As promised earlier, GXBank has started offering its GX Card to its first batch of users in Malaysia. This is a debit card which allows GXBank account users to make payments at merchants that accept Mastercard worldwide.

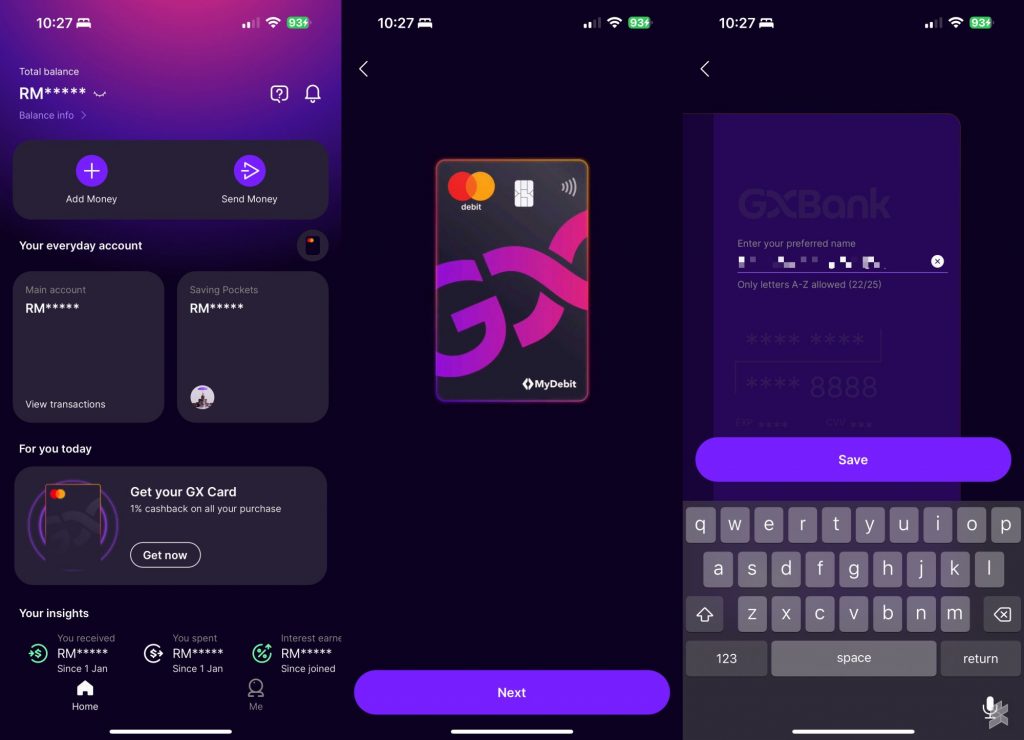

At the moment, the GX Card is offered for free and it is being rolled out to customers in phases. If you’re among the first batch of users, you will see the “Get your GX Card” option on the home screen of the GXBank app. It only takes a few minutes to sign up and you can customise your card with your preferred name up to 25 characters.

