This post is brought to you by UOB.

A recent Visa Consumer Payment Attitudes study showed that more than 60% of Malaysians are choosing to use digital banking for bill payments, transferring money to friends and family, payment at retail locations and, withdrawals. Therefore, it’s important that you get a great digital banking experience and that starts with the mobile banking app.

UOB’s Mighty app provided you with a quick and easy way to access its digital banking services. However, to give you a more personalised and improved digital banking experience, UOB is introducing the TMRW app. Leveraging the power of AI, it provides contextual insights and financial tips by analysing your spending and saving patterns.

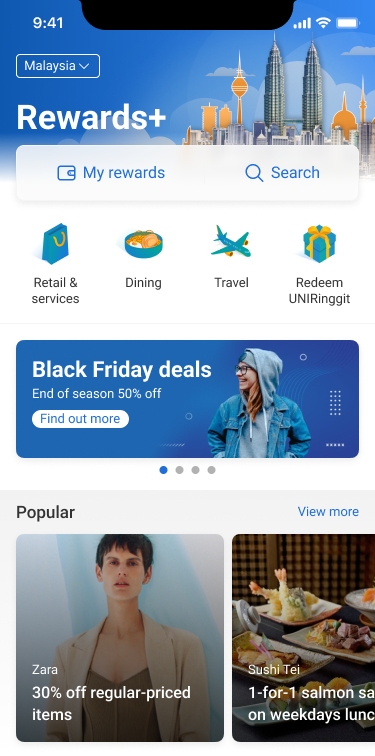

Besides that, UOB is also introducing a new rewards programme with the app called Rewards+ which lets you pay with points, among other things. Let’s take a quick tour of these new features and services.

Monthly Cash Flow Analysis

We’ve all been in this situation before – your pay comes in and before you know it, it’s all gone. You try to trace where all that money went, but the process is tedious as you will have to manually calculate the inflow and outflow of the cash.

The UOB TMRW app takes this burden off your shoulders by performing these calculations for your savings and current account. It then provides an overall view of your cash flow which can be broken down into categories such as withdrawals, bill payments, transfers, purchases and more.

You can even track your spending habits on your credit and debit cards. Here, the UOB TMRW app provides a breakdown of your expenditure by categories like dining, groceries, shopping, eWallet top-up, and entertainment for example. With this data, you can make more informed decisions on how to manage funds to support your lifestyle.

Any changes you make to your spending habits can be reviewed in the monthly expenses graph.

Be informed of changes to your subscription fees

The last thing you need after you have carefully allocated funds for the month is to be caught off guard by a sudden change in fee from one of your subscriptions. So, it’s a good thing that the UOB TMRW app monitors monthly recurring payments for things like subscriptions and service providers.

Using data from a period of 5 months, it can detect any increase or decrease in payment fees and notify you. So even if you missed the email notice from your subscription or service provider, you are still aware of the change.

Low Balance Alert

While we’re on the topic of payments, the UOB TMRW app can estimate if you will have sufficient balance to pay for upcoming payments based on your spending habits from past transactions.

Now, you will rarely be caught off guard by failed transactions or having a service suspended because of a missed payment.

Highlight opportunities to save money

It’s always a good practice to save money wherever and whenever you can. To help you estimate how much you can set aside each month, the UOB TMRW app uses data from your monthly expenditures. This takes away a lot of the guesswork or manual calculation required to figure out how much you can afford to save each month.

Moreover, based on the amount that you can save, the UOB TMRW app will recommend a savings account with the best interest rates.

More rewards to enjoy

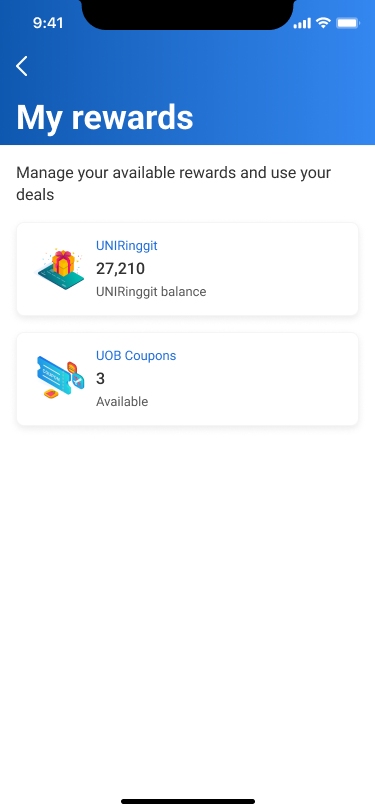

As a UOB customer, you will be entitled to enjoy a whole host of deals and rewards through the Rewards+ programme. Using the UOB TMRW app, you will be able to discover the latest deals on shopping, dining, and travel among other things. Besides that, you can also redeem coupons from UOB for select activities and services.

