The Employees Provident Fund (EPF) has completed its Account restructuring which introduces a new Account 3 (Fleksibel) for members below 55 years old. This new account provides members the flexibility to withdraw funds at any time. Account 3 will start from RM0, but EPF members are given an optional one-time transfer to move funds from Account 2 (Sejahtera) to Account 3 (Fleksibel).

However, some media outlets reported that members could only enjoy hassle-free and flexible withdrawals of up to RM250/day. Is this really true? We’ve gone through EFP’s FAQ and terms for Akaun Fleksibel Withdrawal, and here’s everything you need to know.

How to withdraw funds from EPF Account 3 (Fleksibel)?

EPF members can make withdrawals from Account 3 if there’s sufficient balance. As mentioned earlier, Account 3 will start with RM0 balance and it will accumulate savings starting from your next contribution. With the new restructuring, your new EPF monthly contribution will be distributed at 75% for Account 1 (Persaraan), 15% for Account 2 (Sejahtera) and 10% for Account 3 (Fleksibel).

The minimum withdrawal is RM50 and you can apply for withdrawals online via i-Akaun on the app available on the Apple App Store, Google Play Store and Huawei App Gallery. As shown in the screenshot above, an eKYC process is required if the withdrawal amount exceeds RM250.00.

The RM250.00 is not a hard limit but merely the threshold to require eKYC (electronic Know Your Customer) verification, which can be done online. If you can’t complete the eKYC online, you may proceed to the EPF office or the Self-Service Terminal (SST) for thumbprint verification.

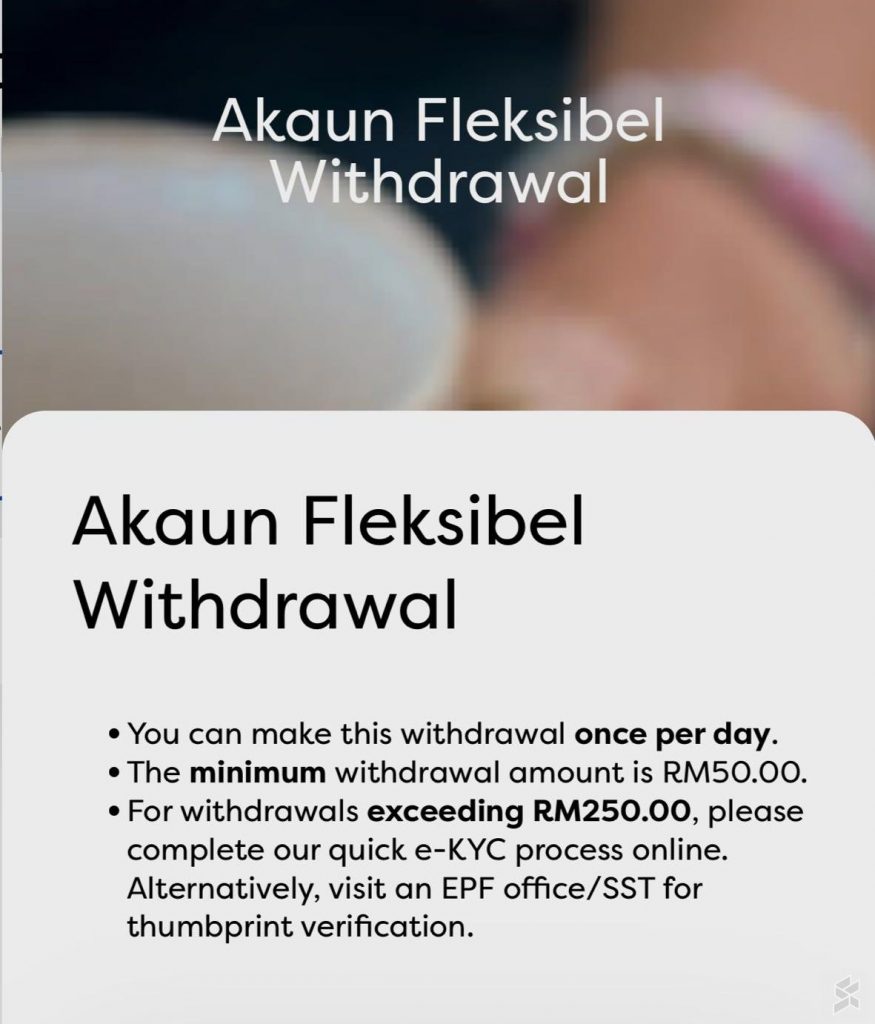

Here’s the step-by-step guide to withdraw your EPF funds from Account 3 (Fleksibel):

Step 1: Login to your KWSP i-Akaun

Step 2: Tap on Withdrawal at the bottom of the screen and then select Withdraw your savings

Step 3: Select Akaun Fleksible and select Withdraw Now. (You won’t be able to withdraw if you have less than RM50 in Account 3).

Step 4: Enter the amount you wish to withdraw, and select Continue

Step 5: Select or update your bank account details to receive the fund, and select continue. Do note that the Bank account must be registered under your name.

Step 6: Read the Members Declaration and select Accept to continue.

Step 7: Key in the TAC number to continue. A confirmation page will appear to indicate that your application is successful.

EPF Account 3 Withdrawal limits and eKYC

As mentioned in EPF’s FAQ, Account 3 (Fleksibel) withdrawal is only for members aged below 55 years old with sufficient savings in Akaun 3 (Fleksibel). You can apply to withdraw any amount from Account 3 as long as the amount is a minimum of RM50.

