If you’re travelling overseas, Touch ‘n Go eWallet (TNG eWallet) provides a seamless cross-border payment experience as you can either use QR payment (via Alipay+) or the eWallet-linked Visa Prepaid card. As announced recently, TNG eWallet has started imposing a 1% conversion fee for overseas QR payments and this markup will be included in the indicated exchange rates in the app.

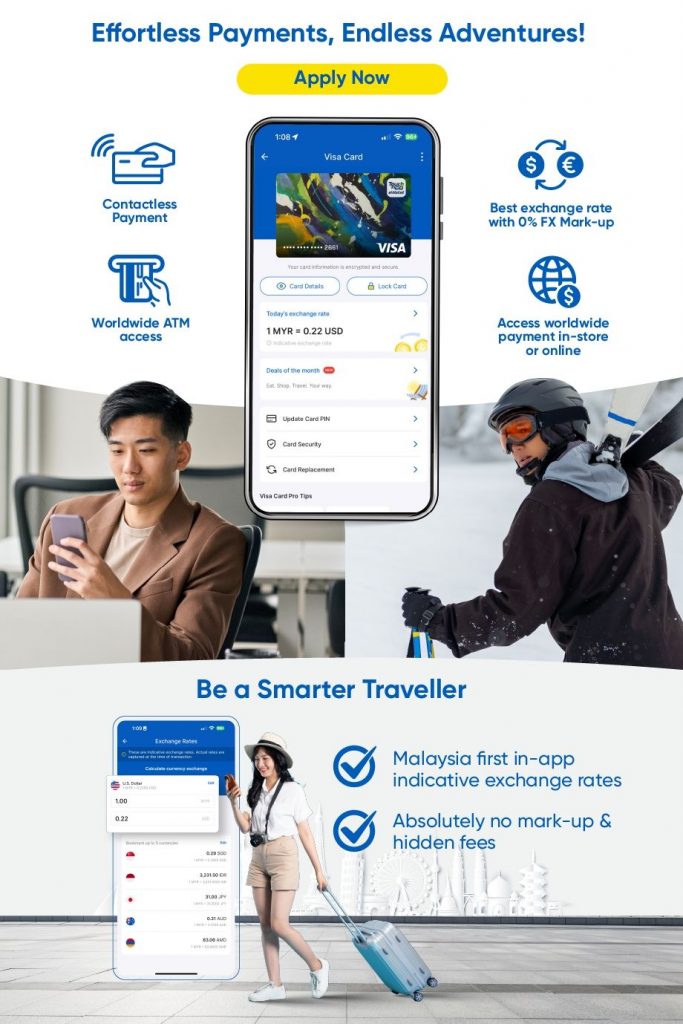

However, if you’re using the TNG eWallet Visa card, TNG eWallet has confirmed that users can perform overseas transactions with 0% FX markup.

TNG Visa continues to offer 0% markup for FX

As indicated in their app and website, the TNG Visa card offers the best exchange rate with 0% FX markup and no hidden fees. To know the exchange rates for the TNG Visa card, you can view the indicative exchange rates for various currencies under the “Visa Card” section.

Typically, most card users won’t know the applicable foreign exchange rates until after the payment is made or when the monthly statement is issued. TNG eWallet claims that this is Malaysia’s first in-app indicated exchange rate calculator that keeps shoppers informed about the latest rates before making a transaction. Users can save up to 5 favourite currencies for easy reference at a glance.

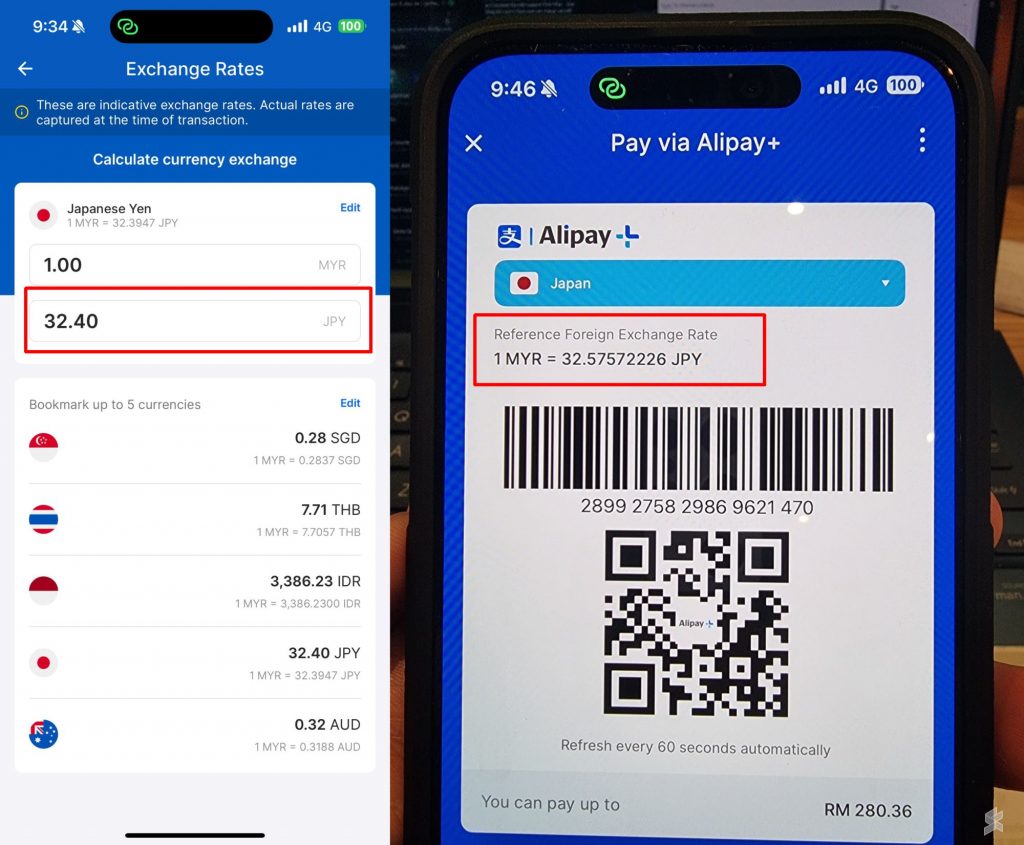

The app also has a disclaimer that the displayed rates are merely indicative and the actual rates are captured at the time of transaction.

You can also use the TNG eWallet Visa card to withdraw cash from the ATM. According to TNG eWallet Visa card’s Product Disclosure sheet, ATM Cash withdrawals in Malaysia will be charged RM1.40 while overseas cross-border ATM cash withdrawals will cost you RM10.00.

TNG eWallet users can order the card from the app and it will be shipped to your mailing address.

Alipay+ QR could offer better rates than TNG Visa card despite 1% markup

With the extra 1% markup for TNG eWallet QR Payments for overseas, you would expect TNG Visa card to be the better option for overseas payments across the board. However, that’s not the case for all currencies from what we’ve discovered.

At the time of writing, the SGD to MYR rate is SGD1 = RM3.53 on TNG Visa versus SGD1= RM3.589 for Alipay+. In this example, TNG Visa has the better rate.

However, when we try MYR to JPY, TNG Visa offers RM1 = JPY32.40 but for Alipay+, they are showing a better rate of RM1 = JPY32.575, which is slightly higher.

This is due to the different FX rates on both Alipay+ and Visa networks, and in some instances, Alipay+ could offer a more competitive rate than Visa despite the 1% markup. So if you’re travelling, it is best to compare the rates for both TNG Visa and Alipay+ in the app and see which one is better for your destination.