Not too long after Shopee revised its SPayLater fees, Lazada Malaysia appears to be rolling out its very own Buy Now Pay Later (BNPL) service that’s called LazPayLater. The new service allows Lazada shoppers to pay for their purchases in monthly instalments and they have also retained one of the best features of the previous SPayLater.

According to RinggitPlus, the LazPayLater service is currently rolled out to pre-qualified users and they are required to submit an application before they can use the service. Lazada has published the FAQ for LazPayLater which reveals more details about its interest and penalty charges.

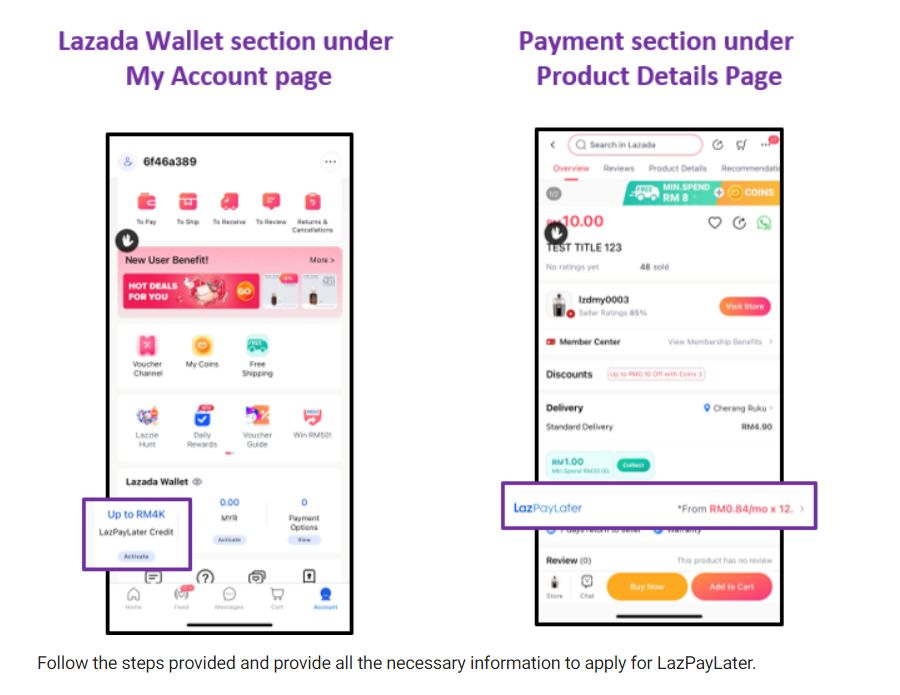

If you’re eligible for LazPayLater, you should be able to see a new “LazPayLater” option in the Lazada Wallet section under the Account tab of the Lazada app. Lazada listings that are eligible for BNPL would also display LazPayLater as a payment option with the lowest monthly instalment amount.

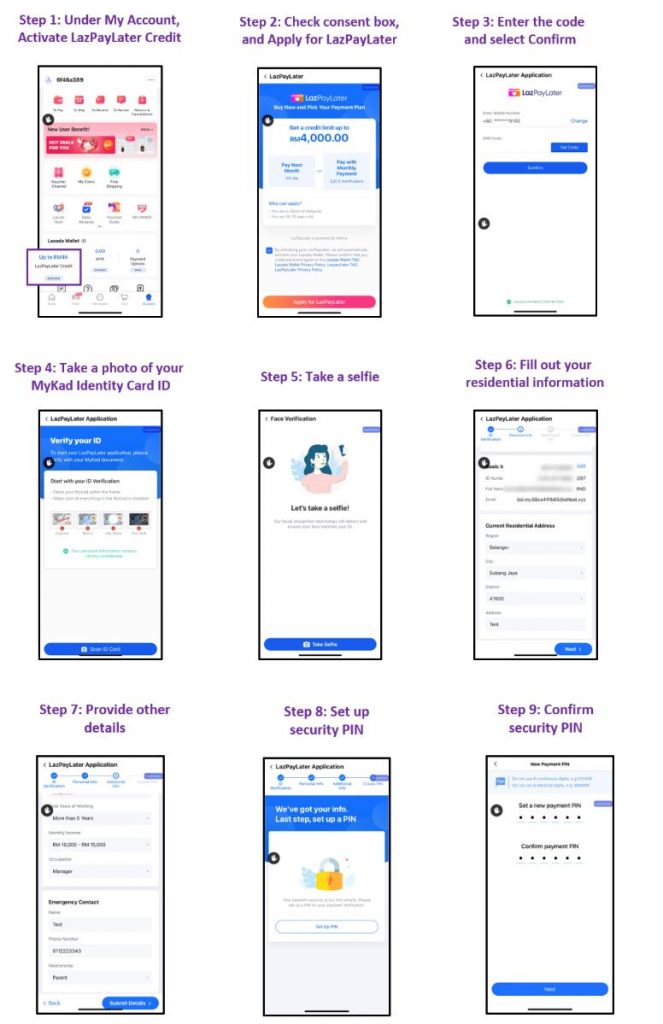

To enable LazPayLater, eligible users would need to perform an electronic know your customer (eKYC) process which requires a copy of the MyKad and a selfie picture. Users will also need to fill up a form about their personal details and set a 6-digit security PIN.

Depending on the individual, qualified LazPayLater users will be given a credit limit of up to RM4,000 which can be utilised on most products on Lazada except for items under the digital goods and fine jewellery categories. LazPayLater does not impose any charges if users pays in full the next month. However, if the user chooses to pay in 3, 6, 9 or 12 monthly instalments, Lazada will impose an interest fee of 1.5% per month.

The FAQ states that LazPayLater will issue a monthly statement every 10th of the next month and the due date is every 25th of the month. Users can pay for the LazPayLater bill using the Lazada Wallet, online banking, credit/debit card, Touch ‘n Go eWallet and Boost eWallet. If there’s an outstanding amount after the due date, LazPayLater will charge an overdue fee of RM30.

As a comparison, Shopee used to offer BNPL with 0% interest if the user pays in full in the following month while the monthly instalment options are charged with a 1.5% interest per month. Effective 17th October, Shopee has started charging a 1.5% processing fee for payments made in full in the following month. If the outstanding amount is not settled by the due date, Shopee will freeze the SPayLater Account and charge a RM10 late fee for reactivation.

Back in September, it was reported that Lazada has plans to partner with BNPL players and it aims to launch the service in Malaysia very soon. When asked why they are not jumping on the bandwagon, Lazada Malaysia CEO Alan Chan said it is their philosophy to bring the best breed of partners to provide financial services into their platform and they are looking to launch BNPL for its Malaysian platform in the “very near future”.

Besides Malaysia, the LazPayLater service is also being rolled out to pre-qualified users in the Philippines, Thailand and Indonesia.

Although BNPL is seen as a convenient payment option for shoppers without a credit card, such services are currently not regulated by Bank Negara Malaysia or any other regulatory agency. There are concerns that BNPLs are potential debt traps and there’s a risk that the charges incurred could be higher than credit cards.

[ SOURCE ]

Related reading

- SPayLater: Shopee’s Buy Now Pay Later is charging a 1.5% fee even if you pay the following month

- ShopBack refreshes itself with Buy Now Pay Later feature, split purchases into 3 interest-free payments

- BNM cautions Buy-Now-Pay-Later users of overspending risk, total charges could be higher than credit cards

- Buy-now-pay-later schemes & the rise of FinTech services in Malaysia | Let’s Talk About #86