GXBank is Malaysia’s first digital bank and it is currently open for public beta. To recap, GXBank is among the 5 successful Digital Bank Licence applicants approved by Bank Negara Malaysia. GXBank is a subsidiary of GXS Bank, a digital bank joint venture in Singapore between Grab and SingTel, along with other investors such as the Kuok Group. On top of that, it is also the first to get the green light to begin digital bank operations ahead of BNM’s April 2024 deadline.

GXBank now available for public beta in Malaysia

Today, GX Bank Berhad (GXBank) announced that it is officially rolling out its beta bank app to selected 20,000 Malaysians. You can download the app via the Apple App Store and Google Play Store, and sign up to be on the waiting list.

After downloading the app, you’ll have to leave your name and email, and they will notify you if you’re among the 20,000 selected Malaysians to try out the app.

Sleek and clean interface

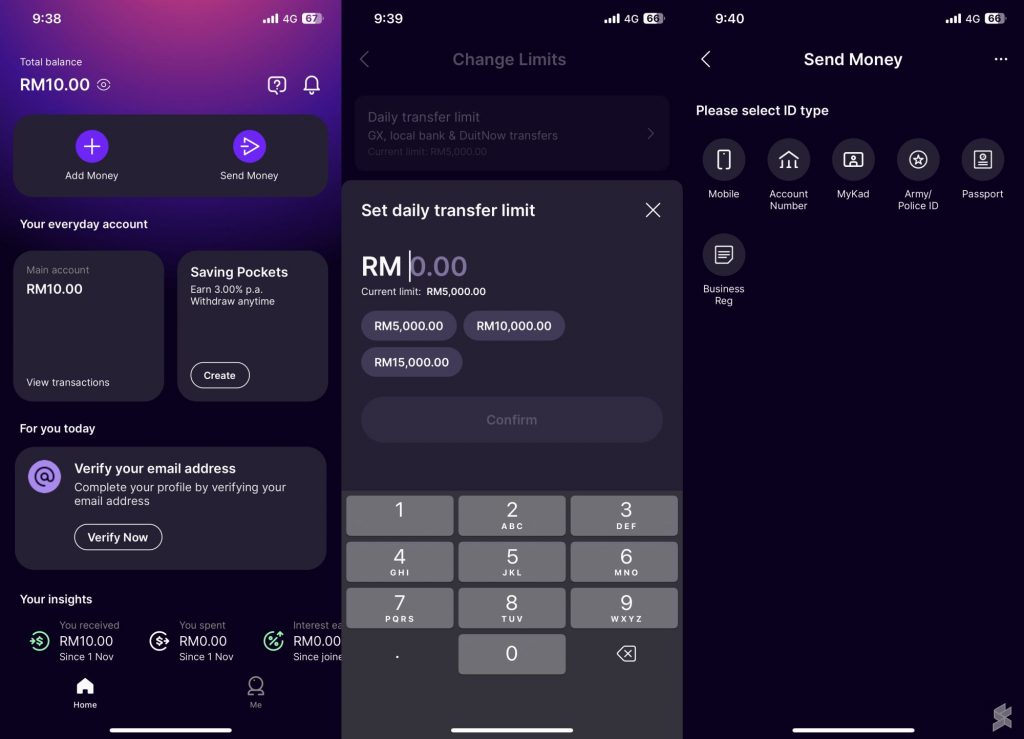

Ahead of the public beta release, we were given early access to GXBank. First impression-wise, the app looks pretty sleek with its black and purple “dark-mode” scheme. The app only comes in English and there’s currently no option to change to other languages such as Malay or Chinese.

