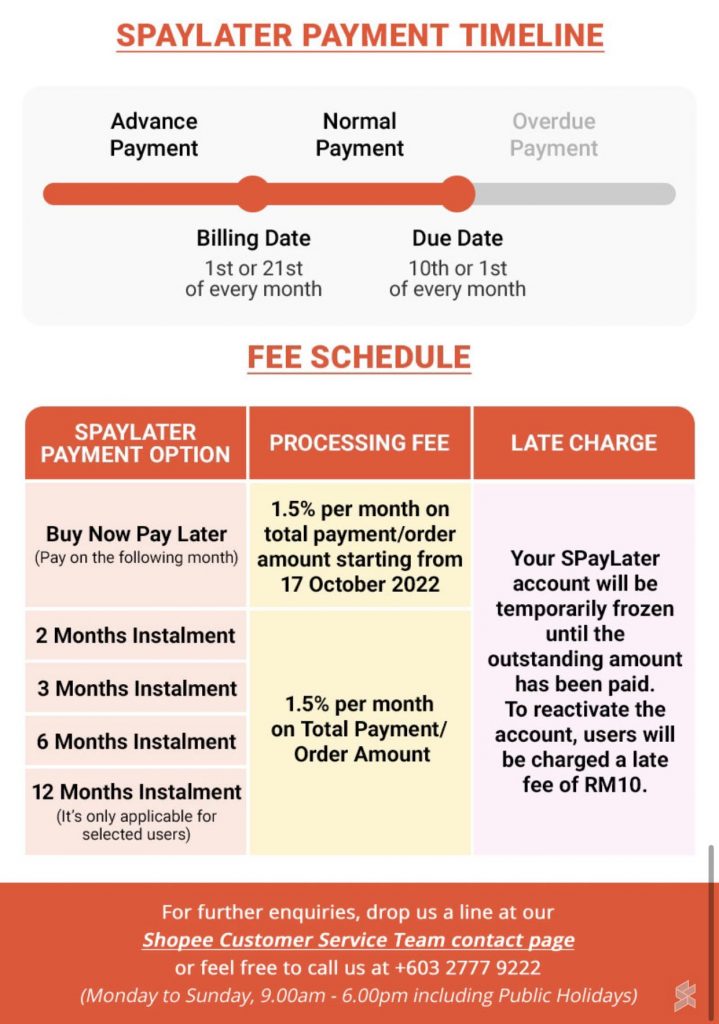

If you’ve been shopping regularly on Shopee, you would have probably used SPayLater, a Buy Now Pay Later feature which allows you to shop now and pay later. Shopee Malaysia has announced that it will start charging a processing fee of 1.5% for its SPayLater payment option starting today, 17th October 2022. As a result, Shopee users who intend to use Shopee Pay Later and pay in full the next month will incur extra charges.

Based on the notice, the 1.5% processing fee will be charged at 1.5% per month on the total payment amount starting today. The 1.5% processing fee is also applied monthly on the total payment amount if you choose to pay via monthly instalments. If you miss the payment due date, your SPayLater account will be frozen and you’ll need to pay a late fee of RM10. Depending on your billing cycle, the SPayLater due date falls on either the 10th or 1st of every month.

