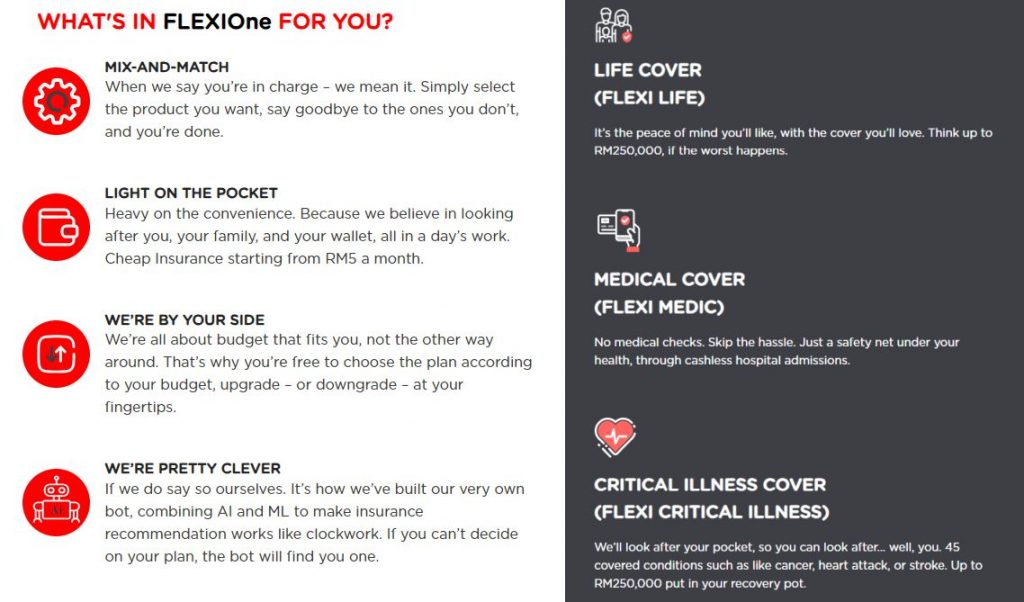

Tune Protect has launched what appears to be the easiest customisable digital life insurance plan in Malaysia. Similar to Yoodo, a digital telco which lets you customise your telco plan, Tune Protect’s FlexiOne provides individuals with the flexibility to mix and match insurance coverage according to their preferences, budgets and needs. Targeted at first-time buyers, those who are on a shoestring budget can start with premiums from as low as RM5 per month.

