GXBank, Malaysia’s first digital bank licenced by Bank Negara Malaysia, has finally issued its GX Card to its first batch of customers. If you missed it, the first batch of GXBank account holders can finally order the physical Mastercard debit card for free from the GXBank app.

GX Card benefits include 1% cashback and free MEPS ATM withdrawals

With the GX Card, GXBank account holders can finally spend their money which was previously a missing feature on its Beta product offering. Unfortunately, the app still doesn’t support QR payments so you can’t use it to scan DuitNow QR codes at smaller retailers.

As part of its introductory promo, GXBank offers unlimited 1% cashback for card spending. This means you can get RM1 cashback if you spend RM100. However, this cashback offer excludes several transactions including eWallet top-ups.

In addition, GXBank is also offering 1.5x GrabRewards points when you use the card to shop at Jaya Grocer retail outlets. GXBank is also waiving its cash withdrawal fees at MEPS ATMs nationwide and they also are not charging extra transaction fees for overseas transactions and overseas cash withdrawals at Mastercard ATMs worldwide.

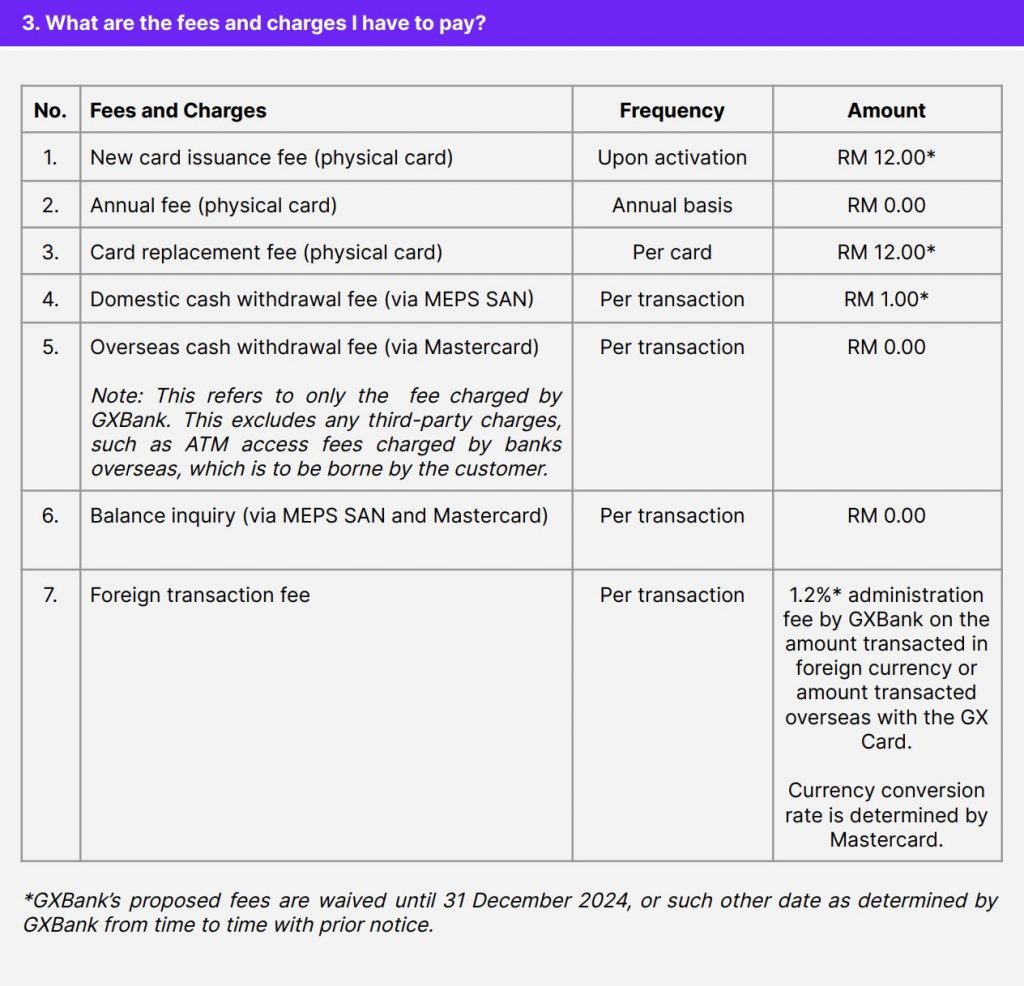

Do note that these fees are currently waived until 31st December 2024 and it is subject to change by GXBank from time to time. For more info, you can view GX Bank’s Product Disclosure Sheet. The 1% cashback and 1.5x GrabRewards promo are offered under the GX Rewards Experience campaign which runs until 5th November 2024.

