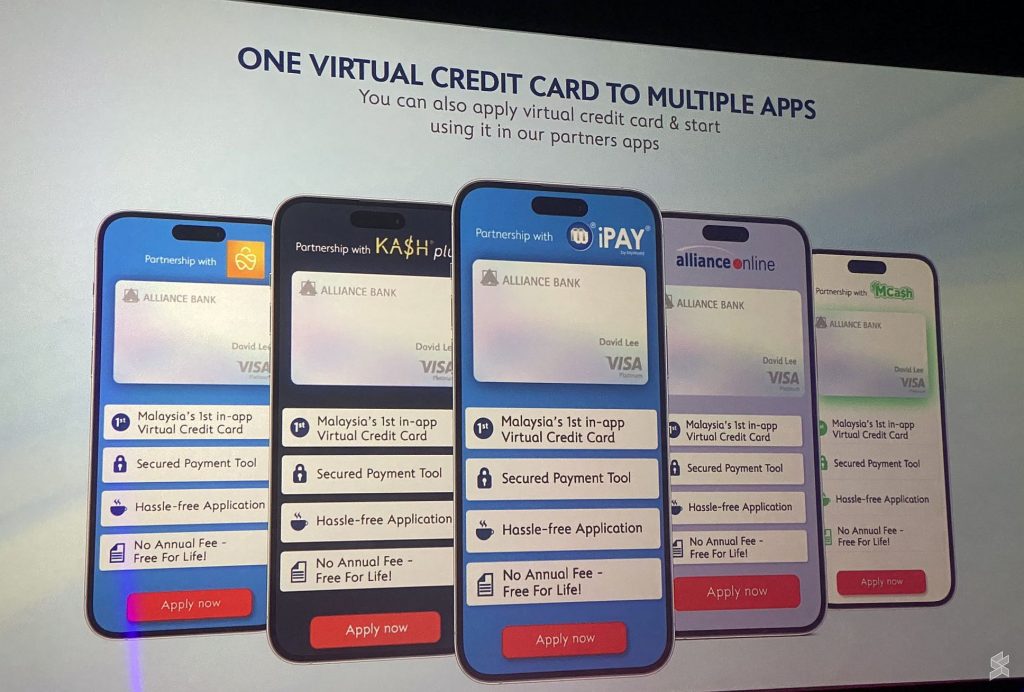

Alliance Bank has introduced Malaysia’s first in-app dynamic virtual card which aims at providing greater control and security for your online transactions. As the name implies, this is a virtual card credit card offering that allows you to create multiple 16-digit virtual card numbers for various online platforms, subscriptions and eCommerce websites.

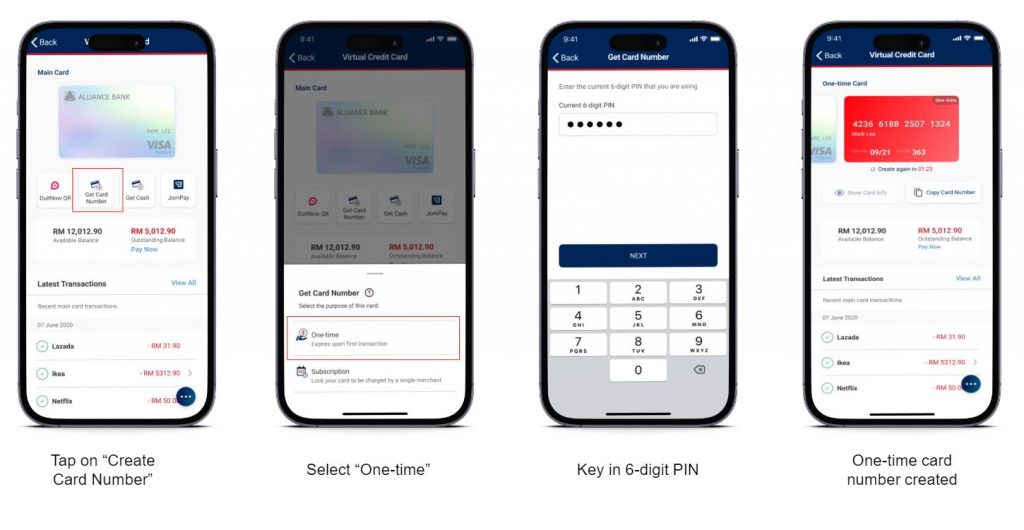

Besides having a permanent virtual card number, Alliance Bank allows you to create a one-time virtual card for online transactions from their mobile app. Just launch the app, tap on “Create card number”, select one-time and confirm by entering your 6-digit pin. Once that’s done, a one-time card is created and you can copy the card number and paste it on the platform’s payment page. These disposable numbers are created at no extra charge.