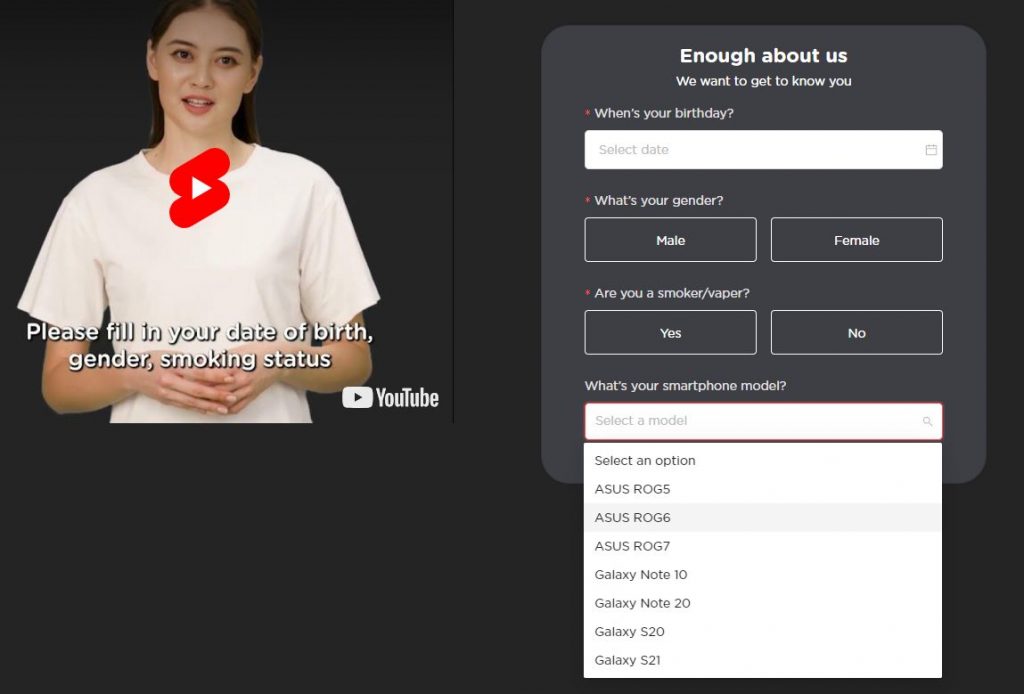

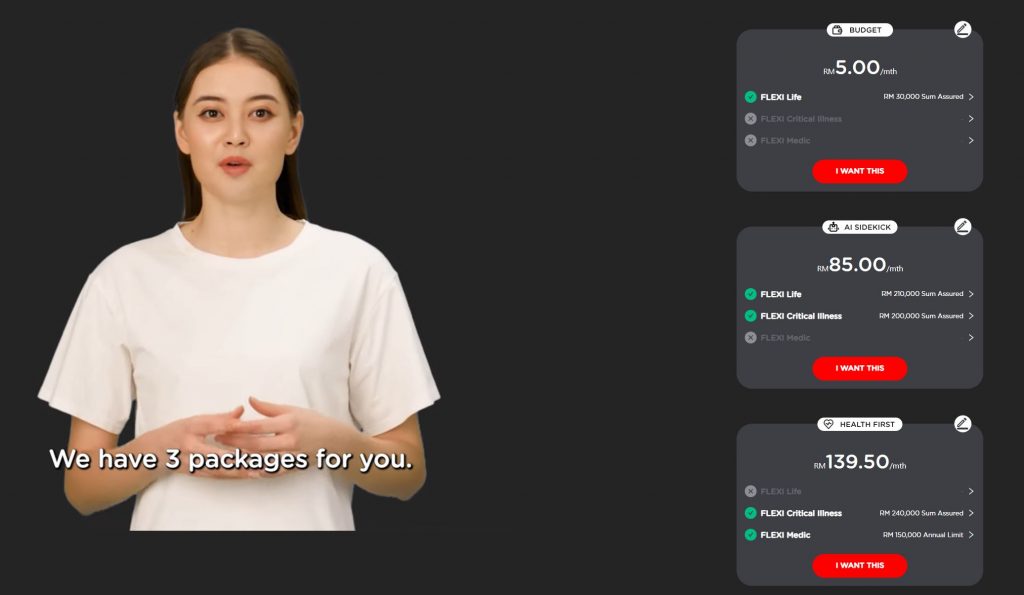

To help you get started, Tune Protect FlexiOne has “Tracy”, an AI virtual assistant, which helps to personalise and recommend the best-suited insurance plan for you. By entering a couple of details, the FlexiOne site will recommend three pre-packaged plans for your consideration.

Some of the questions asked include your date of birth, gender, whether you’re a smoker and interestingly, your current smartphone model. Yes, even the ROG phone is on the list. From our own experience, fortunately, there’s no price difference whether you’re using a Xiaomi, ROG, iPhone or a Samsung Galaxy.

