After rolling out its GXBank physical debit card to all users last month, the digital bank has finally enabled DuitNow QR on its app. This allows GXBank users to make QR payments at merchants that display the DuitNow QR code.

DuitNow QR feature rolling out to GXBank users in stages

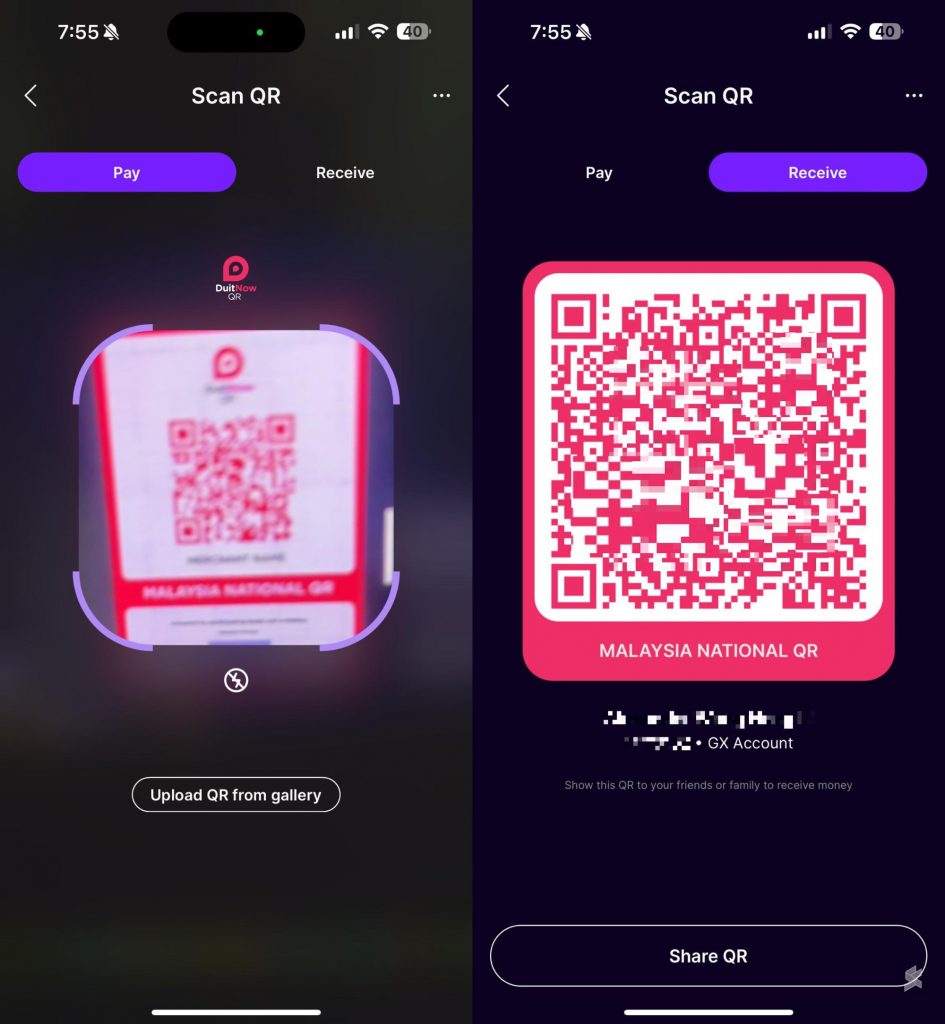

The DuitNow QR feature will appear as a “Scan” button on the home screen which lets you pay or receive payments via QR code. Users can either scan the QR code directly using their phone’s camera or upload a QR code from the gallery. Unfortunately, there’s no option to show your QR code to the merchant for now.

If you want to receive money via QR, you can also display your personal DuitNow QR code that’s linked to your GXBank account number.

GXBank does not charge any fees for QR payments. However, you won’t enjoy the unlimited 1% cashback promo currently offered for GX Card transactions.

Take note that there are transaction limits for DuitNow QR. According to GXBank, the default daily limit is set at RM1,000 per day or up to a maximum of RM5,000. For peer-to-peer or transfers to bank accounts, the default limit is RM5,000, or up to a maximum of RM50,000. These limits can be managed from the GXBank app settings.

The DuitNow QR feature is currently being rolled out to GXBank users in stages. Make sure you’ve updated your GXBank app to the latest version.

Before this, GXBank’s GX Card was the only way for account holders to spend their money and they can do so at any merchant worldwide that accepts Mastercard. On top of that, the card can also be used for cash withdrawals and GXBank is currently waiving the RM1 MEPS fees.

GXBank expands payment coverage via Mastercard and DuitNow QR

With the new DuitNow QR feature, GXBank users can spend their money at even more touchpoints in Malaysia and it enables new users to make physical in-store payments before waiting for their debit card to arrive. As of the end of November 2023, there are over 1.8 million DuitNow QR touchpoints in Malaysia. Besides Malaysia, the DuitNow QR support will eventually enable GXBank users to perform cross-border QR payments in Indonesia (QRIS), Singapore (NETS), Thailand (PromptPay) and China (Alipay) soon.

GXBank is also looking at rolling out new banking features and services from time to time which include personal loans by the end of this year. It still isn’t clear when they will enable Apple Pay and Google Pay support, which is one of the most requested features among digitally savvy users. The digital bank also aims to offer Bahasa Melayu as a language option for the app in a future update.

If you’re interested, you can sign up for GXBank by downloading the app on the Apple App Store and Google Play Store. For more info, you can visit their website.