UPDATE: Prepaid services are officially exempted from SST beginning 6 September 2018. More details here.

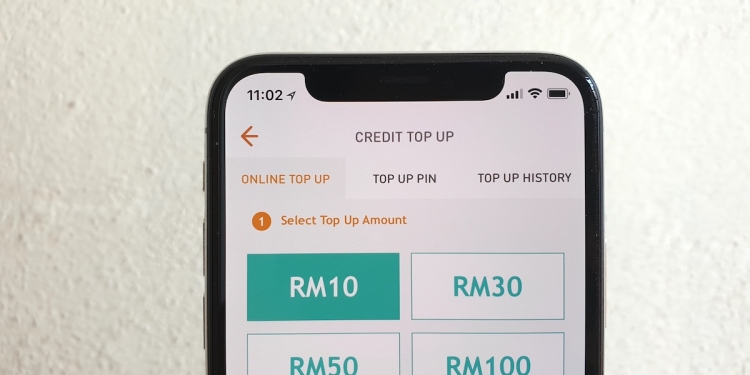

Starting 1 September 2018, all telcos had introduced 6% SST on all services. This is done in accordance with the Sales & Services Tax Act 2018 and it covers all users including postpaid, prepaid and broadband. For postpaid, the 6% tax is applied on the total taxable amount while prepaid users will have to pay the 6% tax at the point of top up.

Obviously, this had caused a lot of dissatisfaction for prepaid users as most of them are getting less value when they reload. For example, a RM10 top up will only come with RM9.43 of credit after deducting the 6% tax.

The Malaysian Minister of Finance, Lim Guan Eng, had responded that prepaid top ups should come with full value after topping up. If you top up RM10, you should get RM10 of credit. He added that the 6% SST should not be passed on to customers. As reported by NST and Astro Awani, he said that users getting RM9.43 instead of RM10 is a technical issue which needs to be ironed out.

Tq. Buat isu SST utk prepaid, perkara ini dlm perhatian KKMM. Kenyataan resmi akan dikeluarkan dlm masa terdekat berkenaannya https://t.co/i2F1vNNwOp

— GobindSinghDeo (@GobindSinghDeo) September 1, 2018

Meanwhile, Minister of Communications and Multimedia, Gobind Singh, had tweeted that his ministry is aware of the SST issue on prepaid reloads and they will be issuing a statement soon. At the time of posting, all prepaid reloads are still charged at 6% SST and telcos have tried to cushion the blow by offering extra freebies in the form of free minutes and free data. You can check out the full list here.

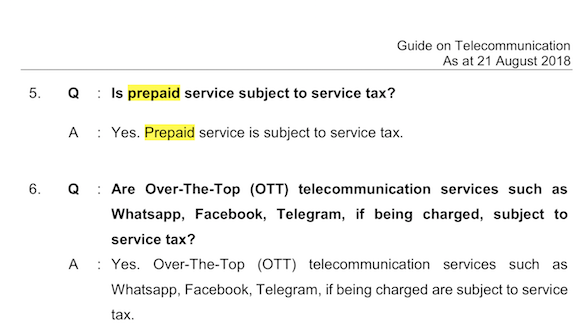

If the government wants to ensure that a RM10 top up remains RM10 in value, one possibility is to exempt prepaid from SST which currently isn’t. This is similar to the previous administration’s move to exempt prepaid from GST effective 1st January 2016. According to the Royal Malaysian Customs Department, prepaid service is still subjected to SST. You can refer to their telecommunications guide on Page 5.

However, if the government is still insisting on taxing prepaid users, another alternative is to tax based on usage. This means you’ll get full value upon top up but you’ll be taxed only when you make a call, send an SMS or subscribe to a data plan.

Of course, there’s the last option of forcing telcos to absorb the 6% service tax for prepaid. If you’re wondering why this wasn’t an issue before GST, it is because our telcos have been absorbing the 6% tax all these while. The telcos had tried to impose the 6% tax on starter packs and reloads but the move was deferred after negotiations with the government. According to a report by TheStar from 2011, the telcos have paid a total of RM6 billion in service tax since 1998.

As mentioned by Lim Guan Eng, the list of items affected by SST will be reviewed taking into consideration the views of the people. You can expect more changes to SST to be made by end of this year. He had given an example whereby prawns were currently covered under SST because it was lumped together with abalone.

For telcos, they are only complying with Sales & Services Tax Act 2018 and the government has to make the necessary amendments if they intend to exempt reloads from SST. What do you think is the best solution? Should the 6% tax imposed for postpaid customers only? Let us know in the comments below.