This is option is great for one-off online transactions as the number is only valid for 30 minutes. If a particular website or platform suffers a data breach, you won’t have to worry as the disposable number is no longer valid.

The dynamic virtual card offering also saves users from the hassle of reissuing a new card if the number has been compromised by cybersecurity incidents. The dynamic virtual credit card for each platform minimises the risk of fraud as the breached number is isolated from the rest of your virtual card numbers.

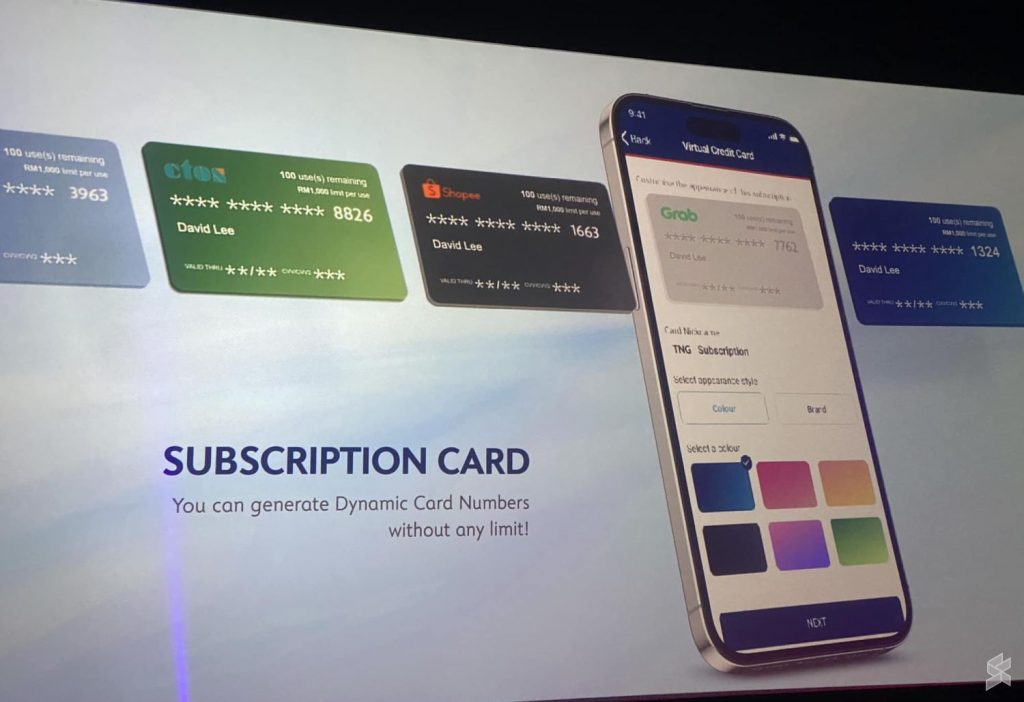

The virtual card offering also caters for repeated online spending such as subscriptions. You can create a virtual card for each of your online platforms such as Netflix, Spotify, GSC, Lazada, Shopee, Grab and TNG eWallet. For greater control, users can set spending and transaction limits for each virtual card or freeze it completely to block transactions for a specific number. For easier identification, each virtual card can be labelled with its own platform’s logo.