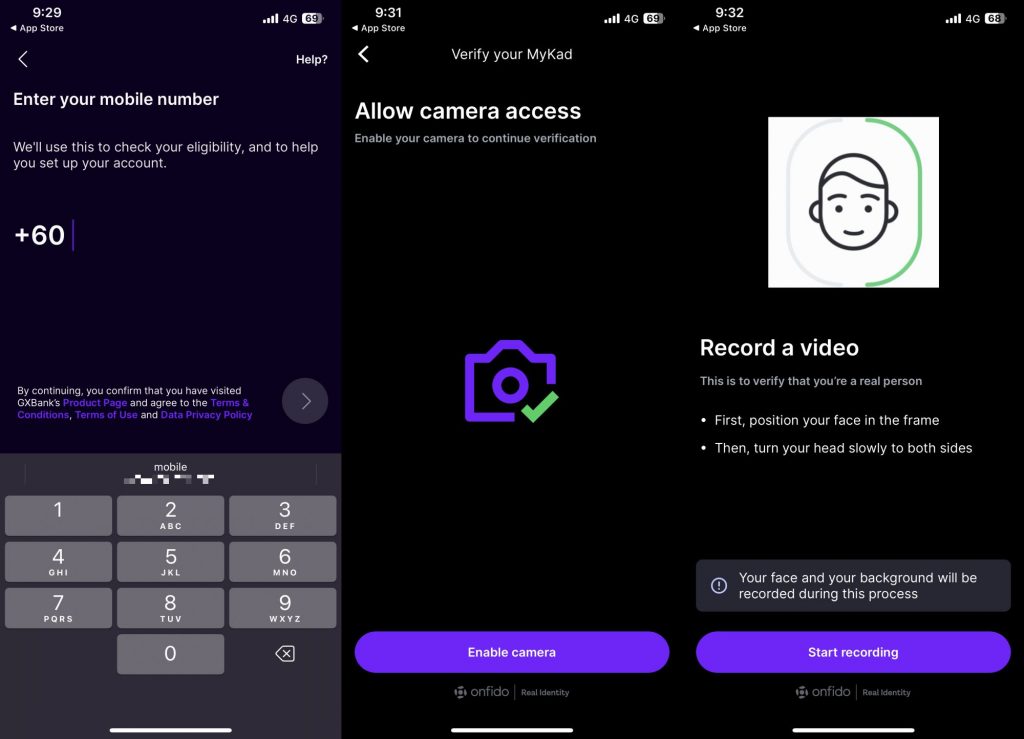

The signup and electronic Know Your Customer (eKYC) process for GXBank is pretty straightforward. Just enter your mobile number, verify via SMS OTP, take a picture of your identification card and record a short video for verification purposes. You are also required to verify your email address later after registration.

Security is also a key focus for GXbank. You can manage your account fully from the app and they have also implemented a 12-hour cooling-off period if you’re switching between devices.