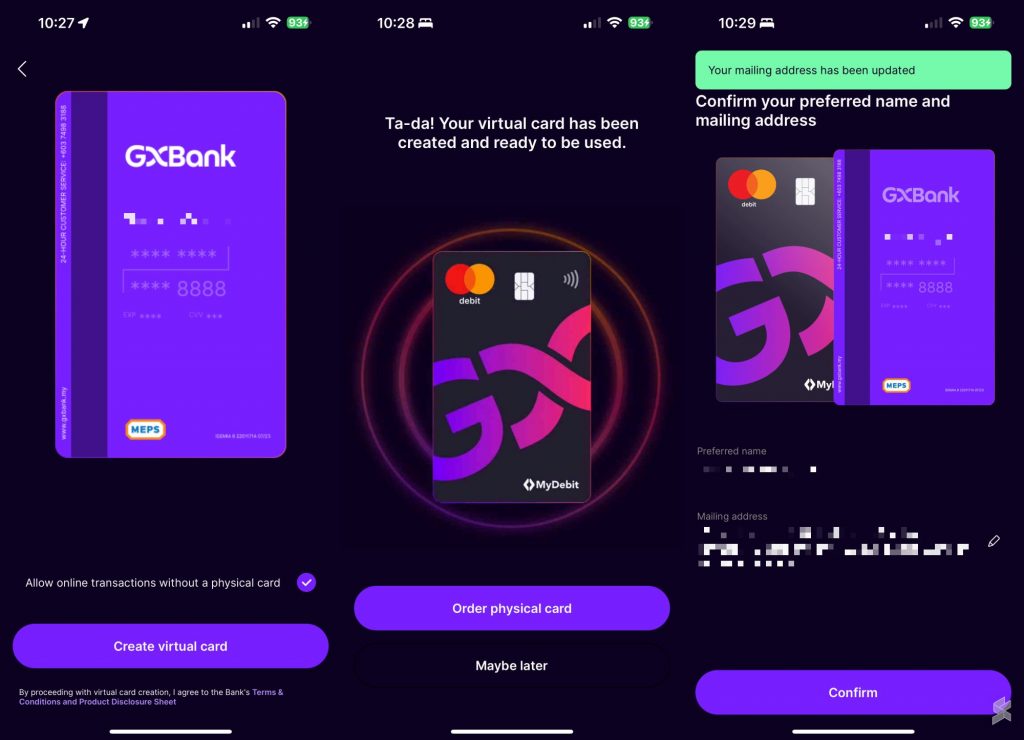

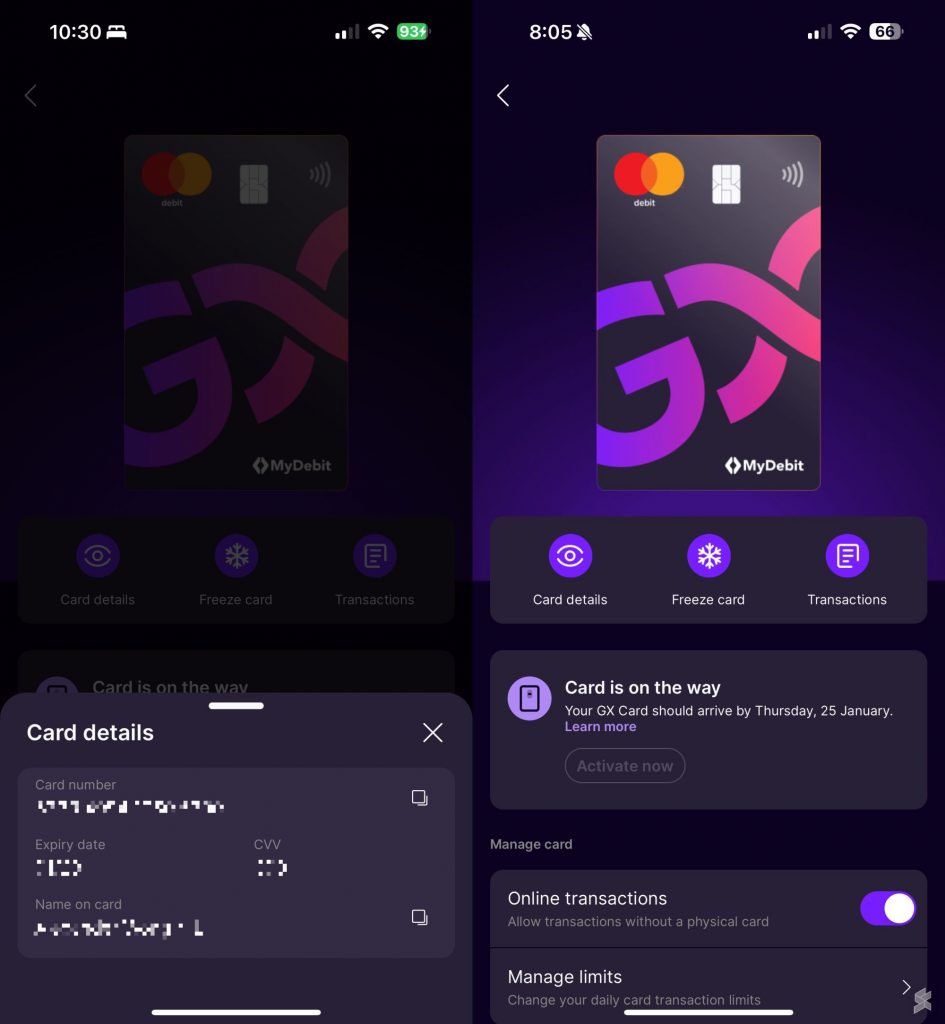

Your virtual GX Card is issued immediately and you can use it for online shopping or in-app payments. You can get the full card details including the number, expiry and CVV by tapping on the Card details in the app.