No separate virtual number for GX Card

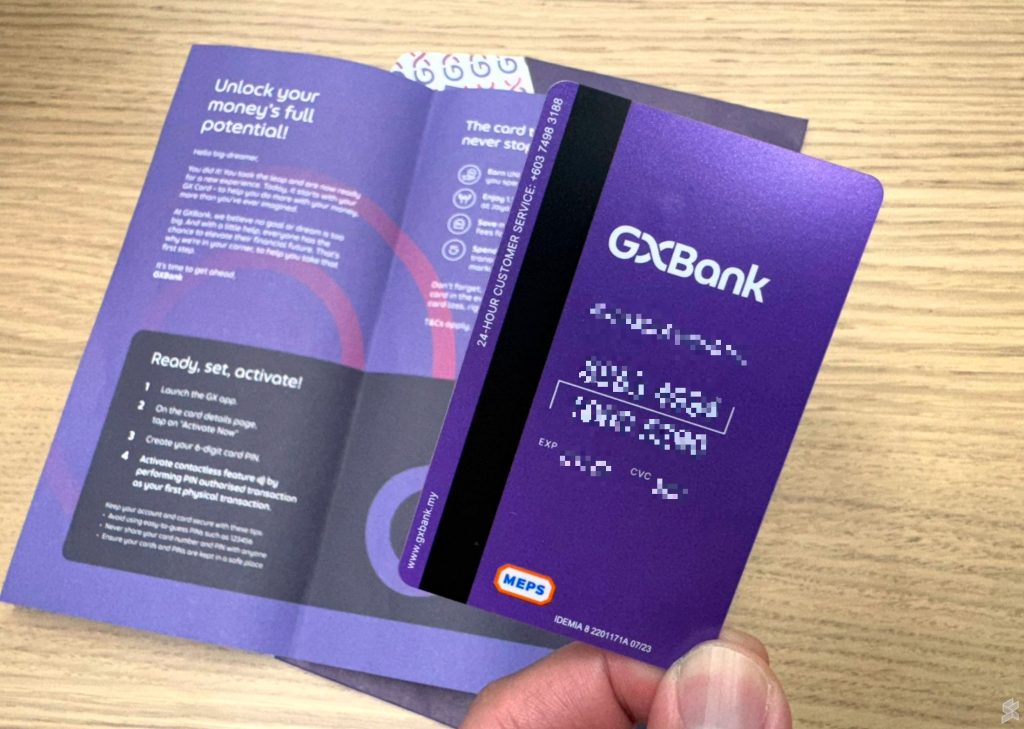

The physical GX Card itself looks pretty sleek with a reflective GX logo in gradient purple and red, on top of a black background. Meanwhile, the rear is all purple and it has your preferred name, card number, expiry and CVC printed on it. To make it easier to spot it among your stack of cards, the GX Card stands out with its maroon edges. Activating the card via the app is pretty straightforward and all it needs from you is to set your card’s PIN.