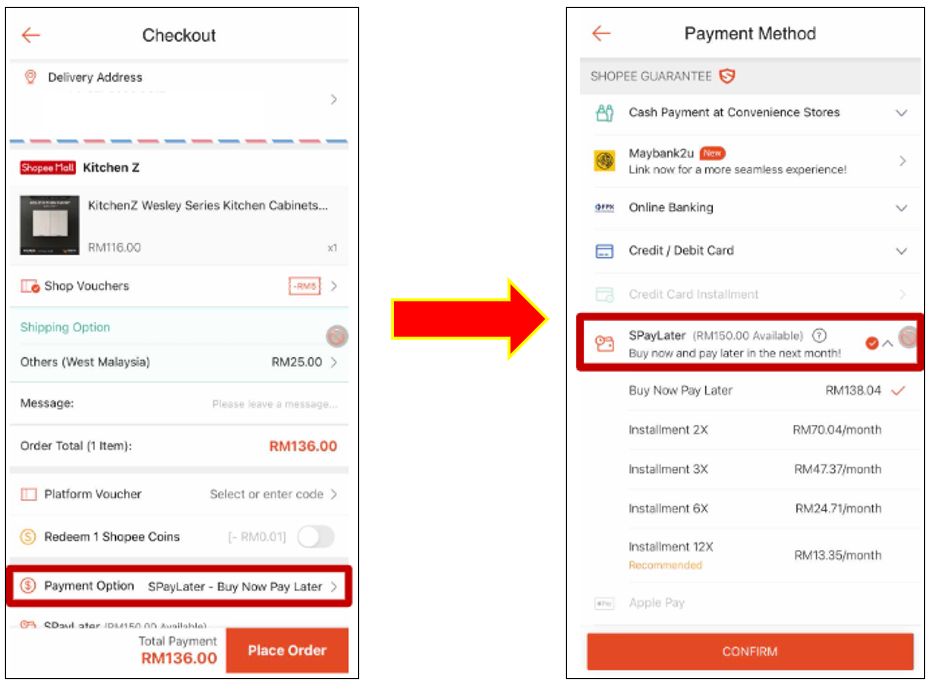

As shown in the example screenshot above, if you buy an item worth RM136, it will now cost you RM138.04 if you use Buy Now Pay Later without instalments. That’s equivalent to a 1.5% charge. If you don’t want to incur extra charges, you’ll have to pay in full using other payment channels such as credit card, debit card, online banking or via ShopeePay eWallet. Depending on the transaction amount and retailer, you could still opt for credit card instalment with 0% interest on selected cards.

