BigPay, the fintech brand backed by Capital A, finally supports DuitNow QR which allows users to use the app as a proper eWallet. This comes after a year it made an announcement to support the national QR code standard by Q2 2021. With DuitNow QR, BigPay users can make cashless payments where DuitNow QR is displayed. On top of that, the BigPay app now allows you to make instant fund transfers to other bank accounts and supported eWallets via DuitNow.

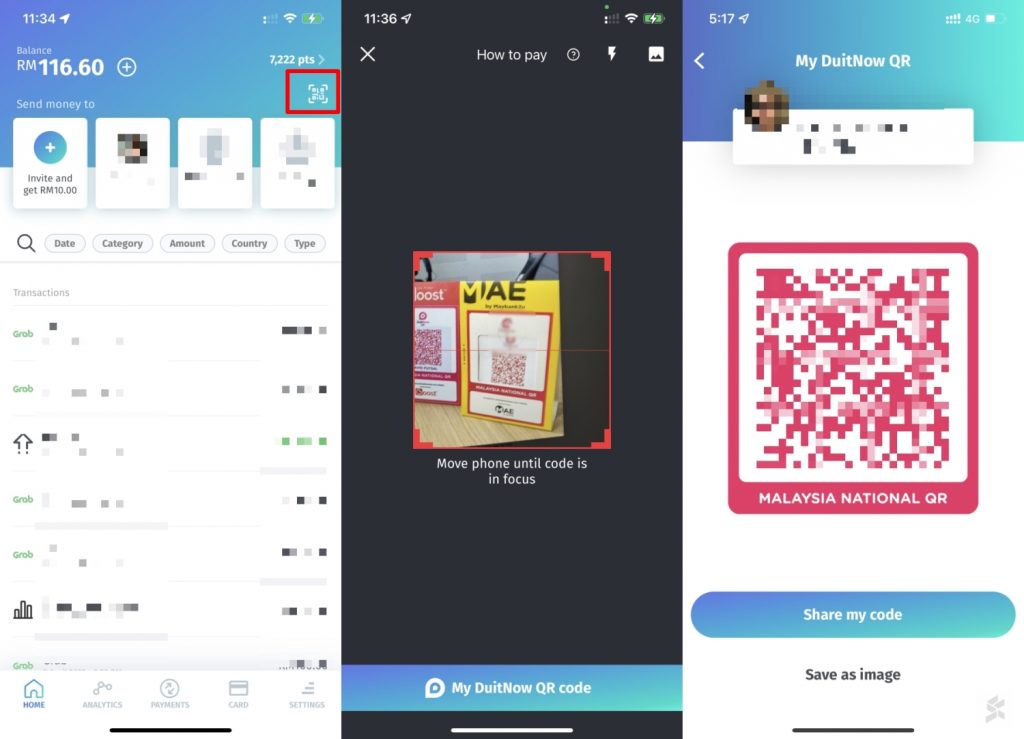

Use BigPay app to scan DuitNow QR codes

To use DuitNow QR, make sure you’re using the latest version of BigPay. On the home screen, you should see a QR code icon on the top right corner which will enable the QR code scanner. Similar to other eWallets, all you’ll need to do is to scan the QR code, enter the amount and confirm the transaction.

BigPay also allows you to display your own DuitNow QR code to receive funds. It works when we scan the personal DuitNow QR code with Maybank MAE. However, it doesn’t work for TNG eWallet as it displays a “DuitNow QR P2P is currently not supported” error message.