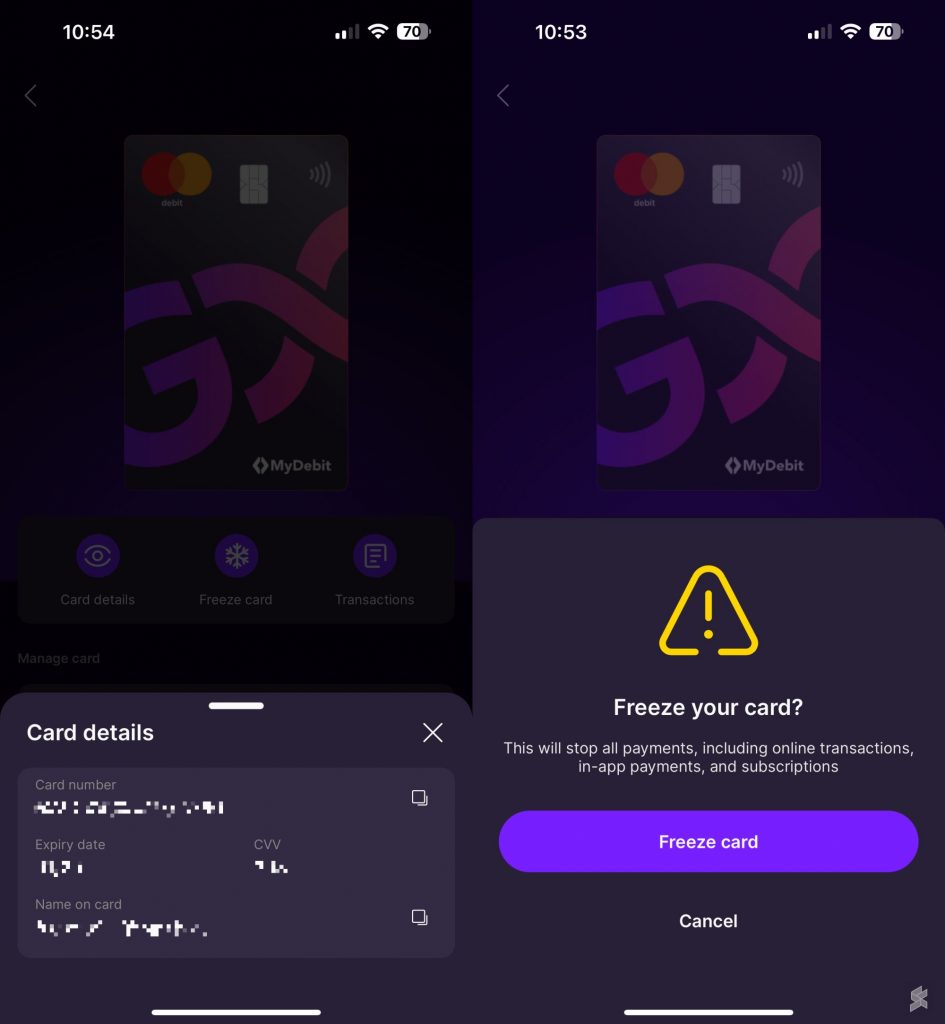

Unlike most popular digital prepaid card offerings in the market like BigPay and Wise, GX Card only issues a single card number for both physical and virtual usage. Ideally, we would have preferred to have a different virtual number for online and in-app transactions. If your virtual card number is compromised by a data breach, it is much easier to generate a new virtual number without replacing your physical card. The GX Card has a 5-year validity from the time of issuance.

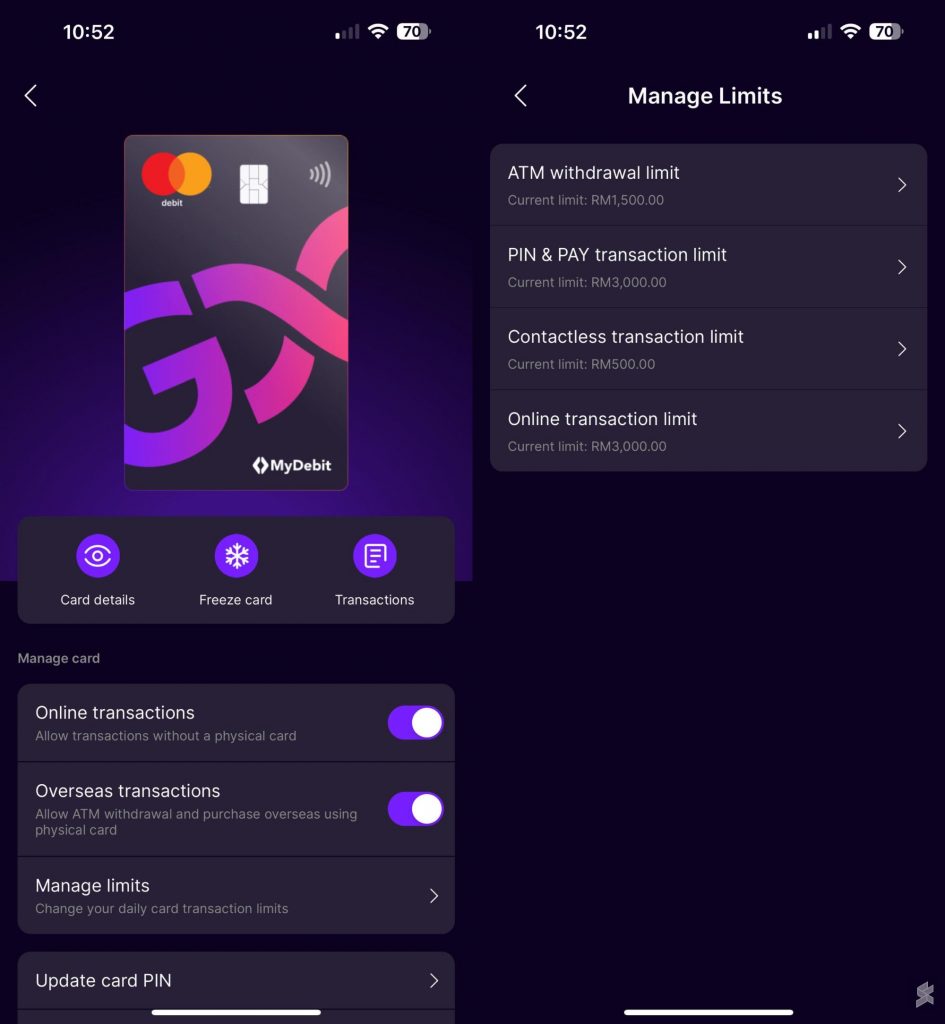

The GX Bank app itself offers a pretty extensive amount of control for your debit card as you can toggle the card options for online and overseas transactions, as well as set specific limits for different transactions (up to a maximum of RM10,000 per day). You can also update the card’s PIN or freeze it instantly if your card is misplaced.

Take note that before you can use the contactless Mastercard PayPass feature, you’ll need to make one physical transaction using your PIN. All transactions will utilise your GX Bank account funds which currently accepts top-ups via online banking or DuitNow transfers. In case you missed it, GXBank offers an interest rate of 3.00% per annum for your deposits and the interest is credited to your account daily.

If you’re interested in signing up, you can register for a GXBank account by downloading the app on the Apple App Store and Google Play Store. At the moment, they offer RM8 instant cashback if you deposit at least RM88 to your account and an additional RM8 if you register your GX Account with DuitNow. On top of that, if you link your GX Account to Grab, they offer up to RM29.40 cashback for your GrabUnlimited subscription (RM4.90 x 6 months).