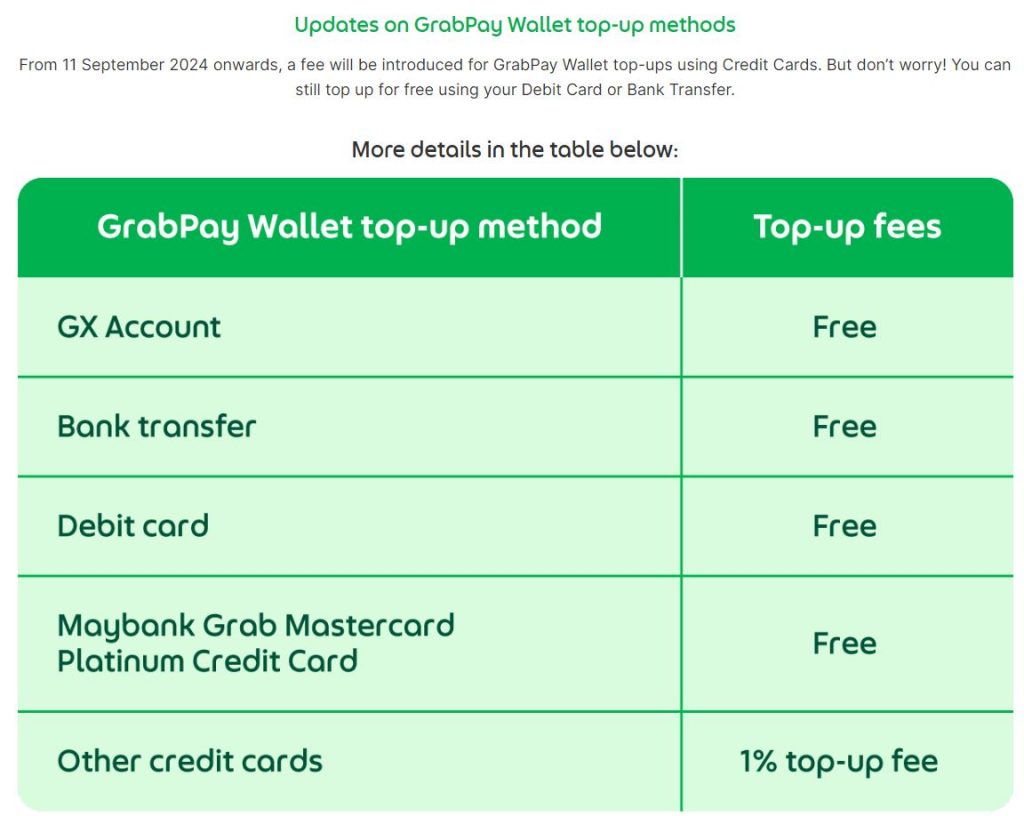

If you always reload your GrabPay eWallet account via credit card, take note that a new fee will be introduced very soon. According to Grab, they are imposing a 1% fee for GrabPay top-ups via credit card from 11th September 2024. However, their co-branded Maybank Grab Mastercard Credit Card will be exempted from the top-up fees for now.

Grab charges 1% top-up fee for credit card reloads

The latest announcement shouldn’t come as a surprise as other eWallets have introduced similar charges for credit card reloads. In 2022, BigPay started charging a 1% fee for reloads made with locally-issued credit cards and a 3% fee for reloads made with foreign-issued credit cards. Early this year, Touch ‘n Go eWallet followed suit by imposing a 1% convenience fee for all credit card reloads.

So if you reload RM100 via credit card, you will be charged RM101 inclusive of the 1% top-up fee.

How to reload GrabPay Wallet without top-up fees

However, there are still other options for GrabPay Wallet users to reload their eWallet without incurring any top-up fees. This includes Debit Cards, Bank Transfers and GX Accounts. As mentioned earlier, reloads with Grab Mastercard Credit Card are still exempted from the 1% fee after 10th September 2024.

In case you didn’t know, eWallet providers have been absorbing the transaction fees for credit card reloads. There are only a handful of eWallets in Malaysia that can accept credit cards as a reload channel and the feature has been abused for easy cashout without incurring cash advance charges from their credit cards.

The other eWallet provider that still accepts credit card reloads is Boost. Since 15th March 2024, Boost eWallet users can reload via credit card for free up to a limit of RM1,000 per month. Once you’ve exceeded the limit, Boost will impose a 1% Convenience Fee for any credit card reload transaction exceeding RM1,000 for the period.