You need to have an existing Bank account to use GXBank

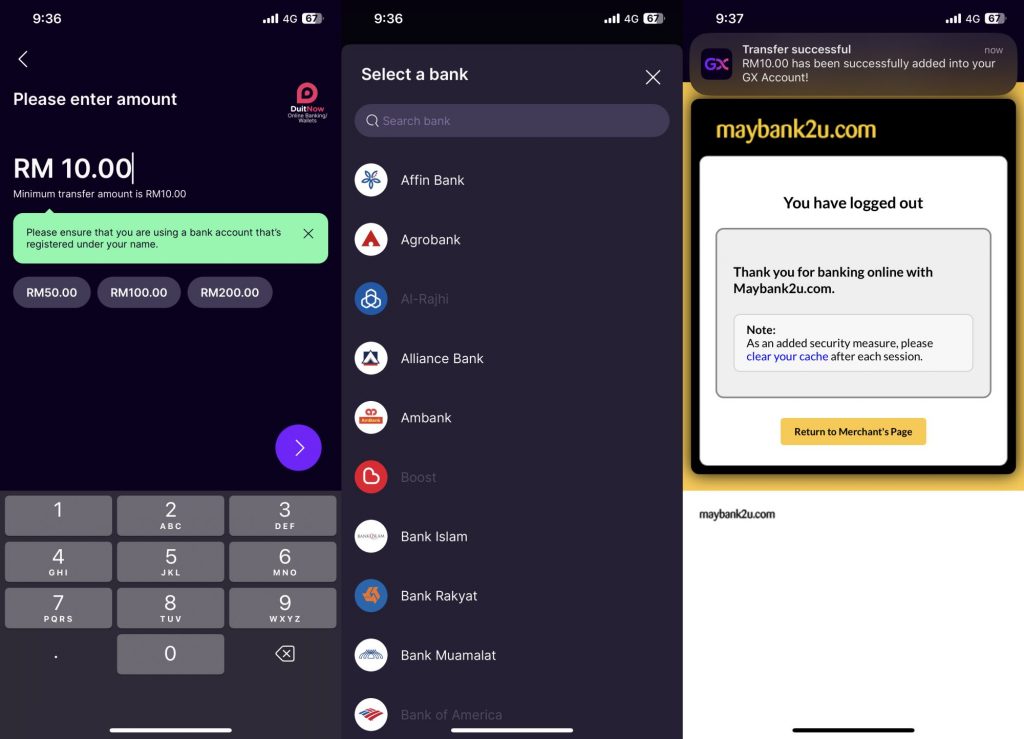

When you think of Digital Banks, you might expect GXBank to target the underbanked or unbanked communities where physical bank presence is limited. However, you’ll need to already have an existing account with a local bank in order to use GXBank. A minimum deposit of RM10 is required and it must come from a bank account that’s registered under your name. So clearly, not an option for those who don’t have a bank account.

From what we understand, this money transfer from an existing account is currently the alternative verification process by traditional banks which substitutes the need to perform an IC and fingerprint verification at a physical branch.

