Malaysian-based eWallets have been tightening their policies on credit card reloads which tend to be abused by some users. Touch ‘n Go eWallet appears to have revised its policy, affecting those who reload more than RM1,000 per month via credit card.

Last year, Touch ‘n Go eWallet implemented a RM5,000 “transferable limit” for reloads made using credit cards. The move was seen as an attempt to curb credit card cash-outs and transfers. The new rule doesn’t impact users who perform credit card reloads for genuine retail transactions.

In March this year, Touch ‘n Go eWallet lowered the transferable limit for credit card reloads to just RM1,000 a month. You can still reload more than RM1,000 per month via credit card without incurring extra fees. However, if you wish to have it “transferable”, you can choose to do so with a 1% fee.

For most users, this doesn’t matter much as funds that are categorised as non-transferable can still be used for your normal day to day eWallet transactions. Since it is “non-transferable”, you can’t transfer the funds out to other eWallet or external bank accounts.

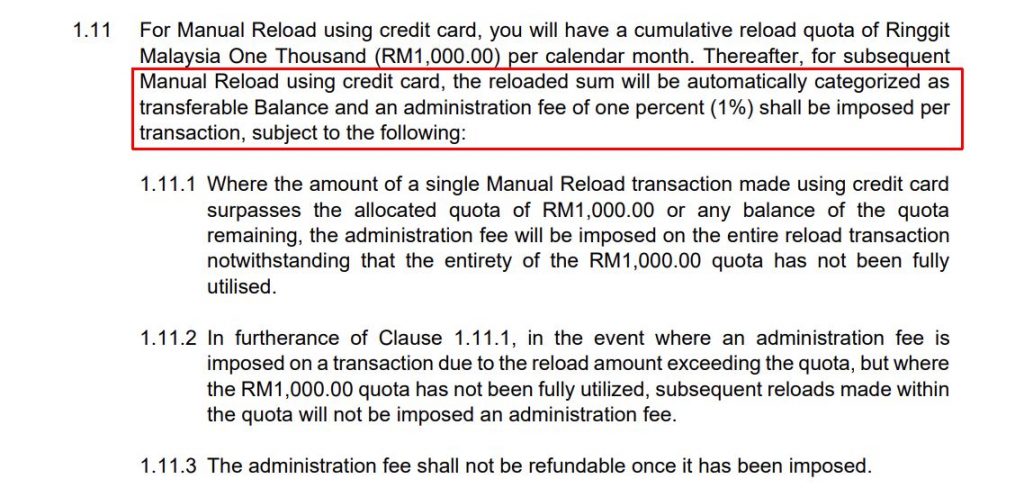

With the latest terms and conditions issued on 10th October that take into effect from 1st November 2023, Touch ‘n Go eWallet will automatically categorise manual credit card reloads over RM1,000 as a transferable balance. This means the 1% administration fee will be applied without giving users the option to choose non-transferable.

However, it is worth pointing out that the T&C explicitly mentions “Manual Reload” using a credit card. From the looks of it, the automatic transferable balance categorisation might not be applicable for auto-reloads and quick payments (direct card payment if eWallet balance is insufficient). If you don’t manually reload your TNG eWallet via credit card and require the funds to the transferred externally, you may not be impacted by this new policy update. If you need more transferable balance without paying extra fees, you can always reload your TNG eWallet via DuitNow from your online banking app.

TNG eWallet is probably the latest remaining local eWallets that offer free credit card reloads within a set quota. BigPay started imposing fees of up to 3% for credit card reloads on 30th August 2023 while foreign transactions that use MYR will be charged an additional 0.5% fee.

Related reading

- BigPay to charge up to 3% for credit card reloads, extra 0.5% fee for MYR transactions overseas starting 30 Aug

- Touch ‘n Go eWallet users can soon trade shares via GoInvest

- Cashless in China: How to pay using Touch ‘n Go eWallet and Alipay in mainland China

- CelcomDigi x Boost Beyond: Malaysia’s first prepaid card with Buy Now Pay Later