This post is brought to you by Versa.

We work hard today so we can enjoy our retirement tomorrow. But that’s only possible if we have enough saved for a financially worry-free retirement. For that, we have the Employees Provident Fund (EPF) where a portion of our earnings are deposited for retirement use. To encourage EPF members to make voluntary contributions to the fund, the government provides an income tax relief of up to RM7,000.

The government is also providing extra tax relief of up to RM3,000 for investments in a Private Retirement Scheme (PRS) until 2025. Depending on your tax bracket, you could enjoy tax savings of as much as RM900. This way, you can create a more substantial retirement fund while enjoying additional tax relief.

So, the question now becomes – what are my options for a PRS? Well, one option you can consider is the PRS offered by Versa, a local digital wealth management platform regulated by the Securities Commission Malaysia.

Who is Versa?

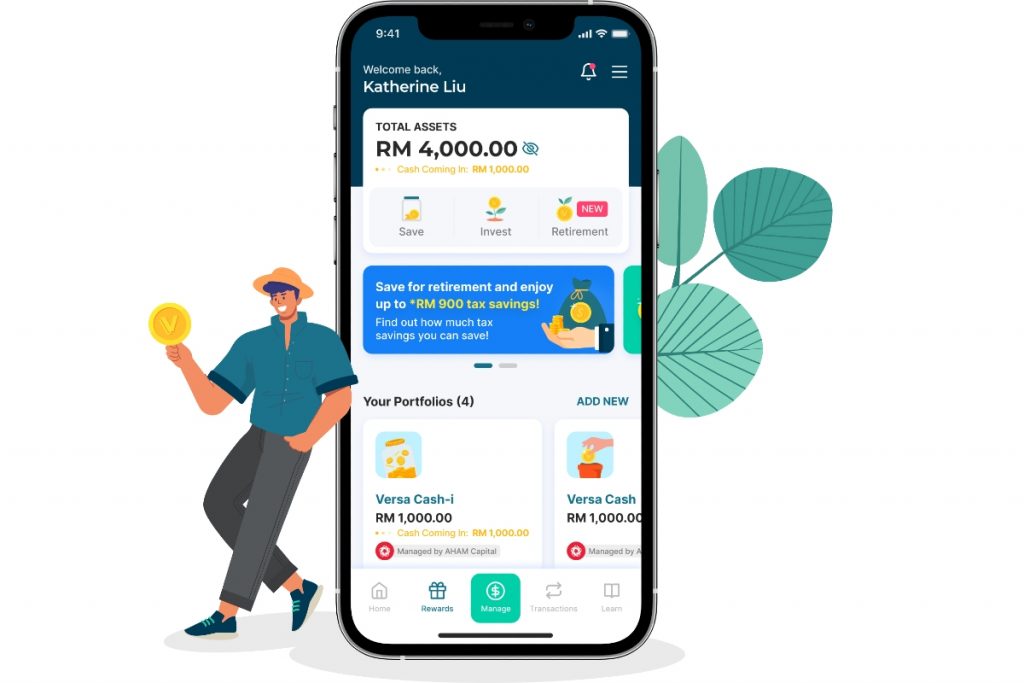

Founded in 2019, Versa is a Kuala Lumpur-based financial technology company backed by AHAM Capital (formerly known as Affin Hwang Asset Management), one of Malaysia’s top 3 asset management firms with other major investors including Penjana (Hibiscus), OSK, and HPRY Ventures. Soon after, the company launched its digital wealth management platform in early 2021.

As of the second quarter of 2023, Versa has transacted RM700 million in investments with 150,000 accounts opened. Versa offers savings and investment portfolios that include conventional and Shariah-compliant funds, with PRS being the company’s latest addition to its portfolio.

How does Versa’s PRS work?

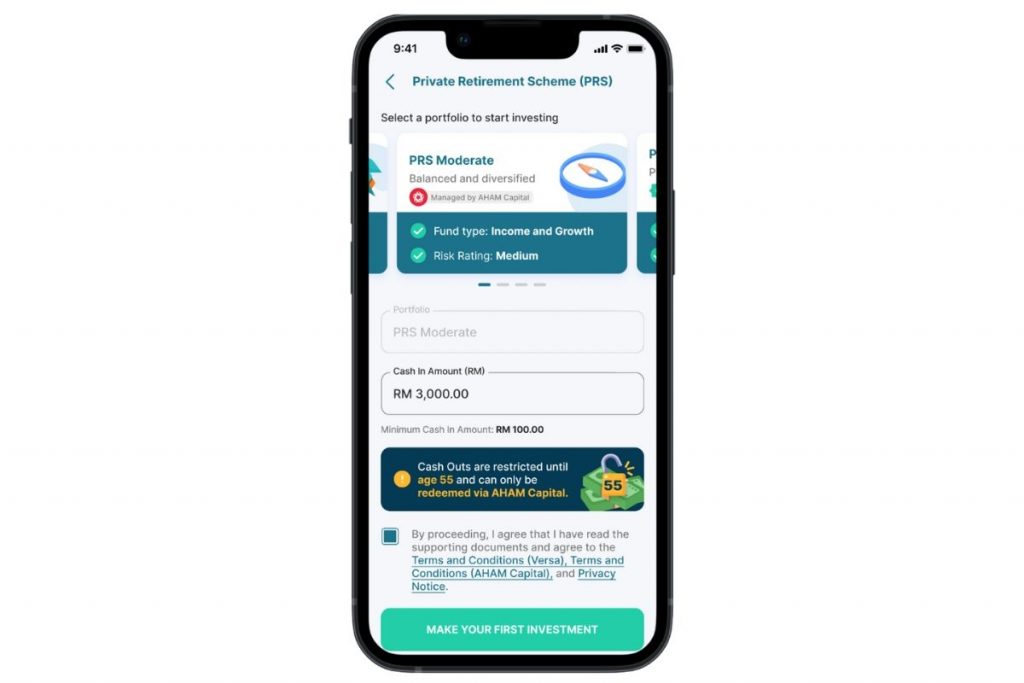

Similar to EPF, contributions made to Versa’s PRS are split and maintained in two sub-accounts – Sub-account A and Sub-account B.