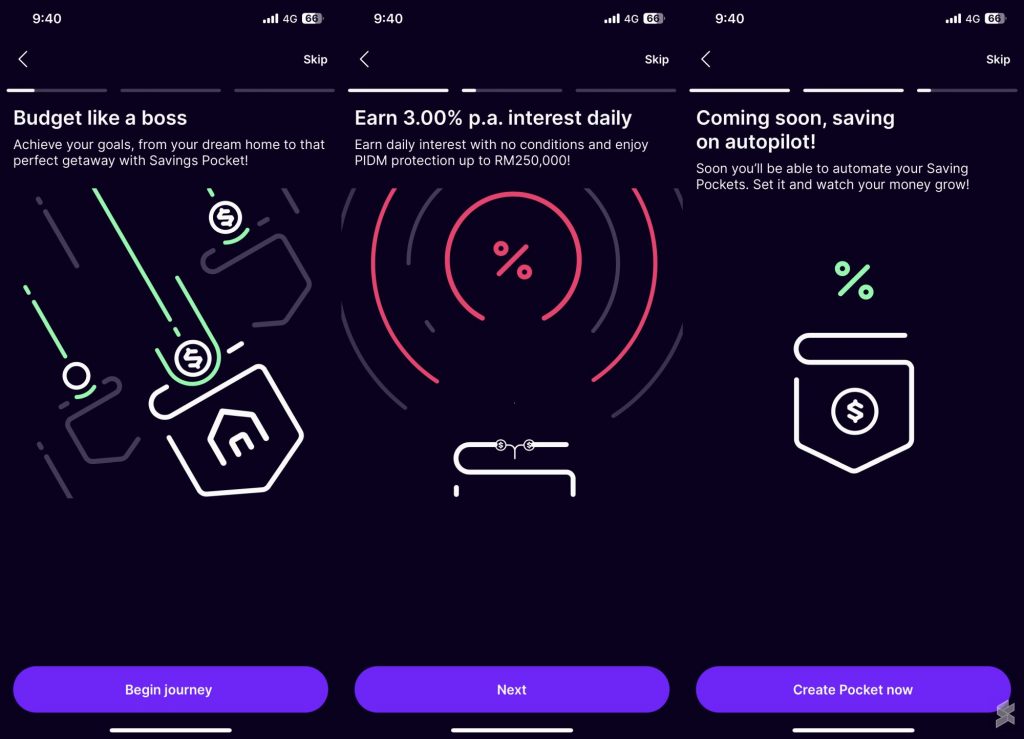

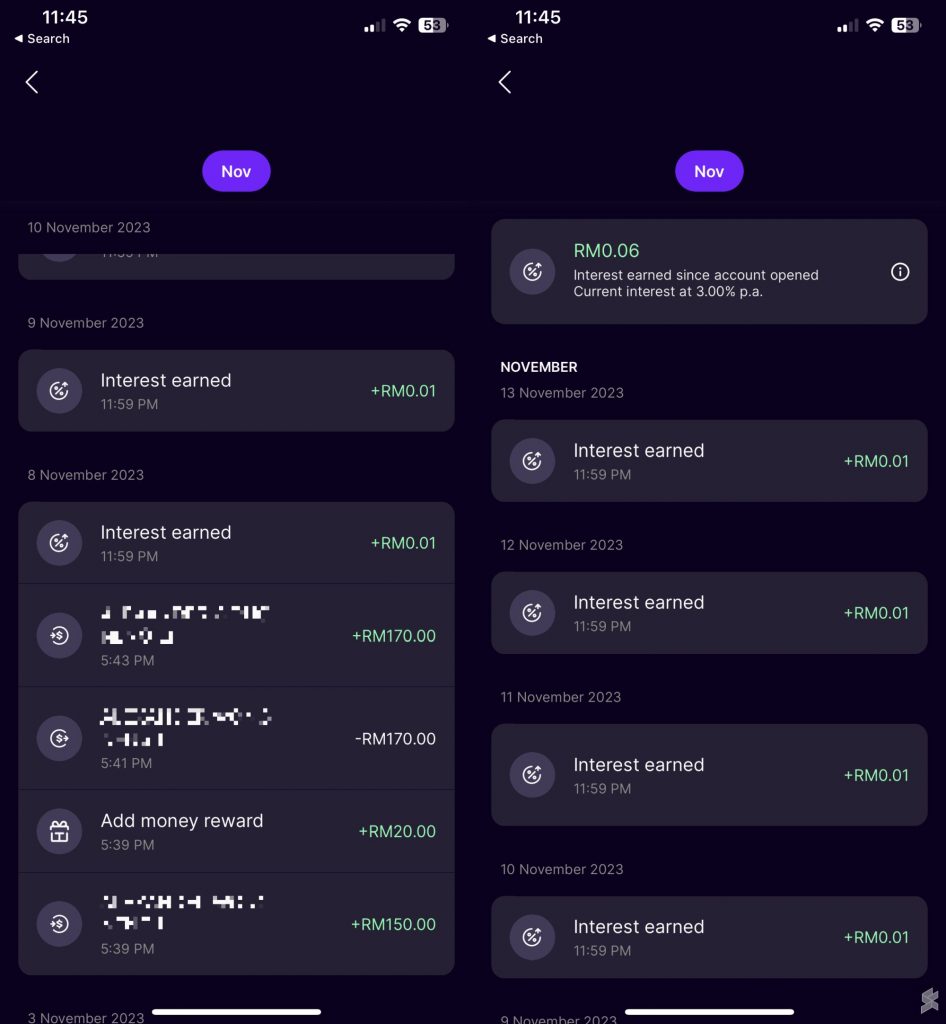

GXBank lets you earn 3.00% p.a. interest daily

Unlike your normal eWallet, GXBank offers an actual bank account that lets you earn interest. GXBank currently offers 3.00% per annum interest and the interest is credited to your account daily.

All deposits to GXBank are protected by PIDM up to RM250,000 for each depositor and it is also licensed by Bank Negara Malaysia.

