[ UPDATE 18/12/2023 09:00 ] Malaysia to impose 10% Low Value Goods Tax for online shopping items shipped from overseas starting 1 January 2024.

===

The Malaysian government will not start collecting the new 10 per cent sales tax — on goods priced less than RM500 and imported from overseas — from April this year, and has instead postponed it, the Royal Malaysian Customs Department (RMCD) announced.

In a brief announcement on March 10 on its Malaysia Sales and Service Tax portal, the RMCD did not say what would be the new date of implementation of the new tax.

“The imposition of sales tax on Low Value Goods (LVG) which was supposed to be effective on April 1, 2023 has been postponed to a date to be determined later,” it said in the announcement.

Previously on January 6, the RMCD said the laws related to the new sales tax on low value goods — which are those priced below RM500 — have come into force on January 1, with sellers who sell low value goods imported into Malaysia and with total sales value of low value goods exceeding RM500,000 within 12 months could already start to register with the RMCD.

In that same announcement, the RMCD had said the effective date for charging and levying sales tax on low value goods would be from April 1. This date has now been postponed, following the RMCD’s latest announcement.

Click here to read a simplified summary by Malay Mail of the proposed low value goods tax, based on the RMCD’s draft tax guide as of January 1.

The content of the RMCD’s draft guide on the low value goods is subject to change, with the latest update being on January 9. The latest version of the draft guide can be found here.

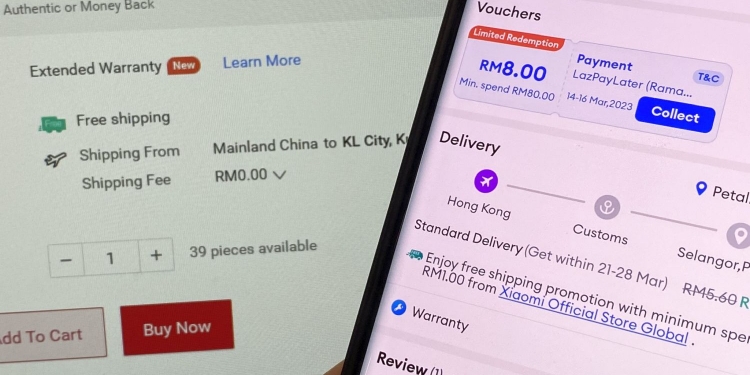

The low value goods tax will only be imposed on the item’s value, and not on the delivery charges or insurance costs to bring the item from overseas to Malaysia.

For example, when a shopper buys a RM490 item from overseas from an online shopping platform, the shopper will have to pay RM490 plus RM49 (10 per cent sales tax on the item), as well as the delivery fee.

The RMCD has also published a list of questions and answers on the low value goods tax, following its webinar on January 17 on the topic. — Malay Mail