GXBank has announced that it is now offering the GX Card to all users. Initially rolled out to select users, the card is now open to all GXBank account holders who have signed up earlier. The physical debit card not only enables GXBank account holders to spend their money but also provides extra perks including unlimited 1% cashback on all retail spending.

How to apply for a GX Card?

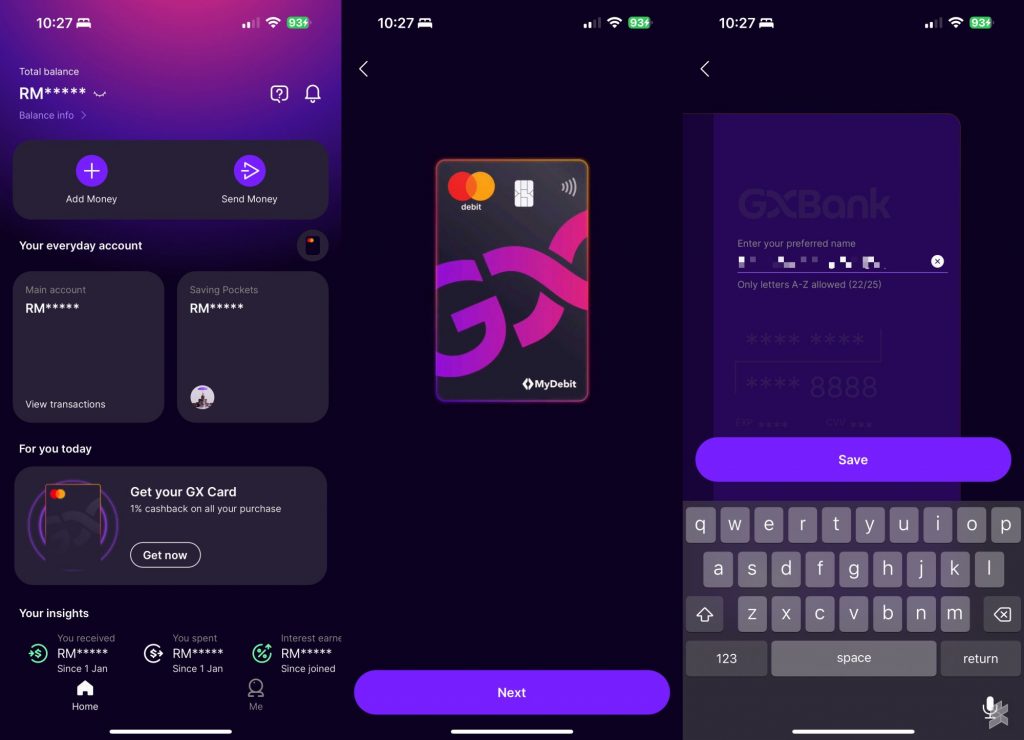

To get the GX Card, you must first download and register for a GXBank account via the app which is available on the Apple App Store and Google Play Store. After signing up, you should see a “Get your GX Card” banner and you can click on “Get now” to continue.

The GX Card application process takes just a couple of minutes. Just follow the steps which include entering your preferred name (up to 25 characters) which will be printed on the back of the card as well as your mailing address. While waiting for the card to arrive, you can already start spending with your GXBank account funds using the virtual card number for online and in-app transactions.

What are GX Card benefits?

As part of GXBank’s introductory offer, they are offering unlimited 1% cashback for card spending which will be credited to your account daily. This means you can earn RM1 cashback if you spend RM100 or RM10 cashback if you spend RM1,000 using the card.