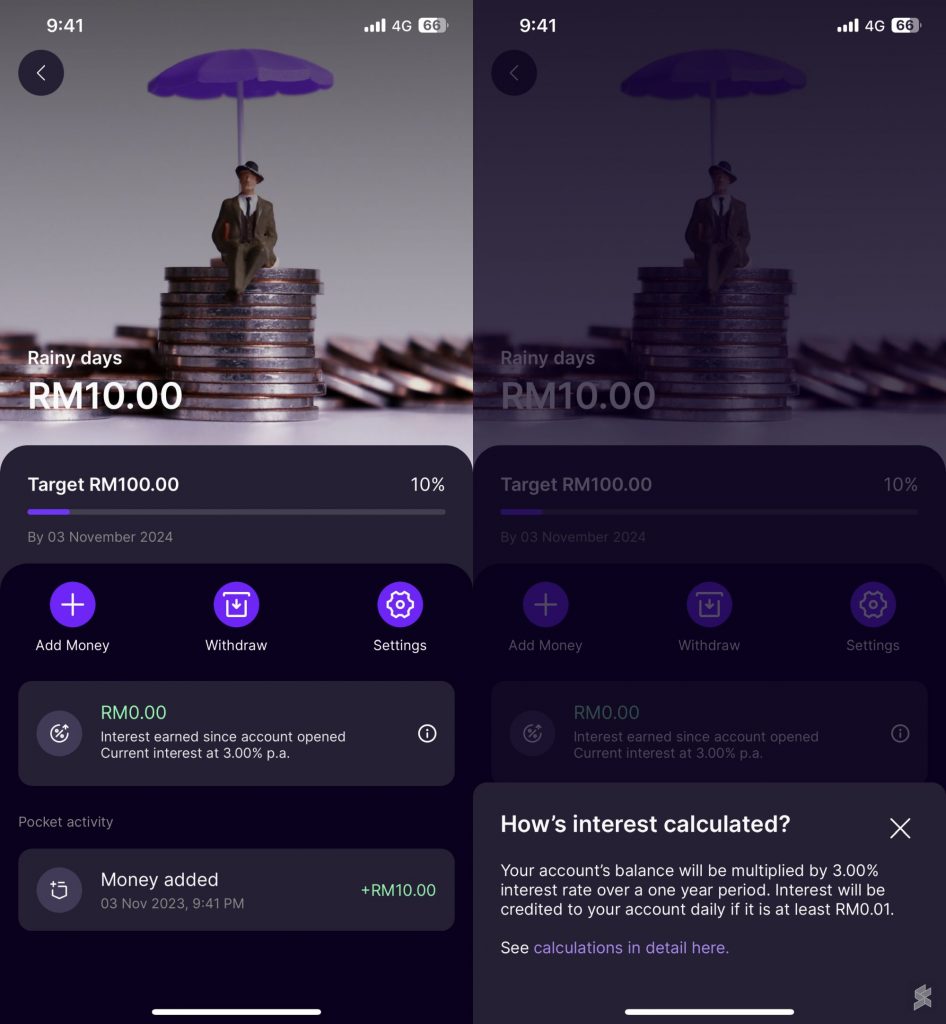

To help you achieve your short-term and long-term savings goals, GXBank has a feature called Pockets. This is essentially a “Tabung” feature which lets you save for medical emergencies, holiday trips or a deposit for your future car or house.

However, take note that the 3.00% p.a. will only be credited to your account daily if the daily interest is at least RM0.01. This means you’ll have to reload at least RM122 to get the minimum 1 sen interest daily.

[ UPDATE 18:00 15/11/2023 ] According to GXBank, users would only need to deposit a minimum of RM60.84 to start earning the RM0.01 interest daily. According to its terms and conditions, the bank system will round up to the nearest RM0.01. Since the daily interest for RM60.84 x 3% p.a. / 365 days is over RM0.005, it will be rounded up to RM0.01 per day.

