Maybank has launched its newly revamped MAE app with new features and a physical card that comes in striking yellow. MAE was initially launched last year as an eWallet that comes with a virtual debit card. The new app promises to offer next generation experiences to customers with a refreshing new banking app.

According to Maybank Group President and CEO Datuk Abdul Farid Alias, “MAE by Maybank2u was developed to be more than just a banking app; we want it to be an all-encompassing platform to help our customers manage their day-to-day money matters. Imagine it to be a pocketable digital bank but with many cool features to help you take control of your money. The app contains the existing features within Maybank2u to help with your daily needs such as paying bills and fund transfers; but we have also introduced new tools to help customers track their spending while encouraging them to save too.”

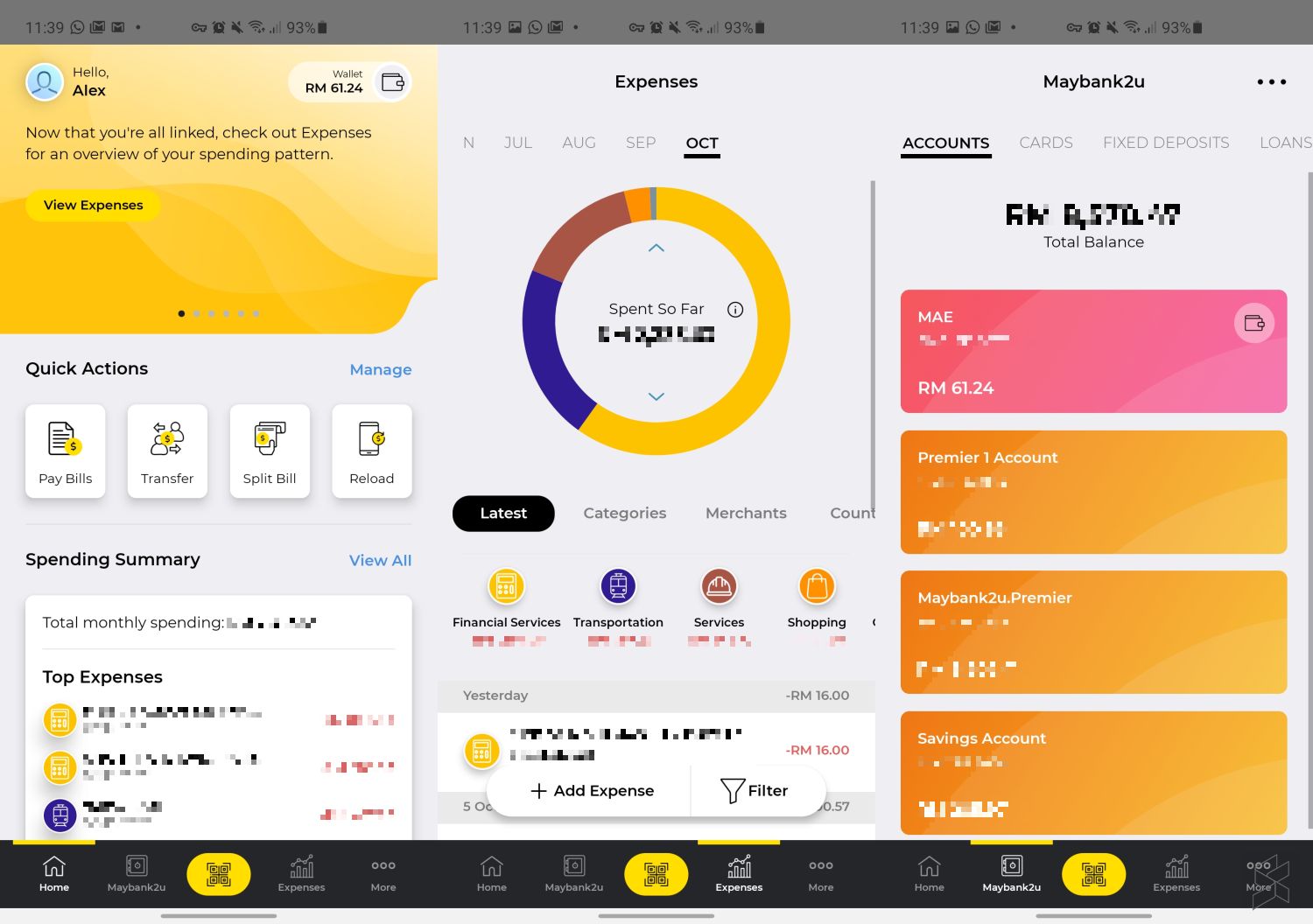

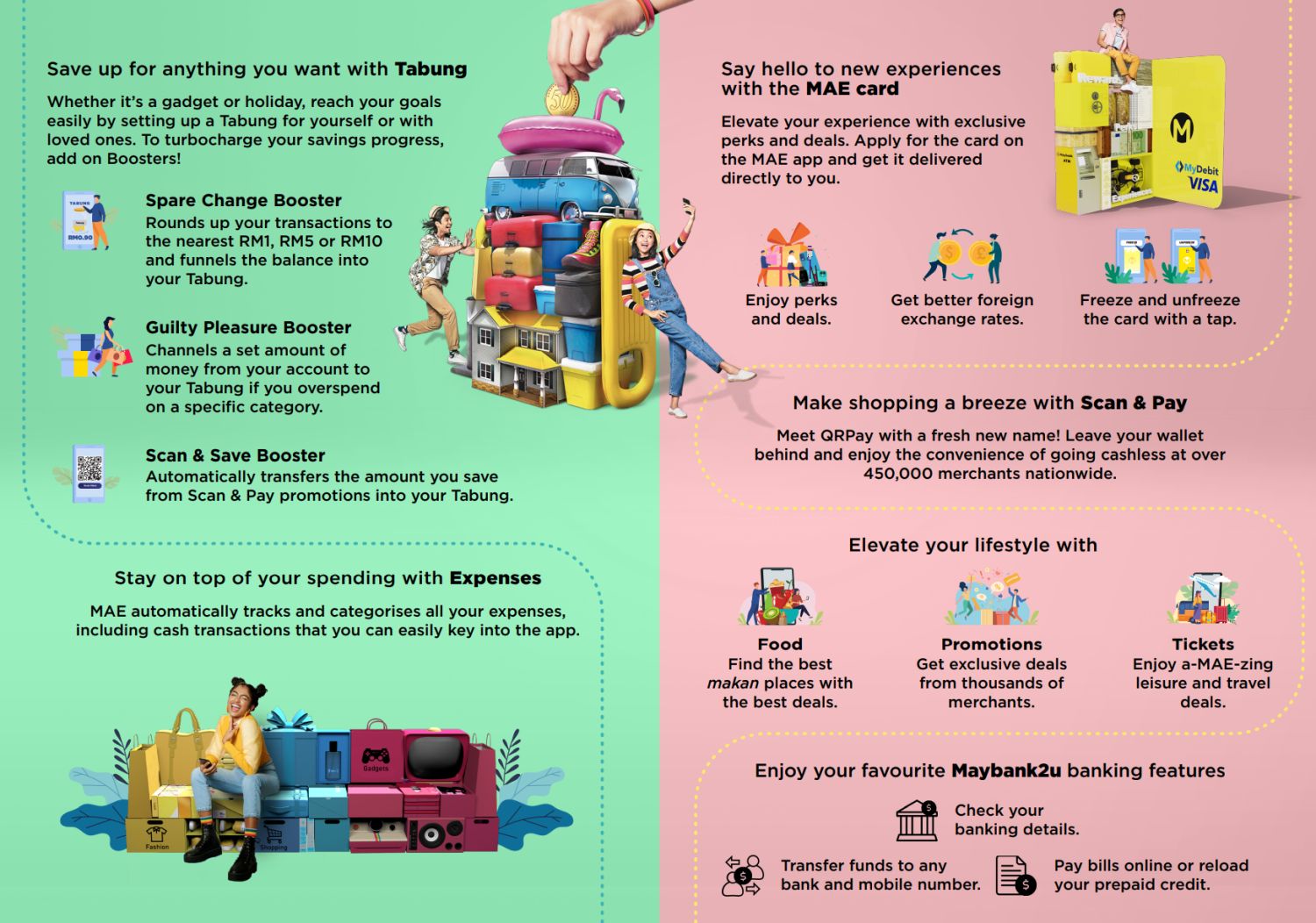

The new MAE app has a fresh new interface that comes with a customisable home screen. One of the biggest features is its expenses tracker which automatically groups your spending by category across all of your accounts including your savings and current accounts, as well as credit cards.