Sub-account A holds 70% of all contributions made to the PRS fund which you can withdraw when you hit retirement age or migrate to another country.

The remaining 30% is held in Sub-account B which you can withdraw from once per year but is subjected to an 8% tax penalty on the pre-retirement withdrawal sum by the Inland Revenue Board of Malaysia (LHDN) unless it’s for housing or healthcare purposes.

Upon reaching the retirement age of 55, you can cash out from both accounts.

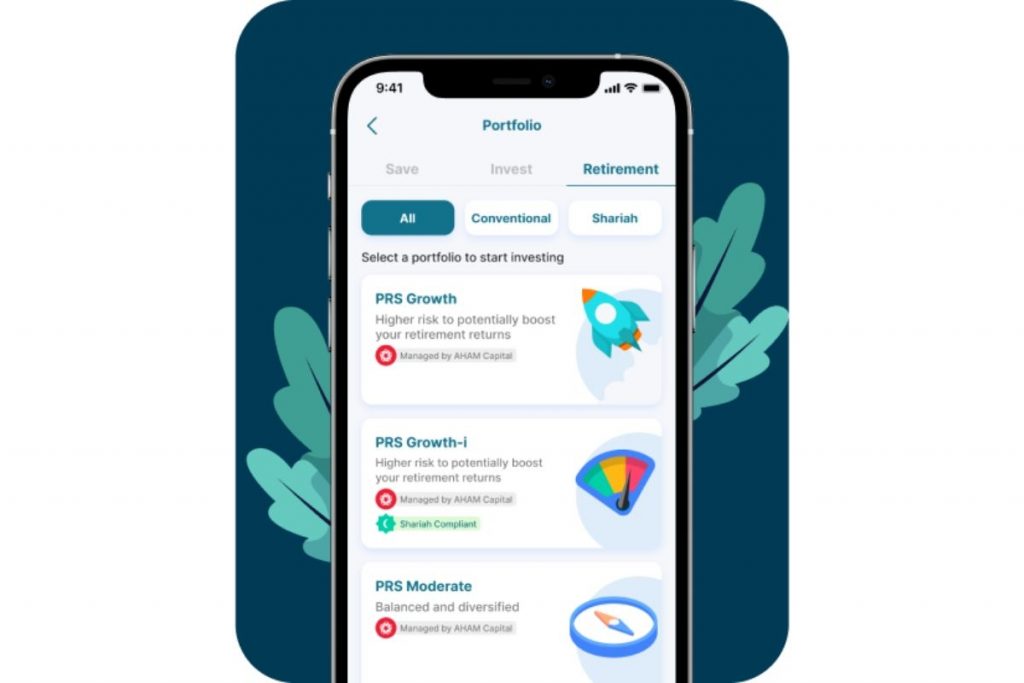

Versa offers three conventional funds and three Shariah-compliant funds for you to choose from. These are:

- AHAM PRS Conservative Fund (PRS Conservative)

- AHAM PRS Moderate Fund (PRS Moderate)

- AHAM PRS Growth Fund (PRS Growth)

- AHAM Aiiman PRS Shariah Conservative Fund (PRS Conservative-i)

- AHAM Aiiman PRS Shariah Moderate Fund (PRS Moderate-i)

- AHAM Aiiman PRS Shariah Growth Fund (PRS Growth-i)

You can find more information on the PRS by going through Versa FAQs.

How do I start investing in PRS?

When Versa set out to start a digital wealth management platform, its primary goal was to save you from having to deal with financial jargon, pushy financial advisors, and taking time off for bank branch visits.

To solve all these problems, Versa developed a user-friendly mobile app with a focus on simplicity. Featuring a pleasing aesthetic, a vibrant colour palette, an organised UI, and easily digestible information, the Versa app offers a gentle learning curve to just about anyone who’s remotely tech savvy.

The Versa app is available for download on the Google Play Store, Apple App Store, and Huawei App Gallery.

Get up to RM210 worth of bonuses by opening a PRS account

In Malaysia, the minimum contribution for PRS is RM100. That being said, Versa is offering new users a Versa Cash bonus of RM110 when they invest a minimum of RM3,000 in PRS before the 28th of December 2023. You will not only be eligible for the Versa Cash bonus but also for the RM3,000 tax relief for the year of assessment 2023.

In addition, we are giving RM100 Shopee vouchers, exclusively for the first 100 SoyaCincau.com readers who apply the voucher code VSOYACINCAU during sign-up and subsequently cash in a minimum total of RM3,000 into any PRS funds via Versa.

Our team will then contact you within approximately 30 working days with your RM100 Shopee voucher. Do note that if you complete your registration and PRS cash in without applying the voucher code, you will not be eligible for the RM100 Shopee voucher.

So, in total, you can get up to RM210 worth of bonuses by investing in PRS via Versa before the 28th of December 2023. Head on over to Versa’s website to learn more about the Versa Cash bonus promo and Private Retirement Scheme.

Disclaimer: The information contained in this article is not intended as, and shall not be understood or construed as, financial advice. The information contained in this article is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. By applying the code, you acknowledge and consent to the sharing of your personal details for the purpose of receiving the RM100 Shopee voucher with SoyaCincau.com.