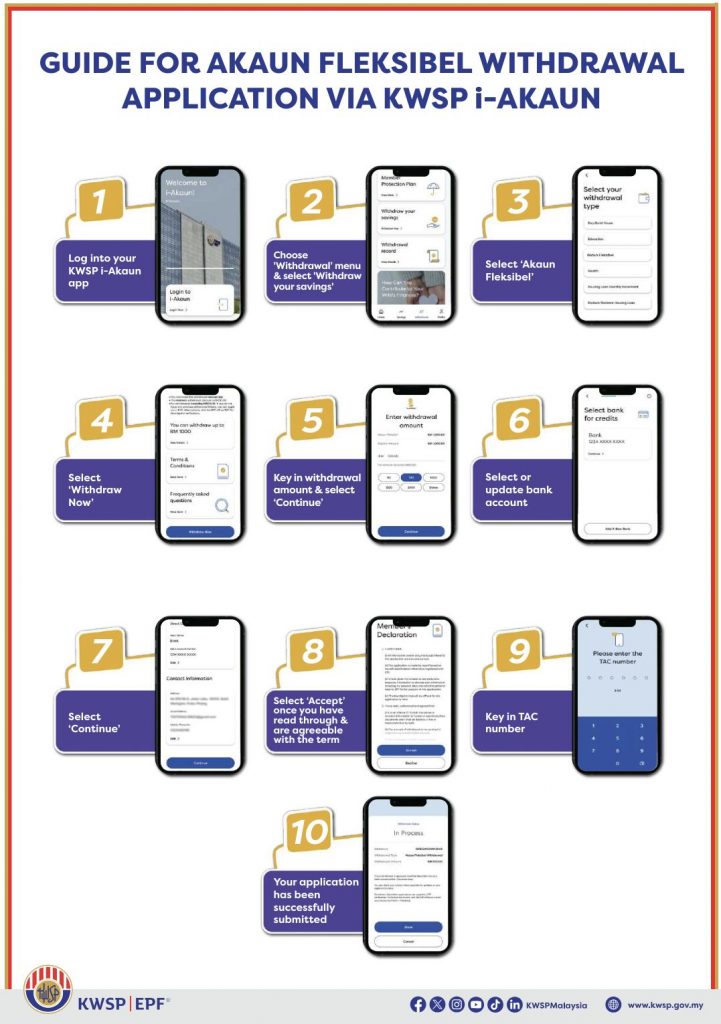

Members do not need to submit any supporting documents, however, an active bank account number is required to ensure smooth payment processing.

EPF has stated that members do not need to be physically present for identity verification at EPF offices as it can be done online. However, it is subject to member’s previous withdrawal history and the withdrawal amount does not exceed RM30,000.

For members who do not have previous withdrawal history or their bank account information differs from the previous withdrawals, an identity verification is required and it can be done in two ways:

- Thumbprint verification via Self-Service Terminal (SST) at any EPC offices, for withdrawal application amount of more than RM10,000, OR

- Online verification, subject to withdrawal application amount of less than RM10,000.

How long does it take for EPF Account 3 funds to reach your bank account?

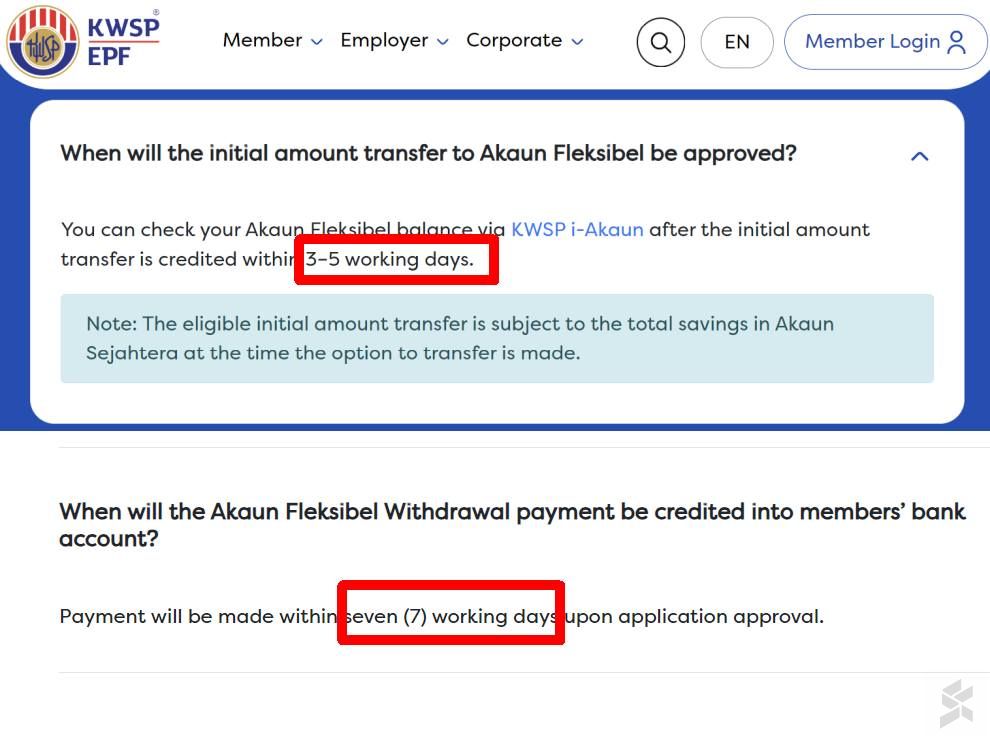

If you’ve applied for the one-time transfer to move funds from Account 2 (Sejahtera) to Account 3 (Fleksibel), EPF has stated that it takes 3-5 working days.

If you have sufficient funds in Account 3 and applied for flexible withdrawal, the payment will be made to your registered Bank Account within 7 working days upon application approval.

For more information, you can visit EPF’s Akaun Flesibel Withdrawal page.