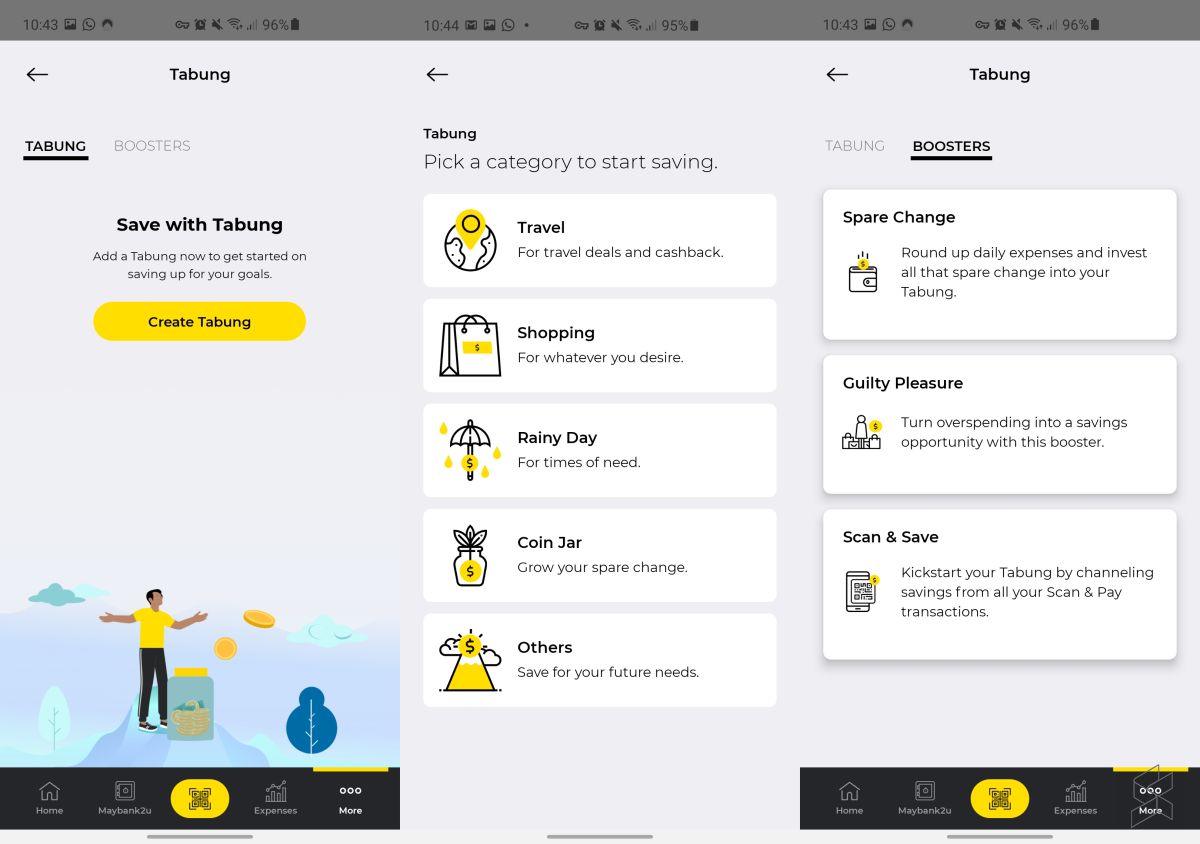

To help you save better, the MAE app has a “Tabung” feature which will assist you in achieving your savings goal. This is similar to the Goals Savings Plan that was introduced on the upgraded Maybank2U in 2018. Once set, MAE will deduct your savings amount automatically in either a weekly or monthly basis. To help you achieve your goals faster, there’s also a Booster function.

With the Spare Change feature under Boosters, you can round up your expenses for each spend and the extra deduction will go into your “Tabung”. The mechanism is somewhat similar to Raiz, whereby if you pay for a RM2.40 item, it will round up to RM3.00 and the extra RM0.60 will be saved. However, this “Tabung” feature is purely for savings and it isn’t investment linked.

Another interesting Booster is Guilty Pleasure which “penalises” you into saving when you exceed your daily set budget for various categories. For example, you can set RM30 as the maximum daily spend on food & beverage and have it deduct RM10 for your “Tabung” when you exceed your daily RM30 limit. You can also save via QR transactions with the Scan & Save feature.

According to Maybank, they are the first Malaysian bank to use e-KYC for new account registration. This means you can open a MAE account in a fully digital experience and there’s no need to visit a physical branch. However, those below the age of 18 will be required to obtain consent from their parents.

The new physical MAE Visa debit card gets a vertical design and it supports Visa Paywave contactless payment. Similar to BigPay, Maybank claims to offer competitive foreign exchange rates which is great for overseas travel and you can freeze the card anytime via the app. The card can be ordered from the app and it will be shipped directly to your doorstep. The card costs RM8 and there’s an annual fee of RM8. You can make unlimited withdrawals at Maybank ATMs nationwide.

MAE also provides a virtual card number and you can use this for online purchases as well as NFC payments via Samsung Pay. The MAE account by default has a maximum account balance limit of RM4,999 and you can increase this to RM10,000 when you apply for the MAE Visa debit card. If you need a higher limit, you can step up to a full-fledge account.

According to Maybank, the all-new MAE will eventually replace the current M2U app and they are giving users time to slowly migrate to the new app experience. Your existing M2U linked accounts and cards are still easily accessibly via the “Maybank2U” tab on the bottom of the screen.

Maybank targets to get 3 million downloads for the app in the next 12 months. To give it a shot, you can download MAE by Maybank2u on the Apple App Store and Google Play Store. You can learn more from Maybank’s website.