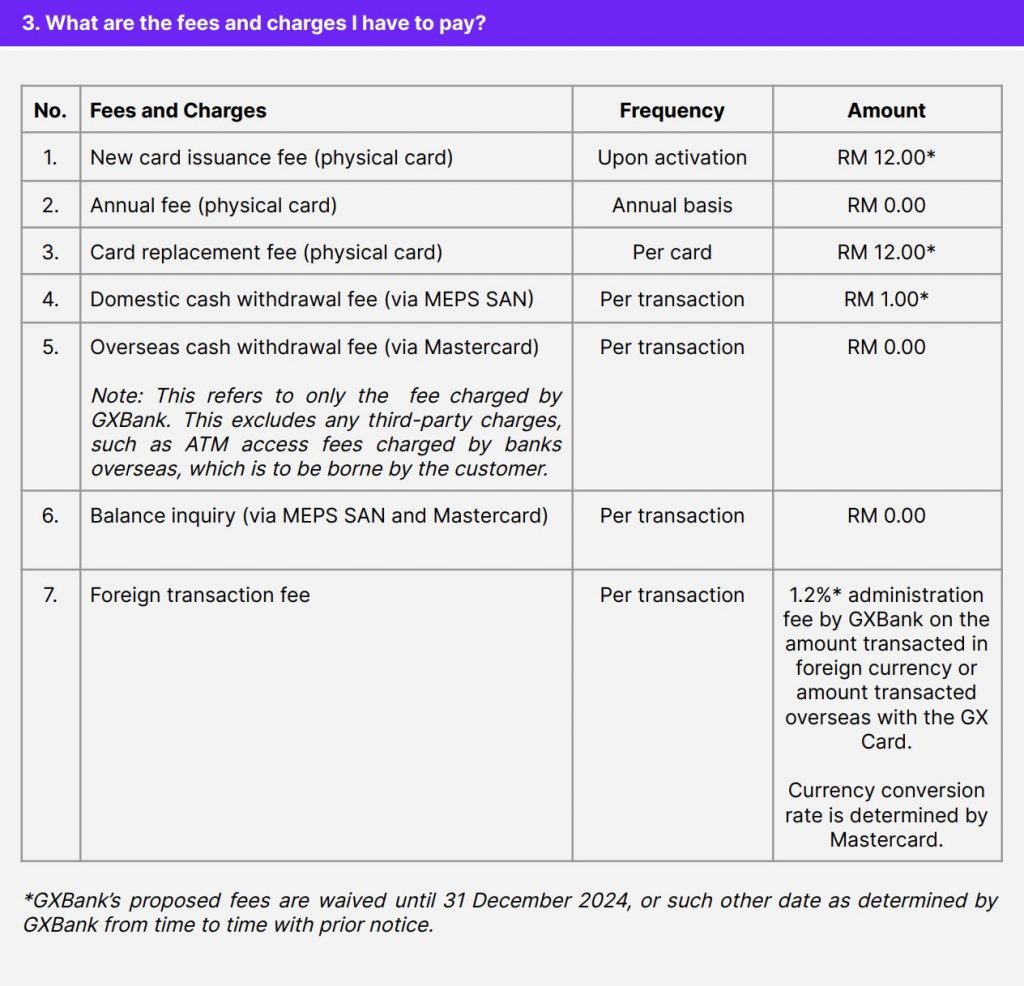

In addition, the GX Card can also be used for cash withdrawals at over 10,000 MEPS ATMs nationwide and the RM1 MEPS fee is waived. The ATM will display the RM1 MEPS notice during cash withdrawal but the fee will be waived in your account statement.

In addition, they are also not charging additional fees for overseas transactions and cash withdrawals at Mastercard ATMs nationwide. GXBank also offers 1.5x GrabRewards if you spend at Jaya Grocer outlets with the card.

Take note that these perks are offered for a limited time. The waivers for transaction fees are currently offered until 31st December 2024. Meanwhile, the unlimited 1% cashback promo and 1.5x GrabRewards offer for Jaya Grocer is valid until 5th November 2024.

GXBank is Malaysia’s first digital bank licensed by Bank Negara Malaysia and they are also a member of PIDM where deposits are protected up to RM250,000. Account holders can earn interest of 3.00% per annum and the interest is credited daily. Since this is a digital bank, there are no physical branches. This means everything including freezing the card and setting transaction limits is managed via the app.

With Ramadan and Hari Raya coming, GXBank has teased exciting campaigns to make preparations for the festive season more affordable and convenient. For more info, you can visit GXBank’s website.