Maybank, Grab and Mastercard are announcing a new partnership next week which claims to feature several firsts in the market. The launch event is happening on the 18th August 2020 and the new product is aimed at savvy and mobile-first consumers.

For an eWallet platform to collaborate with a local bank and Mastercard, this could be the launch of the GrabPay card in Malaysia. GrabPay card was first introduced in Singapore and it was recently released in the Philippines. With a physical card, users will be able to use GrabPay in more places as the card is linked to their eWallet account.

Somewhat similar to the Apple, the GrabPay physical card has no numbers on both the front and the back for greater security. You can use it to pay via chip or contactless payment at millions of merchants worldwide where Mastercard is accepted. On top of that, you can earn GrabRewards points when you spend with your card.

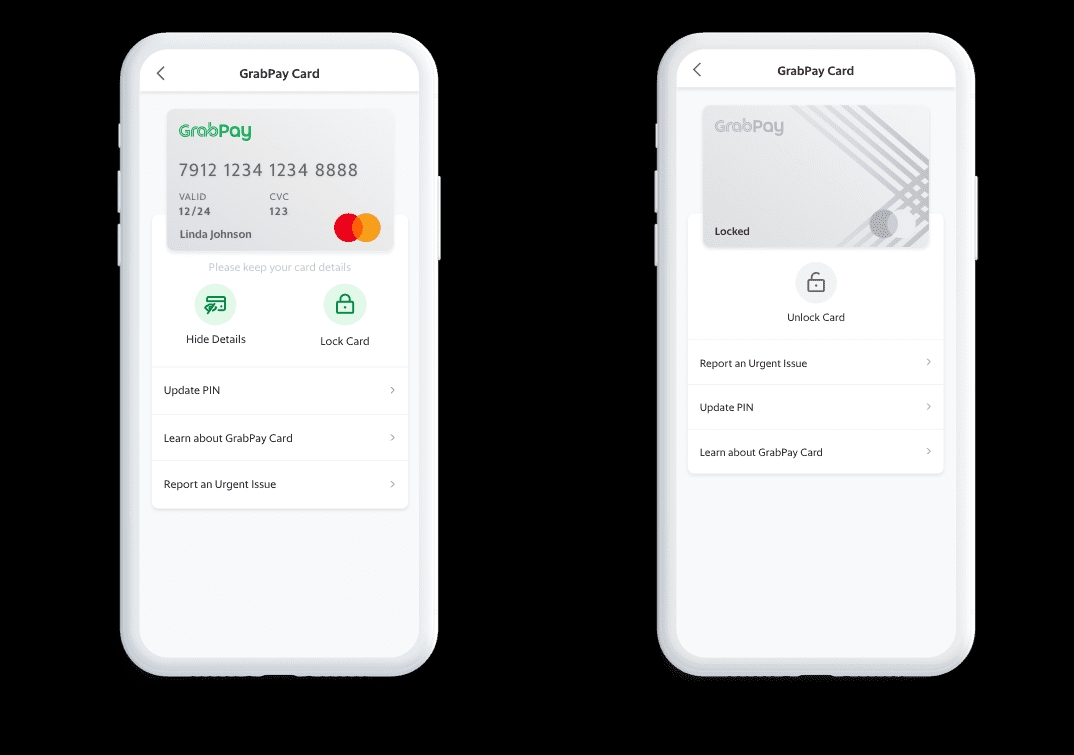

The GrabPay card can also be used for online transactions and you can view the card details including the number, expiry and CVV through the GrabPay app. Similar to the GrabPay eWallet, you can view your transactions and manage your card settings via the Grab app.

In Singapore, the GrabPay card even supports Samsung Pay which lets you earn Samsung Rewards points for every transaction you make with your phone. Since most Maybank cards support Samsung Pay, we are guessing that this could be possible for the Malaysian version.

Take note that this is just our guess for now and we will find out more next week. About two months ago, Shopee had introduced its own Visa-branded credit card in partnership with Maybank. The Shopee credit card allows card holders to earn Shopee Coins for both online and offline transactions and they can earn 5x more coins during selected campaigns.