Bank Negara Malaysia (BNM) has launched the National Fraud Portal (NFP) in conjunction with Payment Network Malaysia Sdn. Bhd. (PayNet) and financial institutions. The portal is an integrated platform created to solidify the coordinated efforts of the National Scam Response Centre (NSRC) in curbing financial scams.

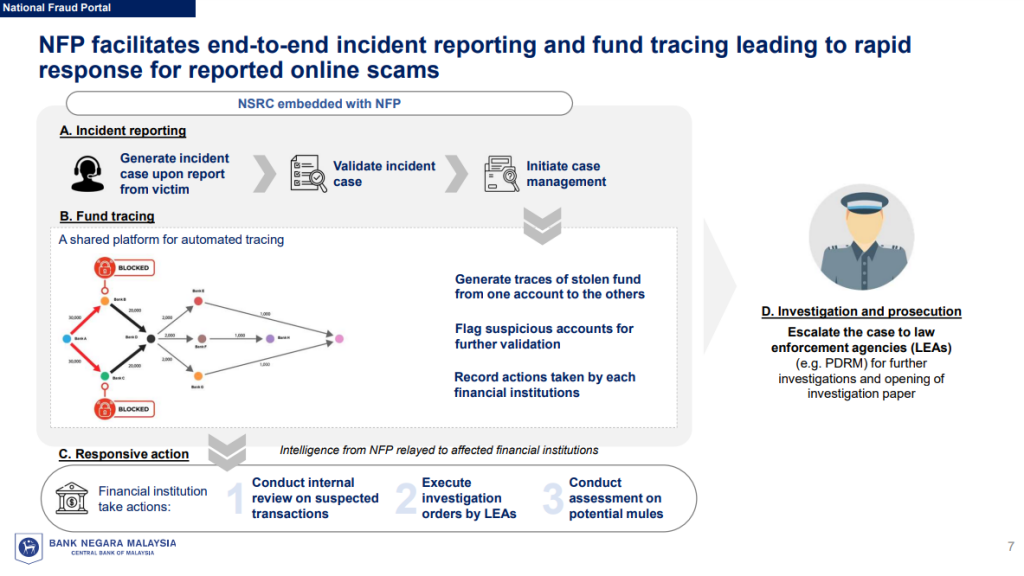

Among the efforts the NFP is set to bring include automated fund tracing and recovery when a scam is reported. This can help financial institutions such as banks to speed up the process of tracking stolen funds across the entire financial system.

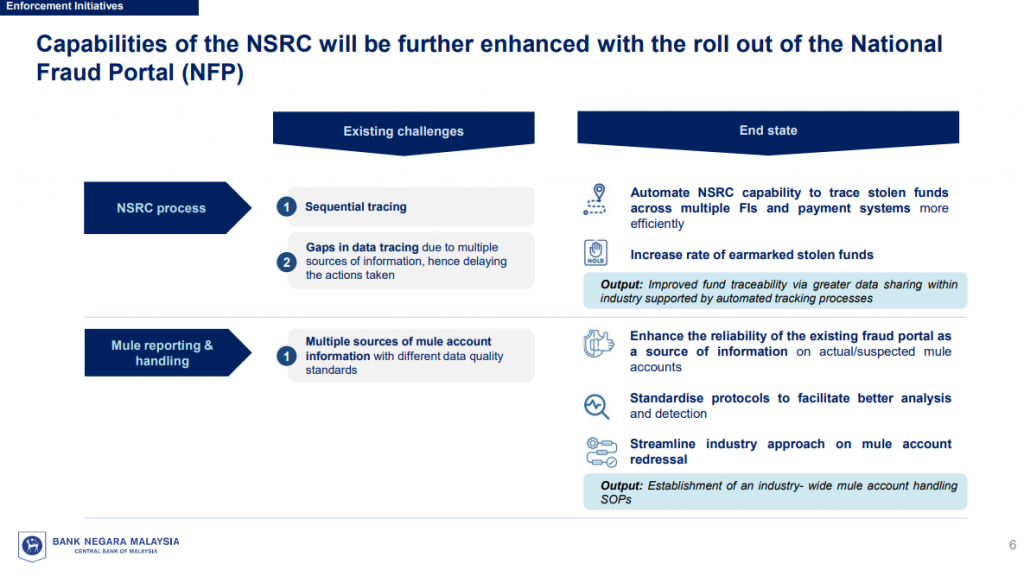

This was previously a challenge faced by the NSRC as there were gaps in data tracing due to multiple sources of information, hence delaying the actions taken. Further transfers instituted by scammers can also be prevented, as a result, while increasing the chances of stolen funds being recovered.

With the establishment of the NFP, financial institutions can now share information and intelligence on information related to fraud incidences effectively among industry peers. Last but not least, NFP can aid in facilitating better identification, assessment, and monitoring of mules. This is thanks to the platform being supported by credible data on mule accounts.

Along with the NFP, the financial industry has also agreed to adopt industry-wide procedures for reporting and handling mule accounts. These procedures are said to enhance the quality of industry-wide mule account data through streamlined mule classification. Consequently, this standardises the industry’s approach towards treating mules to ensure account holders affected by mule account activities can continue to access basic financial services.

These measures complement BNM’s multi-pronged approach to combat financial scams. This includes BNM’s recent directive to financial institutions to ensure victims of unauthorised online banking transactions are treated fairly.

As an example, BNM requires financial institutions to ensure robust fraud investigation processes with enhanced transparency and disclosure obligations. The policy also underscores the need for joint accountability in cases where the evidence points to lapses on the part of the financial institution and negligence on the part of the victim. This approach balances the need to ensure banks continuously enhance their fraud control measures while also reminding customers to remain vigilant in protecting themselves from scams.

Minister of Finance II, YB Senator Datuk Seri Amir Hamzah Azizan said, “The collective effort, dedication, and cooperation across the financial sector and law enforcement agencies must continue, and build on the momentum achieved thus far. Ensuring a secure and safeguarded digital future is crucial in elevating our nation’s status and competitiveness as envisioned under the Ekonomi Madani framework.”

Bank Negara Malaysia Governor Dato’ Seri Abdul Rasheed Ghaffour said, “With the NFP, the NSRC operations are now equipped with an end-to-end automated process from managing fraud reports, validating and tracing stolen funds, to sharing alerts among financial institutions to trigger prompt action.”

At the end of the day, we as members of the public are urged to stay vigilant at all times to prevent ourselves from falling victim to scams. But just in case you find yourself stuck in one of those sticky situations, you should immediately contact your financial institutions or the NSRC at 997. You may also follow the Amaran Scam Facebook page or visit the #JanganKenaScam website for the latest updates on financial scams.