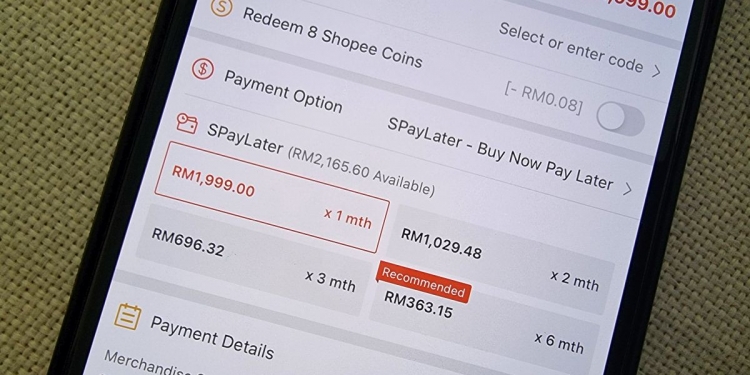

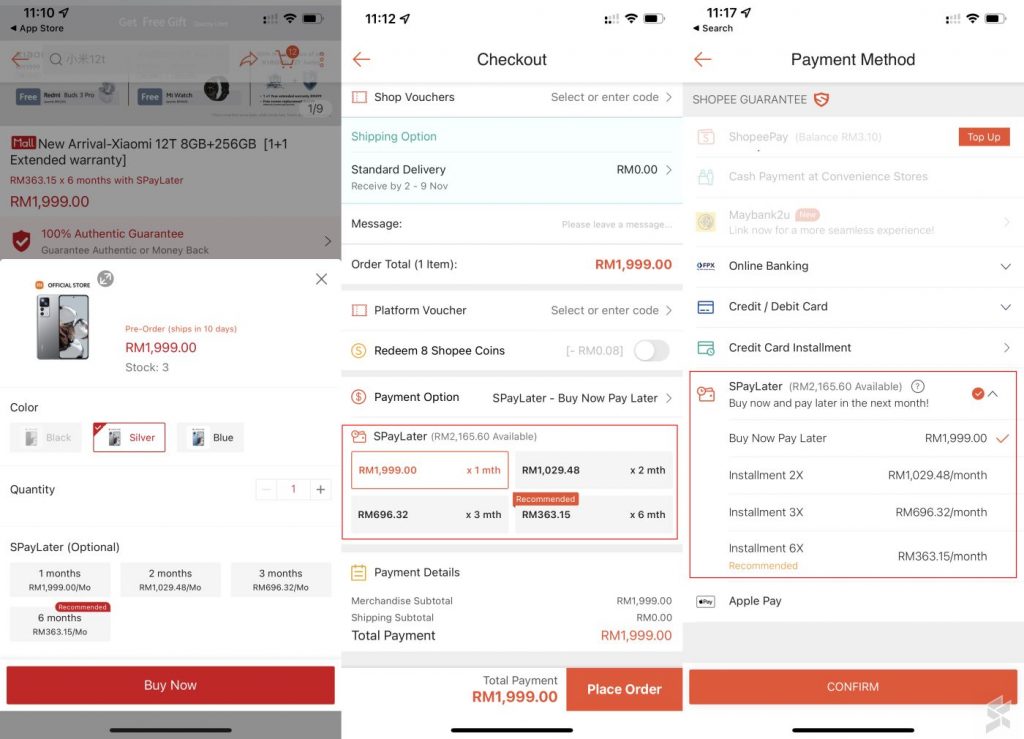

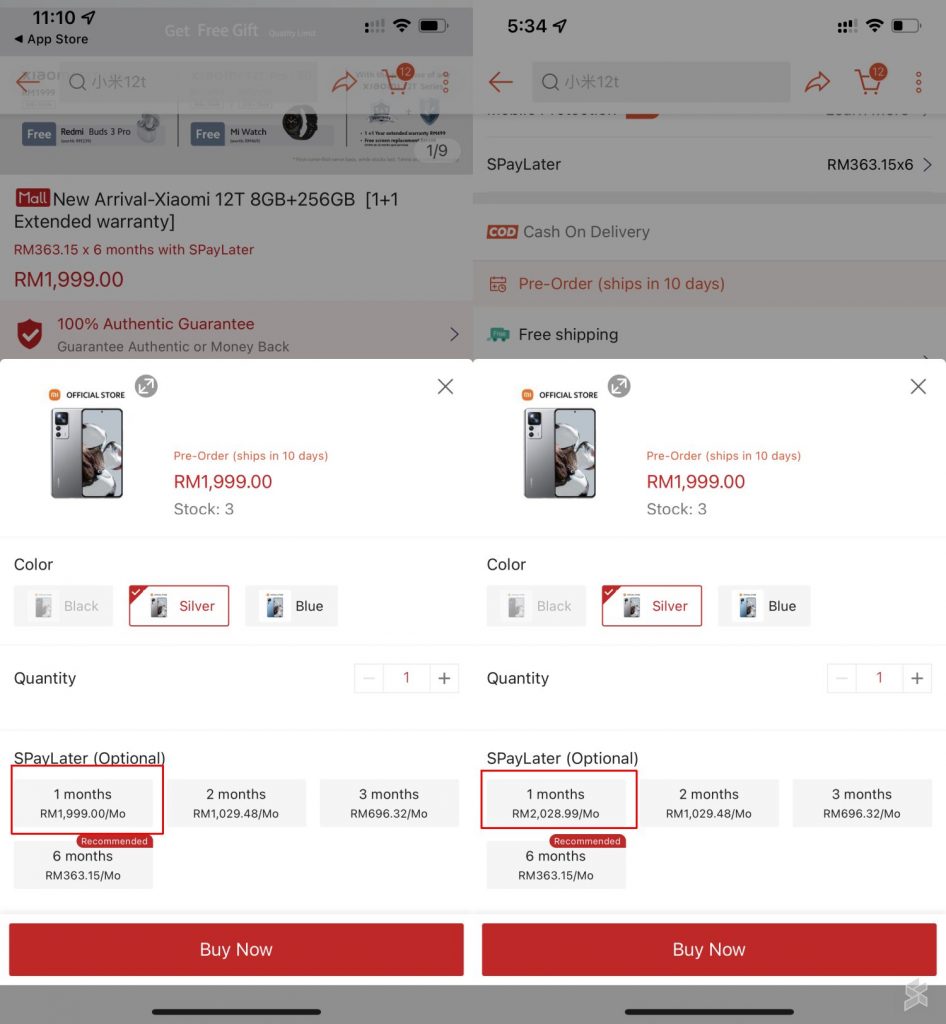

At the time of writing, it appears that the 1.5% processing fee isn’t applied yet. When we try to purchase a Xiaomi 12T priced at RM1,999, the SPayLater feature is still showing RM1,999 for 1x month instalment. At the moment, extra interest charges are only applicable if you select the instalment option with 2 or more months. Based on the amount shown above, SPayLater currently charges 2.5% interest for 2x month instalments, 4.05% interest for 3 months and 9% interest for 6 months. If the 1.5% fee comes into effect, customers will have to pay RM2,028.99 for the 1x month option.

[ UPDATE 17/10/2022 17:00 ]: The new BNPL processing fee has been reflected on Shopee. 1x month SPayLater option now reflects the 1.5% increase.

According to Shopee Malaysia, SPayLater is now certified Shariah-compliant by Amanie Advisors, a global Shariah advisory firm and a registered Shariah advisory company with the Malaysian Securities Commission (SC). It added that SPayLater is consistent with the Shariah permissibility on Bay’ Bithaman Ajil (deferred payment sale), where the parties in a sale transaction agree to make the payment on a deferred basis.

Do you use Shopee’s BNPL feature? Let us know in the comments down below.

Related reading

- BNM cautions Buy-Now-Pay-Later users of overspending risk, total charges could be higher than credit cards

- ShopBack refreshes itself with Buy Now Pay Later feature, split purchases into 3 interest-free payments

- Buy-now-pay-later schemes & the rise of FinTech services in Malaysia | Let’s Talk About #86