As a comparison, Touch ‘n Go eWallet currently offers a higher 3.45% p.a. interest rate for its Go+ feature. However, do note that Go+ is neither capital guaranteed nor capital protected by PIDM. Any losses will not be covered by the Capital Market Compensation Fund.

GXBank doesn’t let you spend or scan DuitNow QR codes yet

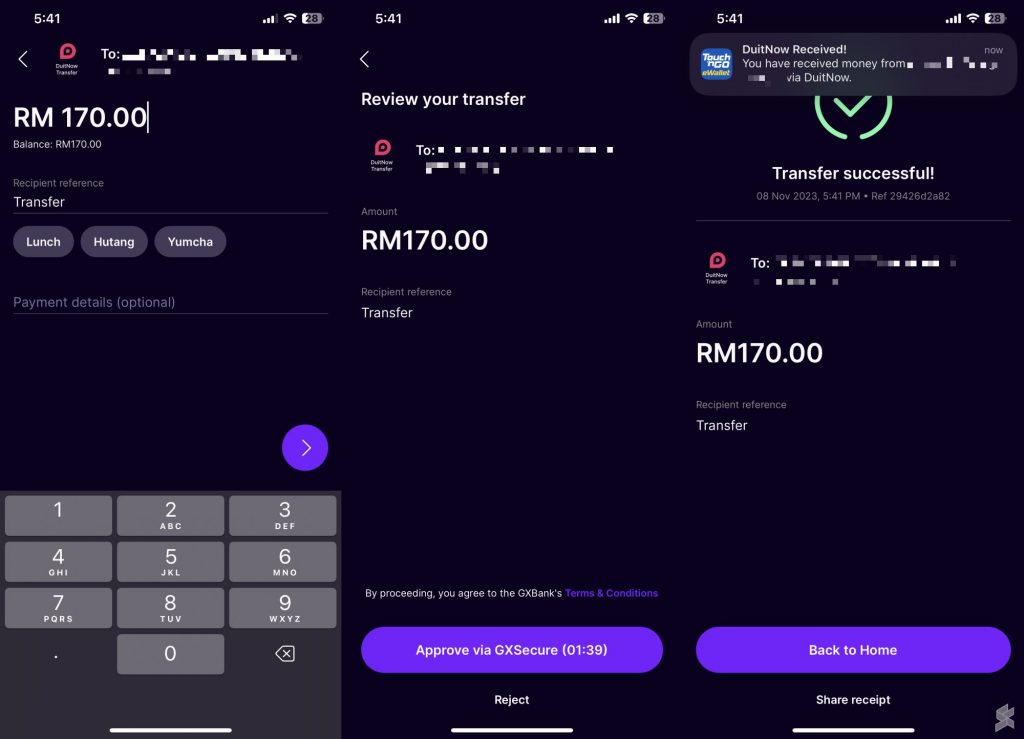

The biggest limitation for GXBank at the moment is that it is purely a savings account. There’s no option to spend via DuitNow QR and there’s no debit Mastercard or Visa card for online or offline spending.

The only native option to “spend” is to transfer your funds out via DuitNow transfer by entering a phone number, account number, identity card or business registration.

According to GXbank, they are working on releasing a debit card soon which lets you earn unlimited cashback for every spend. It added that they will be waiving the RM1 processing fee at MEPS ATMs nationwide.

We still don’t know whether they are partnering with Visa or Mastercard and they have not provided a timeline for the physical cards. It is also not clear if GXBank will support Apple Pay, Samsung Pay and Google Pay.

[ UPDATE 25/11/2023 ] GXBank has revealed more details for its upcoming GX Debit Card with Mastercard Paypass.

GXBank RM20 cashback with RM100 deposit

To attract users to sign up, GXBank is offering RM20 cashback when you deposit a minimum of RM100. The cashback is credited to your GXBank account and you can use it immediately.

In case you’re wondering, you can transfer your entire balance including the RM20 cashback to another bank account or eWallet via DuitNow transfer.