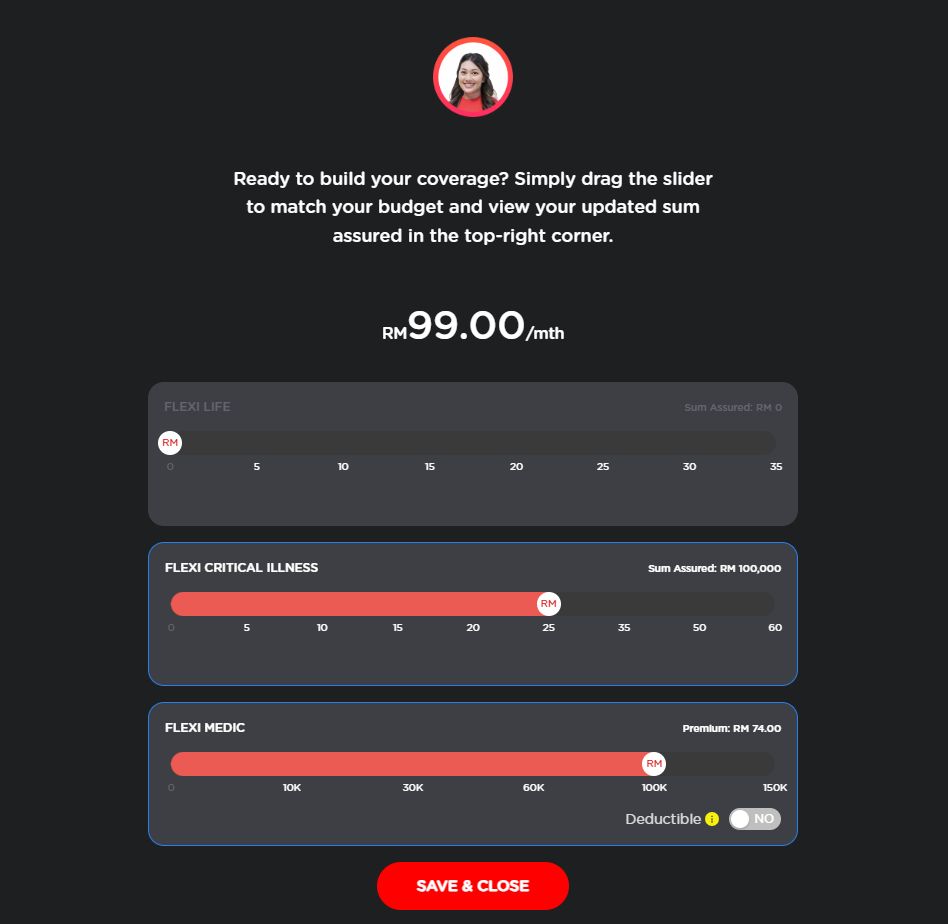

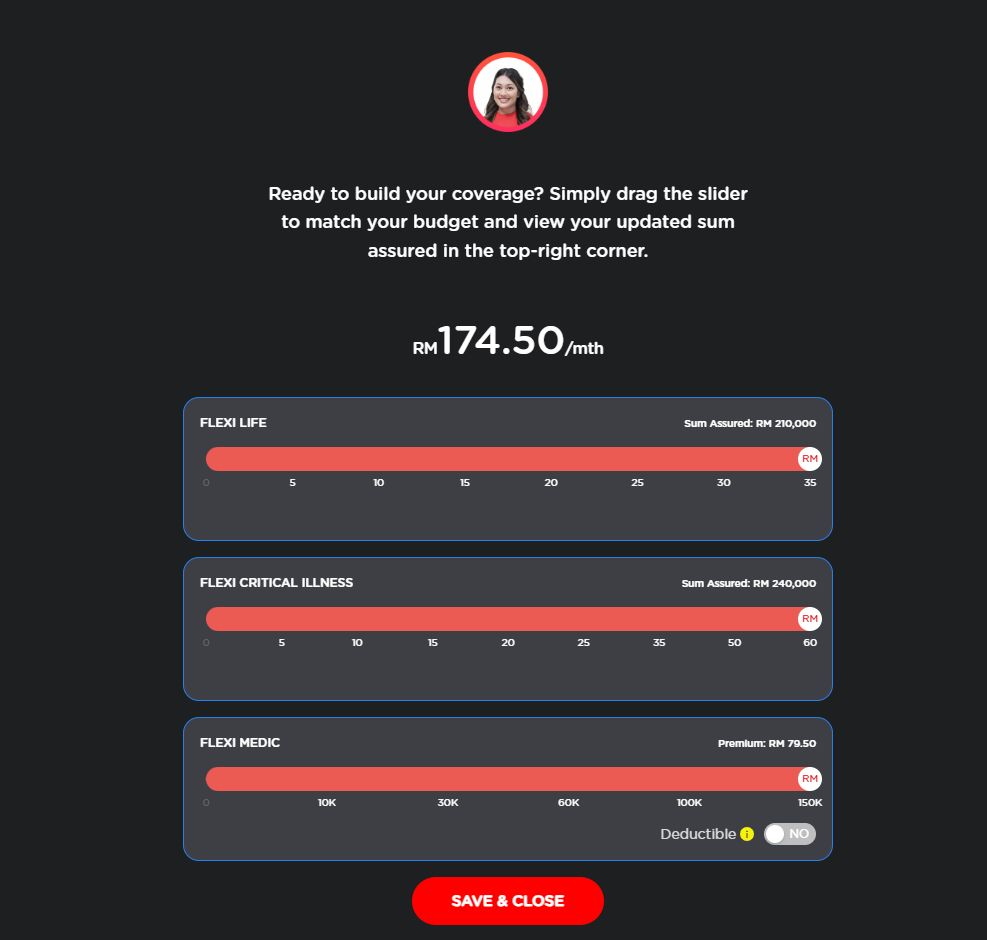

If you want to customise further, you can build your coverage plan by adjusting the individual sliders for Flexi Life, Flexi Critical Illness and Flexi Medic along with its deductible options. You can choose to select one, two or all three coverage.

Customers can also choose to upgrade or downgrade their insurance plan at any time according to their financials and life stages. For example, if a customer is facing financial difficulties, they can still maintain their insurance at a reduced premium and they don’t have to give up on it entirely.

You can customise the sum assured for Flexi Life up to RM210,000, Flexi Critical Illness up to RM240,000 and Flexi Medic up to RM150,000.

For a straightforward and efficient purchase journey, customers are only asked three simple health questions for hassle-free acceptance. The entire Business-to-Consumer (B2C) platform is designed to provide a pleasant 3-minute-to-buy discovery and purchase experience.

Tune Protect Life Principal Officer Koot Chiew Ling said “We are guided by our aspiration of bridging the protection gap in the country by providing affordable insurance solutions to consumers. With FLEXIOne, we are busting the myth that insurance is expensive and rigid. Starting from just RM5 a month, FLEXIOne is ideal for Millennials and Gen Zs who are beginners to insurance and want something light on the pocket, as well as those who are looking to top up their current insurance coverage.”

Under Tune Protect’s 3:3:3 customer promise, they are promising a quick quote within 3 minutes, a three-hour response time and claims pay-out within 3 days upon approval thanks to its digital nature of its products and services.

According to their FAQ, claims can be made easily through their online platform. For Life Cover, just simply fill up a web form and they will pay within 3 days after it is approved. This is similar as well for the Critical Illness Cover.

Meanwhile, for Medical coverage, customers are required to mention IHP at the panel hospital and show their eMedical card via the IHP app. Once they have received the completed details from the hospital, Tune Protect will send a Guarantee Letter within an hour. If the Guarantee Letter can’t be approved, customers can pay first and claim later. Tune Protect’s list of panel hospitals can be found here.

Tune Protect Life offers 2 months free FlexiOne insurance

As a limited-time promo, Tune Protect Life is offering two months free FlexiOne insurance, up to a total of RM300 for purchases made through its B2C platform. On top of that, customers can also join the Refer and Earn campaign where they can get a RM20 referral fee for each successful referral. The campaign will end on 31st January 2024 and you can check out the terms and conditions for the “Free Insurance” campaign here.

For more info, you can check out Tune Protect’s FlexiOne page and download the respective Product Disclosure Sheet for each of the insurance products.