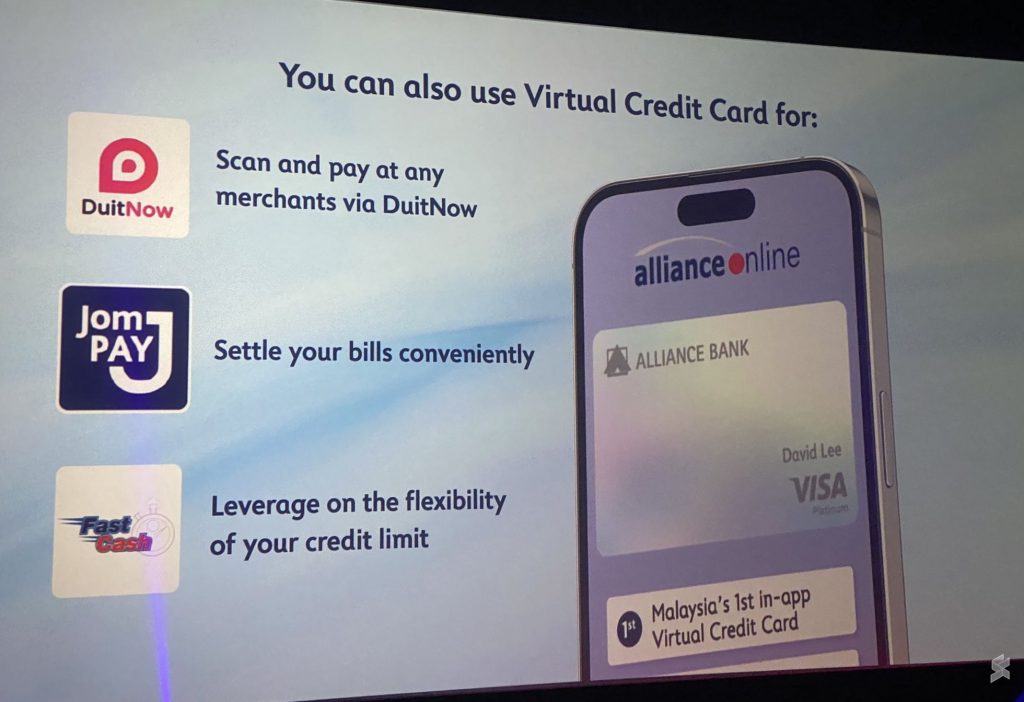

Besides online payment card transactions, the Virtual Credit Card can also be used for DuitNow QR code payments as well as bill payments via JomPay. Alliance Bank is also proud that the new product is also ESG-compliant as there’s no physical card for this offering.

At the moment, it doesn’t support Apple Pay, Google Wallet or Samsung Pay. For in-store physical transactions, users can use DuitNow QR or request for a physical card from Alliance Bank. The new dynamic virtual card feature will be first rolled out for Alliance Bank Visa Platinum Credit Card and it will be expanded to other cards.

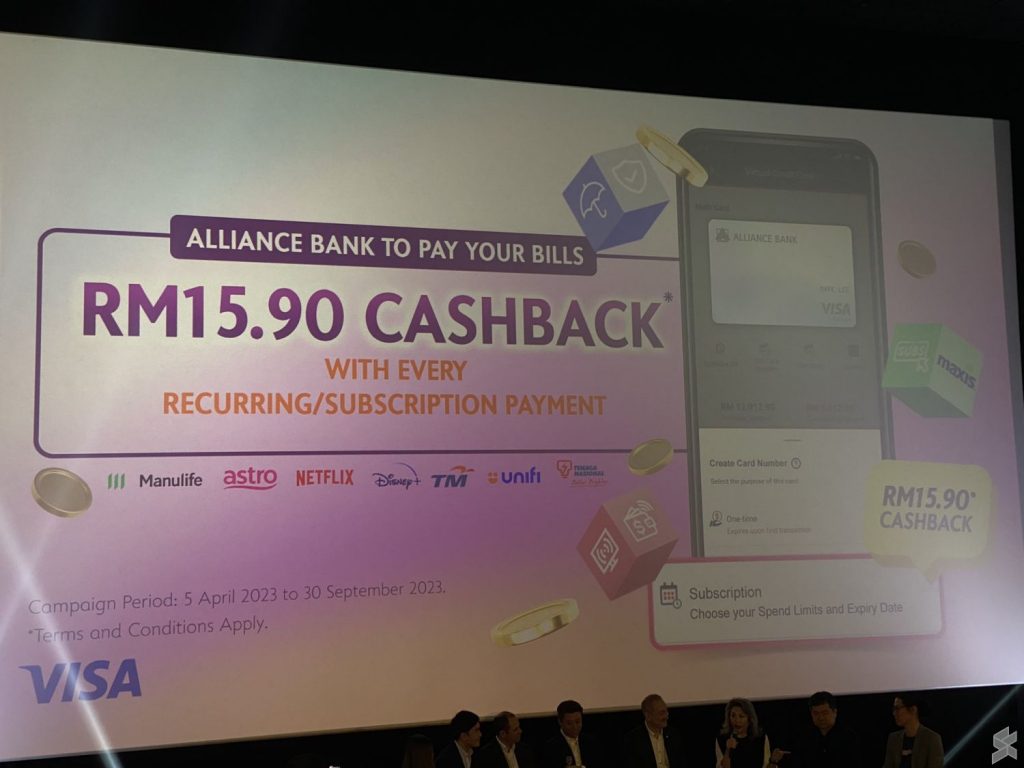

As part of their promo, they are offering RM15.90 cashback with every recurring/subscription payment from 5th April to 30th September 2023. On top of that, they are also offering a 0% Flexi Payment Plan (FPP) for 12 months tenure with a minimum spend of RM500 until 31st December 2023.

If you’re interested, you can apply for the Dynamic Virtual Credit Card through the Alliance Online mobile app which is available on both Google Play Store, Huawei App Gallery and Apple App Store. For more info, you can visit Alliance Bank’s Virtual Credit Card page.