Maybank has introduced its Single Device Access feature for its MAE app which aims to make it convenient for sole proprietors who need to manage multiple M2U access. Previously, users with various business accounts would need to set up MAE apps on different devices. With the new feature, sole proprietors can now have up to a maximum of 5 M2U accounts in a single MAE app on one device.

According to Maybank, the Single Device Access feature will benefit Maybank sole prop customers and allow them to view their financial activities across all the linked accounts on a single device eliminating the need to operate multiple devices which will save them more time and provide further convenience when banking online.

Head of Maybank’s Community Financial Service Malaysia Datuk Hamirullah Boorhan said, “This new feature not only streamlines our sole proprietor customer’s banking experience but also provides them peace of mind with the implementation of additional security measures, including Secure2u and the ‘Kill Switch’ feature. As security remains a top priority for Maybank, each M2U access maintains its own Secure2u for transaction approval, ensuring the highest level of protection. Sole proprietors can then seamlessly validate transactions within the MAE app.”

To use the Single Device Access feature, you’ll need to make sure that you update the MAE app to version 0.9.25 or above. It is available on the Apple App Store, Google Play Store and Huawei App Gallery.

How to add multiple M2U bank accounts in MAE?

Here’s how you can add multiple M2U accounts in the MAE app.

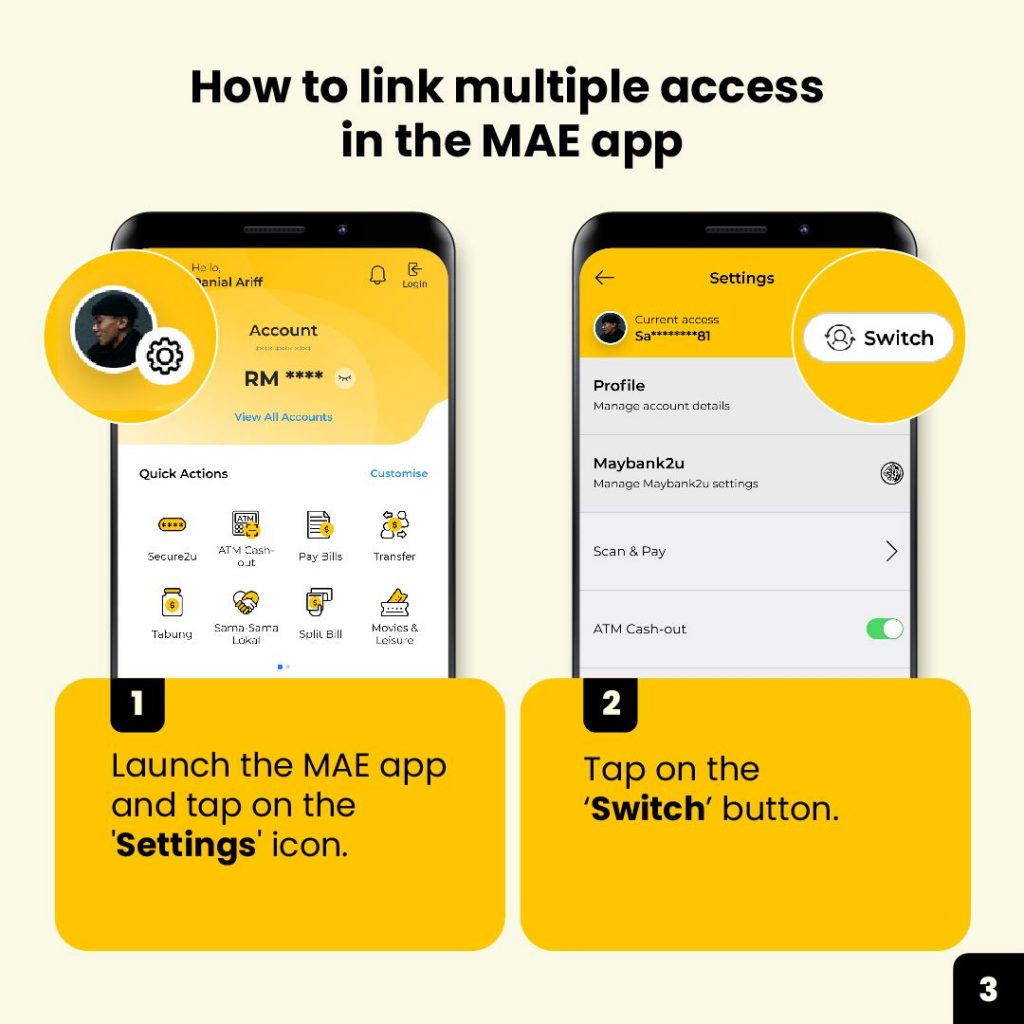

Step 1: Launch the MAE app and then tap on the settings icon at the top left corner.

Step 2: On your MAE settings page, tap on the “Switch” button at the top right corner.

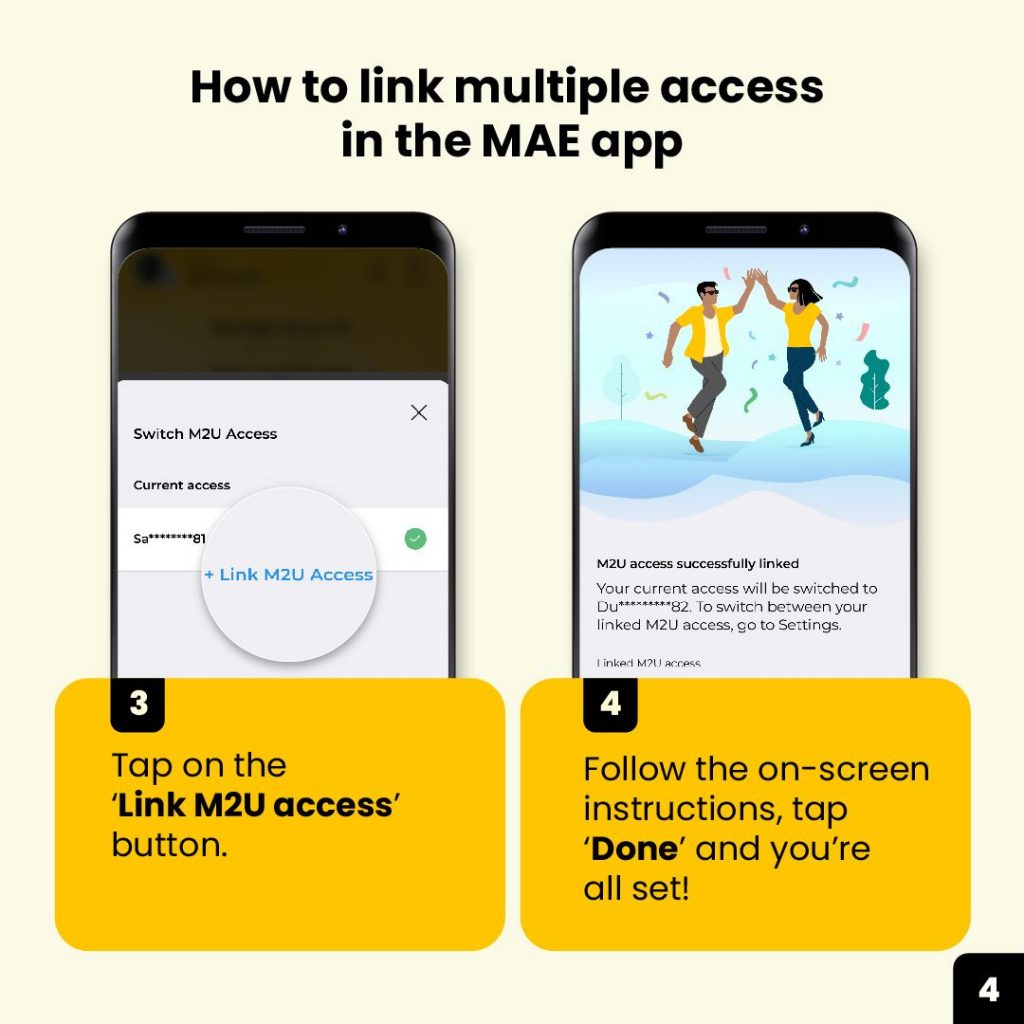

Step 3: On the Manage M2U Access page, tap on “Link M2U Access” at the bottom of the screen

Step 4: Follow the on-screen instructions and tap done.

