BigPay has been a popular prepaid card for travel that allows you to reload via credit card. In the past two years, they have added more restrictions for credit card top-ups by reducing the monthly reload limit to RM1,000 a month. Now they have reinstated the credit card top up limit back to RM10,000 a month but there’s a small fee that you’ll need to pay.

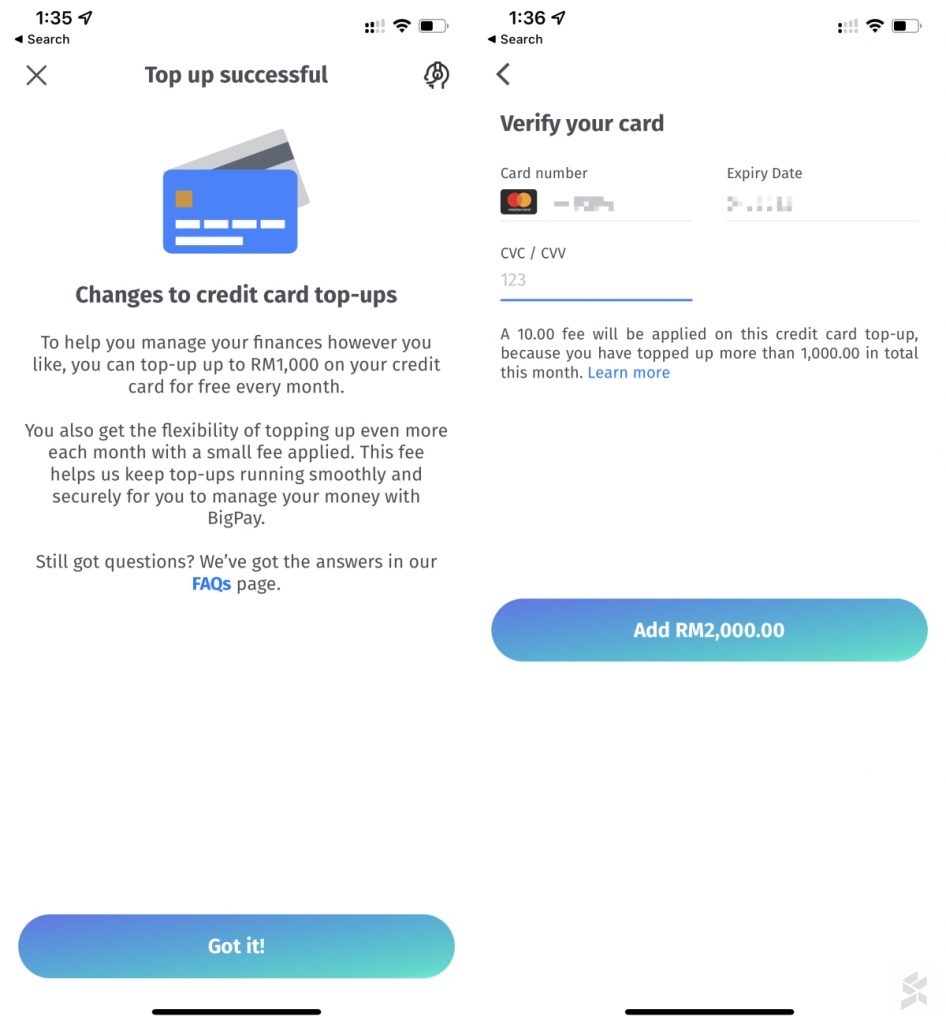

According to BigPay, you can reload up to RM1,000 monthly via credit card for free as usual. However, they will charge a 1% fee for credit card reloads above RM1,000 for the month. That means if you reload RM2,000, you’ll have to pay the 1% fee (RM10) for the excess RM1,000 above the “free limit”. If you top-up RM10,000 via credit card, you’ll have to pay RM90. The fee will be charged on top of your reload amount.

According to BigPay, the fee will help them keep top-ups running smoothly and securely for you to manage your money with BigPay. It still emphasises that its prepaid card is still the best option for spending overseas as credit cards usually charge expensive fees of up to 3% per transaction made abroad. It also claims that credit cards often charges higher bank exchange rates which add up to your overall cost.

Interestingly, it seems that BigPay is also encouraging you to use their credit card top-up as a form of cash advance. It says Credit Card cash advances typically have notoriously high fees of at least 5% with interest rates of 17-18%. According to their blog post, BigPay users can top-up via credit card to avoid paying expensive fees but it reminded them to make sure they pay off their credit card bills too.

[ SOURCE ]

Related reading

- BigPay lets you send money to recipients without a bank account in Indonesia and the Philippines

- After a year of waiting, BigPay finally supports DuitNow QR and instant interbank transfers

- BigPay introduces fully digital personal loans with instant approval. Here’s a quick preview

- BigPay fixes T&C acceptance screen, to increase wallet size to RM20,000 next month