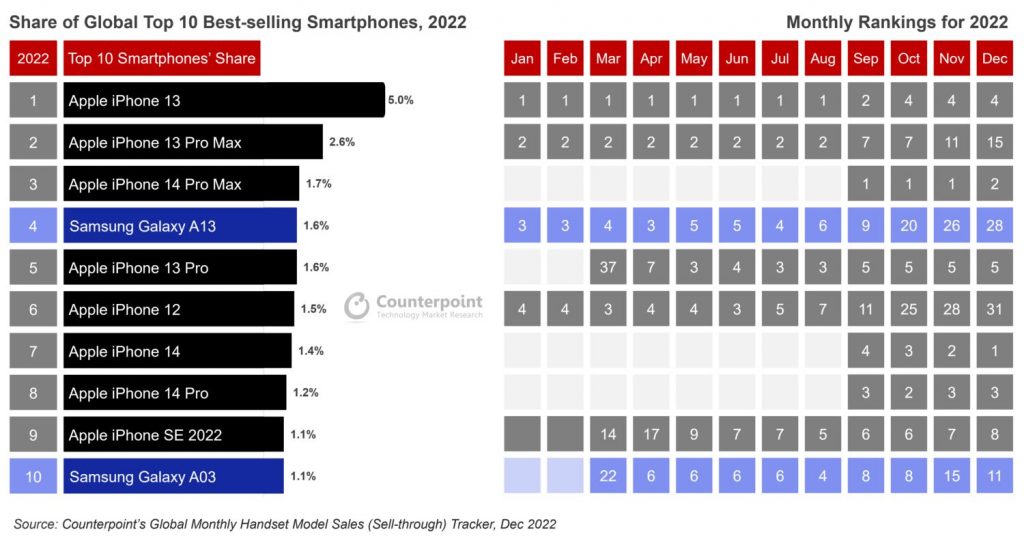

Counterpoint Research has revealed its Global Top 10 best-selling smartphones for the entire year and Apple has emerged as the first brand to capture 8 out of 10 spots on their annual list. Meanwhile, Samsung which remains the dominant smartphone maker in total shipments only has two models on the top ten list.

The best-selling smartphone of 2022 is the iPhone 13 which contributed 28% of total iPhone sales and represents a global smartphone share of 5.0%. On a monthly basis, the iPhone 13 remained the #1 best-selling model from January all the way until August, before eventually dropping to #4 for the rest of the year after the launch of the newer iPhone 14 series. Meanwhile, the top-of-the-line iPhone 13 Pro Max is the second best-selling smartphone with a global share of 2.6% and it was the second best-selling model every month from January to August.

Despite launching towards the tail-end of the year and facing supply issues, the iPhone 14 Pro Max still manages to secure third place on the top 10 list. It immediately became the best-selling smartphone for September, October and November, before dropping to second place in December.

Other iPhone models on the list include the iPhone 13 Pro at #5, iPhone 12 at #6, iPhone 14 at #7, iPhone 14 Pro at #8 and iPhone SE 2022 at #9. Even with the unimpressive upgrades and reusing the same chip as the previous model, the iPhone 14 still manages to become the best-selling smartphone for the month of December. The iPhone 12 was the best-selling smartphone for 2021 and it is also the oldest device on the current top 10 list. According to Counterpoint, sales for the 2020 model had remained robust in the US, Japan and China and it is currently the cheapest new iPhone you can buy without Touch ID.

The only non-iPhone models on Counterpoint’s top 10 list are the Samsung Galaxy A13 and the Galaxy A03, which are budget phones priced under RM800. These are also the only phones on the list without 5G and they made it to the top 10 due to their pricing and regional distribution of the models worldwide.

According to the research company, it believes that the share of the top 10 smartphones will increase this year as brands would focus on clearing their inventory and optimising their launches. It predicts that smartphone brands will make their portfolios leaner this year to reduce cannibalisation. It noted that the active smartphone models globally have reduced significantly from 4,200 models in 2021 to 3,600 in 2022. Counterpoint also expects brands to focus on their portfolio “premiumisation” to translate their volumes into profitability.

Even from last year, we have started seeing more brands reducing the number of flagship launches from the previous two to just a single flagship launch in a year. On top of that, most flagship models have gone upmarket in terms of pricing to make up for expected lower volumes. IDC reported recently that total smartphone shipments worldwide have dropped by 11.3% in 2022 which is the lowest since 2013. It expects slower growth this year due to an indication of rising inflation which will affect consumer spending. Looking at the trend, smartphone makers would be more cautious in their shipments and planning as they would realign their focus on profitability.

[ SOURCE ]

Related reading

- IDC: Worldwide smartphone shipments dropped by 11.3% in 2022, lowest since 2013

- Malaysia’s phone shipments declined by 28.8% in Q1 2022, why Malaysians buy fewer phones this year?

- SoyaCincau Awards 2022: The best Smartphone, Tablet and Smartwatch of the Year

- I used an Apple iPhone 13 Pro Max after years of value Androids. Here’s what I learnt