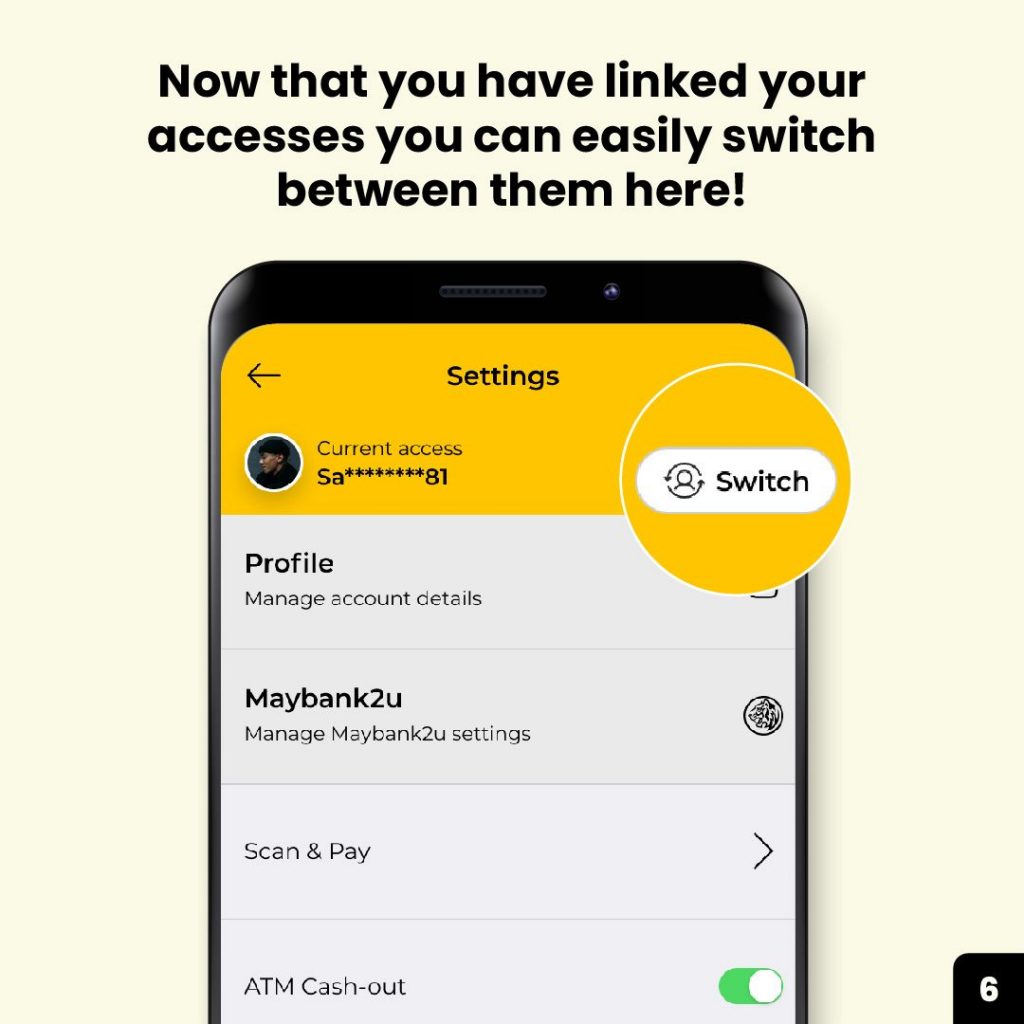

To switch between accounts in MAE, just go to Settings and then tap on the Switch button.

