A revision to the Passenger Service Charges (PSC) was announced by the Malaysian Aviation Commission (MAVCOM) on Tuesday for the First Regulatory Period or RP1. The commission said the new rates will take effect from 1 June 2024 until 31 December 2026 (RP1) and is designed to support the recovery of the aviation sector in the post-COVID-19 environment.

MAVCOM said that the revision was made based on a comprehensive consultation process that started in 2021 and falls under its responsibility for the economic regulation of the Aviation Services Charges (ASC) in Malaysia, under section 46 of the Malaysian Aviation Commission Act 2015 [Act 771], which includes the power to set aviation services charges such as the PSC, aircraft landing and parking charges, among others.

What is PSC?

The PSC, also formerly known as the ‘Airport tax’, is the tax paid by departing passengers regardless of whether they are flying domestic or international flights. The tax is included with every ticket purchase for flights out of airports in Malaysia.

The charge is collected by airlines and paid to the airport operator once the flight is complete. The airport operators in Malaysia include Malaysia Airports Holding Berhad, Senai Airport Terminal Services Sdn Bhd (for Senai Airport in Johor Bahru and Kerteh Airport in Terengganu) and Tanjung Manis Airport in Sarawak.

MAVCOM’s Executive Chairman, Datuk Seri Hj. Saripuddin Hj. Kasim said, “Acknowledging the impact of the COVID-19 pandemic on both the industry and consumers, we have carefully recalibrated our approach. The implementation of the revised PSC is the cornerstone of our strategy to safeguard consumer welfare, support a sustainable and resilient recovery, and ensure the aviation sector’s financial stability while adapting to evolving market conditions. The PSC tariff announced today reflects feedback from various stakeholders, aiming to support the industry’s long-term viability, recovery, and competitiveness.”

New PSC Rates from 1 June

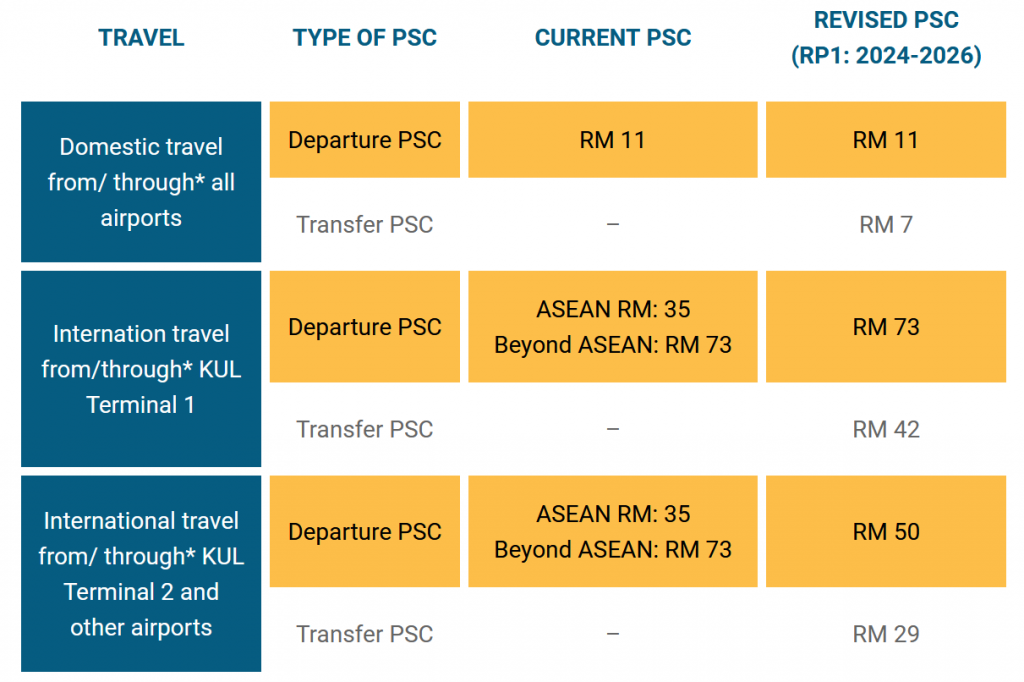

The commission shared a table with the current PSC charges and the new charges that will go live from 1 June 2024:

The PSC for Domestic flights is maintained at RM 11 for every flight, regardless of where the origin airport is located.

A highlight of the new charge is the consolidation of the International Travel PSC. Previously, MAVCOM split the PSC into two categories – Within ASEAN and Beyond ASEAN. Now, they have unified the PSC into a single International PSC. Now all international flights from KLIA Terminal 1 will see a RM73 PSC, while international flights from KLIA Terminal 2 and other international airports in Malaysia will be charged RM50 per flight.

Something new with the revised PSC is the introduction of a Transfer PSC. This means that any flight that transfers to Malaysian airport will be charged the new Transfer PSC in their tickets. Domestic transfers (Example flight: Kuching-KLIA-Kota Baru) will see an RM7 transfer PSC while international transfers (example flight: London-KLIA-Melbourne) will see an RM42 transfer PSC for KLIA Terminal 1 and RM29 for KLIA Terminal 2.

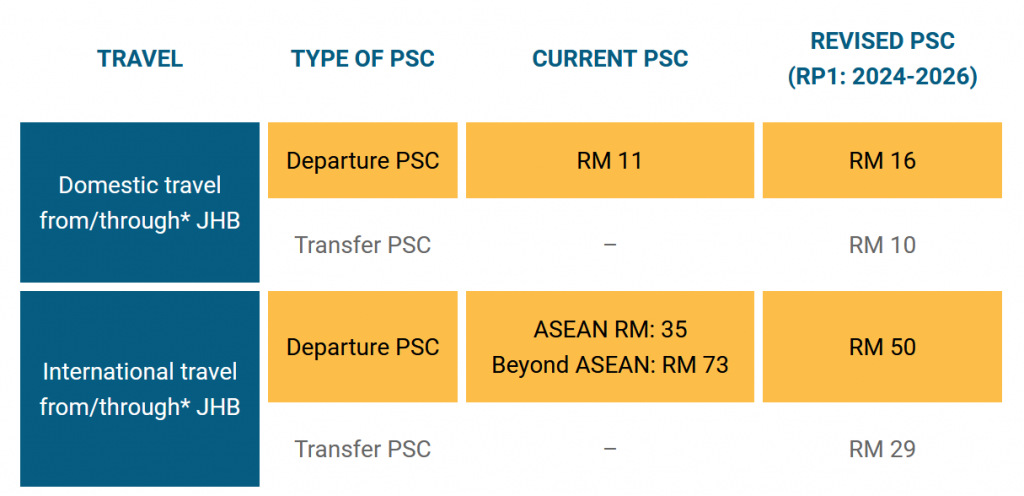

Senai Airport meanwhile will see different PSC charges for its passengers, as seen below:

MAVCOM confirms that tickets purchased before the 1 June 2024 start date will not be charged with the new PSC rates, even though the flight dates are after the start date. So passengers will not need to pay extra tax if they have purchased their tickets.

[SOURCE]