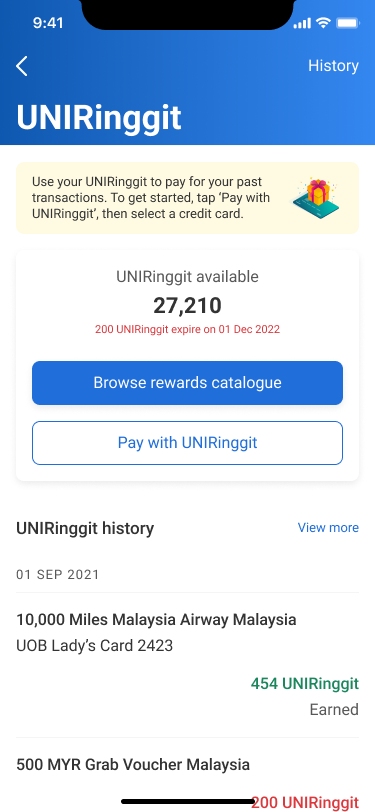

Then, there are the reward points which you can earn by making purchases using UOB credit cards. These points can be tracked in real-time with the app, which makes it convenient when you need to redeem deals with the points.

That’s not all you can do with the reward points. At participating merchants, you can choose to pay with the rewards points instead, further increasing your savings.

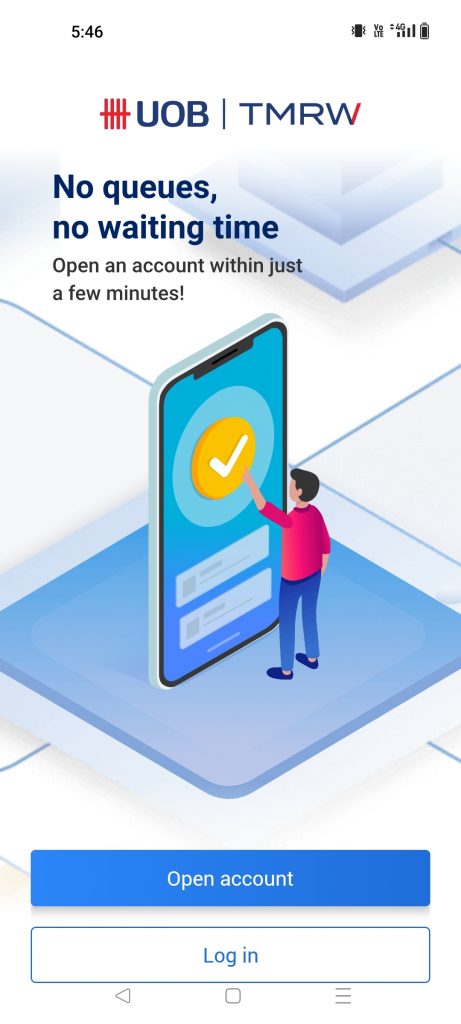

Become a UOB customer in less than 10 minutes

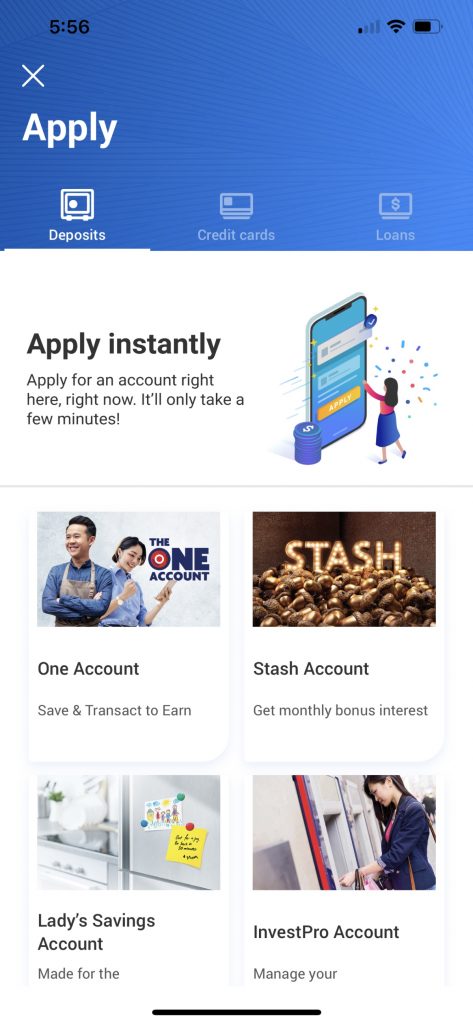

Are you interested in experiencing all these features and services offered by the UOB TMRW app? Well, UOB makes it easy for you to open a savings account as you can do it from the comfort of your home.

Simply log on to www.uob.com.my and choose from one of 4 tailored savings accounts that suit your needs. Once you’ve decided, you can create a savings account in less than 10 minutes.

The UOB TMRW app will only get better

UOB is not stopping here as it plans on introducing new digital banking products in the coming months. You will soon be able to apply for a credit card and insurance online, saving you time in your busy schedule. All these features will be available at your fingertips with the UOB TMRW app.

To start using the UOB TMRW app, you can download it from the Google Play Store, Apple App Store or Huawei App Gallery.