Things to take note about Maybank’s Single Device Access on MAE

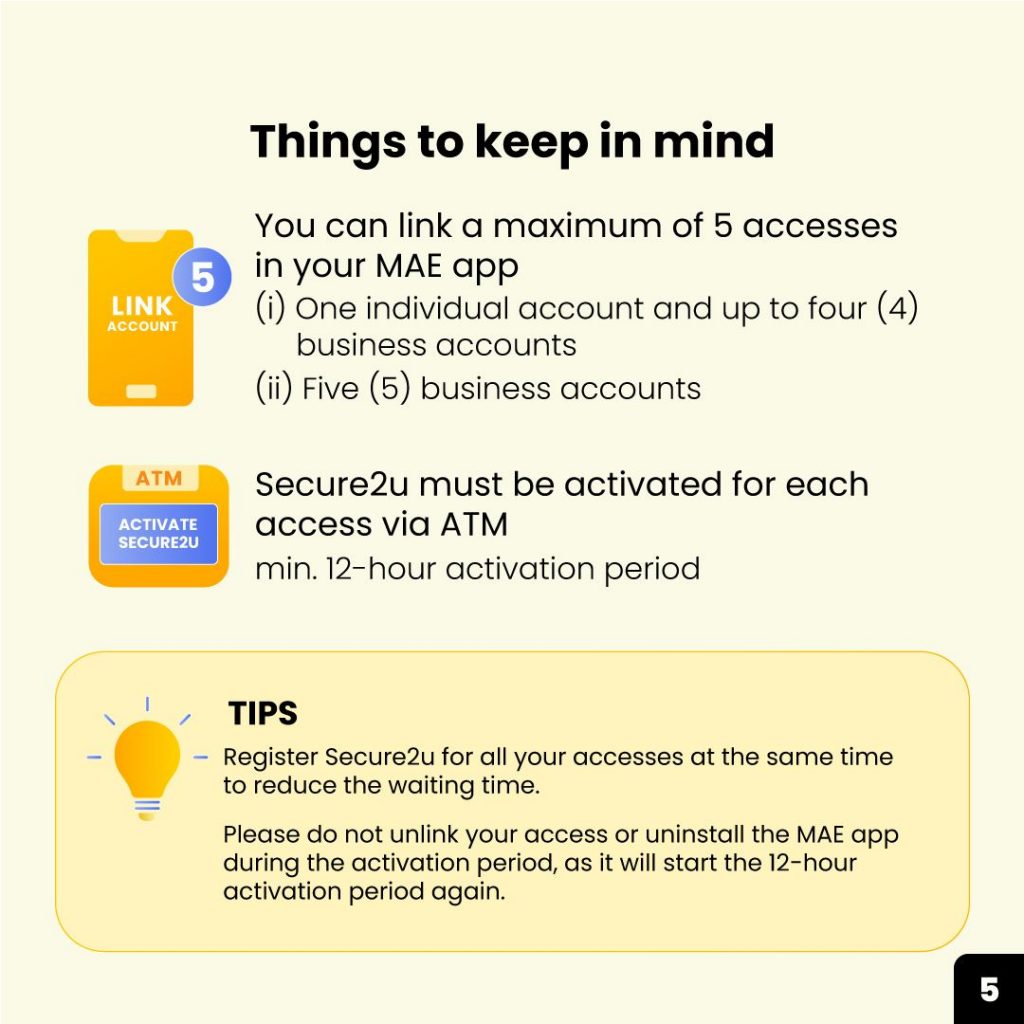

As mentioned earlier, you can setup up to a total of 5 accounts in a single MAE app. This may include 1 individual + 4 sole proprietor business accounts, or 5 sole proprietor business accounts in a single app.

You can only add accounts with access that belong to you. This means you can’t add M2U access that is not registered under your name. In addition, each M2U access can only be actively linked to one device at a time. If you try to link your M2U access to another device, you will be signed out from your current device.

Once linked, you will be prompted to activate Secure2U for each M2U access which can be done at the ATM. Secure2U is MAE’s security verification method which replaces SMS-based OTP and each account has its own Secure2U setup. This is to ensure that only you can authorise transactions as the approval can only be done on your registered device. If you’re adding multiple accounts, you are advised to activate Secure2U one shot to save time.

As part of Maybank’s security measures, there will be a 12-hour cooling-off period. This is only required for first-time registration or when switching between devices.

According to the FAQ, you can enjoy almost all features of the MAE app as usual. However, you won’t be able to perform the following transactions:

- Receive Group Tabung Invites

- Receive Split Bill requests

- Send or receive money requests through the Send & Request function

To learn more, you can visit Maybank’s website.