For physical transactions, you can also order your physical GX Card which supports contactless payment. At the moment, there’s no shipping fee and you can apply for the card at no extra cost. The GX Card has a 5-year validity upon the time of issuance.

Similar to other eWallet-linked prepaid payment cards in the market, the GX Debit Card can be managed fully from the app. This includes enabling or disabling online transactions, ATM withdrawals as well as managing spending limits. If your card is missing, you can also freeze the card instantly to block it from unauthorised payments.

As mentioned before, one of the biggest perks is its unlimited 1% cashback for every spending with the GX Card. That means if you spend RM100, you’ll get back RM1 in cashback. However, the cashback offer excludes several transaction categories including eWallet top-ups. For more info, you can check out the Product Disclosure Sheet.

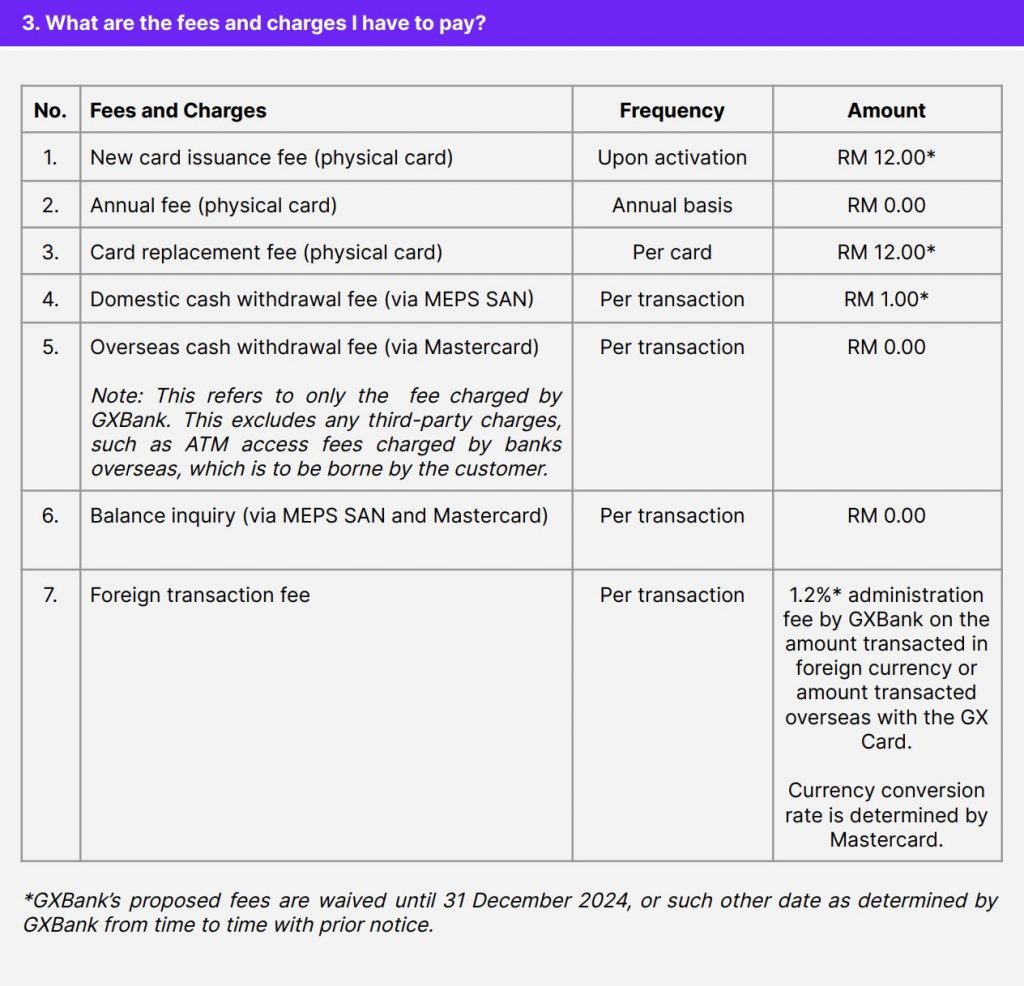

On top of that, GXBank is waiving its annual fees and also ATM withdrawal fees for both local (via MEPS) and international (via Mastercard) until 31st December 2024. If you’re interested, you can sign up by downloading the GXBank app via Apple App Store and Google Play Store