As part of its efforts to curb financial crime, Mastercard has officially launched TRACE (Trace Finance Crime) in Asia Pacific. The network-level solution uses artificial intelligence to identify and prevent money laundering and financial crime. The Philippines is the first country in Asia Pacific and the second country in the world to rollout TRACE, and it is designed to protect consumers and financial institutions.

According to Mastercard, Real-Time Payments (RTP) is rapidly rising among individuals and businesses across Asia Pacific which enables transactions to be settled between accounts at different financial institutions in seconds. However, money launders and mules have also taken advantage of the speed to evade detection by moving funds rapidly between multiple accounts. In most cases, criminals may use third party accounts of unwitting civilians to carrying out the transaction through romance and investment scams.

While financial institutions may deploy its own semi-manual methods or in-house AI solutions to detect illicit patterns, they typically rely on their own data and lack the holistic network-level perspective to trace such criminal activities. Mastercard added that investigations into such matters may take weeks to complete.

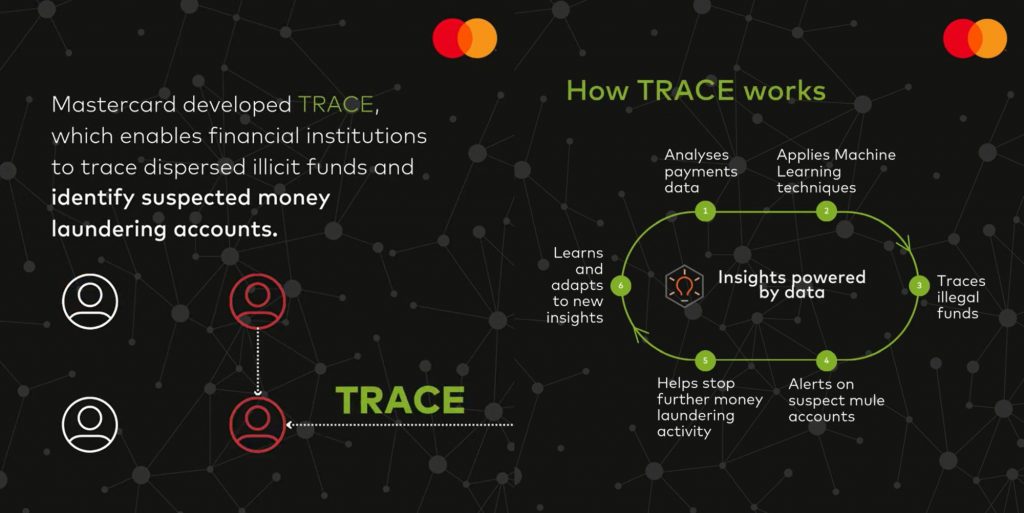

Mastercard shared that TRACE uses cutting-edge data science techniques to trace potentially fraudulent transaction patterns across a payment network, as well as providing proactive alerts to banks about suspicious accounts. It added that TRACE incorporates critical data points across an entire domestic network to identify money mules involved in financial crime such as frauds and scams, giving financial institutions a network-level perspective they wouldn’t otherwise have.

The region’s first TRACE rollout in the Philippines was done in collaboration with local interbank network BancNet (switch operator of InstaPay) which has onboarded 36 domestic banks. The TRACE solution enables participating financial institutions to quickly and extensively trace dispersed illicit funds across the RTP system, identify money mule activity throughout the network, and proactively highlight suspected money laundering accounts, which will allow them to better adhere to the Philippines’ new Anti-Financial Account Scamming Act (AFASA).

Mastercard Executive Vice President for Services in Asia Pacific, Matthew Driver, said, “The launch of TRACE in Asia Pacific marks a transformative step toward safeguarding the integrity of Real-Time Payments while combatting the corrosive effects of financial crime.”

He added, “By ensuring that transactions remain secure and compliant, TRACE helps to protect consumers and financial institutions, while also fostering trust in the digital economy—which will be critical for the region’s economic growth. Mastercard is proud to have collaborated with BancNet on its pilot rollout in the Philippines and is ready to collaborate with other stakeholders across the region to implement TRACE to create a stronger, more resilient global financial system.”

Besides the Philippines, TRACE is also deployed in the United Kingdom. Initially launched by Mastercard in 2018, TRACE is now being used by 21 financial institutions and tier-one banks, covering 90% of the UK’s Faster Payments Service network. According to Mastercard, TRACE has help identified thousands of mule accounts and is continuing to aid uncover hundreds of new money mule accounts monthly.