GXBank has announced a revision to its daily interest rate almost a year after receiving the green light to start its digital bank operations. In addition, it has also reminded users about an upcoming revision for its unlimited 1% cashback programme, which is among the perks offered as a launch promotion.

In a note, GXBank revealed that it has over 800,000 Malaysian customers who have collectively earned nearly RM29 million through its competitive 3.00% p.a. daily interest rate. It added that over half of their customers have saved using the Savings Pockets feature.

On top of that, nearly 26,000 Malaysians have signed up for Cyber Fraud Protect so far. This is GXBank’s new digital insurance product that offers protection against financial scams across all eligible bank accounts, eWallets and credit/debit cards registered under Bank Negara Malaysia.

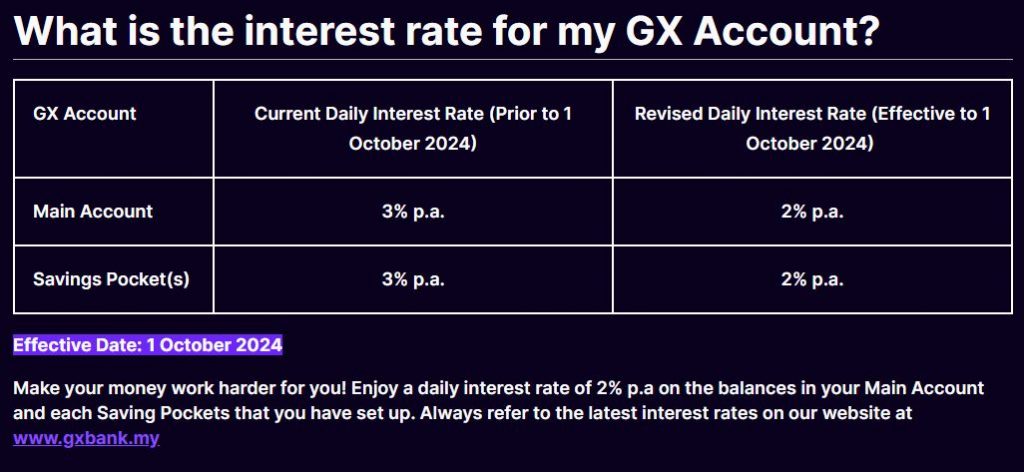

GXBank offers 2.00% p.a. daily interest effective 1 October 2024

To give customers an early heads up, GXBank has announced that its daily interest rates will be revised from the current 3.00% p.a. to 2.00% p.a. for both Main Account and Savings Pocket effective 1st October 2024. Despite the reduced rate, the daily calculated interest will still be credited to customers’ bank accounts daily.

As a reference, Aeon Bank quietly revised its profit rate from 3.88% to 0.88% p.a. on 1st September 2024. However, as part of its new campaign, users can enjoy a higher 3.00% p.a. profit rate for the Savings Pot.

Meanwhile, Boost Bank recently removed its complicated tiering system and is offering 2.5% p.a. daily interest for the Savings Account with no minimum deposit required. They offer a higher 3.6% p.a. daily interest rate for their Savings Jars and a higher 4.0% p.a. daily interest rate if you unlock special Jars by spending a certain amount with a merchant partner.

Will GXBank extend its cashback promo?

Besides the attractive 3.00% p.a. interest rate, another perk from GXBank is its unlimited 1% cashback promo. The cashback offer is among the rewards introduced under the GX Rewards Experience Campaign that runs from 6 November 2023 to 5 November 2024. It isn’t clear if GXBank will extend the cashback programme with a new cashback rate and we expect the digital bank to reveal more details closer to the end of the campaign period.

The unlimited 1% cashback promo applies to GXBank Debit Card spending for local and international transactions. They recently updated the programme to provide the cashback immediately into your Savings Account instead of waiting until the card transaction to be cleared the next day.

The GXBank Debit Card is also currently one of the most competitive cards for overseas usage as they currently waive all markup fees for foreign transactions. In addition, GXBank is also currently waiving fees for cash withdrawals via local (MEPS) and overseas (Visa) ATMs.

Related reading

- GXBank x Zurich Cyber Fraud Protect: Protection against online scams as little as RM1/month

- GX FlexiCredit: GXBank will soon offer flexible credit line with instant approval

- GXBank has acquired over 750,000 customers in less than a year

- No more waiting. GXBank’s 1% cashback is now credited immediately