[ UPDATE 1/11/2023 15:00 ] Can you activate Secure2u overseas? Here’s Maybank’s response.

===

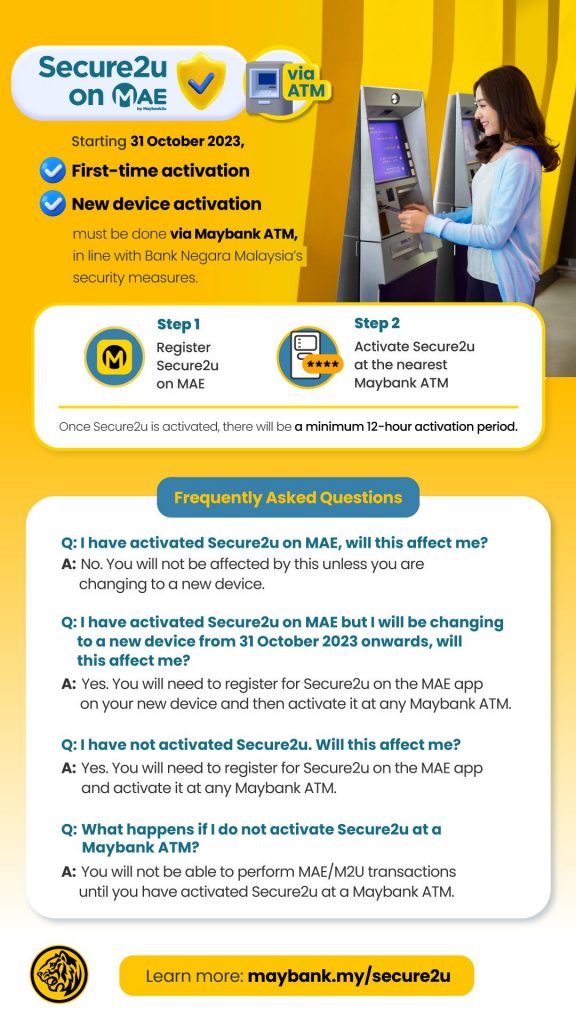

Maybank has announced a new measure to further improve security and to fight scams. Starting 31st October 2023, all Secure2u verification can only be done at Maybank ATMs nationwide. According to Maybank, the new additional measure is to curb unauthorised transactions and fraudulent activities, on top of the five key measures to combat financial scams implemented in July 2023.

Secure2u verification required for First-time activation or new device activation

In case you missed it, Secure2u is a verification feature which is required to approve online transactions as all banks have been instructed to move away from SMS-based OTP (One Time Password). Effective 1st July 2023, Secure2u is the only way to approve Maybank or MAE transactions.

Secure2u activation is required for first-time Maybank user activation or whenever you switch to a new device. If you have already activated Secure2u on your current phone, you will not be affected by this new measure unless you change to a new device. At the moment, Secure2u can be activated via SMS OTP but with this new measure, you’ll have to be physically present at a Maybank ATM with your ATM card to do so starting 31st October.

How to activate Secure2u via Maybank ATM

To enable Secure2u, you’ll have to use the MAE app to register and then activate Secure2u at the nearest ATM. Take note that there’s a minimum 12-hour activation grace period after Secure2U is activated. According to Maybank, the grace period acts as an additional layer to delay and thwart scammers to ensure that customers are the sole approvers of the Secure2u registration.

Here’s how to activate:

- Go to a Maybank ATM, insert your card and key in your PIN

- On the main menu, select Secure2u Activation

- Select Activate Secure2u and follow the on-screen instructions to complete the activation

- Wait for a minimum of 12 hours before you can start using Secure2u to approve transactions

Maybank Group CEO of Community Financial Services Dato John Chong said, “By allowing customers to perform self-activation of Secure2u via ATM, they can better control their online banking authorisation process by physically verifying their identity at the ATM, heightening supervision over their accounts and ultimately, safeguard their monies from scammers. We have also made the process easy and straightforward, keeping customer experience in mind. To register for Secure2u, customers only need to perform two simple steps – firstly, register for Secure2u on the MAE app and secondly, activate Secure2u with their debit, credit or charge card PIN number at any of the 3,000 Maybank ATMs nationwide, at their convenience.”

There are 3,000 Maybank ATMs nationwide and they mostly operate from 6.00am to 12.00am daily. Maybank ATMs can be found at Maybank branches, service centres, as well as selected shopping malls, petrol stations, train stations, hospitals and more.

Maybank has also issued a reminder to customers to never click on links sent from unknown sources and to never download apps from links that are not published on official app stores such as Google Play Store and Apple App Store. Users are also reminded to never share their username and password with anyone, not even with friends or family members.

For more info, you can visit Maybank’s Secure2u page.