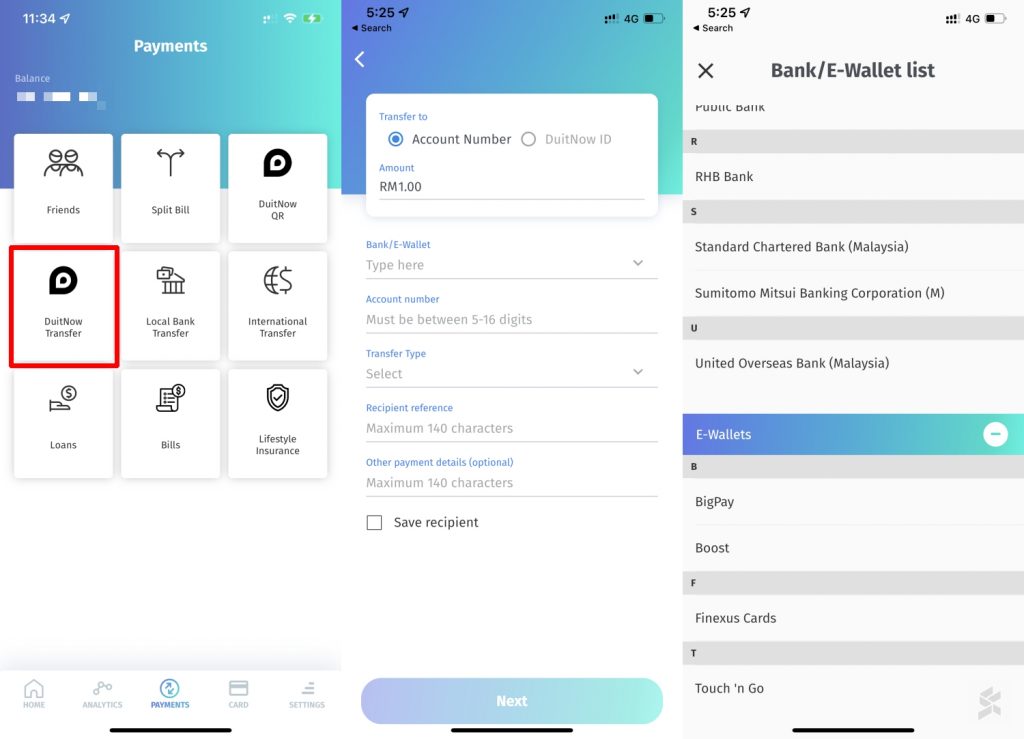

Transfer funds from BigPay to other banks

To transfer funds from your BigPay account to other banks, just go to the “Payments” tab and tap on “DuitNow Transfer”. You have a choice to use the traditional way of entering the account details or use the recipient’s DuitNow ID which may include their IC, Passport or Mobile Number. The Account Number method supports a variety of banks in Malaysia as well as eWallet platforms such as Boost, Touch ‘n Go and Finexus Cards. The transfer is done instantly with no additional fees.

According to the FAQ, there’s a maximum daily limit of RM10,000 for DuitNow QR payment to merchants. For DuitNow QR P2P transfer and DuitNow Transfers (to other bank accounts or DuitNow IDs), there’s a combined daily limit of RM30,000. At the moment, BigPay has a maximum wallet size of RM20,000.

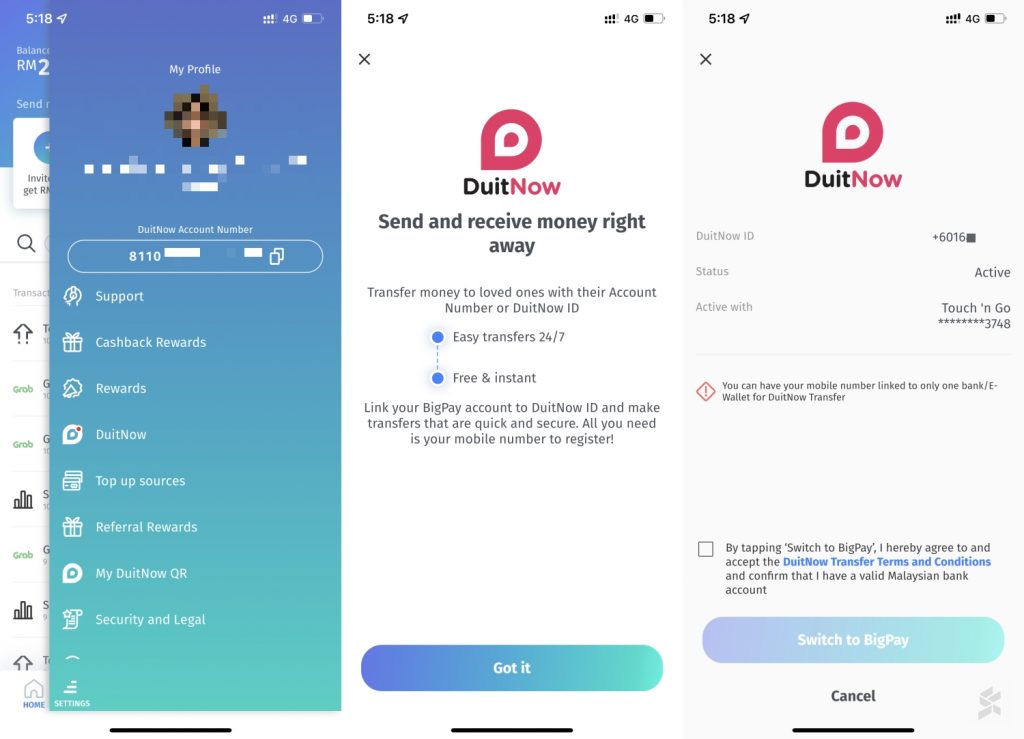

Receiving funds from other banks or eWallets to BigPay

Similar to Touch ‘n Go eWallet, you can also receive funds from other banks via DuitNow. If you go to your BigPay’s profile page, you will be able to view your DuitNow Account Number. From the BigPay app itself, you can also set your mobile number as your DuitNow ID so that your contacts can send money to you with just your phone number. If you’ve already configured your DuitNow ID to another eWallet or online banking account, you are able to switch it to BigPay by tapping on the DuitNow link on your profile page as shown above.

With this new update, BigPay users can now make payments at even more merchants, especially at small businesses that only accept eWallets instead of card payments. BigPay is also a step closer to becoming a digital bank as they now have a physical prepaid card, remittance services, an eWallet with DuitNow QR support and they have also introduced its digital personal loan product last month.

In case you missed it, eligible youths can redeem their RM150 ePemula credit starting 11th April. BigPay is among the four supported eWallets listed by the Ministry of Finance.

Related reading

- ePemula: Youths can claim RM150 eWallet credit from 11 April via BigPay, Grab, Shopee and TNG eWallet

- BigPay introduces fully digital personal loans with instant approval. Here’s a quick preview

- BigPay fixes T&C acceptance screen, to increase wallet size to RM20,000 next month

- Touch ‘n Go eWallet lets you instantly transfer money to other bank accounts via DuitNow