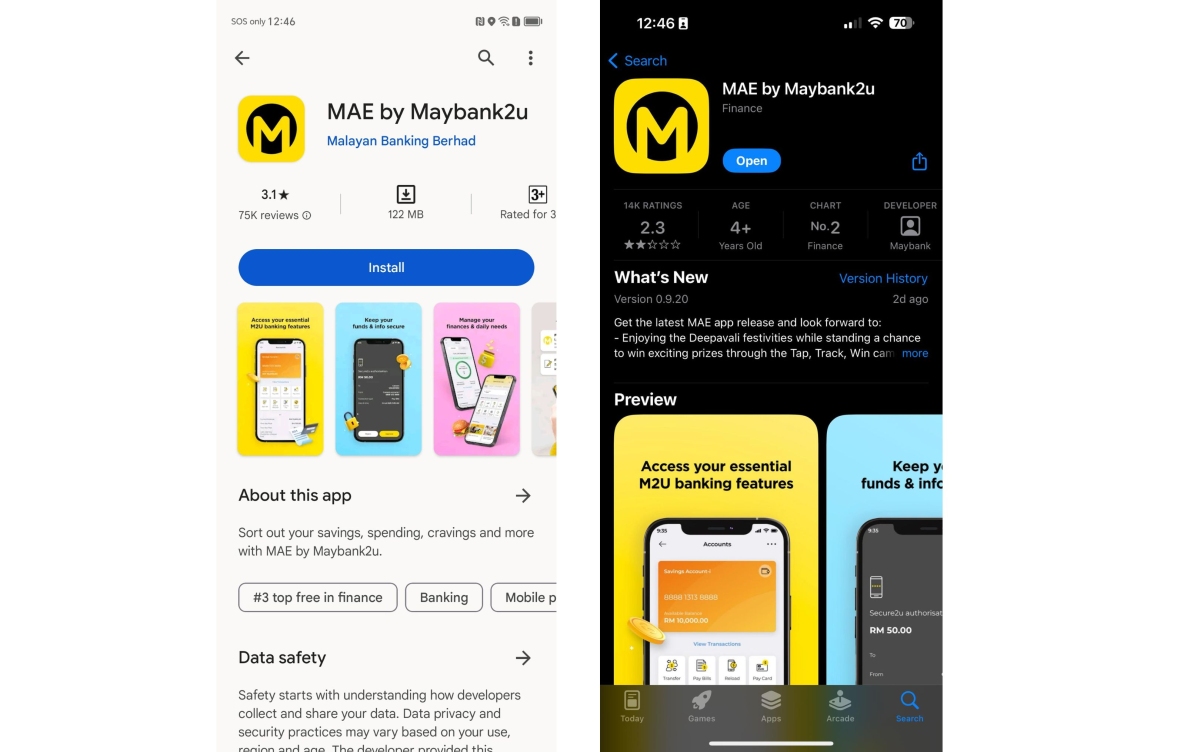

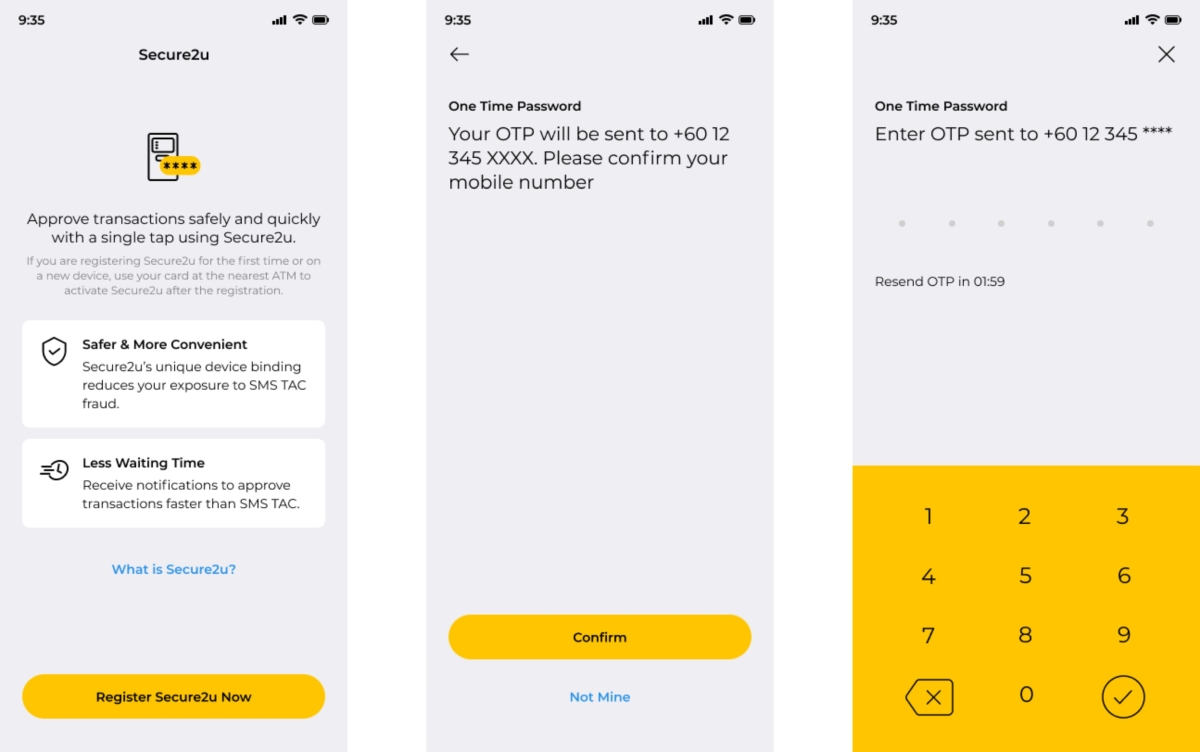

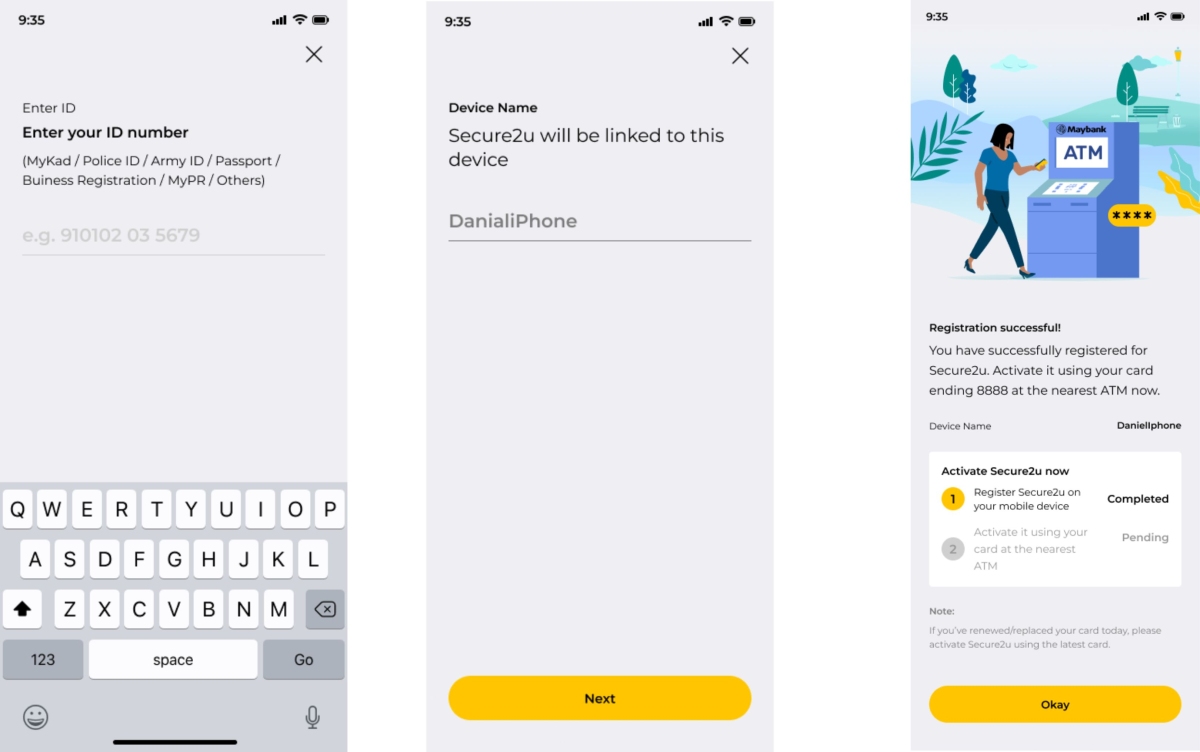

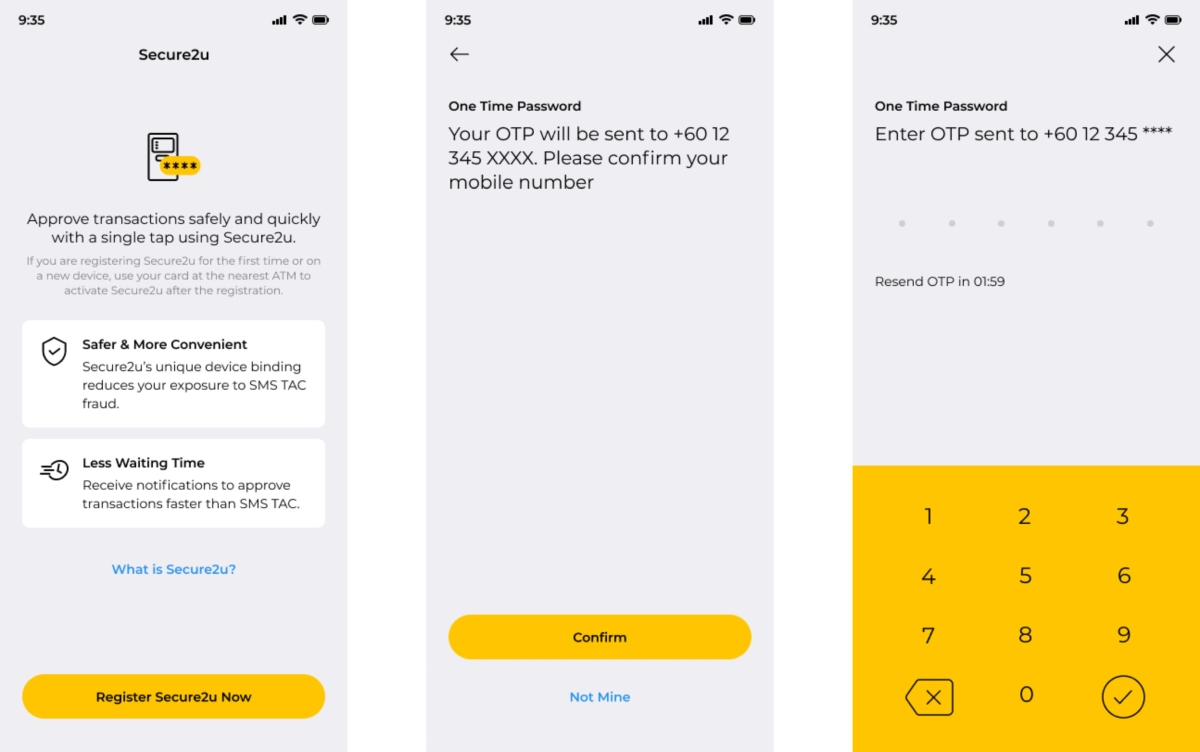

Whether you’re a new customer or switching to a new smartphone, you will need to download and install the MAE app on your smartphone from the Google PlayStore, Apple App Store or Huawei App Gallery. Launch the MAE app and look for Secure2u in the Quick Actions pane.

Click on it to proceed with Secure2u activation. Follow the instructions on the screen to register your smartphone for Secure2u. Once successfully registered, you will need to activate Secure2u at any of the more than 2,900 Maybank ATMs nationwide within 30 days.

At the Maybank ATM, insert your ATM card linked to the account you wish to activate Secure2u for. On the main menu, choose Secure2u Activation to proceed with the activation. For successful registration, you will see the option to confirm Secure2u activation. Click the button corresponding to that option to confirm Secure2u activation.

