TNG Digital just added another service to the growing number of services available on the Touch ‘n Go eWallet. Called Insure360, it is a one-stop health insurance centre, with the insurance underwritten by AIA Malaysia.

Insure360 joins WalletSafe, SafeTrip, SafeHome, and CI Insure as a new services for TNG eWallet users. With Insure360, users can now purchase cost-effective basic medical and critical illness insurance coverage right on the TNG eWallet – without the need for any medical examination. The premiums starts from as low as RM10 per month, so for those looking to get additional insurance coverage to supplement existing employee benefit medical insurance can get different coverage at the tip of their fingertips.

Mix and match plans with Insure360

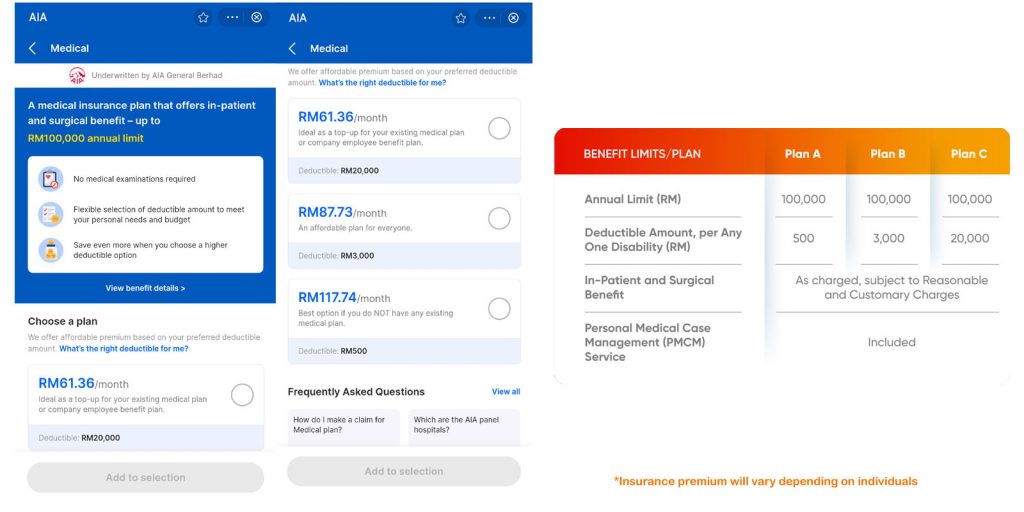

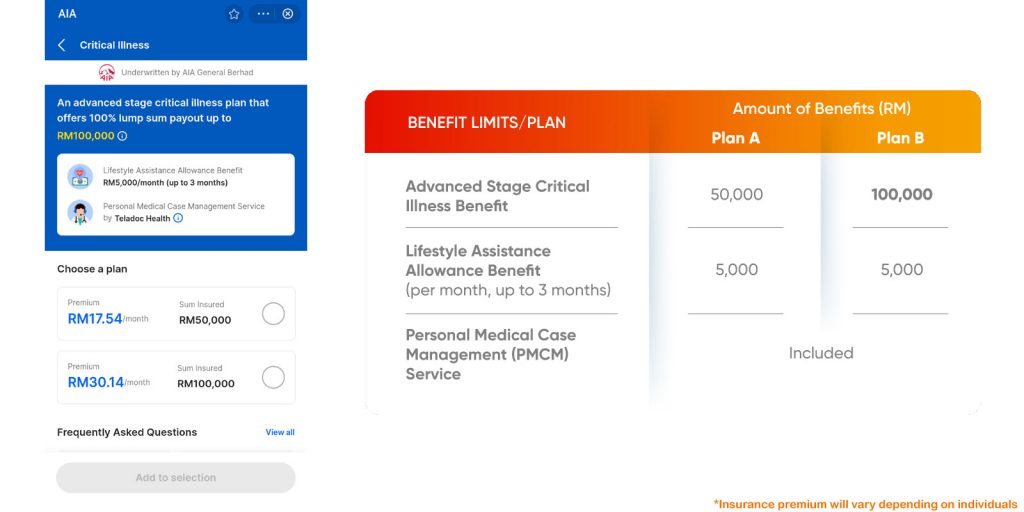

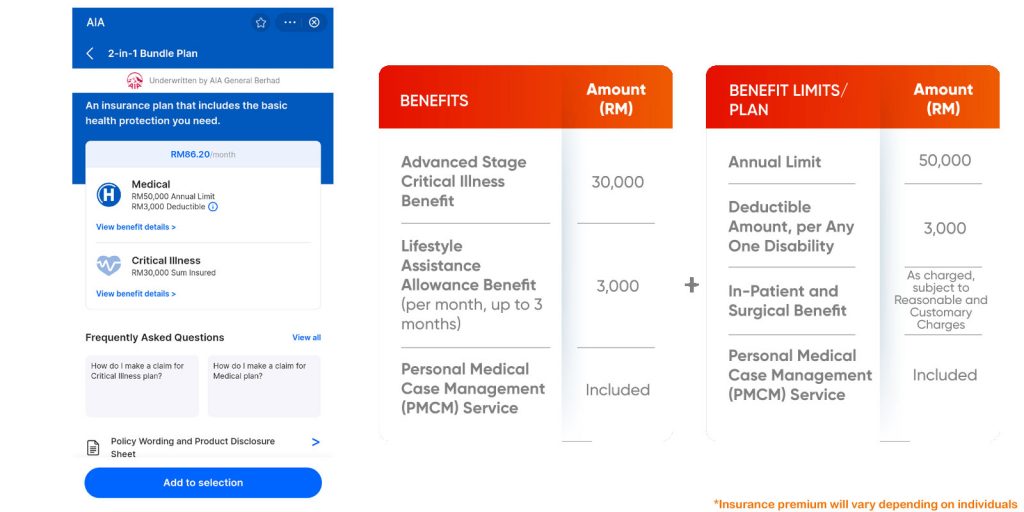

Users have the freedom to mix and match different insurance products (Critical Illness and Medical Insurance) with various plan options or opt for the convenient 2-in-1 bundle. In both options, users are covered for hospitalisation expenses. Additionally, when diagnosed with a critical illness, users will receive a lump sum payout of up to RM100,000 and a lifestyle assistance allowance from the plan, ensuring a financial safety net during times of need.

“Our goal is to promote financial inclusion by offering accessible and affordable insurance protection to people from all walks of life. This plan offers users a basic insurance coverage for critical illness and medical expenses. With a straightforward application process on the Touch ‘n Go eWallet by TNGD, users can customise their plans according to their needs and budget. Like other insurance products under the GOprotect feature on Touch ‘n Go eWallet, users can enjoy a seamless claim process with the fully digital application, with no medical examination required. As part of the hospitalisation process, they are only required to present their MyKad or Passport at the hospital.”

Alan Ni, Chief Executive Officer of TNG Digital

Insure360 users will have access to AIA’s Personal Medical Case Management Service, which connects them with the world’s leading specialists for medical and treatment advice based on a reviewed diagnosis of their medical condition.

In the event of hospitalisation, Insure360 users can undergo a cashless admission at various AIA panel hospitals nationwide. To streamline procedures, users can effortlessly submit claims online through ‘My Policy’ under GOprotect in the Touch ‘n Go eWallet by TNG Digital or via the claim link shared in the policy issuance email. Once the claim is approved, the payment will be instantly deposited into the bank account provided by the user.

Individuals eligible for Insure360 must be eKYC-verified users of the Touch ‘n Go eWallet by TNGD and aged between 18 and 50, permanent residents of Malaysia, work permit holders, pass holders, or individuals who are legally employed and residing in Malaysia.

The insurance premium will vary based on your marital status, your gender and if you are a smoker or not.

For more information about Insure360 in the Touch ‘n Go eWallet by TNGD, visit https://www.touchngo.com.my/consumer/insurance/insure360/