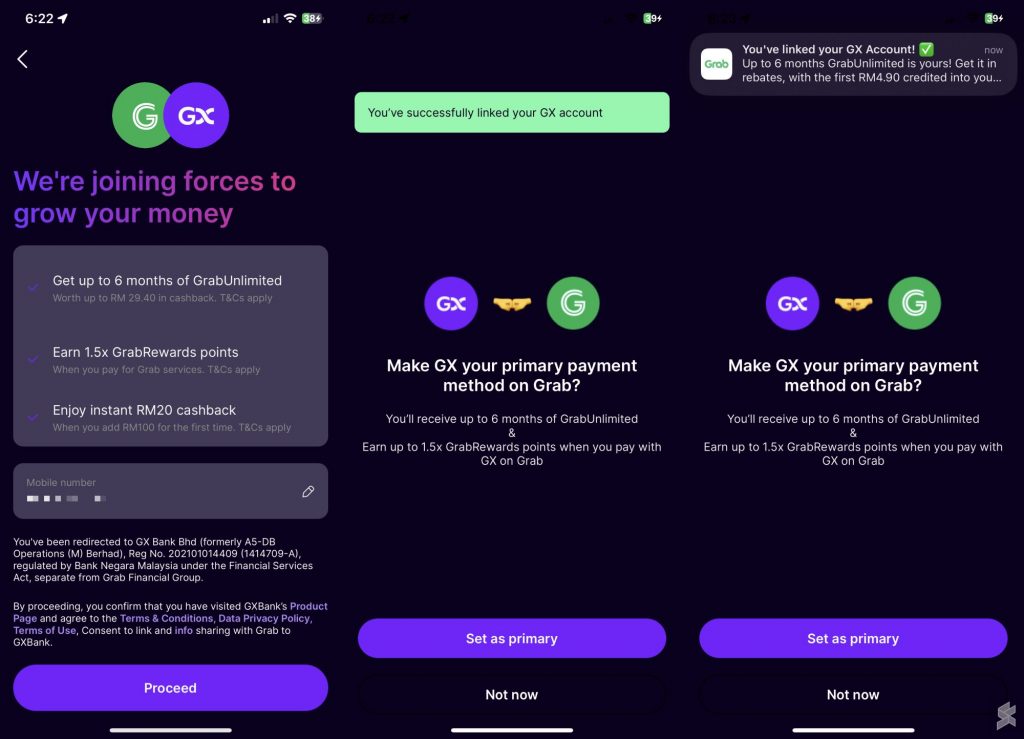

Link GXBank to Grab and get up to 6 months of GrabUnlimited

As an added perk, GXBank is offering up to 6 months of GrabUnlimited when you link your Grab account to GXBank. By linking, you will make GXBank your primary payment method on Grab. According to GXBank, you’ll earn up to 1.5x GrabRewards points when you spend using GX on Grab.

The GrabUnlimited subscription costs RM4.90/month and it offers free delivery vouchers and deals for GrabFood and GrabMart.

There’s still a long way to go for GXBank

GXBank is still in its infancy stage and it seems that the app was released in a hurry to claim the “first digital bank in Malaysia” title. At the very least, we would expect it to support native DuitNow QR or a virtual debit card as its core basic feature. Fortunately, there’s some integration with Grab which expands its payment usage somewhat.

On the surface, GXBank in its current release isn’t compelling enough to sway users from traditional online banks as well as current eWallets. If it aims to compete with eWallets, there are plenty of options right now which support QR payments as well as worldwide acceptance with a linked physical prepaid card. Meanwhile, traditional banks are also expanding their digital banking offering by making it easier to sign up for various financial services including loans and investments.

For now, the biggest carrot for GXBank is the free RM20 cashback which you can redeem and cash out to other eWallets or bank accounts. If you’re a frequent Grab user, the free 6 months of GrabUnlimited worth up to RM29.40/month in cashback could be an enticing offer as well.

For more info, you can visit GXBank’s website.