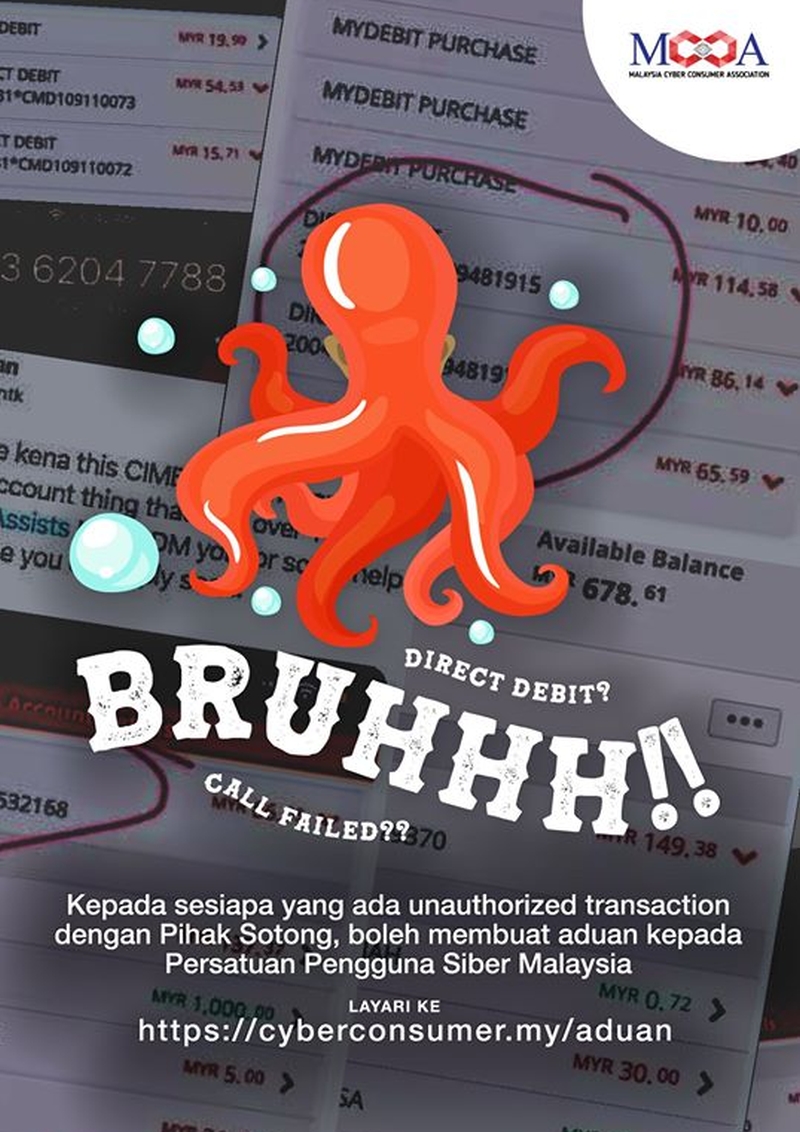

The Malaysia Cyber Consumer Association (MCCA) is aware of the CIMB direct debit issue which went viral in the past few days. Several customers have complained online about unknown transactions that were simply labelled as “direct debits”.

According to MCCA Cyber Security Head, Mohamad Zulfahmy Roslan, the association have received several reports and they urge the bank to be more transparent in issuing financial statement information so that it won’t raise any doubts among consumers. The association also said that the usage of TAC should be enforced to ensure no leakage of funds and this isn’t the first time banks have caused trouble.

TAC implementation would act as an added security layer especially if a user’s card details were compromised through a massive data breach from other sources. However, it is worth pointing out that there are websites that still accept card payments without any 3D authentication. This means there’s no one-time verification code required to complete the transaction. CIMB previously explained that it is common industry practice for banks to accept payments for both 3D and non-3D transactions.

At the same time, consumers should be wary about using their debit or credit cards for online transactions on suspicious websites. They also advise using prepaid cards to safeguard their card and personal information from getting into the wrong hands.

Affected CIMB customers are urged to submit a complaint with the MCCA via its website.

On Friday, CIMB has posted on its Facebook page that all “direct debit” transactions are legitimate debit card transactions performed by customers. They added that some of the transactions with the label “direct debits” are incomplete transactions performed with overseas merchants such as online streaming subscriptions and services.

On Saturday, they have updated that customers that were affected by the “Direct Debit” transactions will receive an SMS with full details of their transactions which includes the date, amount and merchant description. They added that the 1% administration fee that was charged by MasterCard for these transactions will be reversed.

Are you also having the “debit card” unauthorised transaction issue with CIMB? Do let us know if the transactions are indeed legible as claimed by CIMB.