You will then need to wait out the cooling-off period of a minimum of 12 hours before being able to perform online transactions. This is a precautionary step to provide you with the time to take countermeasures for unauthorised Secure2u activations.

What if you’re a MAE account user without an ATM card or an Overseas Customer?

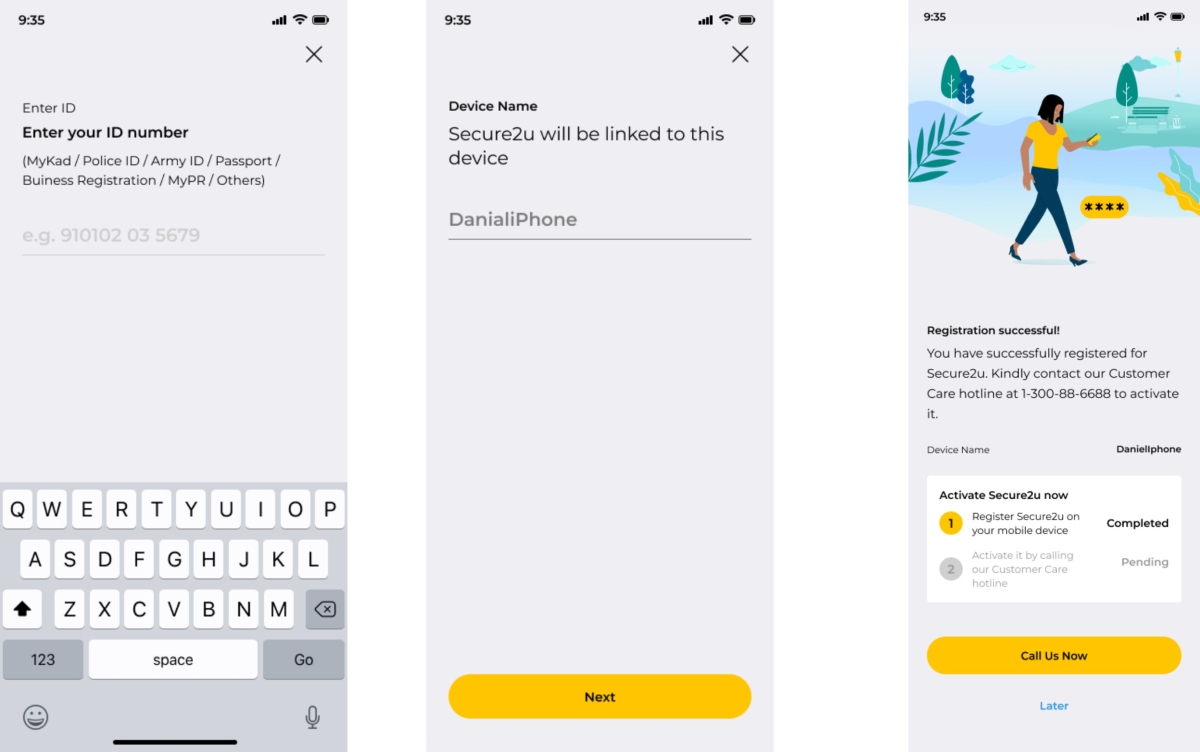

On the other hand, if you’re a MAE account user without an ATM card or an Overseas customer, you will not be able to activate Secure2u at a Maybank ATM. In this case, the process of registering your smartphone for Secure2u on the MAE app is the same.

But instead of using an ATM, you will need to call Maybank Group Customer Care (MGCC) at 1-300-88-6688 within 30 days of successful registration on the MAE app to complete the activation process. You will then need to wait out the cooling-off period of a minimum of 12 hours before being able to perform online transactions.

Always protect your online banking security

Maybank would like to reiterate that the security advantages offered by this two-factor authentication process outweigh the minor inconvenience of activating Secure2u once for new customers or when switching to a new smartphone.

With that being said, Secure2u is just a preventive measure to minimise the risk of unauthorised transactions from your bank account. To completely safeguard your savings account, you should take your own security measures by never approving transactions you don’t recognise or sharing sensitive data, such as your PIN, with anyone.

For a smoother and more secure banking experience, activate Secure2u today.