GXBank, Malaysia’s first digital bank, is quite basic in its current form. It is essentially a savings account and there’s no option to spend via card or QR payments. However, the situation for GXBank will get pretty interesting with their upcoming GX Debit Card as they have shared more details on their website.

GXBank offers unlimited 1% cashback with no cap

As shown above, this is their upcoming GX Debit Card which comes in a physical Mastercard debit card with PayPass. It gets a clean vertical design at the front while the card details including cardholder name and numbers are printed at the back.

According to GXBank, the GX Card offers unlimited 1% cashback for everyday spending and there are no markups on exchange rates or hidden fees on overseas transactions. According to the FAQ, there is no cap on the amount of cashback you can receive when you spend with your debit card. However, there are some categories which are not eligible for cashback such as eWallet top-ups.

Like other “digital bank” offering in the market, you can manage your card including freezing the card and restricting certain transactions such as contactless and online transactions. By default, GXBank account holders will get a savings account and they will need to apply for the card separately. While waiting for the card to arrive, you should be able to use the card for online transactions by obtaining the card details from the app.

Unfortunately, there’s no mention of support for Apple Pay, Samsung Pay or Google Pay.

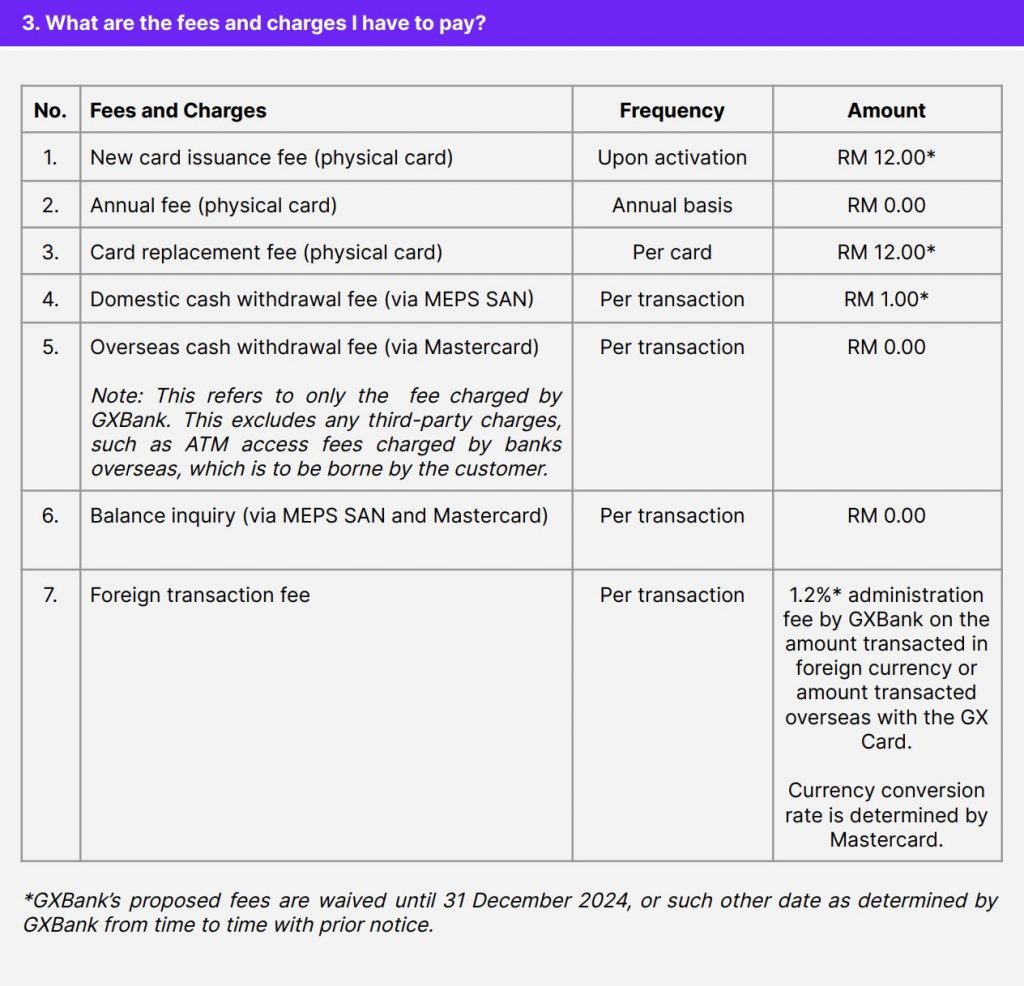

GXBank waives GX Debit Card fees until 31 December 2024

According to the Product Disclosure Sheet, there’s a card issuance fee of RM12 and cash withdrawals from MEPS ATMs will cost you RM1 per transaction. Meanwhile, GXBank will also charge a 1.2% administration fee for the amount transacted in foreign currency or transacted overseas with the GX Card. These fees are waived until 31st December 2024 or other date determined by GXBank from time to time with prior notice.

Interestingly, it is also mentioned that GXBank does not charge fees for overseas cash withdrawals (via Mastercard network). However, there could be other third-party ATM access fees imposed by banks overseas.

At the time of writing, GXBank is open for public beta and they are opening it up for 20,000 Malaysians. You can download the app via the Apple App Store and Google Play Store, and sign up to be on the waiting list.