It has been a challenging year for Huawei’s smartphone business given that its latest smartphones sold overseas lack the ability to use Google Mobile Services (GMS). While it is seeing a decline in shipments for its phones overseas, this is sharply contrasted by its stellar performance its home market in China.

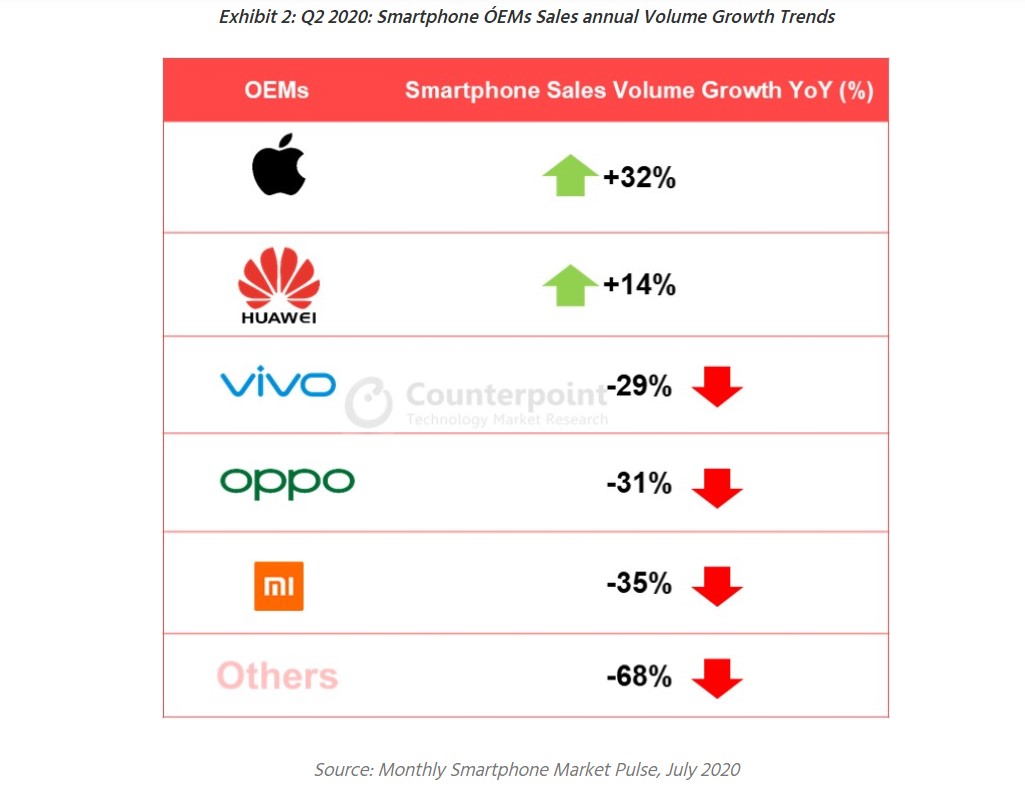

According to a new report from Counterpoint, the Chinese smartphone giant commanded 46% of smartphone sales in China during Q2 2020, netting its highest domestic market share ever. Huawei beat its competitors such as Vivo, Oppo and Xiaomi with its sales volumes rising up 14% compared to the same period last year.

Counterpoint research analyst Flora Tang commented that China has become the most important market for Huawei as its performance overseas has been severely affected as many users shunning their phones due to the loss of GMS.

Tang cited Huawei’s heavy investment in its distribution networks both online and offline for contributing to its rise up the charts. Another factor is the growth of Huawei’s 5G product portfolio with the launch of models like the Mate 30, P40 series and Nova 7 series.

Huawei’s fortune, however, spells trouble for its rivals such as Vivo, Oppo and Xiaomi as they saw sharp falls in their sales volume. China’s smartphone market has seen a slowdown, dropping 17% compared to the same quarter last year, as the demand for smartphones is yet to recover to pre-COVID levels. Sales did, however, rise by 9% quarter-on-quarter indicating some sign of recovery.

Interestingly, Apple emerged as the fastest growing key Original Equipment Manufacturer (OEM) during Q2 2020. In spite of the decline in the market, Apple managed to grow its sales volume by 32% year-on-year. This is attributed to the popularity of the iPhone 11, introduction of the budget-friendly iPhone SE 2020 and price cuts for its product line up.

You can check out Counterpoint’s latest data below for a more detailed breakdown.

Counterpoint’s research also shows there has been significant developments in the 5G space in China. In Q2 alone, 33% of smartphones sold in the country were of 5G enabled smartphones, which is a big rise from just 16% in Q1. That number rose up to 40% by June.

As we mentioned earlier, Huawei’s range of high-end 5G smartphones and its sales account for 60% of the market, ahead of Vivo, Oppo and Xiaomi. Currently, 5G smartphones in China sit within the mid-to-high price bracket of USD400 (about RM1,699) and above. But things are moving very rapidly and Counterpoint expects to see 5G smartphone prices moving towards the lower-tier price bands.

[SOURCE]